XH4D/E+ by way of Getty Photographs

2024 is about to grow to be an inflection level within the Fed’s struggle in opposition to inflation. The stakes are excessive and the market has referred to as the bluff of upper for longer rhetoric to cost in fee cuts as early because the Might 2024 FOMC assembly. For BDCs like Horizon Expertise Finance (NASDAQ:HRZN), charges at 22-year highs have shaped an unimaginable tailwind to its debt portfolio yield which stood at 17.1% on the finish of its fiscal 2023 third quarter. HRZN supplies structured debt merchandise to life science and know-how corporations. This debt sometimes comes with phrases of 3-5 years and with larger charges as a result of elevated credit score danger profile of the debtors. For instance, HRZN originated a $15 million venture loan in August to Tallac Therapeutics, a Bay Space-based biopharmaceutical startup based in 2018 to develop a number of novel immunotherapies to struggle most cancers. Earnings wrapped round gradual web asset worth development is the prize and HRZN final declared a $0.11 per share month-to-month money dividend for a ten.3% annualized ahead yield.

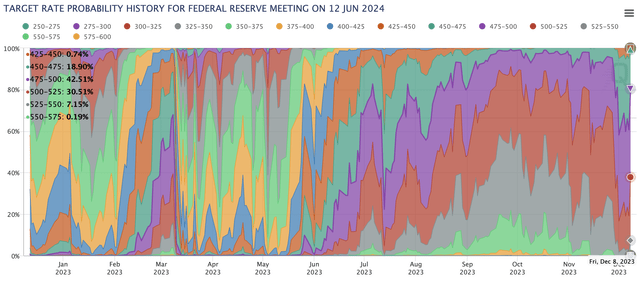

CME FedWatch Device

30-Day Fed Funds futures pricing information as visualized by the CME FedWatch Device at the moment has a 50 basis point cut to the Fed funds fee within the first half of subsequent yr as the bottom case, at odds with the median Fed estimates that rates of interest would solely sit at 5.1% on the finish of 2024. Towards this new zeitgeist, leverage, underwriting high quality, and NAV grow to be the arbiters of worth creation. Assuming flat NAV development with a ten% return per yr pushed by the dividend, an funding in HRZN over 5 years might produce an almost 1.7x return on invested capital. Nonetheless, the BDC’s NAV on a diluted per share foundation has continued to development decrease since I final coated it.

Leverage And Underwriting High quality

HRZN’s debt-to-equity ratio sat at 1.26x as of the tip of the third quarter, larger than most of its enterprise debt BDC friends however nonetheless inside a cushty degree. Leverage is nice for reinforcing returns however amplifies draw back volatility in periods of extra materials financial disruption. HRZN’s ratio has been trending upwards, sitting just under 1x at the beginning of 2022. Excessive leverage when paired with a deterioration in underwriting high quality is the specter set to hang-out BDCs in 2024. HRZN had three investments on nonaccrual standing with a price of $43.6 million and a good worth of $17.2 million on the finish of the third quarter, this shaped 5.78% and a pair of.36% respectively of its funding portfolio. This portfolio was $729.1 million at truthful worth and $754.8 million at price.

Horizon Expertise Finance Fiscal 2023 Third Quarter Type 10-Q

HRZN describes non-accruals as investments which might be no less than 90 days late or occasions the place it doesn’t anticipate to obtain curiosity and principal repayments. Critically, the third quarter represented a deterioration from the tip of 2022 which had 2.90% of its loans on non-accruals at price and 1.15% at truthful worth. Debt funding asset high quality did see fairly substantial modifications with debt investments rated 2 and 1, the bottom credit score high quality ranking tiers, at 13.5% on the finish of the third quarter. This was up from 5.1% on the finish of 2022, a 2.6x improve in 9 months. Nonetheless, debt investments had a weighted common credit standing of three.1 on the finish of the third quarter, unchanged from the tip of 2022 with a rise in debt rated 4 to 22.2% from 13.7%.

Horizon Expertise Finance Fiscal 2023 Third Quarter Type 10-Q

Funding Earnings, NAV, And Spillover Earnings

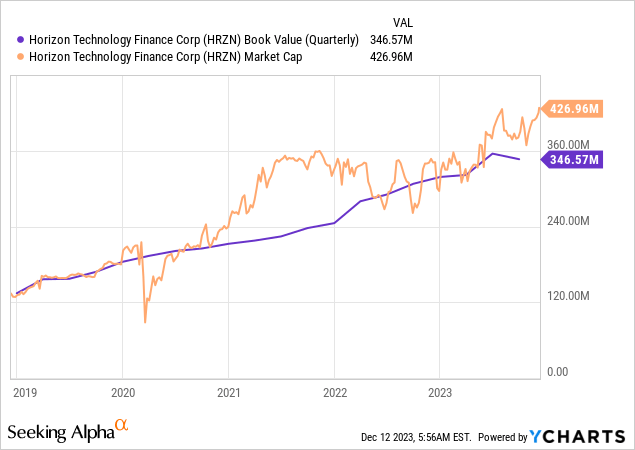

HRZN recorded a third-quarter complete funding revenue of $29.1 million, up 25.3% versus its year-ago comp with the rise in debt yield and the expansion of its portfolio driving the features. The portfolio at truthful worth grew by 15% over its year-ago comp with the dollar-weighted annualized yield on common debt investments on the finish of the third quarter of 17.1% up 120 foundation factors versus 15.9% within the year-ago interval. The BDC funded eight loans totaling $88.4 million in the course of the third quarter, offset by $47 million in repayments, refinancings, and partial paydowns. NAV at $346.57 million was up 12.6% from its year-ago comp however was down $9 million sequentially. Nonetheless, NAV on a diluted per share foundation has declined for 5 consecutive quarters. This was $10.41 per share on the finish of the third quarter, down $1.25 from $11.66 per share within the year-ago quarter.

Most BDCs challenge new fairness and have leaned on this extra closely lately for funding with rates of interest sitting at highs. Nonetheless, HRZN has maybe gone too heavy with its weighted common shares excellent of 32,451,900 on the finish of the third quarter up 26% year-over-year and by 181% over the past 5 years. While this is able to have been accretive as they have been issued with the inventory buying and selling above NAV, the continued decline in NAV per share and the rise of leverage regardless of the difficulty of recent shares means the BDC is much less of a compelling purchase. Internet funding revenue was $0.53 per share, sufficient to cowl 1 / 4 of the dividend by 160%. Outearning the dividend meant an undistributed spillover revenue of $1.23 per share on the finish of the third quarter and an extra particular dividend of $0.05 per share paid out in December. The totally coated dividend set in opposition to the rising portfolio means HRZN is a maintain.