pixdeluxe

Data expertise (XLK) and shopper discretionary (XLY) are among the many sectors Barclays analysts anticipate to see earnings development subsequent 12 months.

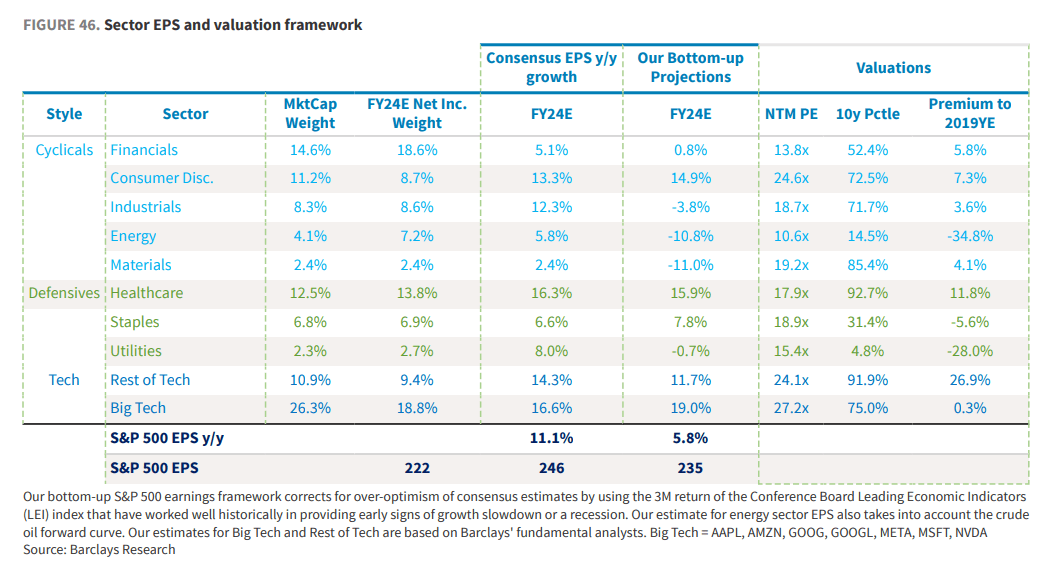

Of their U.S. Fairness Technique report, revealed on Tuesday, analysts stated that they anticipate large tech to proceed being the first driver of the S&P 500 (NYSEARCA:SPY) earnings development.

The sector, they wrote, ought to profit from secular development drivers, an incrementally stronger IT spending atmosphere, and the increasing adoption of AI expertise.

“However we’re cautious of the group’s next-twelve-month P/E a number of, which embeds a premium to its 10-year median among the many highest within the index.”

As well as, “comparatively wholesome households” ought to help discretionary spending. The sector stays under-owned. Barclays analysts anticipate earnings development to outpace the general S&P 500 (SPY) and favor services-oriented names.

Staples (XLP) and healthcare (XLV) might ship strong earnings development, “however historically defensive sectors might stay out of favor in a ‘soft-ish’ touchdown state of affairs.

The power sector (XLE) might see detrimental earnings development, offset by a reduction to ahead P/E.

Usually, there may very well be a major upside threat to the top-down earnings forecasts because of oil worth targets being above consensus and a resilient refining macro atmosphere.

Additionally, tech is buying and selling on the highest premium to the 2019 year-end (above 25%), and at 95, 10-year percentile. Vitality is buying and selling on the lowest premium to 2019 year-end (about -35%) and at 15, 10-year percentile.

Analysts have a detrimental outlook for industrials (XLI), supplies (XLB) and utilities (XLU), that are more likely to lag the S&P 500 (SPY) in earnings development, with no vital low cost to ahead multiples, they wrote.

“We anticipate the industrials and supplies sectors to cope with weaker manufacturing exercise in 2024, in addition to a comparatively outsized impression from slowing development [not including the U.S.]. Industrials additionally stay a consensus obese amongst long-only funds, regardless of trimming publicity all 12 months.”

Lastly, the monetary sector (XLF) might proceed to face headwinds from the credit score atmosphere subsequent 12 months, the report stated. Banks might see a trough in internet curiosity revenue however not for a number of quarters.