- BTC has a silver lining; the sharper pullback might have flushed out weak palms.

- In the meantime, PEPE might nonetheless steal the highlight.

This month, Bitcoin [BTC] has twice tried to interrupt previous the $65K resistance, with each makes an attempt adopted by sharp pullbacks.

The newest drop, which drove BTC right down to $58K – its lowest in over two weeks – has raised considerations a couple of deeper correction.

Buying and selling at $62,662 at press time, AMBCrypto warns that if an analogous sample holds, Bitcoin might face additional draw back stress.

Nevertheless, there’s a silver lining. The sharper pullback might have flushed out weak palms, doubtlessly sparking renewed curiosity from stronger consumers.

This cleaning impact usually results in contemporary accumulation, setting the stage for a rebound.

Whereas Bitcoin has struggled, memecoins like PEPE have seen a resurgence. PEPE has risen over 5% in per week.

Usually, memecoins thrive in periods of market uncertainty as merchants search high-risk, high-reward alternatives.

However PEPE’s efficiency should still be tied to Bitcoin’s value motion.

BTC is displaying short-term potential

At present, it seems to be like BTC is heading towards a short-term correction, with longs regaining management out there.

This state of affairs units up a great short-squeeze situation, the place brief sellers are compelled to purchase again BTC, driving the worth of every token increased.

Nevertheless, this doesn’t assure a rebound robust sufficient to place BTC for a bull run to $70K.

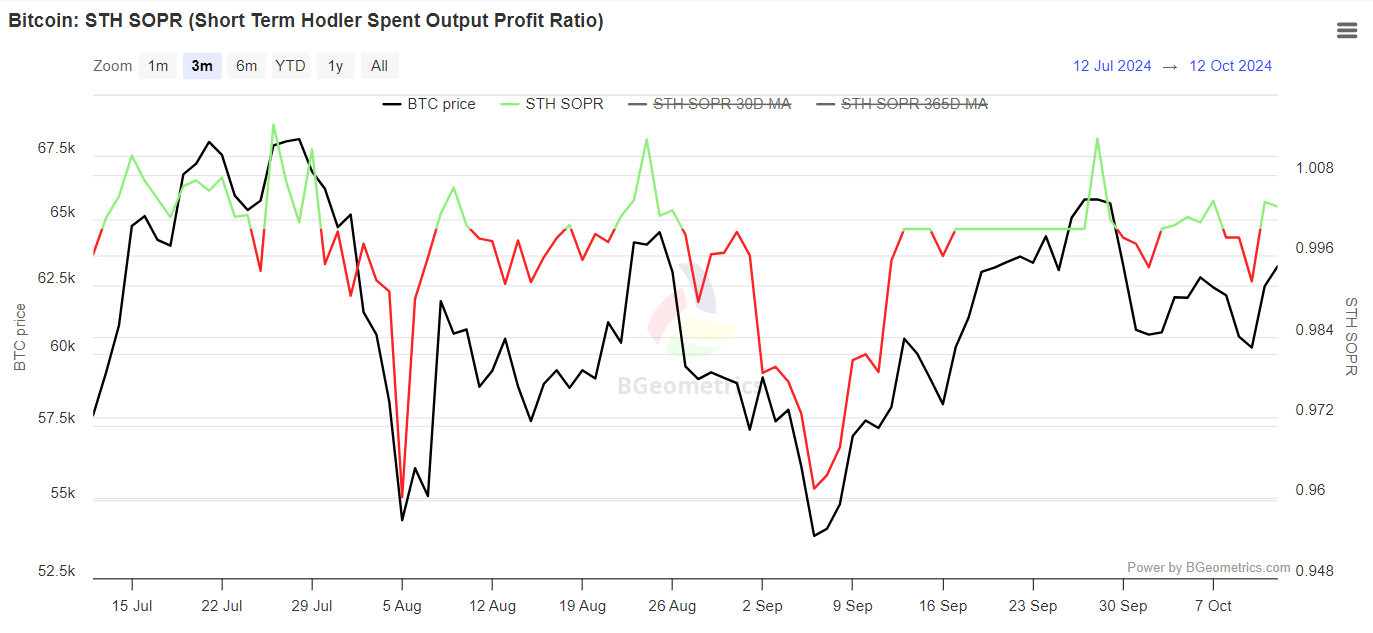

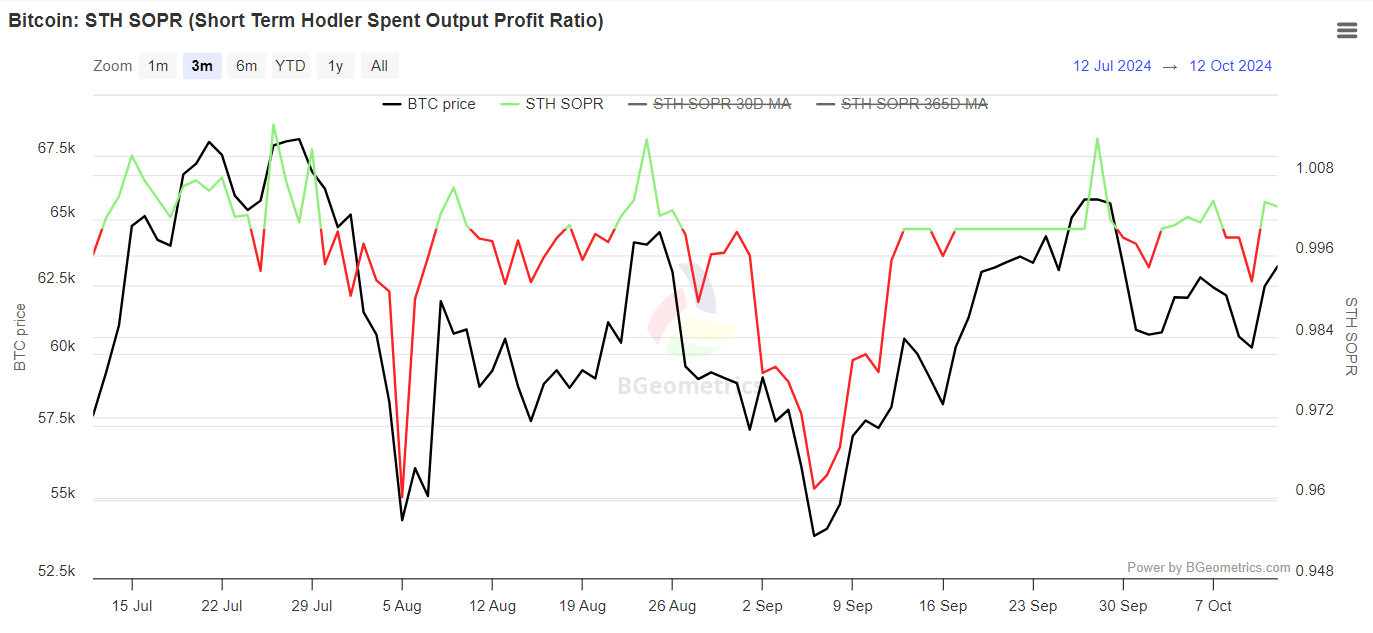

Over the previous week, long-term holders have moved lower than common, whereas sellers holding BTC for lower than 155 days have began to dump their holdings, as indicated by the inexperienced wig.

Supply: BGeometrics

Within the context of a bull market, elevated promoting usually indicators a possible market high. As extra buyers take income, considerations develop a couple of deeper pullback that might push BTC again under $60K.

Conversely, if $62K proves to be a market backside – with longs dominating, LTHs remaining regular, and others viewing this as a dip to purchase – it might sign the beginning of an accumulation section.

It’s essential to observe these actions carefully; any slight divergence in these tendencies might restrict the chance of a rebound, which at present appears possible.

PEPE would possibly keep within the inexperienced

Traditionally, memecoins have seen dramatic rallies throughout Bitcoin corrections as merchants search high-volatility alternatives in a shaky market.

Nevertheless, they’re additionally extremely delicate to Bitcoin’s broader market course.

If BTC can maintain its present ranges and begin to rally, PEPE might expertise a short-term correction as merchants shift focus again to BTC and different high-cap belongings.

On the flip facet, if Bitcoin continues to falter, PEPE might profit from one other memecoin cycle, doubtlessly pushing it to new vary highs.

Whereas many newly launched memecoins have recorded double-digit surges, PEPE would possibly proceed to remain within the inexperienced as properly.

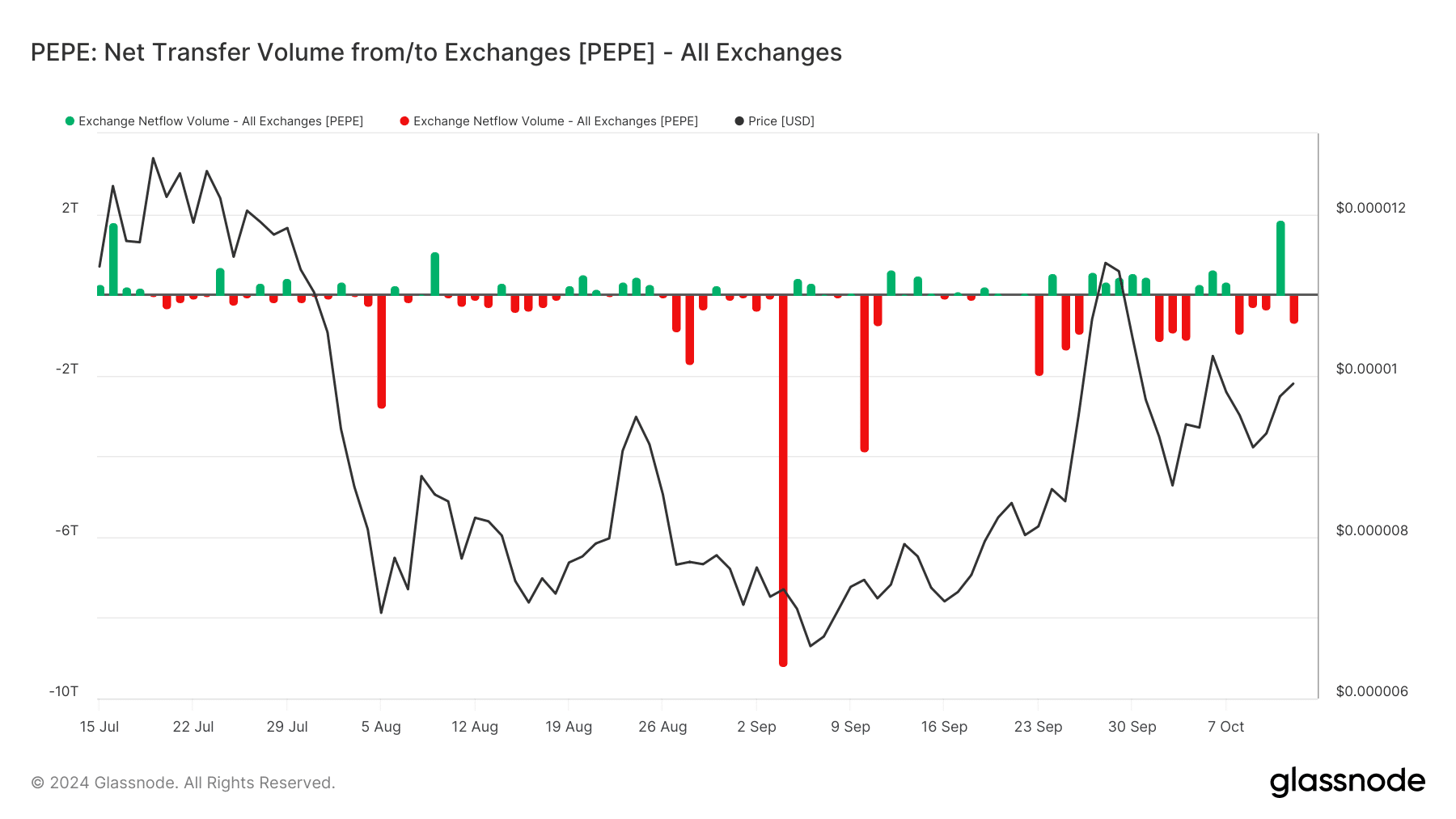

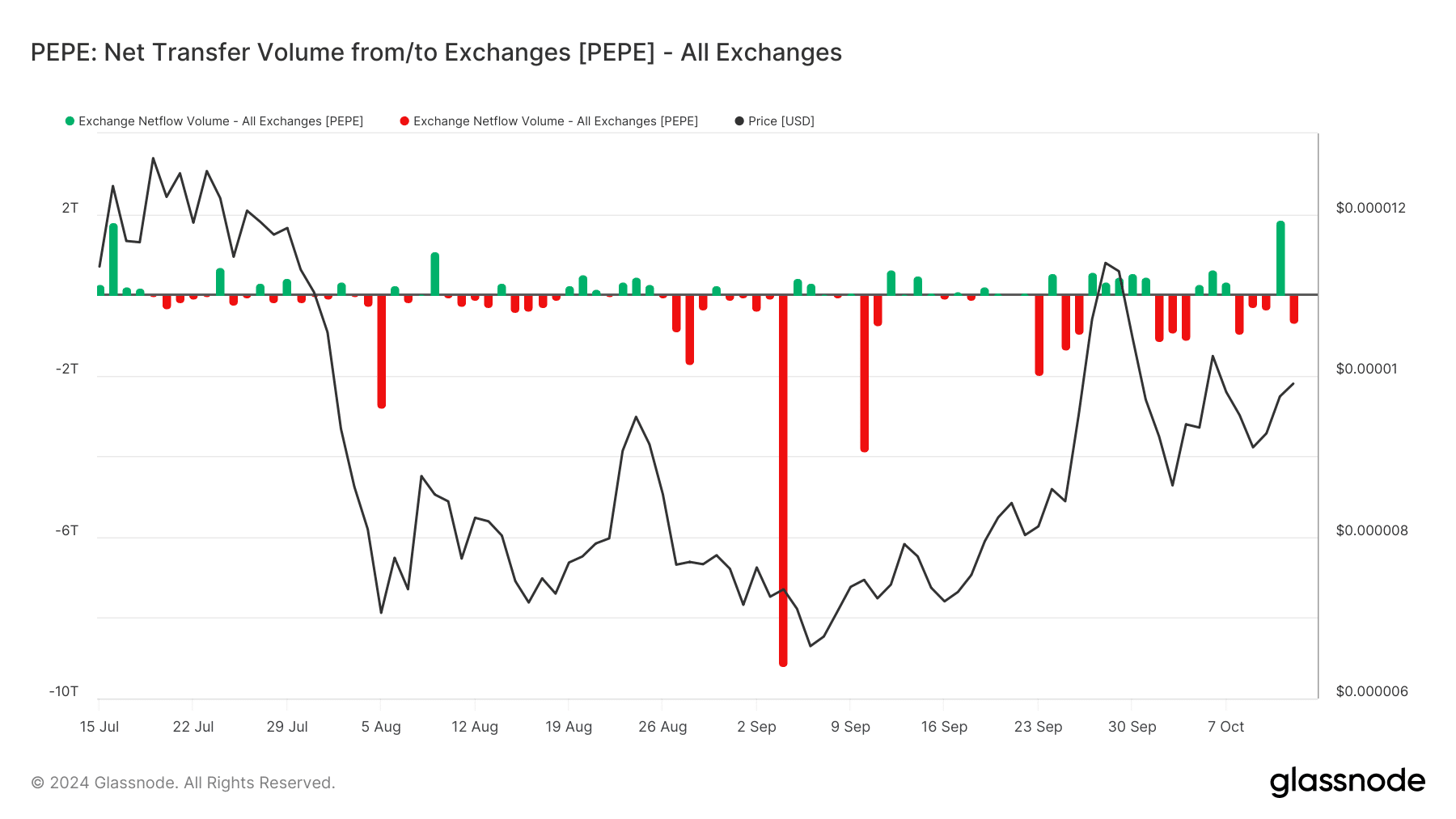

Supply : Glassnode

Within the final three days, PEPE surged above $0.000010 however struggled to carry that stage.

An enormous inflow of 1.8 trillion PEPE tokens deposited into exchanges – the very best in three months – has made it robust for the bulls to keep up momentum.

This highlights simply how risky memecoins could be. Curiously, as BTC pulls again, PEPE is once more experiencing a rise in web withdrawals, which traditionally indicators a market backside.

For a profitable bull run, constant web outflows are essential. If this pattern breaks as BTC regains dominance, it might dampen the renewed optimism surrounding PEPE.

Life like or not, right here’s PEPE’s market cap in BTC’s phrases

Total, the market seems to favor memecoins proper now. The following few days might be essential in figuring out whether or not BTC can regain energy, or if PEPE will proceed to steal the highlight.

If it does, PEPE would possibly quickly break previous the $0.000010 resistance.