PDQ1000

After the brutal sell-off of the final two years, REITs are poised for a surge. There are dozens of high quality REITs whose yields are at or close to their all-time highs. Inflation seems to be underneath management, and almost right down to the Fed goal of two%. Rates of interest will in all probability maintain regular or drop within the foreseeable future. Nonetheless, this upswing won’t profit all REITs equally, and there are some potential land mines within the REIT panorama.

Due to the quite a few fee will increase over the previous two years, cautious buyers can now get about 5% with little or no threat (and little or no upside). So what motive would you’ve gotten, to spend money on a safety paying lower than 5%, except it has important upside potential within the share worth? Would not there be even much less motive to spend money on one which has important draw back threat?

That is very true when there are such a lot of REITs yielding greater than 5%, with important upside constructed into the worth. (In a current article, I highlighted 10 such REITs.)

For the extra risk-averse buyers, worth buyers, and retirees who depend upon dividend revenue, this text identifies 11 REITs which can be doubtlessly overvalued by no less than 10% and yield considerably much less than 5%. Then I take a better take a look at the highest 6 corporations on that checklist.

The Checklist

Listed below are the 11 REITs that match the above standards. On this desk, “Premium” is the p.c by which the present share worth exceeds the merited purchase worth.

| Firm | Ticker | Sector | Premium | Yield |

| Safehold | (SAFE) | Internet Lease | 225% | 3.63% |

| Industrial Logistics | (ILPT) | Industrial | 73% | 1.32% |

| Franklin Road | (FSP) | Workplace | 63% | 1.64% |

| Farmland Companions | (FPI) | Farmland | 58% | 1.90% |

| DigitalBridge Group | (DBRG) | Knowledge Heart | 49% | 0.24% |

| City Edge | (UE) | Strip Heart | 30% | 3.80% |

| Welltower | (WELL) | Medical | 29% | 2.72% |

| Potlatch Deltic | (PCH) | Timber | 27% | 3.78% |

| Americold | (COLD) | Industrial | 23% | 3.12% |

| Iron Mountain | (IRM) | Knowledge Heart | 22% | 4.11% |

| Empire State Realty | (ESRT) | Workplace | 14% | 1.63% |

Supply: Hoya Capital Earnings Builder

Chicken’s Eye Overview

No firm is ideal. Each firm has points, and each firm has favorable points. A Purchase case may be made for a few of the corporations on the checklist, and a Maintain case may be made for nonetheless others. I can’t try an exhaustive overview of every firm. As an alternative, I’ll take a snapshot of every of the highest 6 REITs on the checklist, to focus on the issue areas that contribute to the chance that the corporate could also be overvalued.

Right here is the checklist once more, with every firm rated for 7 salient components: FFO Development, Dividend Development, Dividend Security, Steadiness Sheet, Valuation, NAV, and Profitability. Strengths are highlighted in inexperienced. Downside areas are flagged in pink.

| Ticker | FFO Development | Div. Development | Div. Security | Steadiness Sheet | Valuation | NAV | Revenue |

| SAFE | |||||||

| ILPT | |||||||

| FSP | |||||||

| FPI | |||||||

| DBRG | |||||||

| UE | |||||||

| WELL | |||||||

| PCH | |||||||

| COLD | |||||||

| IRM | |||||||

| ESRT |

Supply: Hoya Capital Earnings Builder and Searching for Alpha Premium

Subsequent, let’s take a better take a look at the highest 6, focusing solely on the issue areas, to know why they’re flagged.

Safehold Inc.

Safehold (SAFE) has downside areas in Dividend Security, Steadiness Sheet, Valuation, NAV, and Profitability.

Searching for Alpha Premium assigns this firm a Dividend Security grade of F, indicating it’s in imminent hazard of a dividend lower, which might in all probability be adopted by a swift and important tumble in share worth. This alarming ranking relies totally on the corporate’s indebtedness and FFO/Debt ratios.

Let’s take a better take a look at the debt image. SAFE has an exceedingly excessive Debt Ratio of 65%. (The components for Debt Ratio is Complete Debt divided by Complete Belongings.) The common Debt Ratio for REITs as a complete is at the moment simply 30%.

| Firm | Debt Ratio | Debt/EBITDA | Variable Price |

| SAFE | 65% | 10.0 | 0.0% |

Supply: Hoya Capital Earnings Builder

Making issues worse, the corporate’s capacity to pay its approach out of debt with its earnings is poor, as mirrored by a ten.0 Debt/EBITDA ratio, in comparison with the REIT common of 6.3. SAFE’s FFO/share fell this yr by virtually 70%. Whether or not it recovers quickly sufficient to protect the dividend stays to be seen.

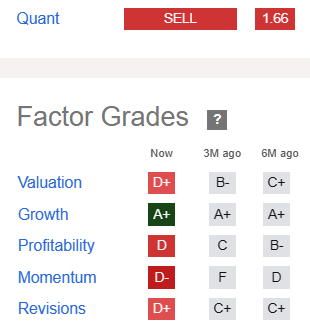

Because of the dive in revenues, the Searching for Alpha Quant Rankings system additionally sees profitability as an issue for SAFE, assigning a profitability grade of D and a Promote ranking.

Searching for Alpha Quant Rankings (Searching for Alpha Premium)

SAFE is at the moment priced at a stratospheric 40.0x FFO ’23. In the meantime, the corporate’s share worth displays solely a (-2.1)% low cost to the estimated NAV, whereas the typical REIT is promoting for a reduction of (-18.0)%.

| Firm | Value/FFO ’23 | Premium to NAV |

| SAFE | 40.0 | (-2.1)% |

Supply: Hoya Capital Earnings Builder

Industrial Logistics Properties Belief

Industrial Logistics (ILPT), which is externally managed by RMR Group, has progress and steadiness sheet points. Its FFO per share has collapsed over the previous two years, at the moment standing at about 25% of its 2020 ranges.

| ILPT | 2020 | 2021 | 2022 | 2023 |

| FFO/share | $1.86 | $1.89 | $1.17 | $0.48 |

| % change YoY | — | 1.6 | (-38.1) | (-59.0) |

Supply: Hoya Capital Earnings Builder

This has led to drastic dividend cuts and plenty of pink ink on the steadiness sheet. The quarterly dividend, which was unfazed by the pandemic, was slashed from $0.33 to only $0.01 in July of 2022 and stays at that degree right now.

In the meantime, its Debt Ratio of 86% and Debt/EBITDA of 16.7 are formidable issues, to say the least, and the corporate holds a horrifying 53% of its debt in variable-rate devices, so it’s paying excessive rates of interest.

| Firm | Debt Ratio | Debt/EBITDA | Variable Price |

| ILPT | 86% | 16.7 | 53.2% |

Supply: Hoya Capital Earnings Builder

Franklin Road Properties

Franklin Road Properties (FSP) has FFO progress, Dividend progress, steadiness sheet, and valuation points, beginning with a drastic decline in FFO. From $0.75 per share in 2020, it has steadily dropped all the best way to $0.29 per share this yr.

| FSP | 2020 | 2021 | 2022 | 2023 |

| FFO/share | $0.75 | $0.55 | $0.40 | $0.29 |

| % change YoY | — | (-26.7) | (-27.3) | (-27.5) |

Supply: Hoya Capital Earnings Builder

As with ILPT, this has led to drastic dividend cuts and steadiness sheet points. The quarterly dividend was lower in July 2022, from $0.09 to only $0.01, the place it stays right now.

Money owed have piled up, leading to a really excessive Debt Ratio of 60% and Debt/EBITDA of 16.0, abysmal even by Workplace REIT requirements. An alarming 53.0% of the FSP’s debt is held at variable charges. Even when the Fed stops elevating charges, these variable fee devices sometimes carry a lot increased rates of interest than fixed-rate money owed.

| Firm | Debt Ratio | Debt/EBITDA | Variable Price |

| FSP | 60% | 16.0 | 53.0% |

Supply: Hoya Capital Earnings Builder

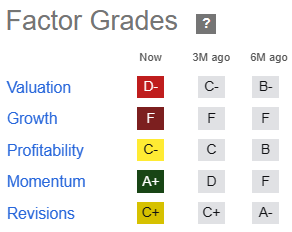

Though FSP’s Value/FFO and low cost to NAV are in step with the beaten-down Workplace REIT sector, the Searching for Alpha Quant scores system assigns the corporate a D- for valuation.

FSP Issue Grades (Searching for Alpha Premium)

That is primarily based partly on its very low dividend yield, in addition to its Value/Money Move of 14.48 and its ahead Value/AFFO of 48.80, each of that are far above the sector common.

Farmland Companions Inc.

Farmland Companions (FPI) can also be going through FFO progress, Dividend progress, steadiness sheet, and valuation points. Like ILPT and FSP, these start with a considerable decline in FFO, from $0.43 in 2020 to $0.17 in 2023.

| FPI | 2020 | 2021 | 2022 | 2023 |

| FFO/share | $0.43 | $0.25 | $0.30 | $0.17 |

| % change YoY | — | (-41.9) | 20.0 | (-43.3) |

Supply: Hoya Capital Earnings Builder

Dividend progress has been laconic, with just one dividend enhance prior to now 5 years (from $0.05 to $0.06). Worse, FPI earns a Dividend Security grade of D from the Searching for Alpha Quant Rankings system, indicating a important threat of a dividend lower.

The lapse in revenues has induced the payments to pile up, with Debt/EBITDA of 14.9 choking the circulate of dividends and funding capital, and the comparatively excessive 12.4% of debt held at variable charges leeching but extra FFO.

| Firm | Debt Ratio | Debt/EBITDA | Variable Price |

| FPI | 36% | 14.9 | 12.4% |

Supply: Hoya Capital Earnings Builder

FPI buyers will inform you promptly that that is an funding within the underlying worth of the land, so conventional REIT metrics are much less vital. So let us take a look at NAV. Whereas FPI’s peer Gladstone Land (LAND) is priced at a (-12.8)% low cost to the estimated NAV, FPI is priced at 5.3% premium. So shares appear a bit overpriced, even in comparison with the worth of the land.

| Firm | Value/FFO ’23 | Premium to NAV |

| FPI | 40.0 | 5.3% |

Supply: Hoya Capital Earnings Builder

The Searching for Alpha Quant Rankings system assigns FPI a grade of F for valuation.

DigitalBridge Group

DigitalBridge Group (DBRG) is going through dividend progress, steadiness sheet, and valuation points. The corporate fully discontinued its dividend in the course of the pandemic, which isn’t uncommon, however waited till September of 2022 to renew paying dividends, slashing from the unique $0.11 per share, down to only $0.01, the place it stays.

In the meantime, money owed have piled up. The Debt Ratio for DBRG is 1590 foundation factors increased than the REIT common of 30.0%, and Debt/EBITDA can also be a bit troubling at 8.0.

| Firm | Debt Ratio | Debt/EBITDA | Variable Price |

| DBRG | 45.9% | 8.0 | — |

Supply: Hoya Capital Earnings Builder and creator calculations

Value/FFO ’23 on DBRG is a whopping 40.0. In the meantime, DBRG is promoting at a scorching 19.4% premium to the estimated NAV, whereas the typical REIT is at the moment promoting at an (-18.0)% low cost.

| Firm | Value/FFO ’23 | Premium to NAV |

| DBRG | 40.0 | 19.4% |

Supply: Hoya Capital Earnings Builder

Searching for Alpha Quant scores system assigns DBRG a grade of F for valuation.

City Edge Properties

City Edge Properties (UE) arguably has steadiness sheet and valuation points. The corporate’s Debt Ratio is 2200 foundation factors above the REIT common, and its Debt/EBITDA can also be considerably elevated, at 8.2.

| Firm | Debt Ratio | Debt/EBITDA | Variable Price |

| UE | 52% | 8.2 | 4.7% |

Supply: Hoya Capital Earnings Builder

That’s troublesome for a REIT rising FFO at solely 2.5% every year.

| UE | 2020 | 2021 | 2022 | 2023 | 2024 |

| FFO/share | $0.88 | $1.09 | $1.21 | $1.24 | $1.27 |

| % change YoY | — | 23.8 | 11.0 | 2.5 | 2.4 |

Supply: Hoya Capital Earnings Builder

Though the corporate’s Value/FFO is in step with the Purchasing Heart REIT sector, shares are promoting at a reduction to the estimated NAV of solely (-2.1)%, which is 1590 foundation factors costlier than the typical REIT.

| Firm | Value/FFO ’23 | Value/FFO ’24 | Premium to NAV |

| UE | 13.4 | 13.2 | (-2.1)% |

Supply: Hoya Capital Earnings Builder

Searching for Alpha Quant Rankings system assigns UE a valuation grade of D+.

The Backside Line

I’m not essentially advocating a Promote on any of those corporations. Nonetheless, I’m advocating a powerful word of warning if they’re in your watchlist, or if you’re lengthy in any of those, with massive allocations. There appear to be many higher alternate options to your cash nowadays. However that is simply my opinion.

As at all times, the opinion that issues most is yours. As a result of it is your cash.