- Morgan Stanley is ready to pave the best way for the wirehouse adoption of BTC ETFs

- Solely aggressive risk-tolerant purchasers with over $1.5M can be eligible

Wealth administration agency Morgan Stanley will now permit choose purchasers to purchase U.S spot Bitcoin ETFs (exchange-traded funds).

In response to a CNBC report, on Friday, the agency instructed its monetary advisors to begin providing the merchandise from 7 August. Citing individuals acquainted with the matter, the report acknowledged,

“The agency’s 15,000 or so monetary advisors can solicit eligible purchasers to buy shares of two exchange-traded bitcoin funds beginning Wednesday.”

Is BTC ETF second-wave adoption right here?

Proper now, Morgan Stanley will solely supply BlackRock’s iShares Bitcoin Belief (IBIT) and Constancy’s Smart Origin Bitcoin Fund ( FBTC). Nevertheless, solely purchasers with an aggressive threat tolerance can be eligible.

“Solely purchasers with a web value of at the least $1.5 million, an aggressive threat tolerance, and the will to make speculative investments are appropriate for bitcoin ETF solicitation.”

This implies it will be the primary main Wall Road wealth administration agency to supply BTC ETFs to purchasers. By extension, it will sign the start of the long-awaited second wave of adoption.

For perspective, the huge demand seen in H1 2024 was primarily from particular person retail traders, hedge funds, asset managers, and enterprise capitalists (VCs).

Bitwise CIO Matt Hougan referred to as the first-wave adoption a ‘down fee’ earlier than wirehouses be part of. Main wirehouses take care of high-net people and institutional traders. Morgan Stanley is a type of. Others embody Wells Fargo, UBS, JPMorgan, Goldman Sachs, and Credit score Suisse.

In response to Bloomberg ETF analyst James Seyffart, these wirehouses management $5 trillion of consumer wealth and will maybe be probably the most bullish cue for BTC ETF adoption.

A ‘playbook’ for ETF Adoption?

After finalizing their due diligence, these main companies are actually projected to supply BTC ETFs in Q3 or This fall. In truth, BlackRock’s Head of Digital Belongings, Robert Mitchnick, additionally predicted that the majority of them would start providing the merchandise by this yr.

“When you concentrate on the massive wirehouses and personal financial institution platforms, none of them have actually opened them to their advisers but…However definitely this yr is probably going.”

As of Could, Bitwise data confirmed that skilled traders accounted for about 7%—10% of the AUM (property underneath administration) of BTC ETFs, which stood at $50B then. That’s about $3-$5 billion. It meant retail traders dominated the AUM, however that might change with wirehouses becoming a member of the celebration, based on Hougan.

“Starting about six months after the preliminary allocation, many companies start allocating throughout their complete e-book of purchasers, with allocations starting from 1-5% of the portfolio.”

That is the playbook to be careful for as wirehouses be part of the celebration.

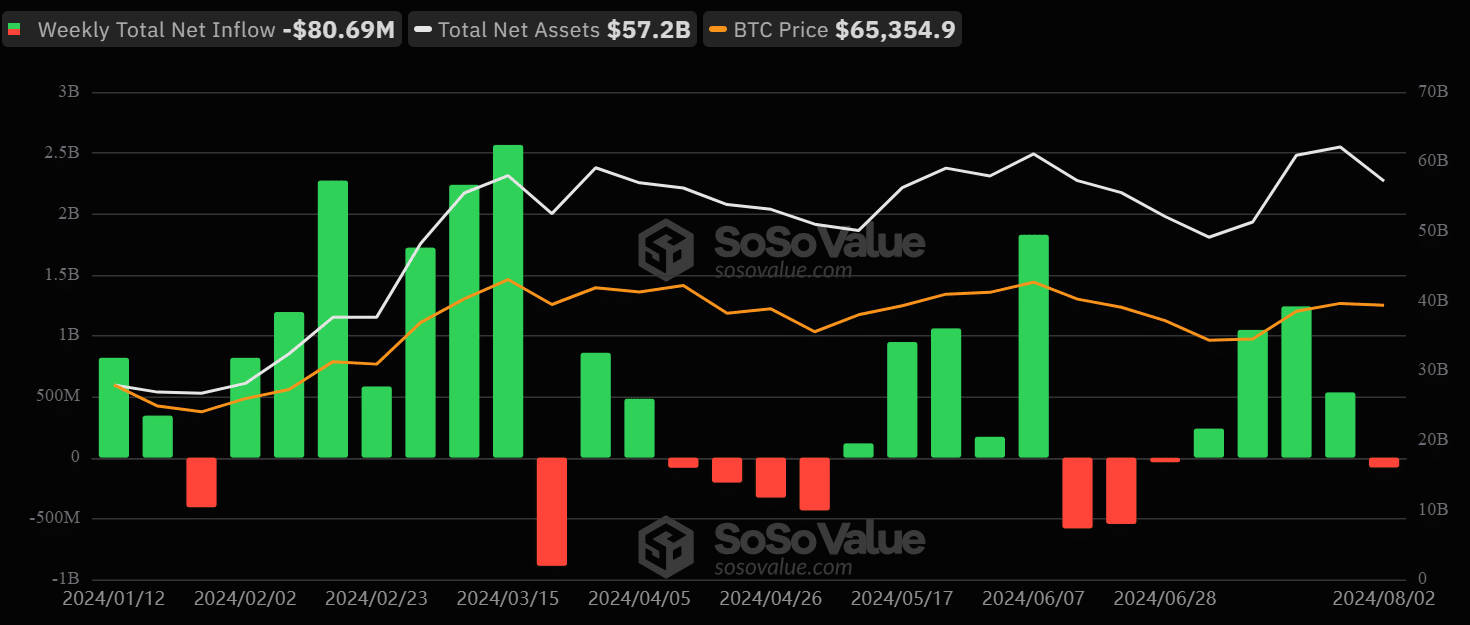

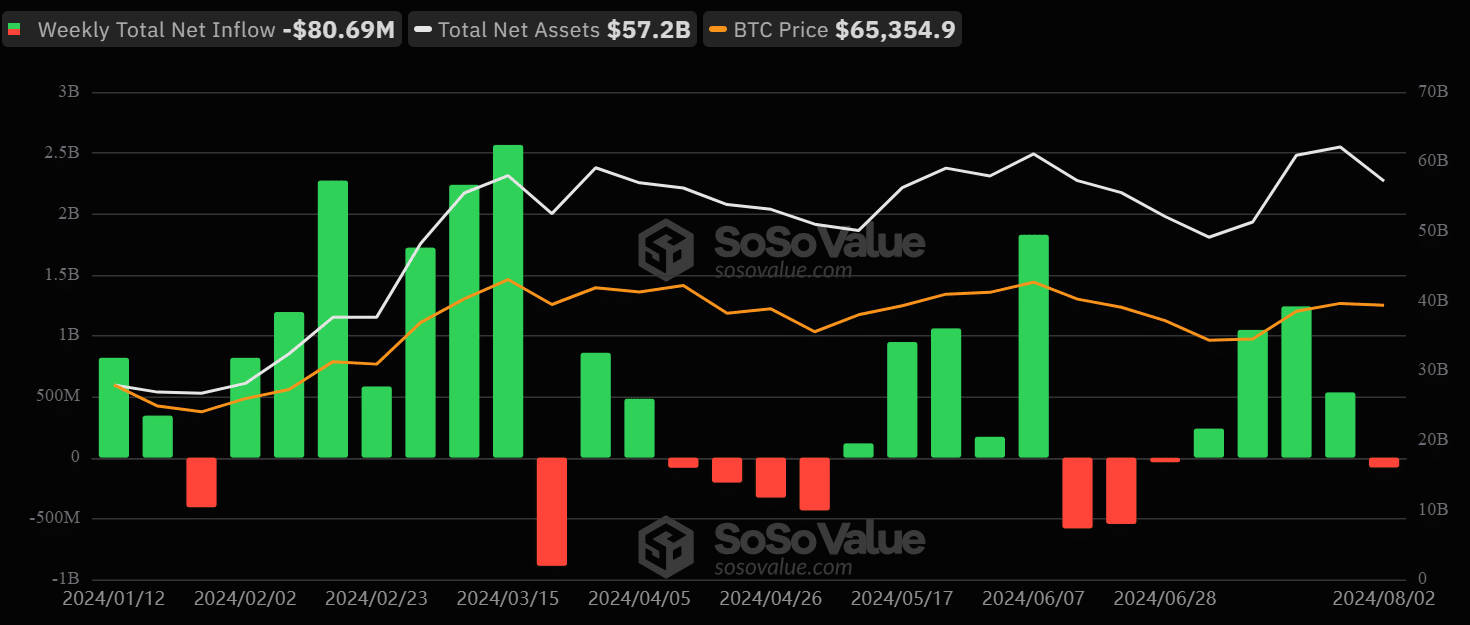

At press time, whole AUM stood at $57.2 billion with weekly web outflows of $80.69 million, underscoring an total risk-off investor method this week. It stays to be seen whether or not the inflow of wirehouses will change the present market pattern and assist BTC’s worth.

Supply: Soso Worth