Eric Francis

“Development” and “utilities” in the identical sentence, with out the phrase “not” in between? You learn that accurately. A mix of the present rate of interest surroundings and regular nationwide march to transform to inexperienced vitality immediate renewed consideration to iShares U.S. Utilities ETF (NYSEARCA:IDU). This beaten-down defensive ETF possess a portfolio poised for a number of enlargement and progress.

It is usually one thing I believe the late, nice worth investor Charlie Munger, Warren Buffett’s very long time investing accomplice, would have appreciated. Mr. Munger handed away earlier this week, simply 5 weeks shy of his one centesimal birthday.

Home utilities… actually?

Why pay any consideration to utilities now, when the sector, which represents solely 2.4% of the S&P 500 SPDR ETF (SPY), has been one of many worst performers for 2023? It begins with the high-quality index IDU relies on, the Russell 1000 Utilities RIC 22.5/45 Capped Index. It accommodates predominately high-quality, secure regulated monopoly utilities and “growthy” nonregulated utilities poised to capitalize on the 2022 Inflation Discount Act (IRA) tax incentives.

Latest CPI and PPI outcomes exhibiting a secure to downward pattern in inflation have supported a broader consensus that the Fed might have come to the tip of its charge hikes, with others even anticipating potential charge cuts. Decrease charges profit utilities as they’ve excessive capital bills funded by means of borrowing. The IRA tax incentives intend to assist formidable infrastructure expansions over a number of many years by decreasing regulated and nonregulated corporations’ price of capital as they construct extra energy grids, EV charging stations, and put money into clear vitality options.

There’s a sturdy correlation between Treasury yields and controlled utility yields, which leads many traders to contemplate utilities a proxy for the bond market. In truth, for a lot of institutional traders who’ve a mandate to be totally invested and solely use shares, utilities are sometimes the closest factor they must a diversifier. That is a kind of unwritten guidelines of Wall Avenue that turns into a self-fulfilling prophecy: charges drop, utility shares get a bid. It occurs typically.

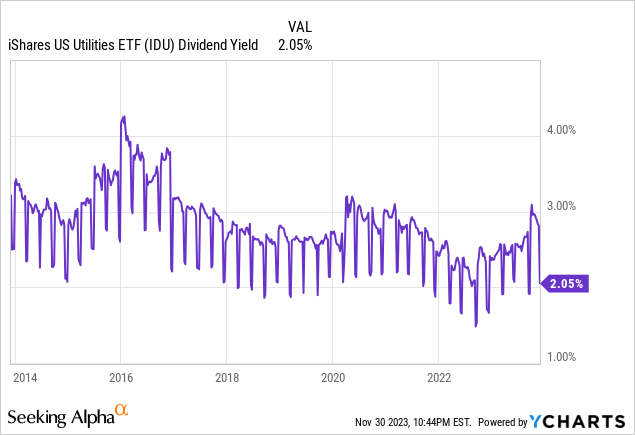

With 52% of IDU’s portfolio within the 10 largest holdings, this ETF is in sync with my sturdy choice for top-heavy, concentrated funds. As proven beneath, utility shares should not the yield hogs they as soon as had been, however they nonetheless pay dividend charges above most different sectors. And, as famous above, a few of that yield has been traded off for progress potential.

Utilities: candy spot for infrastructure spending

Utility valuations are primarily based on earnings and dividend yield progress, together with the power to get better bills in a monopoly service space. The extra pro-business the state the utility operates in, the higher the potential efficiency as they can cross by means of their capital bills by means of charge will increase.

And naturally, you want good administration groups to develop earnings and dividends. With the extra tax incentives supplied by the IRA, each regulated and nonregulated utilities can have decrease building and working prices for inexperienced vitality tasks. This may hold pass-through bills to the purchasers decrease and extra politically palatable.

Whereas Treasury yields stay mounted, utility yields sometimes develop over time. Utility inventory costs also can recognize by means of earnings and dividend progress, in contrast to Treasury costs.

Yr-to-date, the Utility Sector has been one of many worst performers throughout the S&P 500. IDU is down shut to eight% in comparison with an increase of almost 20% for SPY. The sector is buying and selling with ahead multiples underneath 15x subsequent 12 months’s earnings, close to a 20-year low.

With inflation coming down and potential charge cuts on the horizon, this low beta sector has the potential for a number of enlargement, along with dividend progress. Added to the large have to develop the nationwide electrical grid and super tax incentives supplied within the 2022 IRA, IDU is poised to commerce meaningfully increased. With captive customers, progress and stability within the defensive utility sector can probably be present in IDU.

Dangers to the thesis

IDU is a low beta (0.6) funding, which suggests it’s sometimes about 40% much less risky than the broad inventory market. Nonetheless, utility valuations can change considerably with adjustments in rates of interest, present and future authorities laws, new applied sciences, and unexpected macroeconomic and political occasions.

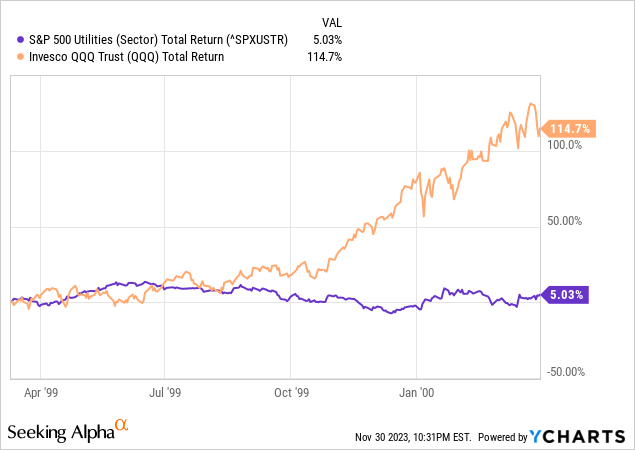

There may be additionally the chance, as with all worth conditions, that the market will not acknowledge that worth so shortly. This was the case again within the late Nineteen Nineties and into the 12 months 2000, which in some ways resembles the present investing local weather.

Look no additional than the chart beneath. QQQ hung out grinding increased, then took off at a charge rivaled solely by the present charge of spending by the US Congress! However Utilities not solely lagged behind the “pleasure,” they had been down for many of the 12 months. Word that this isn’t 2023. It’s 1999!

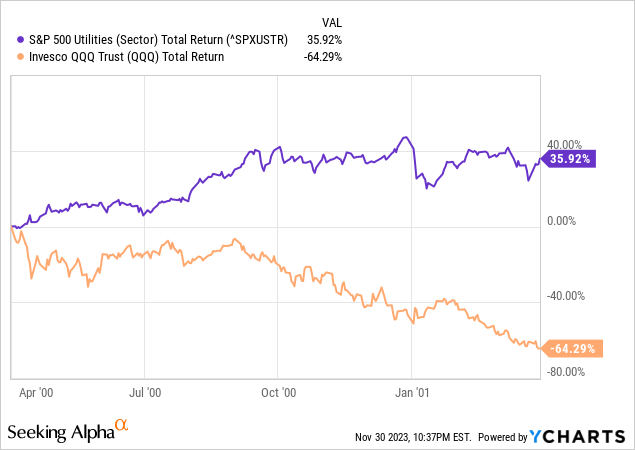

Then, the Dot-Com Bubble period, like a fireworks present, ended with its loudest section. This chart covers the final 12 months of that bubble, ending on 3/31/2000. From that time ahead, this occurred. That is the 12 months after the 12 months proven above. A really completely different story. Worth swung again into favor, all of a sudden, and convincingly.

Whereas it’s now not the late Nineteen Nineties (fortunately), worth investing, together with within the type of a well-crafted portfolio of high quality utility shares, ought to be shifting up the ranks on traders’ watch lists. I do know they’re on mine. And whereas my present enthusiasm stops at a Maintain score for IDU, that has extra to do with my total warning relating to equities on the whole, at the least till I see extra proof of a sustainable upside breakout in additional than the Magnificent 7 shares.