Home Republicans on the GOP’s “weaponization” subcommittee mentioned in a Friday report that the IRS has agreed to finish its “abusive” coverage of shock visits to taxpayers’ houses following stress from the panel.

“The Committee’s and Choose Subcommittee’s oversight revealed, and led to the swift finish of, the IRS’s weaponization of unannounced area visits to harass, intimidate, and goal taxpayers,” reads the report. “Taxpayers can now relaxation assured the IRS is not going to come knocking with out offering prior discover—one thing that ought to have been the IRS’s apply all alongside.”

The IRS introduced in July that it could finish most unannounced agent visits to the houses of Individuals, citing safety issues.

However it additionally got here after the company engaged in what gave the impression to be witness intimidation, after visiting the New Jersey house of journalist Matt Taibbi on the identical day he appeared earlier than Congress to testify on authorities abuse.

Following the incident, Chairman Jim Jordan (R-OH) demanded solutions from the IRS, writing “In mild of the hostile response to Mr. Taibbi’s reporting amongst left-wing activists, and the IRS’s historical past as a software of presidency abuse, the IRS’s motion might be interpreted as an try to intimidate a witness earlier than Congress.“

Taibbi thanked Jordan on Saturday, writing in response to the report:

One of many instances outlined is my very own. My house was visited by the IRS whereas I used to be testifying earlier than Jordan’s Committee in regards to the Twitter Information on March 9th. Honest thanks are because of Chairman Jordan, whose employees not solely demanded and acquired answers in my case, however achieved a concrete policy change, as IRS Commissioner Daniel Werfel announced in July new procedures that may “end most” house visits.

Anticipating criticism for expressing public due to a Republican congressman, I’d prefer to ask Democratic Occasion partisans: to which elected Democrat ought to I’ve appealed for assist on this matter? The one who known as me a “so-called journalist” on the Home ground? The one who informed me to take off my “tinfoil hat” and put better belief in intelligence providers? Those in management who threatened me with jail time? I gave votes to the occasion for thirty years. Which elected Democrat would have carried out primary constituent providers in my case? Be at liberty to boost a hand.

If silence is the reply, why ought to I ever vote for a Democrat once more? –Racket News

Taibbi had opined earlier in the day on the disturbing IRS house visits, writing in Racket that: maybe probably the most ‘unsettling revelations’ occurred after his case – when on April 25, 2023 a girl was visited by an IRS agent utilizing a pretend title.

On that date, a girl was visited at her house by a person figuring out himself as “Invoice Haus” from the IRS’s Felony Division. He then “knowledgeable the taxpayer he was at her house to debate points regarding an property for which the taxpayer was the fiduciary,” and after sharing “particulars in regards to the property that solely the IRS would know,” the taxpayer “let him into her house.”

The lady knowledgeable “Haus” that the property points had been resolved, and furnished paperwork to show it. At this level, he knowledgeable her of his actual goal, claiming she was delinquent on a number of tax filings and offered “a number of paperwork to the taxpayer for her to finish.”

Hesitating, the girl supplied to place him on the cellphone together with her accountant, however when he didn’t reply the cellphone, she contacted an legal professional, who “repeatedly informed Agent ‘Haus’ to go away the taxpayer’s house because the taxpayer had not acquired any prior discover from the IRS of any concern.” The agent reportedly replied that he was with the IRS and will go into anybody’s home at any time, and earlier than leaving informed the taxpayer she had “precisely one week to fulfill the remaining steadiness or he would freeze all her property and put a lien on her home,” because the Committee report put it.

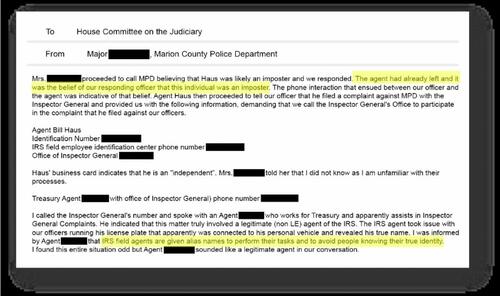

As soon as “Haus” left, the taxpayer feared a rip-off and had the great sense to right away contact the Marion, Ohio Police Division (MPD), upon whose experiences this story finally ends up being based mostly. (Emails revealed under.) The MPD ran the plate of “Invoice Haus” and located it got here again to a automotive owned by somebody with a special title. The police contacted the automotive proprietor, who “attested that he was an IRS agent however admitted Invoice Haus was not his actual title; he was utilizing an alias.”

* * *

Taibbi additionally notes that “Agent Haus” was pissed after his identification was found, after which filed a grievance with the Treasury Division’s Inspector Basic in opposition to the MPD for outing him. It was solely after a senior MPD supply known as the Inspector Basic (TIGTA) that they had been in a position to verify that Haus was an precise IRS agent.

As Taibbi additional considers:

Pause right here to think about the quite a few issues already confirmed, to police, by the IRS:

IRS brokers make area visits utilizing aliases;

IRS brokers make “pretext” visits, i.e. they announce they’re asking about one factor, when actually by their very own admission, they may be investigating one thing else;

The IRS makes native, covert house visits with out informing native authorities.

Consider the issues that would come up from the final concern alone. In response to the exchanges, the IRS isn’t required to tell native officers of investigative exercise, however as famous by the TIGTA official in communications with the MPD, that is one thing they need to do, to keep away from mixups. Right here for example, even after a prolonged inquiry, native police had been not sure “Agent Haus” actually labored for the Treasury. Think about if the taxpayer known as police to come back over throughout her go to, and consider the issues may go flawed. It’s madness that the Treasury would have investigators utilizing aliases making Clockwork Orange-style “surprise visits” with out informing native officers.

Superb.

Loading…