PeopleImages

Introduction

I began masking Hudson Applied sciences (NASDAQ:HDSN) inventory in late 2021 when one share was buying and selling at round $4. Since then, I’ve written about HDSN a number of instances, and every time I’ve up to date my thesis, I’ve come to comparable conclusions that the corporate is undervalued and has good operational progress prospects. These calls had been maybe one of the profitable in my quick profession as an analyst.

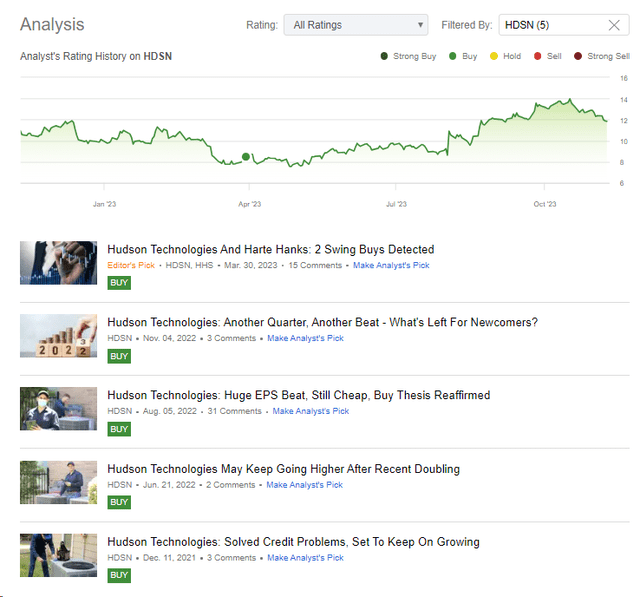

In search of Alpha, the creator’s protection of HDSN inventory

It has been greater than six months since I final reported on the corporate, and in that point Hudson Applied sciences has managed to do lots. How has my thesis modified? Let’s determine it out collectively.

Financials And Prospects

Hudson Applied sciences is a $540-million refrigerant companies firm that gives options to recurring issues throughout the refrigeration business primarily in the US.

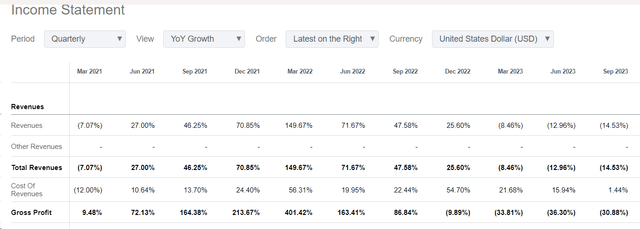

In Q3 2023, HDSN recorded revenues of $76.5 million, a ~15% lower in comparison with the identical interval in FY2022, primarily as a result of decrease promoting costs for sure refrigerants (-27% YoY). The gross margin was 40%, down from 49% in Q3 2022.

In search of Alpha, HDSN’s Revenue assertion

The cooling season in 2023 confronted a difficult pricing atmosphere and decrease gross sales quantity, contributing to a 17% decline within the sale worth of sure refrigerants over the nine-month interval. Nonetheless, HDSN achieved a gross margin of 40%, barely greater than its long-term focused gross margin ranges, the administration crew famous through the latest earnings name. The corporate’s gross margins had been positively impacted by higher-margin carbon gross sales and the DLA contract. Excluding these contributions, gross margins would have been nearer to 38%.

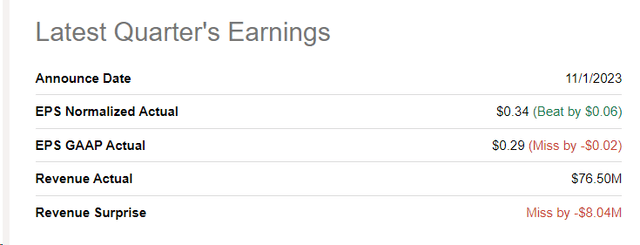

The corporate’s working earnings for Q3 2023 was $23.1 million, in comparison with $36.3 million in Q3 2022, and internet earnings was $13.6 million or $0.30 per fundamental and $0.29 per diluted share, down from $29.4 million or $0.65 per fundamental and $0.62 per diluted share in Q3 2022. The corporate’s outcomes did not beat consensus estimates for GAAP EPS and income, which is why the shares reacted post-earnings with a decline, which developed right into a (not but robust) correction.

In search of Alpha Information

In search of Alpha, HDSN

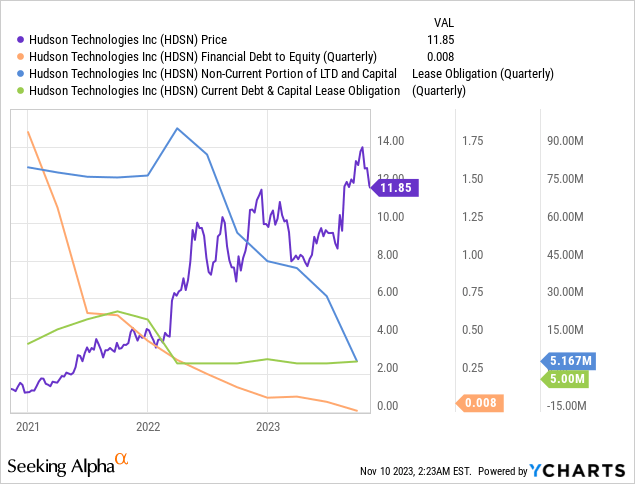

HDSN aggressively paid down its debt, culminating within the full compensation of its time period mortgage forward of the March 2027 maturity date. At the moment, HDSN’s debt-to-equity ratio is nearly zero because of the remaining minor liabilities on the steadiness sheet, which considerably reduces the corporate’s credit score danger.

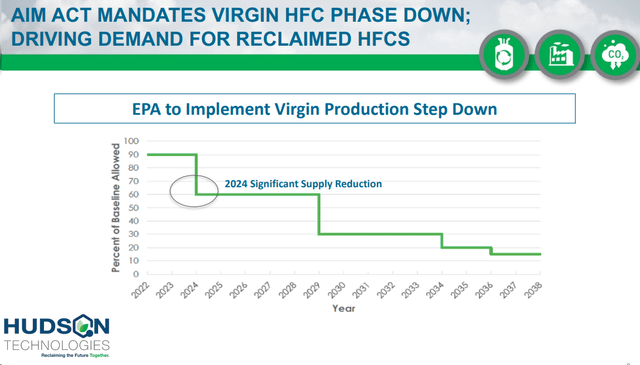

The corporate sees the upcoming 40% baseline discount in virgin HFC manufacturing and consumption allowances as a big alternative for its enterprise. Typically talking, HDSN nonetheless seems to be well-positioned for the business shift, emphasizing its proprietary reclamation know-how and dedication to the round financial system for refrigerants.

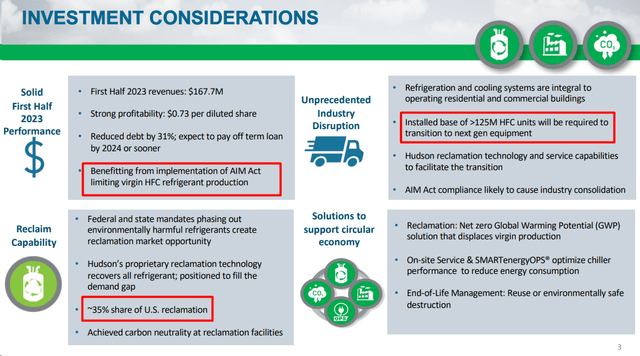

HDSN’s IR supplies

Regardless of the pricing challenges in latest quarters, the corporate is assured in its long-range gross margin goal of 35%. Apparently, market circumstances favor the corporate in attaining its objective. As one other In search of Alpha analyst, Blake Downer, famous in his not too long ago revealed good evaluation, the worldwide refrigerant market is projected to develop with a CAGR of seven.4% to 7.98% till 2030, and the refrigerant recycling market is anticipated to see a CAGR of 10.5% via 2028. Lengthy-term traits point out growing demand within the HVACR business as a result of shifts within the world equilibrium temperature. With a share of round 35% of the whole market, I consider HDSN is well-positioned to curb the rising demand available in the market.

Primarily based on what the administration mentioned, HDSN stays centered on sustainable and accountable refrigerant administration and anticipates an inflection level for the HFC market in 2024. The corporate sees its reclamation know-how as a key asset in assembly the rising demand for environmentally pleasant cooling and refrigeration options.

Trying on the outcomes of previous quarters, I’m personally inclined to belief the administration of HDSN: Their actions have actually turned the corporate round, which had sure issues with its debt again in 2019, and right now, not one of the previous threats is a severe danger issue for the corporate. One other measure of the administration’s success is the shareholders’ return for the reason that turnaround. So when HDSN executives say they’re betting on 2024, I consider them. In actual fact, a pointy drop in virgin manufacturing is deliberate for 2024, which ought to increase the corporate’s gross sales.

HDSN’s IR supplies

And what about HDSN’s valuation?

HDSN’s Valuation And Wall Avenue’s Expectations

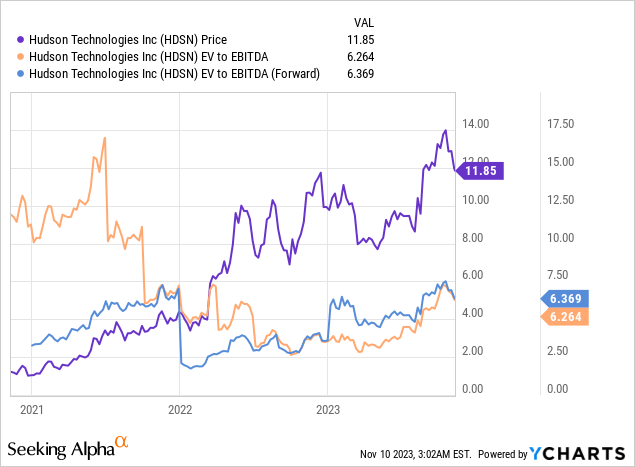

Once I final wrote about Hudson Applied sciences, the inventory was buying and selling at an EV/EBITDA of ~3x, making it very low-cost. As HDSN has grown (+40% since my bullish name), valuation multiples have additionally risen:

However right here it is vitally essential to know that the valuation of a inventory doesn’t happen in a vacuum: It takes into consideration the dangers of investing within the firm and the state of the market as an entire. 2023 was removed from the most effective 12 months for small caps, so it’s unlikely that the rise in HDSN’s EV/EBITDA will be defined by the market’s transfer. Almost definitely it’s about deleveraging: the market remembered that the corporate had issues 4 years in the past, and in 2023 the market was lastly satisfied that that is now not a big danger issue, so it began to offer HDSN the next a number of. No less than that is how I see it.

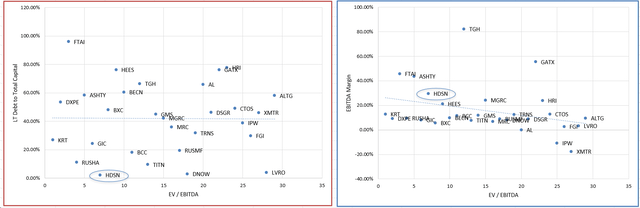

If I perceive this accurately, then the equity of the valuation of the corporate must be based mostly on its marginality (in comparison with different corporations). And right here we have now an issue as a result of HDSN’s area of interest is sort of particular and slender. Assume for your self: An organization with a capitalization of $560 million is a participant in its business with a 35% market share. But when we keep within the broader business – Buying and selling Firms and distributors – then HDSN is unbeatable with its present EV/EBITDA ratio given its debt and marginality ranges:

Writer’s work, based mostly on In search of Alpha information

The corporate with its minimal debt burden trades at a reduction of 29% to the broad business median, whereas its EBITDA margin (TTM) is a number of instances greater than the median worth.

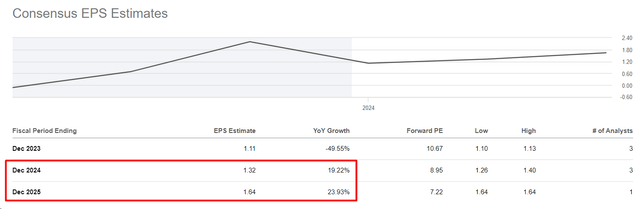

The market expects that we are going to see a restoration within the firm’s EPS once more in 2024.

In search of Alpha, creator’s notes

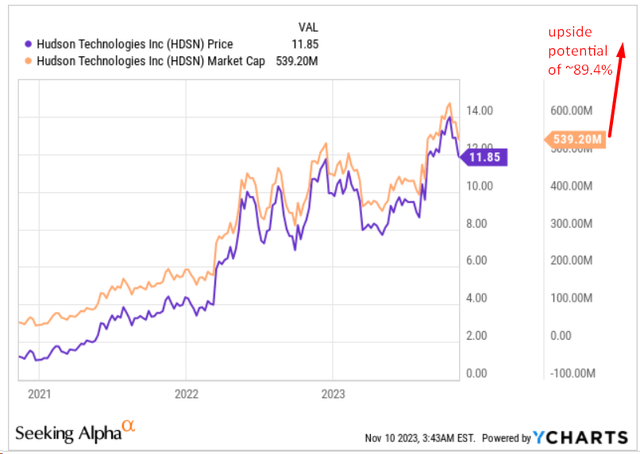

Making an allowance for the consensus estimate for HDSN’s FY2024 income of $321.7 million, an EBITDA margin of 40% (barely decrease than FY2022) leads to a forecast EBITDA of ~$128.7 million. If the EV/EBITDA a number of rises to no less than 8x, which appears a good situation given the present post-deleveraging interval, we get an enterprise worth of ~$1.029 billion. Hudson’s internet debt is simply $8.4 million, so the fairness worth of the corporate must be $1.021 billion, which is 89.4% greater than what I see on the display right now:

YCharts, creator’s notes

The Backside Line

Because it at all times comes with investing in shares, HDSN has loads of completely different danger elements within the aggressive claims administration business that must be taken into consideration. First off, the corporate faces the challenges of financial downturns impacting demand, regulatory modifications affecting operations, and potential pressure from catastrophic occasions resulting in a surge in claims. Expertise dangers, integration challenges from historic acquisitions, dependence on a number of main shoppers, and pricing strain from cost-conscious insurers are further issues. The labor scarcity within the business and the potential for reputational harm additional contribute to the chance profile. Particular to HDSN, its comparatively small dimension, vulnerability to new entrants, and reliance on a restricted set of services pose further dangers that traders ought to rigorously contemplate earlier than making funding choices.

However regardless of the comparatively excessive danger, the reward aspect of the equation appears way more enticing to me. Sure, HDSN’s a number of has risen fairly a bit over the previous 12 months, however nonetheless, the corporate has grow to be much more enticing in comparison with different extra leveraged and fewer marginal gamers within the business.

Primarily based on what I see right now, HDSN continues to be a ‘Purchase’ even at its present costs.

Thanks for studying!