- Uniswap’s CEO receives SEC’s Wells discover, just like Coinbase.

- Ripple’s resilience provides classes for Uniswap.

Amidst the continued authorized battle between Ripple [XRP] and the Safety and Change Fee (SEC), the highlight has now turned to Uniswap Labs.

On the tenth of April, Uniswap’s [UNI] CEO, by way of an X (Previously Twitter) post, knowledgeable the crypto neighborhood that he had acquired a Wells discover from the SEC.

Uniswap CEO’s persistent optimism

Expressing his issues, Hayden Adams, Uniswap’s CEO, in a latest dialog with the “Bankless” podcast, famous,

“The SEC is basically taking very aggressive stances and mainly making an attempt to close down crypto.”

He additional make clear the Wells discover relating to Uniswap’s interfaces. This coincided with a latest courtroom ruling involving Coinbase’s classification as a dealer.

He mentioned,

“They only misplaced in courtroom like two weeks in the past with Coinbase proper? It didn’t like go to trial and so they misplaced in courtroom, it misplaced on the earliest attainable stage that you would be able to lose.”

The comparability underscores the importance of the ruling and suggests a possible precedent for Uniswap’s case.

Uniswap to observe Ripple’s footsteps

Moreover, Stuart Alderoty, Ripple’s CLO citing criticism in opposition to SEC highlighted,

“The SEC continues to lose. The Second Circuit Court docket of Appeals refused to rethink their determination in Govil which held that if a purchaser suffers no monetary loss, the SEC is just not entitled to disgorgement from the vendor.”

This means that Uniswap may wish to take some notes from Ripple’s resilience playbook. Notably, regardless of regulatory hurdles, Ripple sustained constructive buying and selling momentum till the latest market downturn.

Contemplating the latest crypto massacre, many tokens skilled important double-digit declines. Nonetheless, some traders appeared to grab the chance to build up extra XRP.

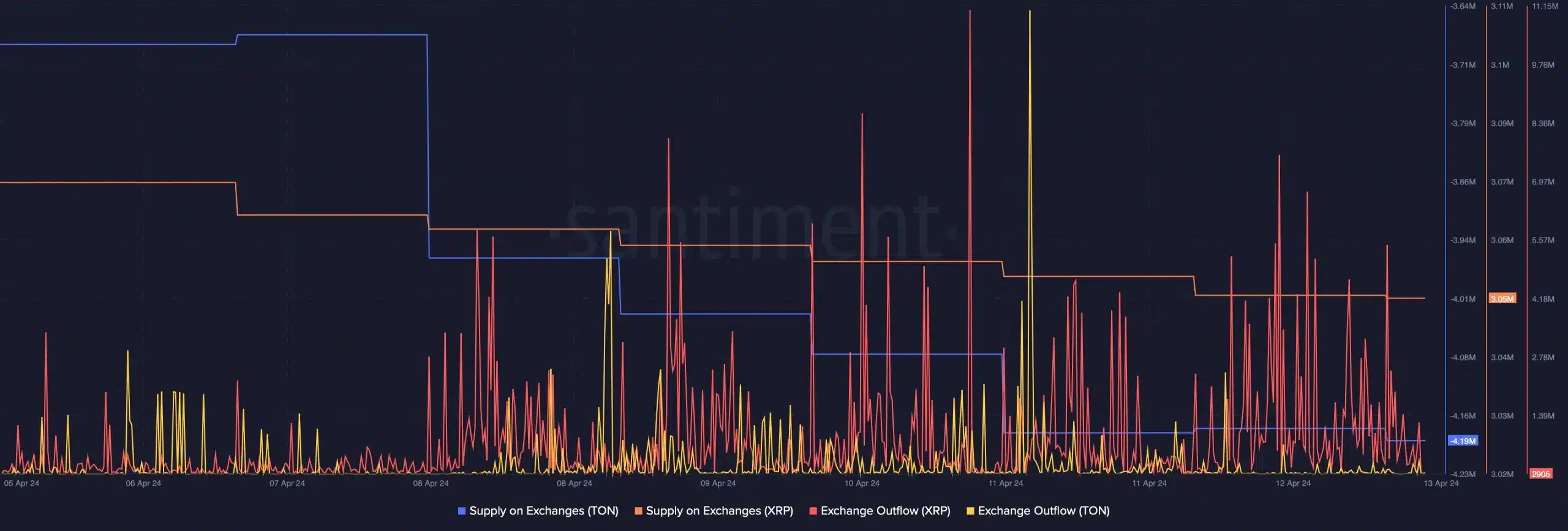

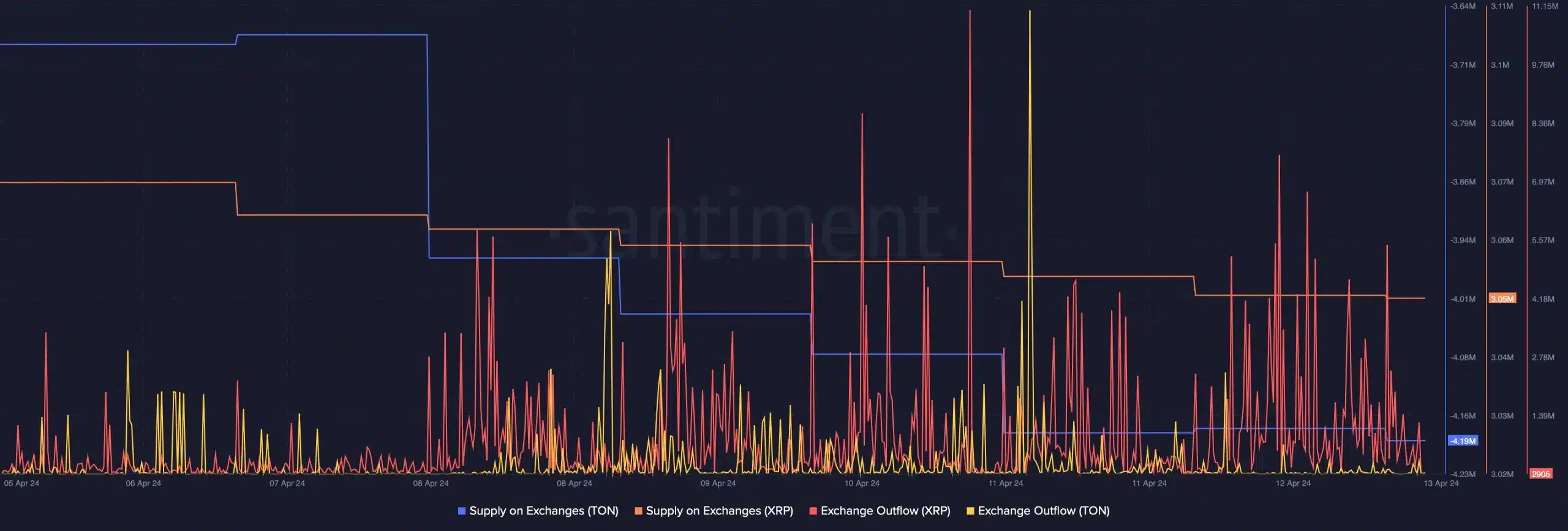

This was underlined by AMBCrypto’s evaluation of Santiment’s knowledge, whereby XRP trade outflows elevated in the previous few days.

This indicated that regardless of the general market decline, sure traders seen the drop in costs as a shopping for alternative.

What’s lies forward for Uniswap?

Within the face of those challenges, UNI skilled a big decline of 12.64% over the previous 24 hours, signaling a consolidation section.

The weekly chart revealed a pointy 28.21% lower, plummeting from $11 to $7 in simply three days.

As Uniswap’s authorized battle’s period stays unsure, the query stays unresolved: How far will the SEC go?

Nonetheless, with continued resilience and studying from different altcoins, particularly XRP, UNI token holders may foresee a big worth rise within the coming days.