Buying and selling platforms supply customers quite a lot of choices, however few specialise in decentralized perpetual futures. dYdX stands out on this area of interest, providing customers an revolutionary platform for perpetual buying and selling, characterised by excessive transaction pace, low charges and numerous alternatives for DYDX token holders. Additionally it is completely suited to novice merchants because it simplifies the DeFi expertise and makes the transition from centralized exchanges seamless.

The current developments in dYdX’s providing make it a really perfect alternative for individuals who wish to discover decentralized finance (DeFi) with ease. Designed to assist inexperienced persons navigate dYdX and its options, this information offers the important steps wanted to begin buying and selling.

What’s dYdX?

dYdX is a decentralized perpetual trade. Launched in 2018, it has established itself as a pacesetter in decentralized perpetual buying and selling by its mixture of cutting-edge know-how and affordability. The platform’s development is supported by main enterprise capital corporations and buyers, together with Andreessen Horowitz, Paradigm, and Polychain, amongst others.

In 2023, dYdX introduced its migration from the Ethereum blockchain to the Cosmos ecosystem with the dYdX Chain. This transition marked a significant milestone for the platform, enabling higher scalability, full decentralization, distribution of 100% of protocol charges to Stakers, and better throughput. The migration additionally enabled dYdX to implement a totally decentralized order e book system and matching engine that present merchants with higher management and precision.

dYdX Chain is totally decentralized so the Privy integration permits customers to simply onboard utilizing completely different wallets or social media and never should carry out Know Your Buyer (KYC) checks. All you want is a funded crypto pockets or social account and you can begin buying and selling in minutes.

dYdX has established itself as a number one platform for the perpetual buying and selling of crypto belongings. The platform’s common day by day transaction quantity constantly exceeds $1 billion, reaffirming its place as a significant participant within the buying and selling panorama. It has surpassed many decentralized buying and selling platforms and competes with outstanding centralized exchanges, demonstrating dYdX’s rising affect out there.

The right way to commerce on dYdX?

Step 1: Getting began

Earlier than you begin buying and selling on dYdX Chain, you’ll need a suitable cryptocurrency pockets, electronic mail or socials (X or Discord). To arrange a pockets:

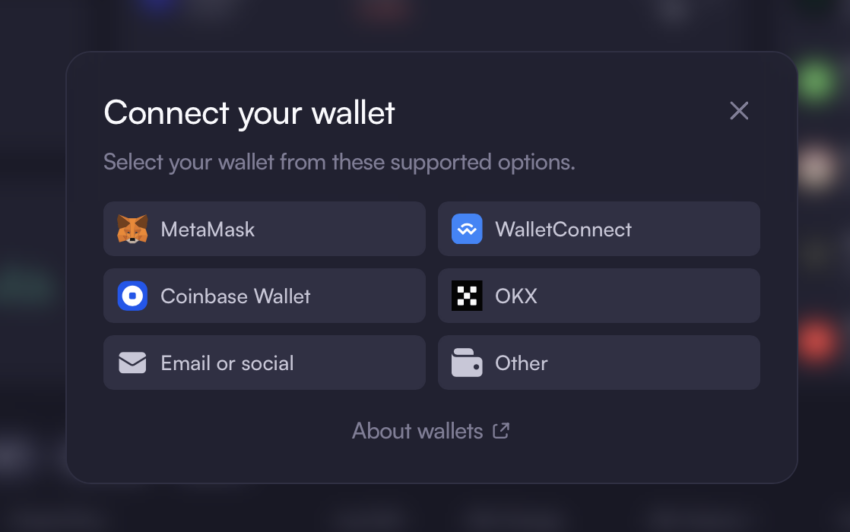

Connecting a pockets. Supply: dydx.commerce

- Set up and configure: Obtain and set up the pockets app or browser extension and arrange your account by following the prompts. Be sure to save your restoration seedphrase safely. By no means share this phrase with anybody because it provides full entry to your pockets.

- Finance your pockets: Switch sure cryptocurrency, equivalent to USDC, to your pockets. That is crucial for buying and selling on dYdX Chain. Relying in your chosen pockets, chances are you’ll must buy cryptocurrency from an trade or switch it from one other pockets.

Step 2: Connect with dYdX

Now that your pockets is prepared and funded, it is time to connect with dYdX Chain:

- Go to dydx.commerce — the front-end consumer interface for dYdX Chain.

- Join your pockets or socials: Click on on the ‘Join Pockets’ button and choose your pockets sort. Comply with the prompts to finish the connection. Ensure that your pockets extension or app is open and able to work together with.

- Authorize: You can be prompted to authorize transactions by your pockets interface. Please ensure that to test the main points earlier than confirming. This step ensures that you just perceive and approve the connections and transactions that happen.

Step 3: Discover the platform

As soon as linked, you may discover dYdX Chain’s interface:

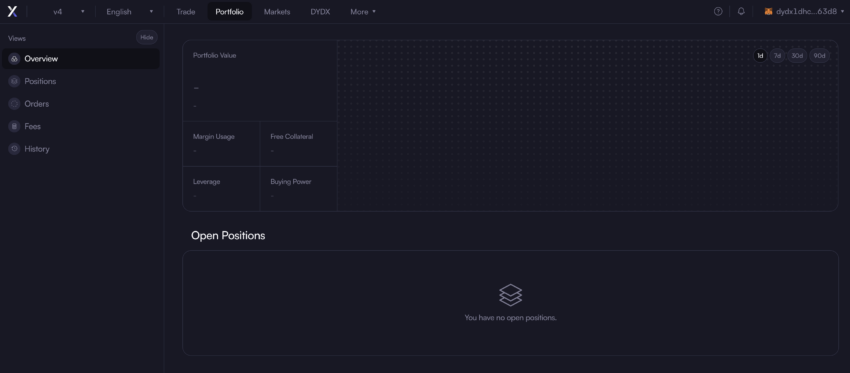

- Dashboard: The dashboard offers an outline of your account, together with balances, open positions and buying and selling historical past. This part additionally offers shortcuts to key functionalities, making it simpler to handle your portfolio.

Portfolio interface. Supply: dydx.commerce

- Markets: Navigate to the Markets part to view accessible buying and selling pairs, lately listed markets, 24-hour USDC distribution, largest gainers, present costs and 24-hour buying and selling volumes. You can too view value traits so you may make knowledgeable selections.

Market interface. Supply: dydx.commerce

- Order e book: dYdX Chain’s order e book and matching engine are totally decentralized and purpose-built for the optimum buying and selling expertise. It reveals lively purchase and promote orders, supplying you with perception into market traits. This data can information your buying and selling technique, particularly when inserting restrict orders.

Step 4: Begin buying and selling

Now that you just’re aware of the interface, you are prepared to put trades:

- Choose a market: Select a buying and selling pair from the Markets part. dYdX Chain gives over 63 pairs, permitting you to diversify your portfolio or deal with particular belongings. You may swap between the chosen market and all accessible pairs utilizing the All markets button within the prime left menu.

- Order sort: Decide an order sort, equivalent to a market order (fast execution at present costs) or restrict order (execution at a particular value). Restrict orders are helpful for specifying actual entry or exit factors to your trades. For an in depth overview, try this comparability desk.

- Enter buying and selling particulars: Enter the quantity and value to your transaction. Double-check these particulars earlier than creating the ultimate model to keep away from errors.

- Set the leverage: Deciding what leverage to make use of is an important side of perpetual buying and selling. Leverage refers back to the funds borrowed from the platform to amplify a commerce and act as a multiplier of earnings or losses. dYdX Chain gives as much as 20x buying and selling leverage. The liquidation value is mechanically calculated earlier than you enter the commerce, permitting you to handle threat successfully.

- Perceive dYdX buying and selling prices: Charges fluctuate relying on the kind of transaction and your buying and selling quantity over the previous 30 days. The prices are between 0.025% and 0.05% for buyer orders. Typically, charges are decrease than these on centralized exchanges. As much as 90% of your buying and selling charges will probably be refunded on to your dYdX Chain deal with. Moreover, an incentive program is at the moment lively that, relying on the board, will distribute USD 5 million in DYDX to eligible merchants.

- View and ensure: Please double-check all particulars earlier than finishing your transaction.

- Handle your positions: Monitor open positions from the dashboard and handle them by closing or adjusting them as crucial. Monitoring your positions might help you adapt to market modifications and shield your investments.

Step 5: Benefit from dYdX buying and selling rewards and launch incentives

Buying and selling rewards encourage customers to commerce in keeping with the protocol. dYdX rewards customers for every profitable transaction based mostly on the quantity paid. The system mechanically distributes the buying and selling rewards per block on to the dealer’s account. Earlier than every transaction, the UI additionally reveals the anticipated variety of rewards a transaction of that measurement will obtain.

dYdX Chain flywheel. Supply: dYdX

The dYdX Chain can also be working a Launch Incentives Program tailor-made to increasing and transitioning the present dYdX consumer base to the brand new protocol. The board proposal put aside $20 million of DYDX from the dYdX Chain Group Treasury to be distributed as compensation for buying and selling and market making actions. An in depth weblog put up describing this system particulars could be discovered right here.

Step 6: Keep knowledgeable

Buying and selling on dYdX Chain requires you to remain knowledgeable:

- Group: Be a part of the dYdX group on social media or take part in boards to remain knowledgeable about updates and alternatives. Group involvement may also present worthwhile insights and assist.

- Studying sources: Uncover academic supplies from dYdX Academy and different DeFi sources to enhance your buying and selling abilities. Steady studying will assist you to refine your methods and navigate the platform extra successfully.

- Safety: At all times preserve safety in thoughts, allow two-factor authentication (2FA) and keep away from sharing delicate data. Verify your safety settings often to guard your belongings.

Though perpetual buying and selling is inherently dangerous and never really helpful for inexperienced persons, dYdX Chain offers a wonderful place to begin for these concerned with buying and selling perpetual futures. The platform options excessive liquidity, assist for a variety of belongings and low prices due to its superior know-how. These options make dYdX Chain a severe competitor to outstanding centralized exchanges.