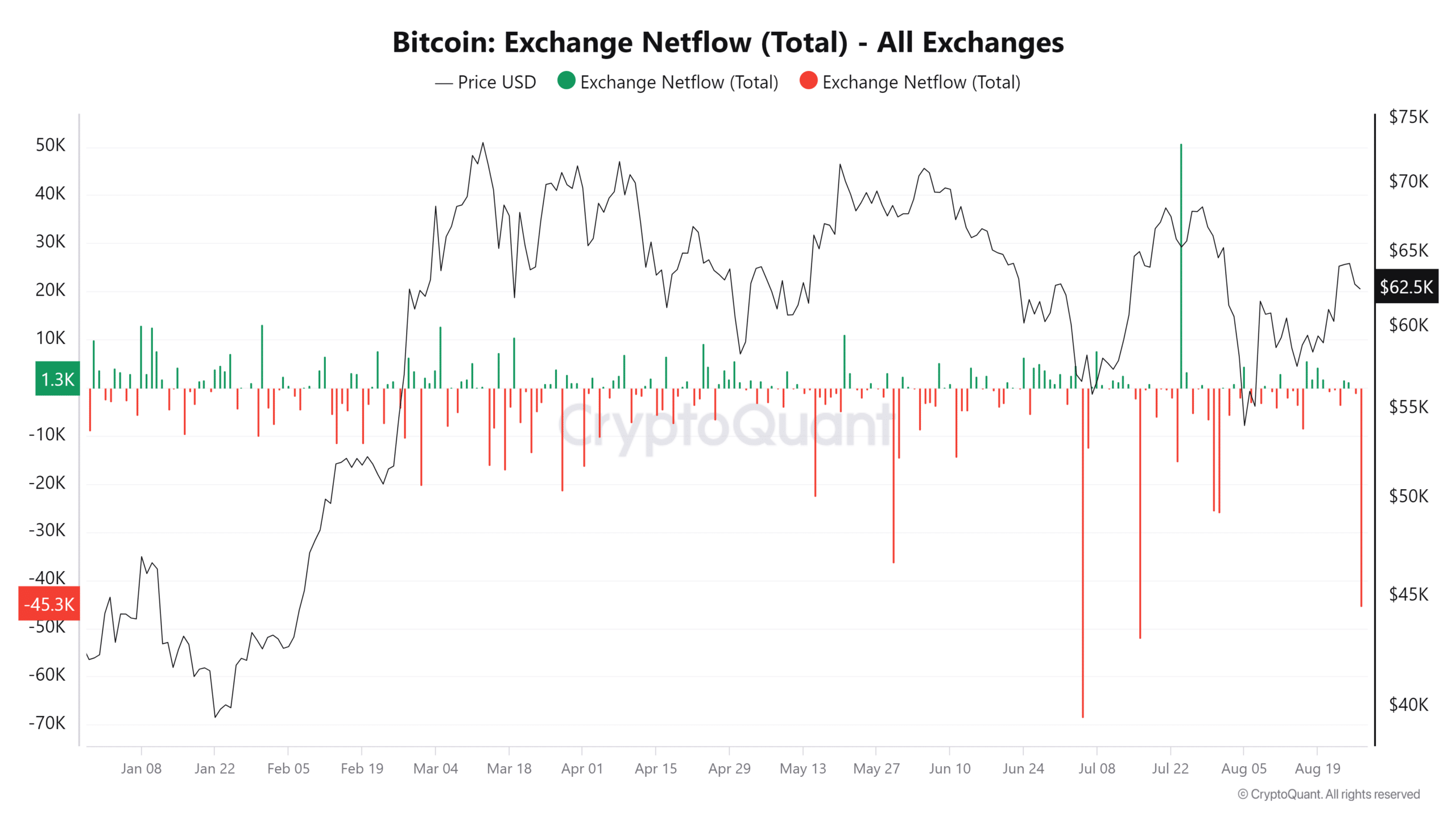

- BTC noticed an outflow of over 45,000.

- BTC has declined within the final 24 hours however remained round $62,000.

The current volatility in Bitcoin’s [BTC] value has led to elevated exercise amongst merchants and holders.

Whereas Bitcoin has managed to keep up its place across the $60,000 stage, the fluctuations in the previous few days have induced some holders to rethink their positions, resulting in sell-offs.

Bitcoin sees sell-offs from short-term holders

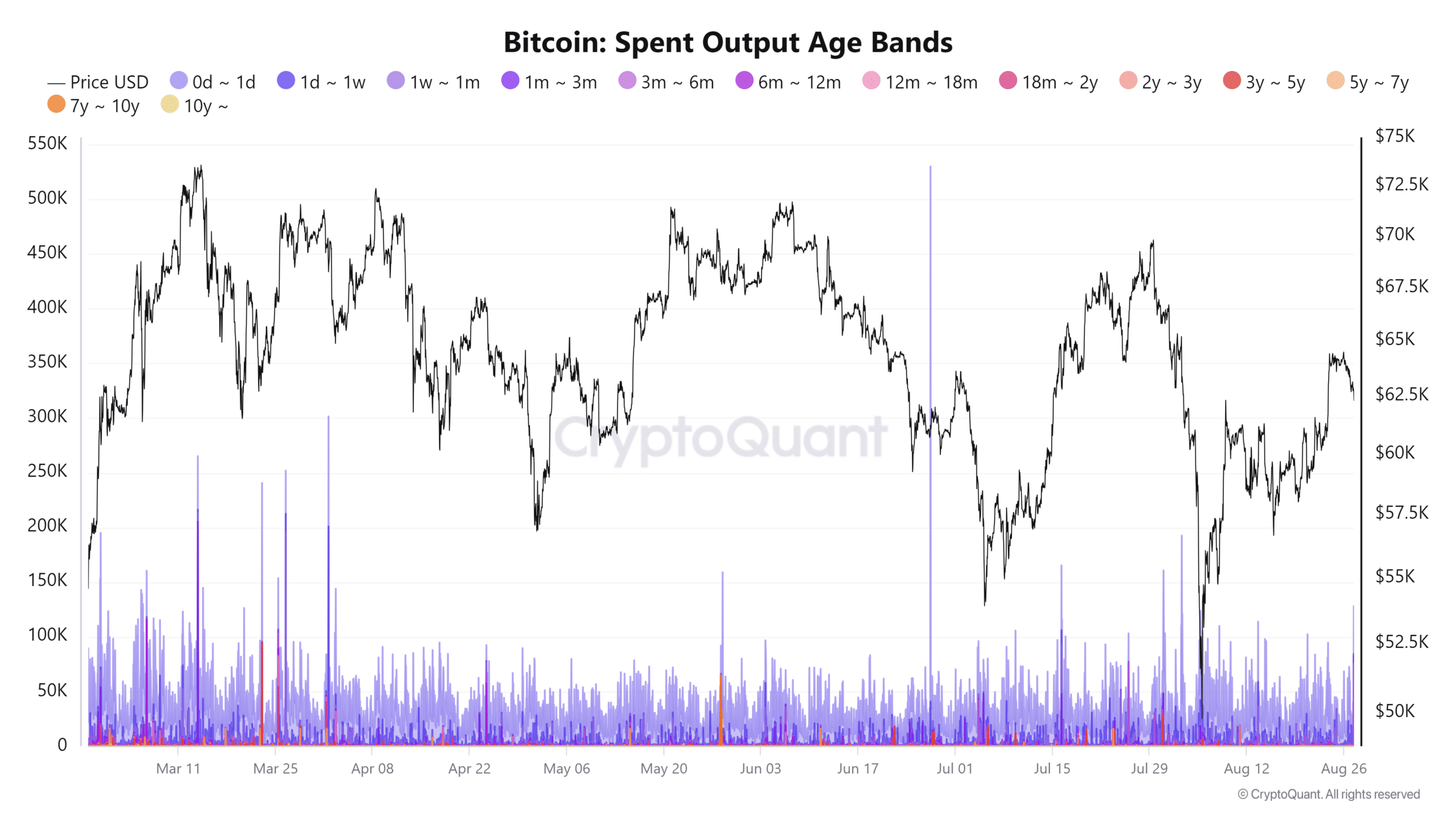

Current information from CryptoQuant indicated that some beforehand dormant Bitcoin networks have began to point out renewed exercise.

Particularly, evaluation of the 1w-1m spent output age bands revealed that short-term Bitcoin holders have transferred a major quantity—33,155 BTC.

This uptick in short-term holders’ exercise may sign rapid market promoting strain.

Supply: CryptoQuant

The present market volatility and uncertainty doubtless drive the choice to switch and promote these holdings.

Buyers might search to lock in income after Bitcoin’s current value actions or mitigate potential losses in the event that they anticipate additional declines.

Moreover, some could also be rebalancing their portfolios in response to the altering market dynamics.

This elevated exercise amongst short-term holders may add downward strain on Bitcoin’s value, notably if these transfers result in important promoting on exchanges.

Bitcoin data its largest outflow of the month

Regardless of the current sell-off exercise from short-term holders, Bitcoin recorded its largest outflow on the twenty sixth of August, indicating a major shift in market conduct.

In keeping with the evaluation of CryptoQuant’s trade netflow, it was strongly unfavourable, round -45,432 BTC. The final time Bitcoin skilled a unfavourable outflow of this magnitude was in June, almost two months in the past.

A unfavourable trade netflow signifies that extra BTC was withdrawn from exchanges than was deposited.

This pattern is usually thought-about bullish, suggesting that holders are shifting their Bitcoin off exchanges. When traders withdraw their property from exchanges, it usually displays confidence.

Supply: CryptoQuant

Additionally, this motion contrasts with the promoting strain seen from some short-term holders.

This suggests that whereas some market contributors are locking in income or mitigating dangers, a bigger group of traders is selecting to carry their BTC off exchanges.

BTC’s volatility stretches

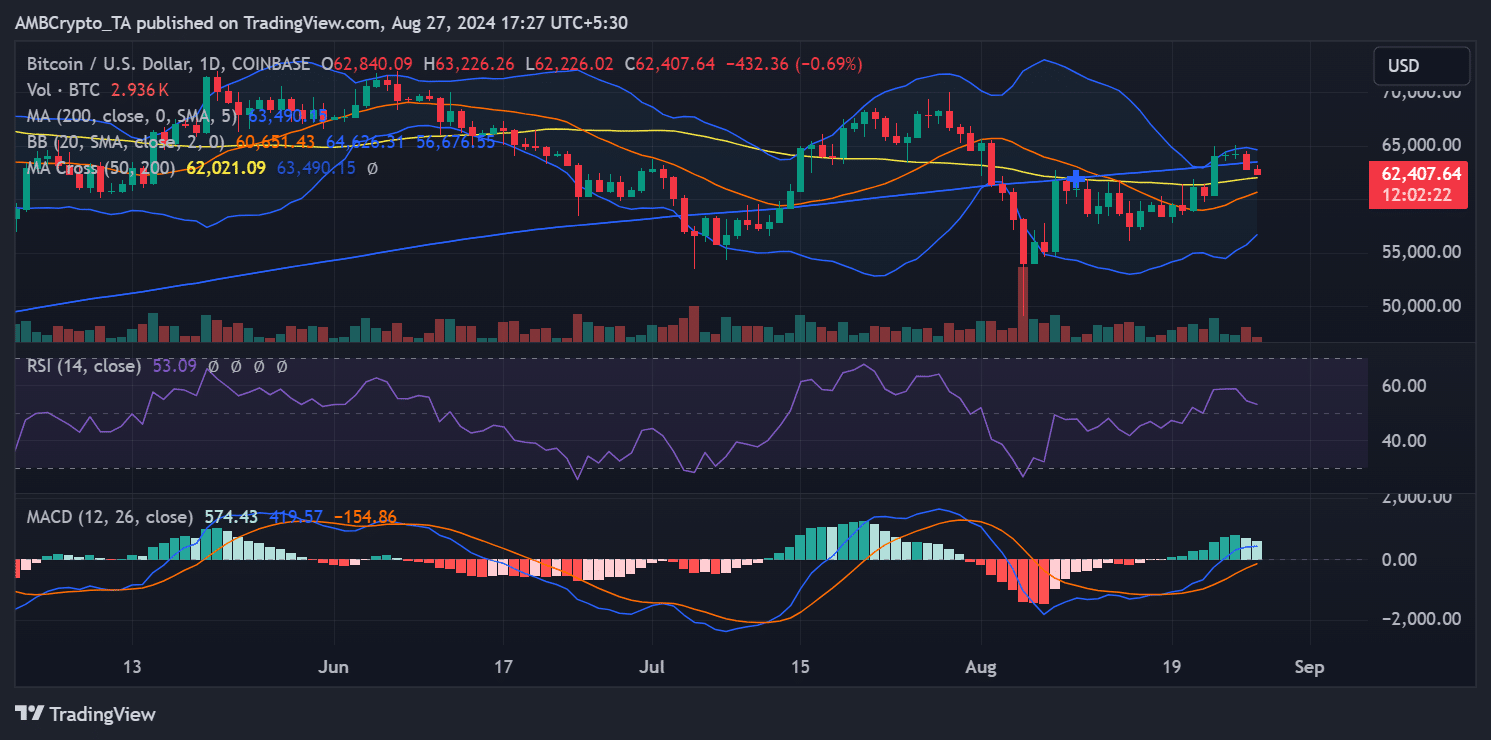

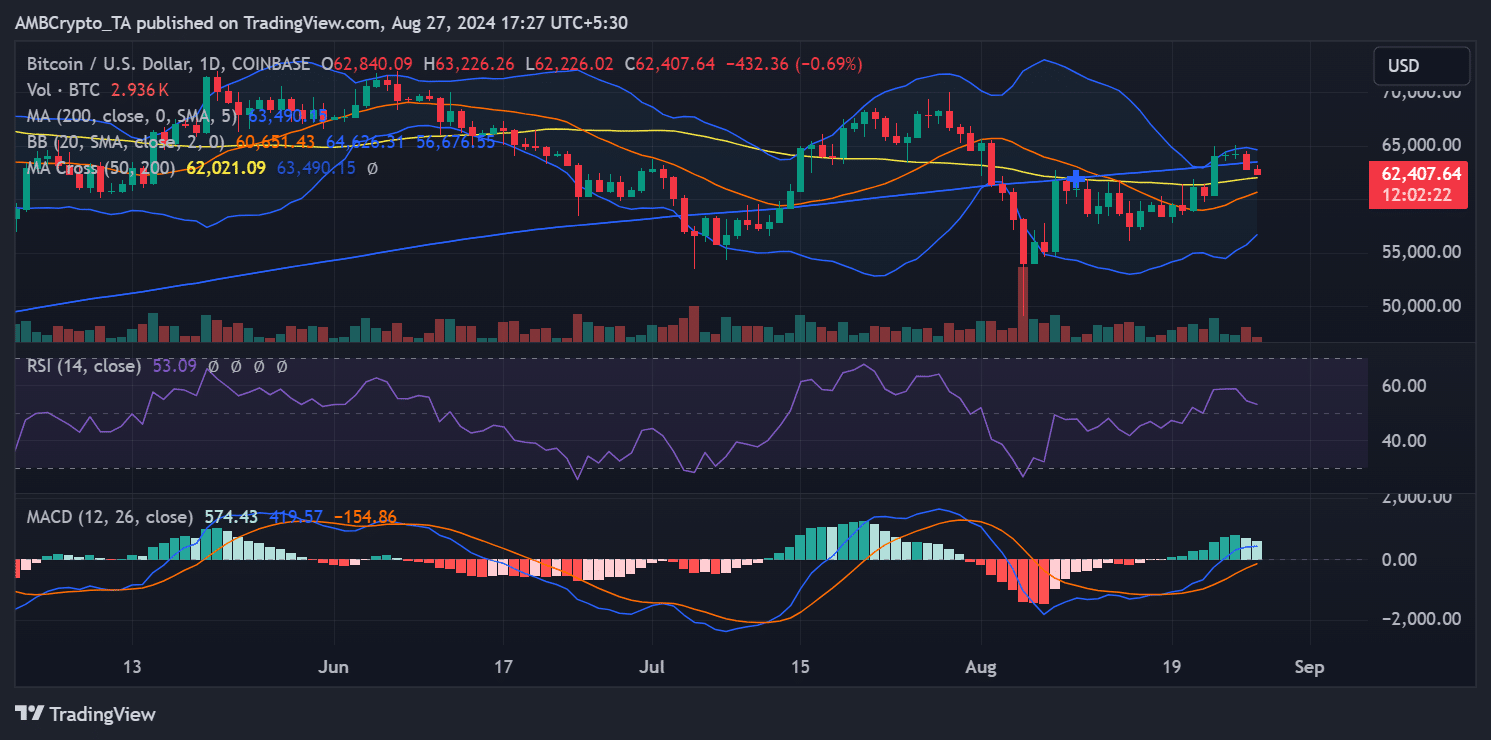

AMBCrypto’s evaluation of Bitcoin’s every day pattern highlights the continuing volatility that Bitcoin has been experiencing.

The examine of its Bollinger Bands—a technical indicator that measures value volatility—reveals that the bands have stretched in current days, reflecting the elevated value fluctuations.

Supply: TradingView

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Within the final buying and selling session, Bitcoin misplaced over 2% of its worth and has continued to say no by virtually 1% within the present session.

As of this writing, Bitcoin was buying and selling at roughly $62,401. The widening of the Bollinger Bands indicated that the market has skilled greater volatility, with value actions turning into extra pronounced.