- The CVD revealed that shorts outpaced longs however it may very well be nice for the worth.

- A declining Open Curiosity presently alongside excessive volatility prompt warning.

Bitcoin’s [BTC] bounce from $60,731 to $63,049 has not deterred merchants from opening quick contracts, AMBCrypto confirmed. However traditionally, a excessive variety of quick positions may very well be nice for BTC’s worth.

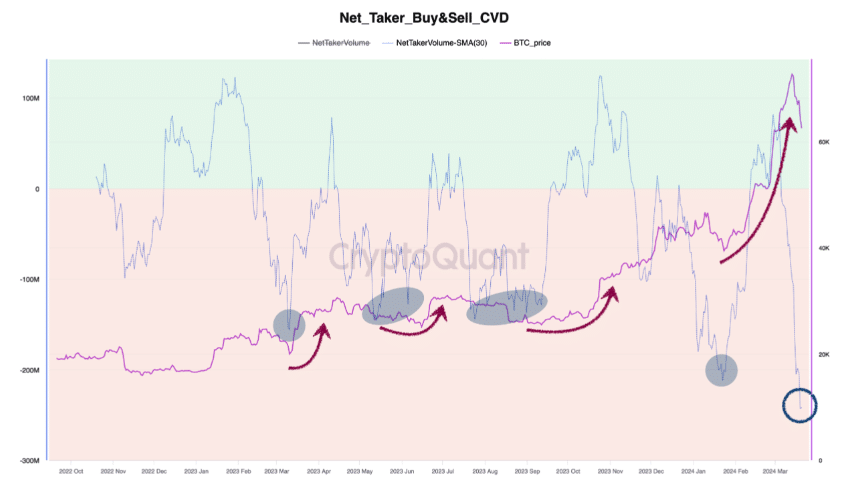

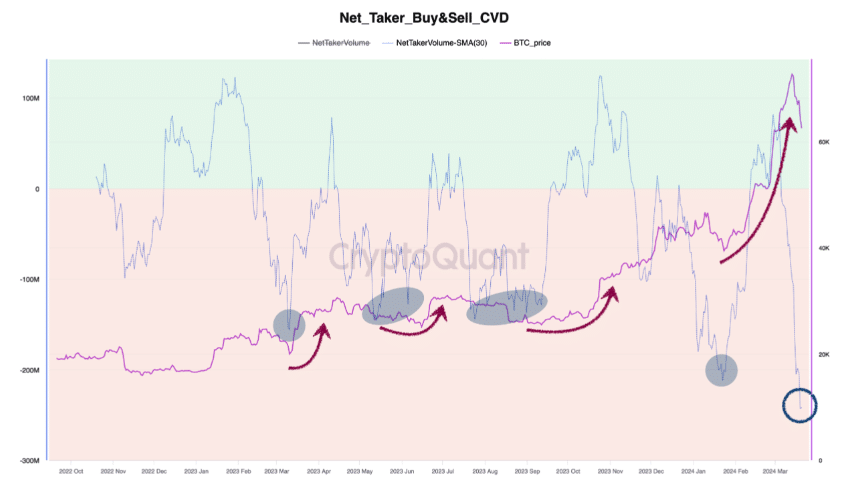

SignalQuant, an on-chain analyst additionally aligned with our viewpoint. The analyst had posted his ideas in regards to the matter on CryptoQuant. From the submit, SignalQuant thought-about the Taker Purchase/Promote Cumulative Quantity Delta (CVD).

One says it’s restoration time

Not like the spot CVD, the Taker Purchase/Promote CVD tracks exercise within the derivatives market. For these unfamiliar, it offers the distinction between longs and quick positions.

The inexperienced space (as proven beneath) infers that lengthy exceeded shorts. However at press time, the metric was within the learn area, indicating that shorts had been dominant.

Supply: CryptoQuant

The writer concluded the evaluation by noting that,

“Nevertheless, the historic sample reveals that after a interval of dominant market shorts, Bitcoin worth both strikes sideways or rebounds sharply.”

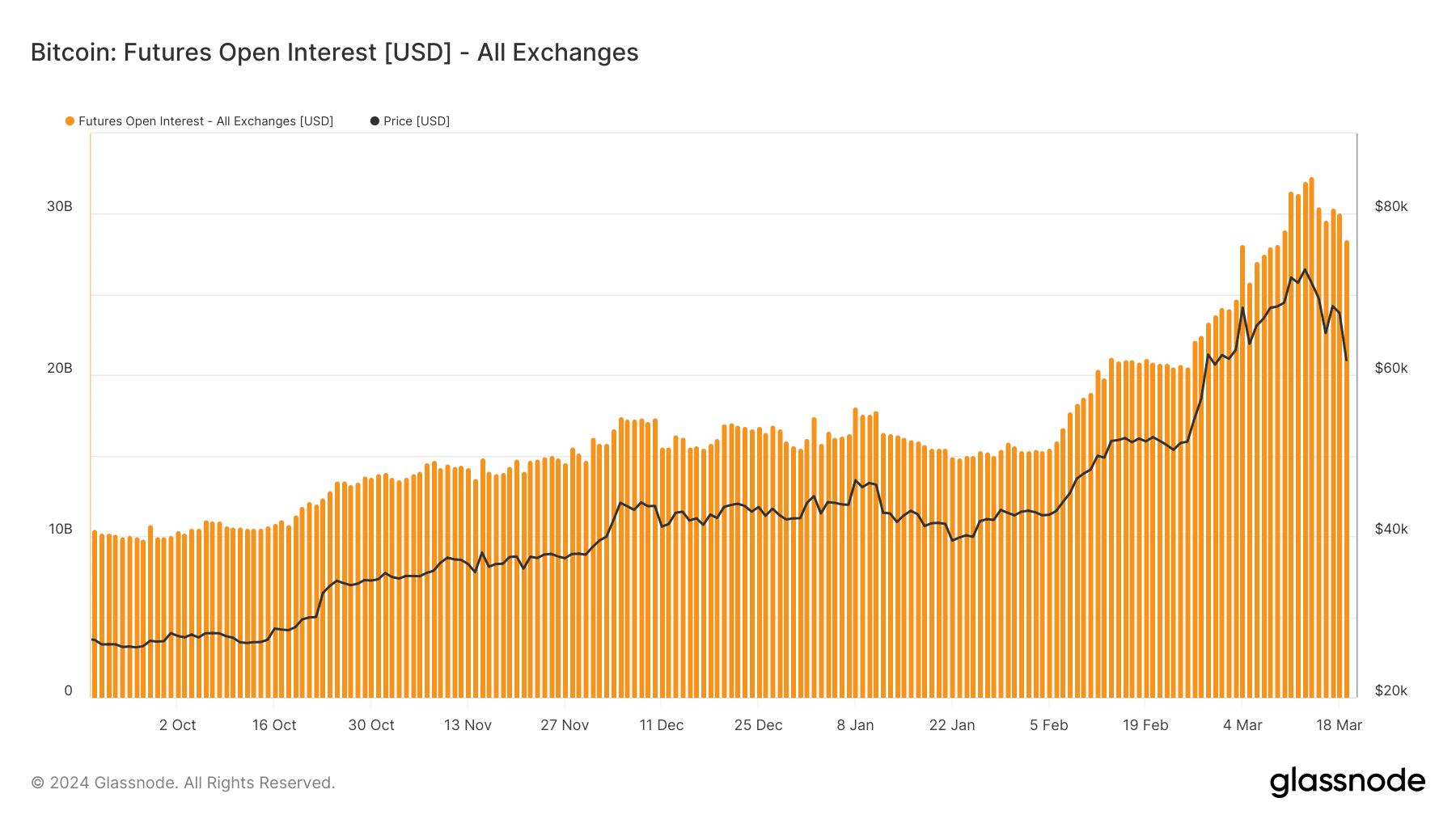

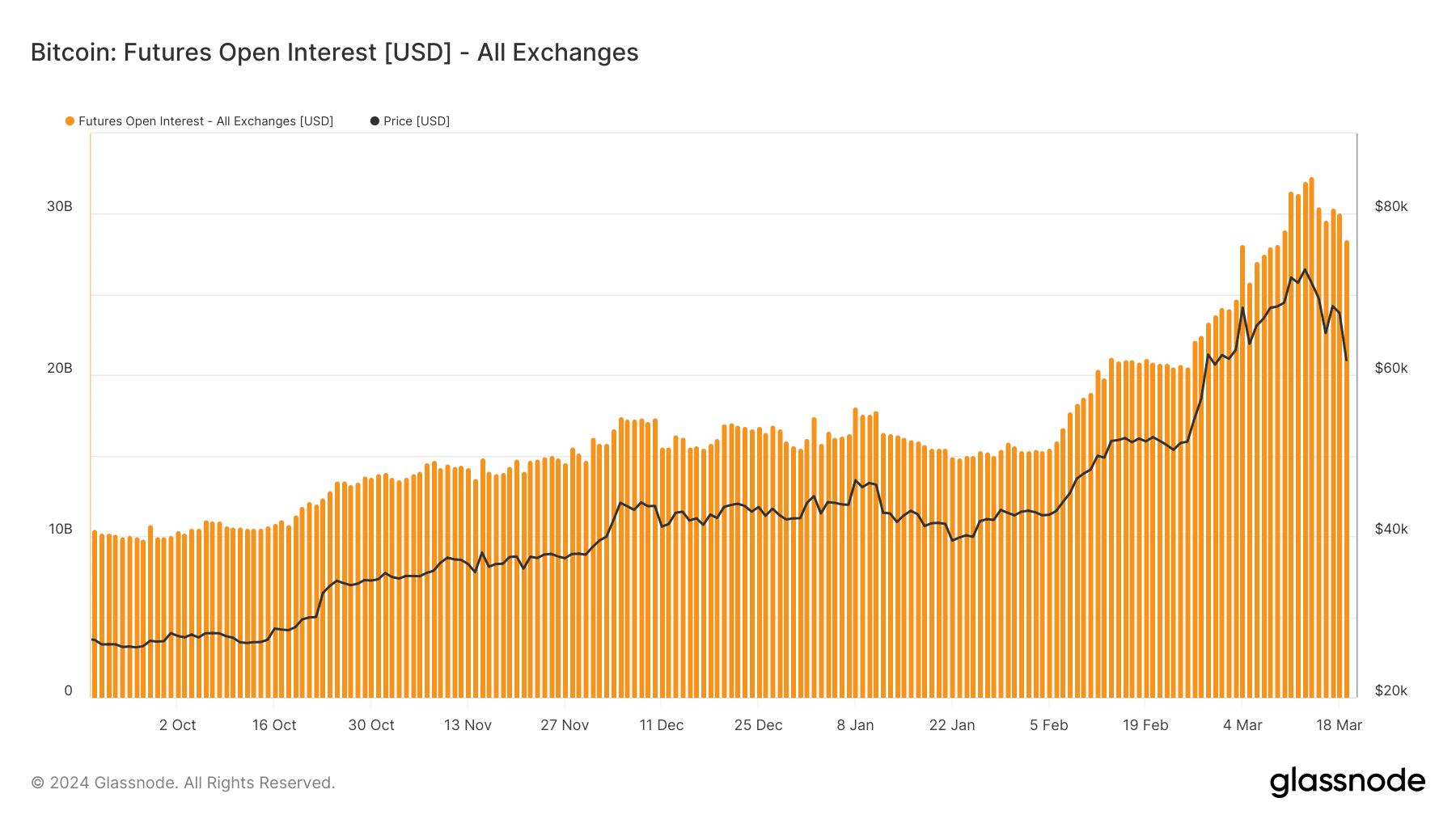

Nevertheless, there was one other twist to Bitcoin’s state of affairs. This time, it concerned the Open Curiosity (OI). OI is the variety of excellent contracts within the futures market.

Typically again, AMBCrypto reported how the OI was one of many main catalysts that triggered BTC’s rise to $73,000. At press time, Glassnode’s information confirmed that the OI has been lowering.

This means that merchants are closing their beforehand open contracts. If we go by an identical state of affairs that occurred through the 2021 bull cycle, Bitcoin’s correction may not be over.

Supply: Glassnode

The opposite opposes

If that is so, the worth of Bitcoin may pull again as little as $58,000. Regardless of the current decline, BTC’s Yr-To-Date (YTD) efficiency was a 42.60% enhance.

Nevertheless, one other nosedive from the press time degree might see this quantity reduce quick. Ought to Bitcoin’s worth lower, it may not contemplating how previous cycles have been.

For instance, when the coin approached the 2016 halving, the uptrend it had at the moment, went off. Throughout the third halving in 2020, an identical state of affairs occurred.

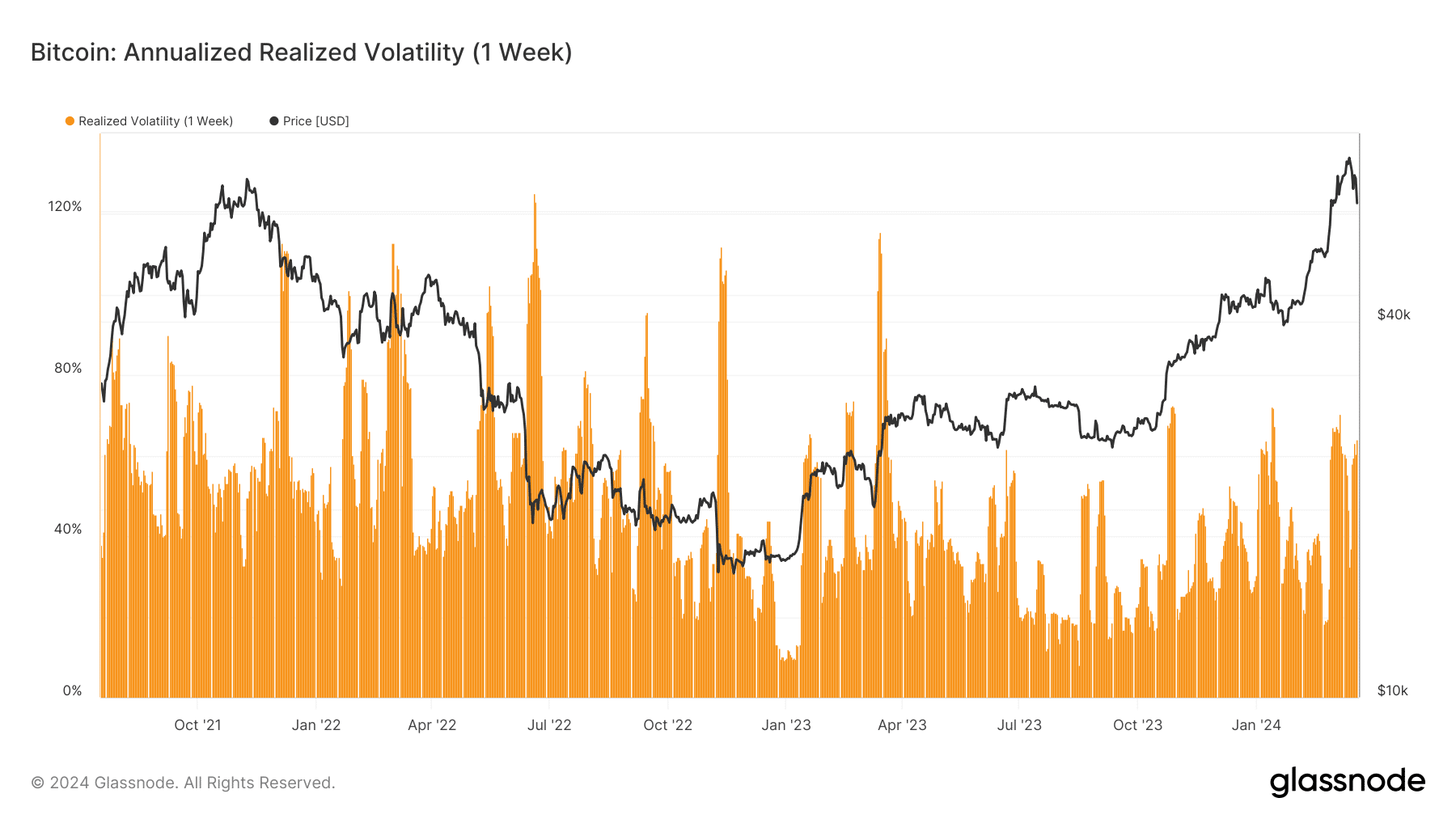

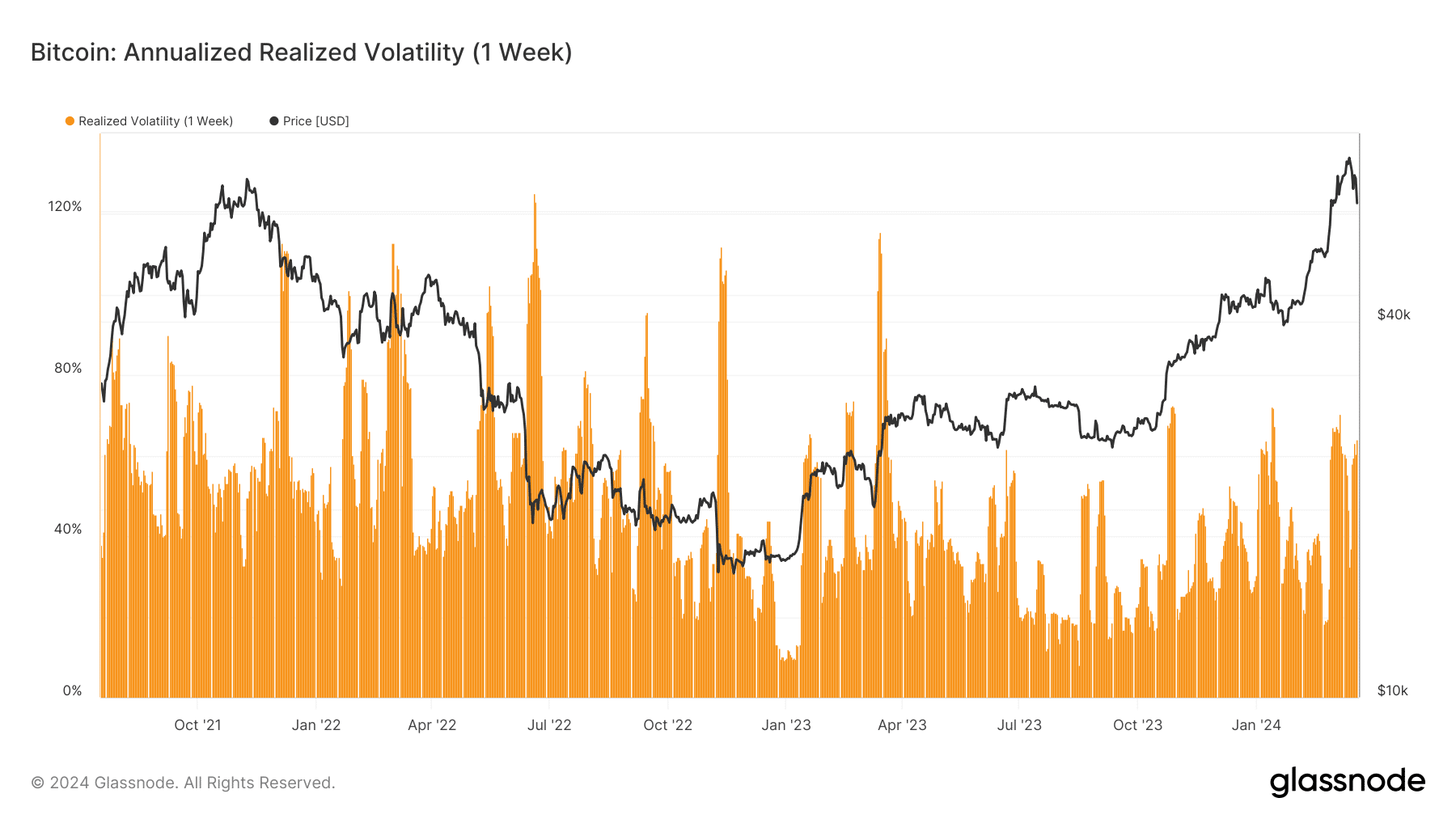

Moreover, AMBCrypto assessed the Realized Volatility. By definition, Realized Volatility appears to be like on the returns a cycle has given in contrast with what has occurred previously.

The results of this tells whether it is dangerous or to not commerce BTC. Low values of the Realized Volatility indicate it may not be dangerous to lengthy or quick Bitcoin.

Supply: Glassnode

Sensible or not, right here’s BTC’s market cap in ETH phrases

However at press time, the one-week Realized Volatility was 60.6% indicating a high-risk phase. Due to this fact, it could be higher for merchants to keep away from opening BTC contracts presently.

As issues stand, costs might fluctuate both manner, and high-leverage bets might face huge liquidation. As well as, the worth of BTC has extra tendency to say no as soon as extra earlier than a notable restoration.