Authored by Charles Hugh Smith via OfTwoMinds blog,

Absent demand from tens of hundreds of thousands of rich, high-income consumers, asset valuations will fall as Boomers unload belongings to fund their retirement.

There is a peculiarly flawed logic behind the extensively held view that the Child Boomers will seamlessly switch tens of trillions of {dollars} of their wealth to the Gen-X and Millennial generations as they exit stage left. That is flawed for a really primary cause: the extraordinarily overvalued belongings that shall be transferred–real property and stocks–only reached such excessive overvaluation as a result of there’s a surplus of consumers who’re sufficiently rich (and keen) to pay bubble-inflated costs.

Because the possession of each actual property and shares is concentrated within the fingers of the wealthiest 10% who are usually older, what number of Gen-Xers and Millennials have the means to purchase million-dollar bungalows and overpriced portfolios? If consumers are scarce as a result of entrenched wealth-income inequality, then as soon as Boomers begin promoting their huge holdings of shares and hundreds of thousands of overpriced properties, costs will plummet if sellers outnumber certified and keen consumers.

In different phrases, the bloated valuations Millennials hope to inherit will solely stay on the at present overvalued ranges if hundreds of thousands of certified consumers emerge to snap up each Boomer bungalow at right now’s bubble costs. If there are fewer consumers than sellers, costs will decline accordingly.

Youthful generations hoping to inherit million-dollar McMansions and inventory portfolios overlook that many getting older Boomers are planning to promote their shares and houses to fund their retirement. Boomers who’re rich on paper are rich as a result of their possession of shares and actual property; they should liquidate these belongings to afford to retire at their desired degree of consolation.

One other neglected issue is inheritances typically require promoting the home to separate the cash between heirs. As soon as once more, the inheritance relies on consumers rising like locusts to purchase up each home being bought at absurdly overvalued costs. What number of youthful individuals may have the means or willingness to purchase the hundreds of thousands of overpriced bungalows being dumped available on the market?

Hopeful heirs additionally overlook that costs are set on the margin. Take a neighborhood of 100 properties. If each residence that sells fetches fewer {dollars}, the sale of solely 10 properties can minimize the valuations of the opposite 90 homes in half in a number of years.

Individuals are dwelling longer these days, and since few retirement / nursing properties are being constructed, many Boomers should keep in their very own residence as they develop previous. Assisted dwelling / nursing residence charges run round $10,000 to $12,000 or extra a month; non-public nursing care in residential properties sometimes runs between $6,000 to $9,000 a month. Few can afford these choices until they promote their home. It is extra reasonably priced to proceed dwelling at residence till the tip of 1’s life.

That may both devour the inheritance or lengthen the switch of belongings to the purpose the heirs are of their 70s. For instance, my Mother is 95 years previous, bless her coronary heart, and she or he bought her home 17 years in the past to fund her retirement in an assisted dwelling advanced. Her home proceeds funded her retirement years; there shall be little left (if any) for her heirs.

If we think about the huge focus of wealth within the high 10% (sometimes the wealthiest Boomers), it is clear there aren’t sufficient younger individuals who can afford to purchase belongings at right now’s valuations to maintain the costs at nosebleed ranges. As this chart reveals, the highest 10% personal 44% of all actual property within the US, whereas the underside 50% of households personal a meager 11%.

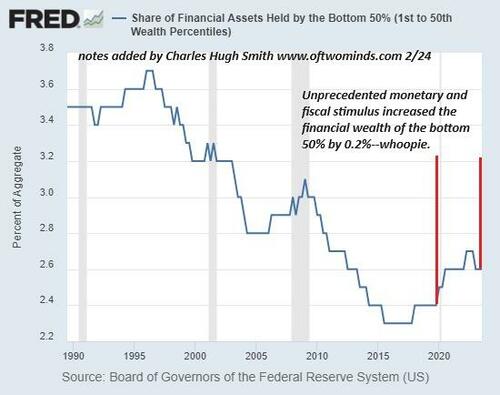

That is far more than their share of the nation’s monetary wealth, which is a rounding-error 2.6%:

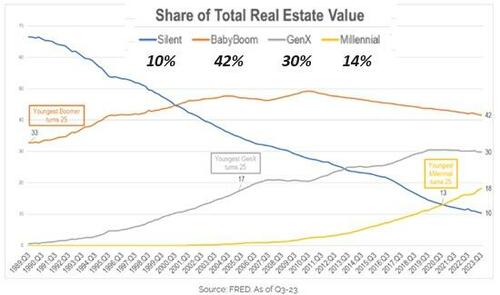

Boomers personal 42% of all actual property worth, with Gen-Xers holding 30% and Millennials proudly owning 14%. We will surmise that almost all of Gen-Xers who can afford to purchase a house have already finished so. Given their comparatively modest numbers and age, relying on Gen-Xers to take in hundreds of thousands of Boomer Bungalows for $1 million doesn’t mirror generational / monetary realities.

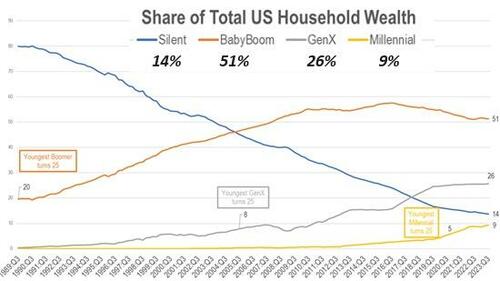

That leaves the shopping for of hundreds of thousands of Boomer Bungalows for $1 million every to Millennials, who’ve the numbers however not the wealth to take action. Boomers maintain 51% of family wealth, whereas Millennials maintain a mere 9%.

So the expectation that nosebleed valuations for homes and shares will stay at a “completely excessive plateau” relies on flawed reasoning that Millennials shall be shopping for hundreds of thousands of properties being dumped by Boomers to fund their retirement at right now’s costs, and this shopping for by Millennials will preserve the excessive valuations of properties and shares they are going to finally inherit–possibly far later in their very own lives than they anticipate.

This does not add up. The focus of wealth within the high 10% and the Boomer technology means there can not probably be sufficient consumers within the ranks of these with few belongings, excessive debt hundreds and modest incomes with adequate wealth and earnings to purchase Boomer belongings at right now’s bubble costs.

Because the high tier of older, wealthier of us personal 50% of all wealth, there is no such thing as a manner these with lesser means can afford to purchase all these belongings at right now’s bubblicious valuations. It merely would not compute.

Absent demand from tens of hundreds of thousands of rich, high-income consumers, asset valuations will fall as Boomers promote belongings to fund their retirement. In lots of instances, the wealth youthful individuals hope to inherit shall be consumed by pricey nursing residence charges.

That is the worth of enabling a focus of wealth within the fingers of the highest 10% and the older generations who purchased belongings at pre-bubble costs and have loved the appreciation created by stupendous bubbles.

However these valuations will solely be reaped by the primary sellers. Everybody promoting as demand falters as a result of inadequate numbers of consumers who can afford to pay right now’s costs will discover valuations will fall as soon as promoting overwhelms demand.

The expectation that tens of trillions of {dollars} in belongings whose worth is ready on the margins will magically retain their bubble valuations as getting older Boomers liquidate their belongings en masse in an financial system the place solely 20% of the populace can afford to purchase a home at right now’s costs just isn’t grounded in demographic or monetary realities.

* * *

Become a $3/month patron of my work via patreon.com. Subscribe to my Substack for free

Loading…