Grayscale’s lately launched Bitcoin ETF, GBTC, is witnessing a gradual decline in outflows, as round $5 billion in digital belongings are withdrawn from the fund.

Regardless of the substantial outflows, market analysts specific optimism that the worst could also be over. This sentiment suggests a possible optimistic shift in Bitcoin’s value efficiency.

Bitcoin Outflows Gradual Down

Within the wake of the US Securities and Trade Fee’s (SEC) current approval of a number of spot Bitcoin ETFs, Bitcoin skilled a notable 20% decline. Important outflows from Grayscale primarily fueled this downturn.

Analysts attribute the substantial outflows to profit-taking maneuvers by traders beforehand uncovered to the fund’s low cost. Moreover, there have been indications that some merchants have been reallocating their investments away from GBTC as a consequence of its comparatively excessive charge.

GBTC at present costs a 1.5% charge, whereas competing ETFs similar to BlackRock’s IBIT have charges beneath 1%.

These components performed a pivotal function within the preliminary surge of outflows from the fund. Nonetheless, current traits point out a slowdown, with $255 million withdrawn on the eleventh day of buying and selling, the lowest GBTC outflow because the first day of buying and selling. Nonetheless, the entire outflows from the fund are over $5 billion, based on BitMEX Analysis.

Concurrently, the sell-off has led to a considerable discount in Grayscale’s Bitcoin stability, which now stands at over 508,000 BTC, valued at $21 billion, based on Arkham Intelligence. It’s value noting that because the launch of spot Bitcoin ETFs, the fund has deposited 113,129 BTC into Coinbase, equal to $4.6 billion.

BTC Worth Will Get better

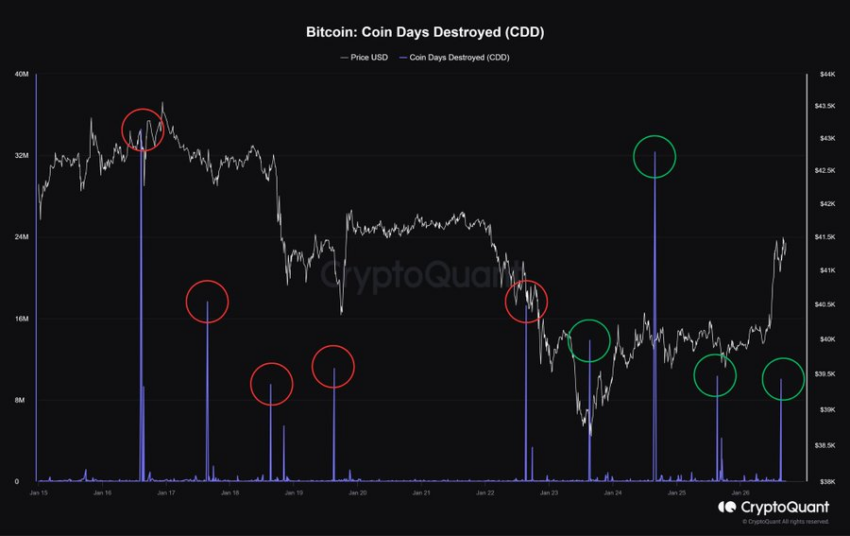

Market analysts interpret the decline in GBTC outflows as a optimistic indicator of Bitcoin’s value trajectory.

For example, JA Maartun lately shared a chart illustrating the diminishing impression of Grayscale on BTC costs. Regardless of the sell-off, Bitcoin’s worth not solely remained secure but in addition demonstrated a powerful enhance.

“All promoting strain from Grayscale was absorbed and the value even managed to extend, which is spectacular,” Maartun stated.

One other analyst, Ted, dismissed the narrative round GBTC promoting as excessively sensationalized. His evaluation revealed that the inflow of Bitcoin into the market by means of 9 new spot BTC ETFs surpassed the outflow from GBTC by over 120,000 BTC within the final 90 days.

In distinction, Resdegen highlighted Bitcoin’s resilience in buying and selling above $41,000 regardless of the varied promoting pressures. The analyst identified vital components, similar to GBTC’s substantial outflow, the US authorities announcement of promoting $130 million value of seized BTC, and Celsius’ motion of $1 billion in ETH, which seemingly had no antagonistic impression on the highest cryptocurrency value.

Anticipating bullish alerts on the horizon, Resdegen emphasised the potential for bears to face vital challenges, significantly with the upcoming BTC halving occasion.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.