anamejia18/iStock by way of Getty Photos

Illumina (NASDAQ:ILMN) has been one of many worst performers within the S&P Well being Care Choose Fund (XLV), falling 40% in 2023 alone. Illumina’s market cap has fallen from over $75 billion to simply $18 billion at the time of this writing, representing an 80% decline from all-time highs in 2021. Whereas the market’s pessimism surrounding Illumina may be understood, the divestment of Grail may deliver Illumina again on observe and result in shareholder appreciation sooner or later.

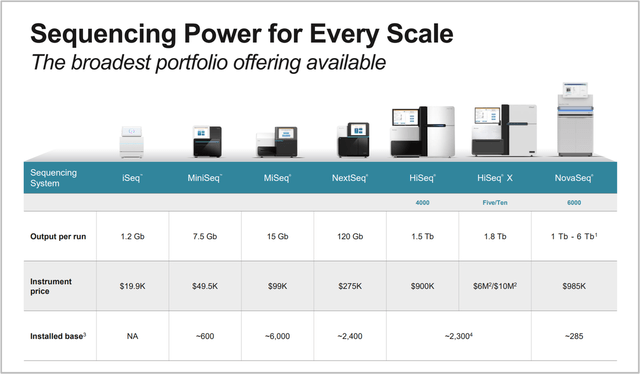

Illumina stands on the forefront of manufacturing superior genomic sequencing techniques. These systems are able to analyzing DNA fragments current in blood or varied different samples. This know-how is broadly employed in numerous fields, together with legal investigations and pharmaceutical analysis.

Illumina’s aggressive benefit lies in two key areas. First, the scalability of its DNA sequencing platform is a serious power. The firm’s proprietary sequencing by synthesis (SBS) know-how tracks the addition of labeled nucleotides because the DNA chain is copied, enabling the sequencing of greater than 20,000 human genomes per yr. The current introduction of the NovaSeq X production-scale sequencing techniques has considerably decreased the price of studying a human genome to as low as $200.

Compounder Fund

Secondly, Illumina gives a extremely built-in and scalable system that gives a decrease price of possession to prospects. The corporate supplies complete help for pattern preparation, instrument management/administration, and post-run evaluation. This integration, together with their informatics suite, bio-IT platform, and linked analytics, makes it tough for patrons to change to rivals as soon as they begin utilizing Illumina’s options. This integration positions Illumina as a cornerstone of the broader sequencing and multi-omics ecosystem.

Illumina holds a formidable 80% market share with round 90% of all DNA sequencing being accomplished with Illumina’s devices.

Grail Divestment Might Unlock Shareholder Worth

Illumina initially spun off Grail in 2016 however retained a 12% stake. Later, in 2021, it reacquired Grail regardless of opposition from European and U.S. regulators. By way of Grail’s complete most cancers take a look at, Galleri, which might detect a number of forms of most cancers from a single blood pattern, Illumina aimed to extend its whole addressable market. Executives claimed that by reacquiring Grail, Illumina may enhance its potential market by $60 billion, provided that the liquid biopsy market is projected to succeed in over $75 billion by 2035.

Regardless of pending regulatory approvals, Illumina accomplished the acquisition, resulting in substantial fines and allegations of anti-competitive habits. Thus, the EU Antitrust Positive and Regulatory Opposition, Illumina was fined a document €432 million ($476 million) by the European Union for closing its takeover of Grail earlier than securing EU antitrust approval. The deal, which was initially opposed by each the European Union and the U.S. Federal Commerce Fee (FTC), was seen as doubtlessly anti-competitive.

Regulators have been involved that Illumina, upon buying Grail, may stop Grail’s rivals from accessing the know-how wanted to develop competing blood-based most cancers detection assessments. On the flip facet, Illumina and researchers claimed that Illumina may broaden the accessibility and scale back the price of Grail’s Galleri take a look at. By way of early most cancers detection, 1000’s of lives might be saved yearly.

However, EU antitrust officers ordered Illumina (ILMN) to promote its Grail unit, and Illumina adopted swimsuit by submitting an SEC submitting for a possible divestiture of its GRAIL unit. Illumina acknowledged that the corporate has already been contacted by events. Though it didn’t disclose additional particulars, potential suitors are possible giant prescription drugs.

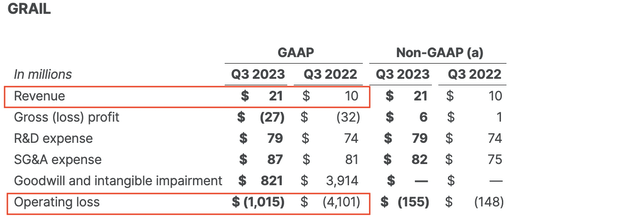

Whereas Grail is without doubt one of the solely corporations with a blood take a look at designed to detect a number of early-stage cancers in the marketplace, it doesn’t have regulatory approval and certain wants much more knowledge to show it really works. Thus, the corporate has been a cash pit for Illumina to this point and has not contributed to its top-line earnings.

Illumina

A big a part of Illumina’s losses over the previous two years may be attributed to the Grail acquisition, together with authorized prices. That is regardless of Grail solely producing $21 million in income within the final quarter and nonetheless doubtlessly years from industrial approval.

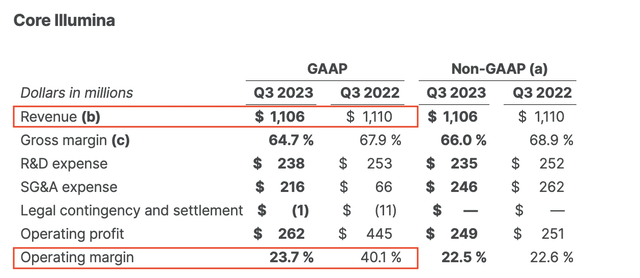

Illumina

Illumina’s core income, nevertheless, comprised of its sequencing machines, stays rock strong with robust working margins. If Illumina divests Grail, general working margins will soar again to round 25%, permitting the market to worth Illumina based mostly on its core earnings. Extra importantly, the divestment will open up billions in contemporary liquidity for Illumina, which can assist bolster its stability sheet, which has deteriorated because of its acquisition-related losses over the previous two years. The corporate may use the money to additional strengthen its aggressive benefits in its core enterprise and give attention to improvements by investing in Analysis and Improvement.

Valuation

At an $18 billion market cap, Grail’s market worth of $7-$10 billion, represents roughly half of its complete worth. Till only recently, shares have been buying and selling at ranges much like 2011, when Illumina had simply $1 billion in annual revenues.

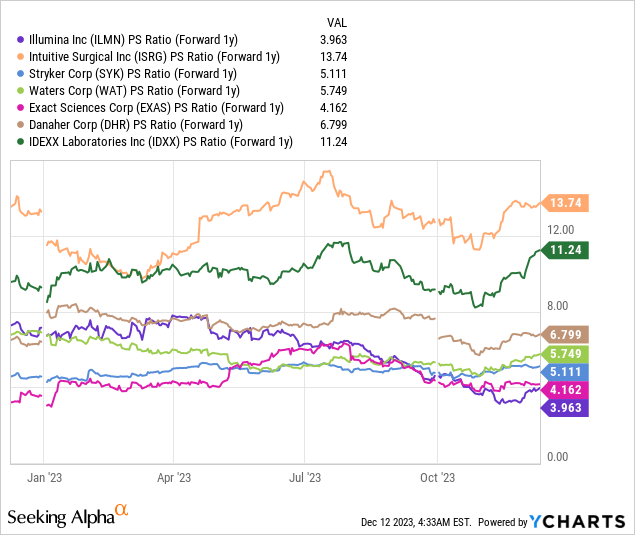

Since its all-time highs in 2021, Illumina’s a number of contracted from over 17 instances Worth to Gross sales (P/S) to simply below 4 instances annual revenues as of the newest. Arguably, that valuation was too excessive, even for a monopoly with over 30% web revenue margins, but Illumina’s core fundamentals haven’t modified, for my part. Even earlier than the Grail acquisition, Illumina had a 13-year median Worth to Gross sales Ratio of 12.3, attributable to its excessive revenue margins, progress, and general robust aggressive place.

Subsequently, I imagine its valuation ought to be in comparison with Intuitive Surgical (ISRG), which has a comparable aggressive place and comparable margins. Just like Intuitive Surgical, Illumina additionally advantages from rising recurring revenues and economies of scale. Round 80% of its revenue comes from higher-margin consumables and providers, with every new instrument bought making a recurring income stream. As genome sequencing prices lower, demand for his or her providers will increase, permitting Illumina to keep up a aggressive edge by maintaining the entire price of possession decrease for his or her purchasers in comparison with rivals.

Earlier than the Grail Acquisition, Illumina’s web revenue margins hovered round 20-30%, which was among the many highest inside the medical gadgets and diagnostics business. Within the newest Q3 earnings, Illumina highlighted its goal to return to 25% core revenue margins by 2025 and 27% by 2030. Assuming that Illumina doesn’t additional develop revenues (which seems unlikely), this is able to translate into roughly $1 billion in working revenue by 2025. On the present market cap, this is able to translate into simply 18 instances Worth to Earnings (P/E). In distinction, Intuitive Surgical trades at 72 instances P/E, IDEXX Laboratories (IDXX) at 54 instances P/E and Stryker (SYK) at 43 instances P/E.

Illumina’s core marketplace for genetic sequencing is expected to succeed in between $15 billion and $25 billion, relying on the estimate. If Illumina’s market share drops to 50% attributable to elevated competitors, it may nonetheless develop revenues to round $10 billion by 2030. Given the truth that Illumina almost doubled its revenues over the previous seven years, this estimate is not unrealistic, for my part. If Illumina reaches 27% revenue margins by 2030, this is able to translate into $2.7 billion in working revenue. At a 30 instances P/E ratio, or 8.1 Worth to Gross sales, Illumina’s market cap may then stand at simply over $80 billion, which represents a possible upside of over 300%.

In fact, these are very tough estimates and the precise income numbers and valuation figures are tough to foretell. However, its present valuation definitely leaves potential for upside sooner or later. Additionally, Illumina may face rising competitors from newer gamers comparable to Oxford Nanopore Applied sciences (OTCPK:ONTTF) and Pacific Biosciences (PACB), which may hinder its progress and margin plans. Nonetheless, Illumina’s latest strongest sequencer of its NovaSeq X Sequence, outperforms all competing sequencing platforms based mostly on the Value per Gigabase. Moreover, corporations comparable to Actual Sciences Corp (EXAS) and 6 different corporations testified within the U.S. that they relied on Illumina’s system and acknowledged that it’s extra superior than others and switching is just too pricey.

Subsequently, I imagine Illumina’s aggressive edges are more likely to be sustained as the corporate stays technologically forward of its rivals and has considerably greater R&D spent in comparison with smaller corporations comparable to Pacific Biosciences.

Takeaways

Whereas Illumina’s acquisition of Grail has solid a shadow of pessimism over the corporate, the power and resilience of its core enterprise could also be undervalued. The potential funds from the sale of Grail may allow Illumina to refocus on its areas of experience—innovation, and progress. Moreover, Illumina stands to learn from substantial tailwinds offered by the quickly increasing international healthcare market.

Nonetheless, the thesis comes with dangers. The corporate faces elevated competitors and regulatory challenges, significantly in rising markets like China, the place rivals are gaining floor. There’s additionally the inherent uncertainty within the biotechnology sector, the place technological developments can quickly change the aggressive panorama. Moreover, the continuing authorized and regulatory challenges associated to the Grail acquisition may proceed to impression the corporate’s financials and inventory efficiency within the brief time period. However, in the long run Illumina’s inventory may current a compelling alternative.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.