Demand for yield is rising as central financial institution rates of interest stay at stubbornly excessive ranges. In the USA, the Federal Reserve has left rates of interest at a 23-year excessive, between 5.25% and 5.50%.

Though rates of interest have began to fall in most nations, they continue to be at excessive ranges in comparison with the place we had been in the course of the pandemic. All which means buyers can allocate money to risk-free property akin to authorities bonds to generate returns.

Monetary providers firms have additionally created lively funds that concentrate on returns. We have written about coated name ETFs just like the JPMorgan Premium Fairness (JEPI) and the JPMorgan Nasdaq Fairness Premium Earnings Fund, which ship vital returns.

Cryptocurrencies additionally generate a number of the largest returns within the business. Solana has a 7% staking yield, whereas Celestia, Cosmos Hub, and Injective yield over 10%. For an asset that yields 10%, which means a $10,000 funding will return $1000 yearly.

The proceeds of Ondo Finance

Ondo Finance is likely one of the high gamers altering the crypto yield business. It is likely one of the largest firms within the Actual World Tokenization (RWA) sector.

The builders launched two funds: US Greenback Yield (USDY) and US Treasuries (OUSG), which have amassed greater than $500 million in property.

USDY and OUSG are higher alternate options than widespread altcoins akin to Tether, USD Coin and Dai. Not like these stablecoins, USDY and OUSG pay you for holding them. Accessible to people and establishments, USDY invests in financial institution deposits and short-term U.S. Treasury securities after which distributes these returns to buyers.

USDY’s finest use case is money administration, which offers collateral, and as a substitute for Tether. USDY has a yield of 5.7%, which is barely increased than the 10-year bond yield of 5.35%.

Alternatively, the OUSG is a tokenized asset that provides customers entry to short-term US authorities bonds. The vast majority of these funds are invested within the Blackrock USD Institutional Digital Liquidity Fund (BUIDL), a fund that has grown to $500 million in latest months.

OUSG is a extra difficult fund than USDY because it has a minimal coin restrict of $100,000 and a minimal redemption of $50,000. It is usually a costlier fund that can cost as much as 0.35% in January subsequent 12 months. Moreover, OUSG is simply obtainable to certified buyers.

Due to this fact, the USDY is an funding instrument with higher returns. Nonetheless, it’s unclear whether or not this efficiency will proceed if the Fed begins chopping charges. When this occurs, many of the property invested in will begin to generate decrease returns.

Ethena affords a risk-taking strategy

Ondo Finance’s property are much less dangerous as a result of they’re backed by actual property. Ethena, however, affords a riskier strategy to producing returns.

Ethena runs the USDe stablecoin, which has grown into a large $3.3 billion coin and the fourth largest stablecoin on the earth. USDe, the artificial greenback, has a yield of seven.4%, one of many largest within the crypto business. It has greater than 250,000 holders.

The platform makes use of comparatively difficult approaches to generate these returns. It generates its returns in two methods: consensus on asset deployment and financing and foundation unfold.

A staked asset is a state of affairs the place the builders spend money on liquid staked Ethereum tokens and generate a return. Ether has a return of over 3.7%.

The financing and foundation unfold happen when the builders enter into complicated by-product transactions to generate returns. On this case, when individuals mint USDe stablecoin, the corporate opens a corresponding brief place to cowl the delta of the property obtained. Traditionally, this unfold has generated optimistic returns.

USDe usually has a better return than Ondo Finance’s USDY token. Nonetheless, I imagine it’s a riskier asset to spend money on because it bears similarity to Terra USD, a stablecoin that collapsed in 2022.

There are additionally indicators that regulators will go legal guidelines towards stablecoins like USDe. In the USA, a Senate invoice has sought to ban stablecoins that aren’t backed by fiat forex. The identical factor occurs in Europe.

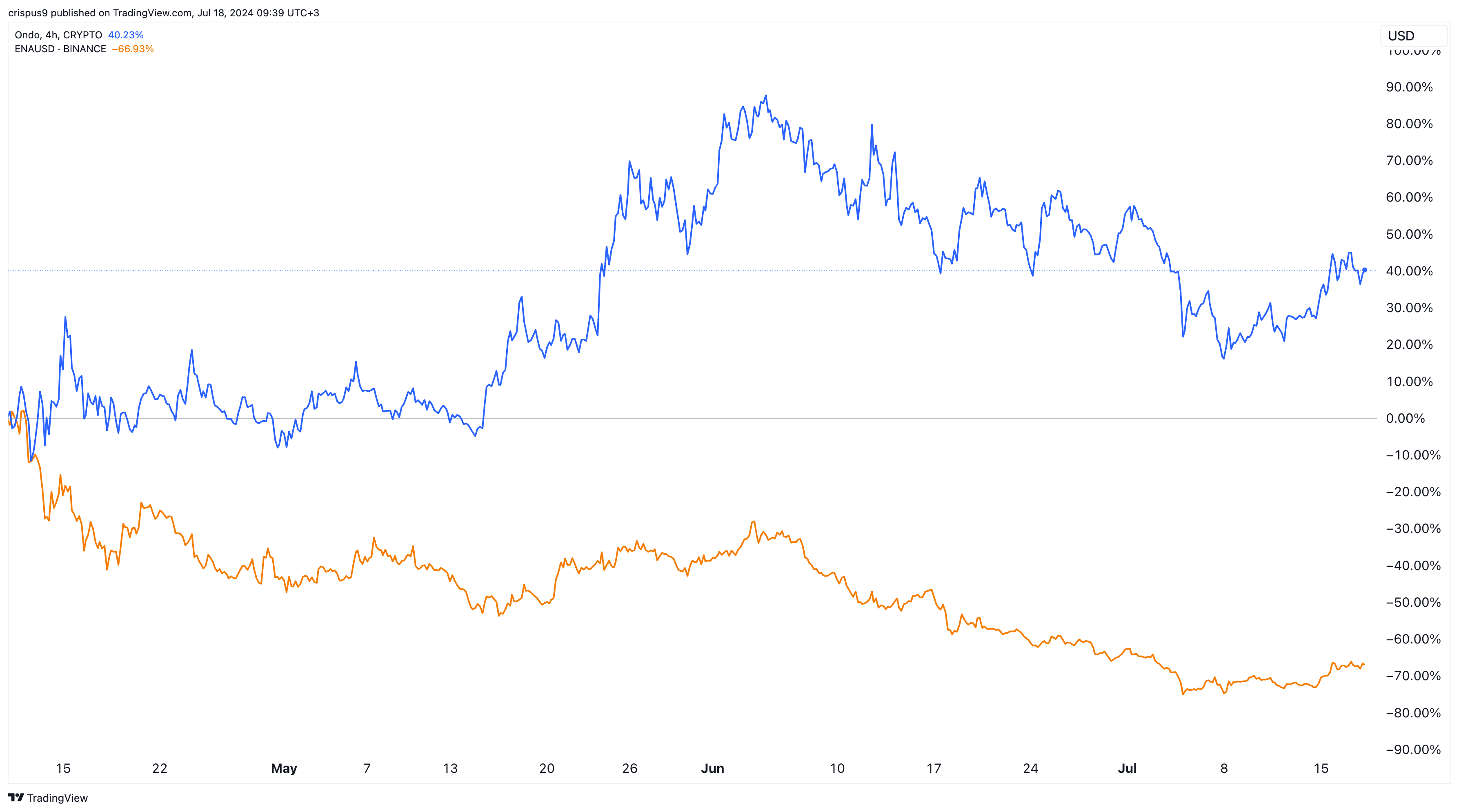

ONDO and ENA tokens have diverged

$ONDO vs $ENA tokens

These dangers clarify why the ONDO and Ethena tokens (ENA) have diverged in latest months. The Ondo Finance token has risen over 40% since April this 12 months. Ethena’s ENA token has crashed by greater than 70% as buyers proceed to fret about its future.

Due to this fact, if you’re solely occupied with producing returns, I believe investing purely in authorities bonds or associated ETFs is a greater different than investing in USDY and USDe.

Nonetheless, in case your aim is to interchange your stablecoins like Tether and USD Coin, I imagine USDY is a greater asset to spend money on resulting from its stability. USDe, however, is comparatively dangerous and will lose its peg, particularly in periods of excessive volatility.

The publish How Ethena and Ondo Finance are Altering the Crypto Yield Trade appeared first on Invezz