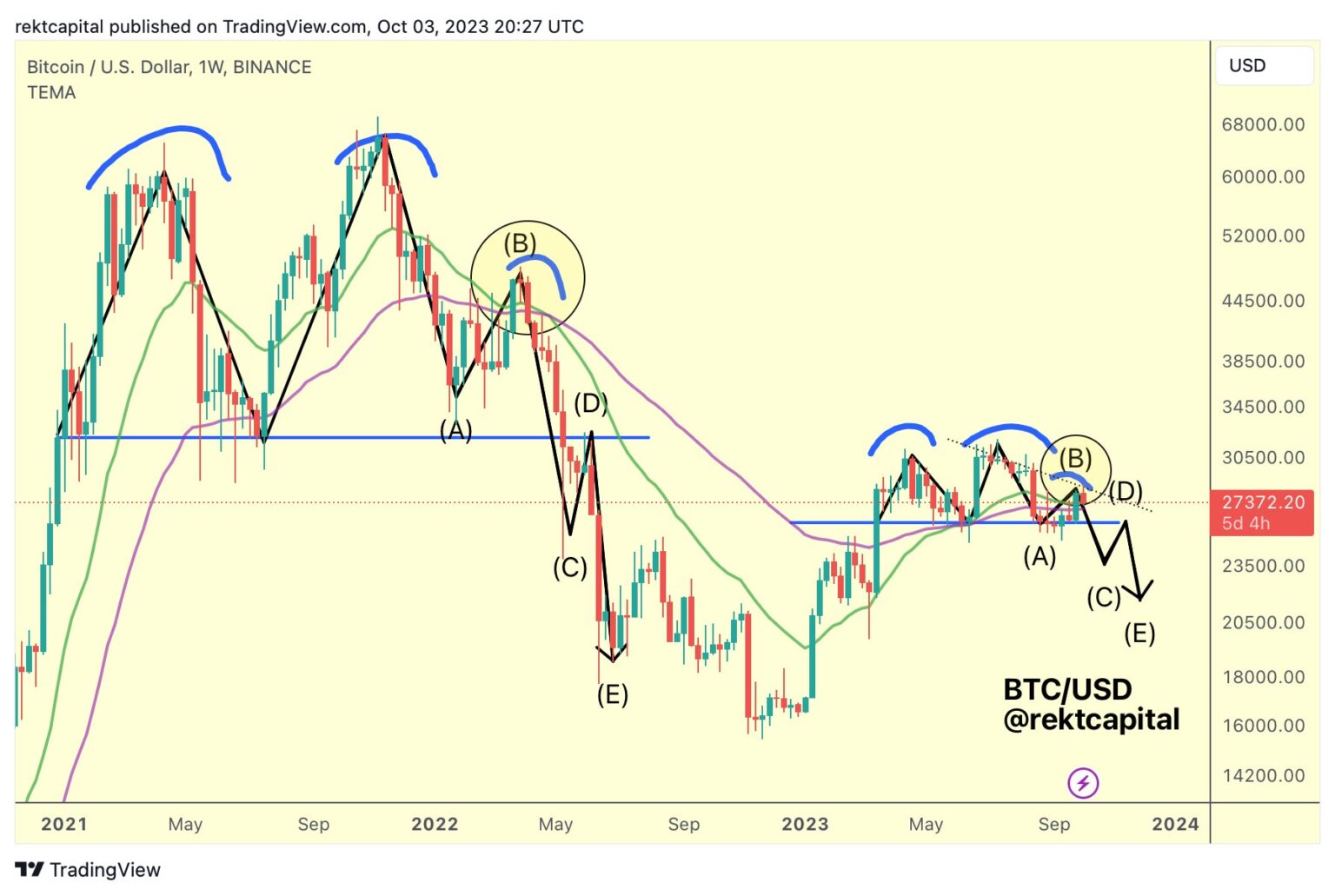

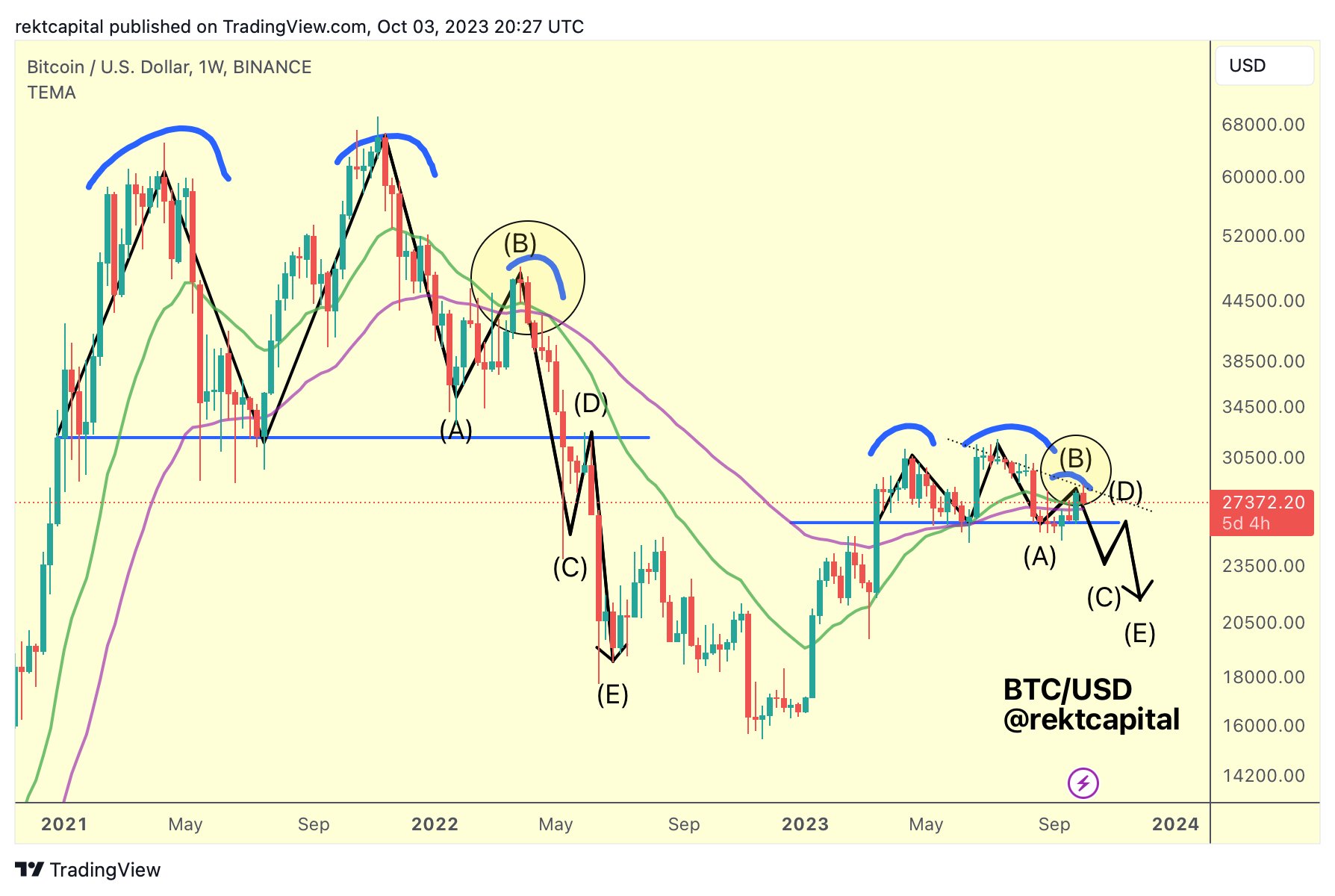

An in depth evaluation by well-regarded crypto analyst Rekt Capital has spotlighted a recurring bearish fractal within the historic worth information of Bitcoin, elevating prospects of a possible crash beneath the $20,000 mark. Notoriously seen in 2019 and 2022, this sample appears to be reemerging within the present 2023 market.

For these unfamiliar, the fractal indicator identifies potential turning factors on a worth chart by highlighting repetitive worth patterns. In easy phrases, a bearish fractal suggests a possible decline in worth. Such a sample materializes when there’s a peak worth with two consecutively decrease excessive bars/candles on its flanks. An up arrow usually marks a bearish fractal, indicating the potential for worth descent.

Right here’s Why Bitcoin Value May Drop Beneath $20,000

The essence of this bearish sample begins with a double prime. Opposite to expectations, this double prime doesn’t validate with a dip beneath a big help degree. As an alternative, the worth usually sees a reduction rally, forming a decrease excessive, solely to crash beneath the beforehand talked about help.

This help then morphs into a brand new resistance degree, driving the worth additional down. This sequence was noticed in each 2019 and 2022, and the present market state of affairs in 2023 mirrors the preliminary phases of this sample. Rekt Capital means that the market is doubtlessly in the course of this bearish fractal, with uncertainty round the place the reduction rally would possibly conclude.

From the start of April to the tip of August, BTC fashioned a double-top sample within the weekly chart. Nevertheless, the Bitcoin worth held above the neckline at round $26,000. Then, in mid-August, BTC began its reduction rally which took the worth as much as $28,600. “We’re most likely within the A to B [phase of the] bearish fractal,” the analyst added.

Diving deeper into potential situations, the analyst believes Bitcoin’s worth may rally as much as roughly $29,000 earlier than experiencing additional declines. Some key occasions to look at for embody potential overextensions past the bull market help band. If Bitcoin fails to retest and preserve this band as help after breaking out, the bearish fractal stays legitimate.

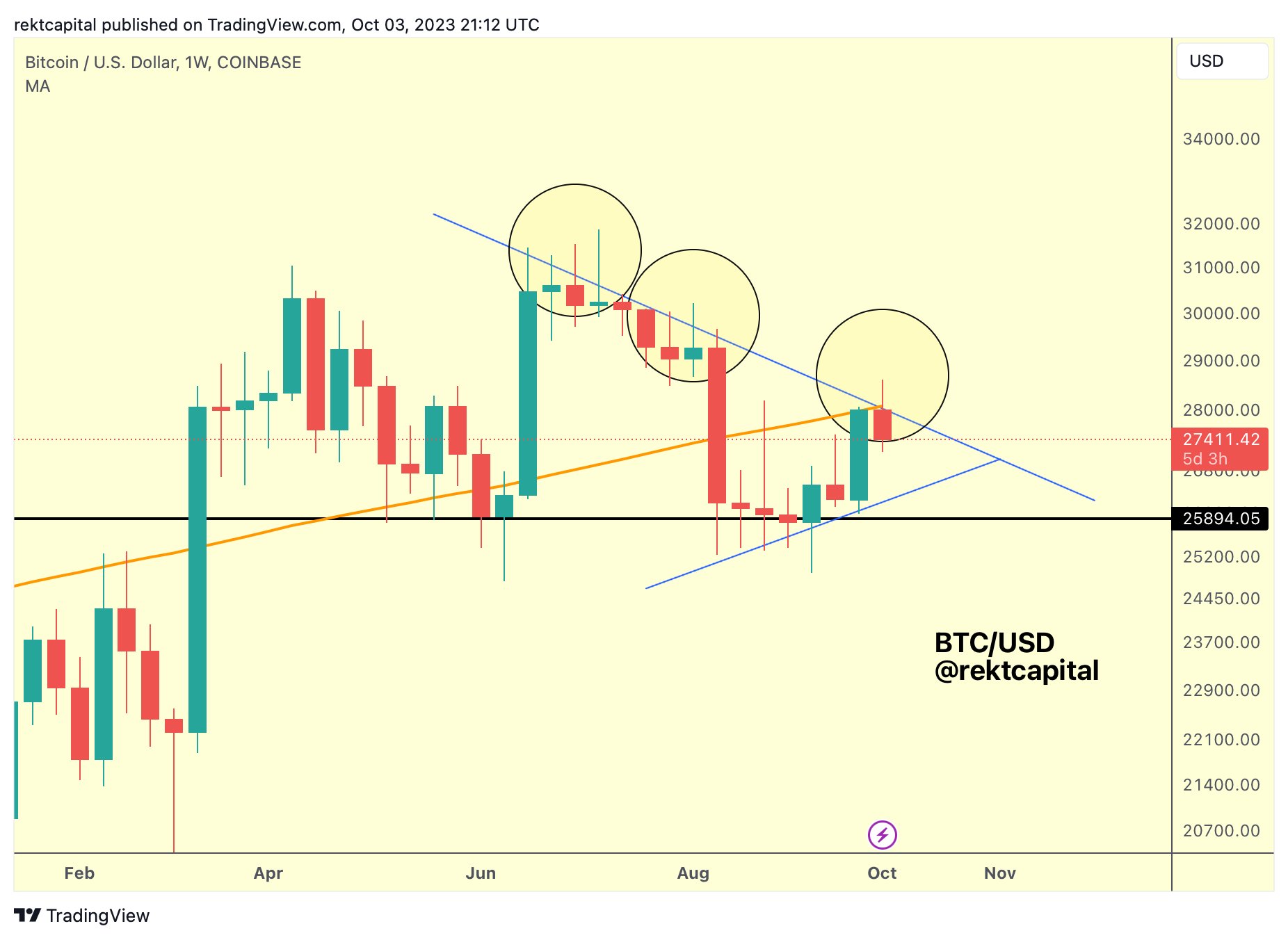

One other vital level to observe is the revisit of the decrease excessive resistance. Even when the worth wicks past this resistance, a subsequent rejection would preserve the bearish outlook intact. There are, nevertheless, standards that would invalidate this bearish perspective: the bull market help band (blue) persistently holds as help, a weekly shut past the decrease excessive resistance ($28,000), and breaking previous the $31,000 yearly highs.

On the subject of different technical indicators, Rekt Capital highlighted that Bitcoin has not too long ago rallied to the 200-week MA. This shifting common (MA), nevertheless, appears to be performing as a present resistance. Moreover, the 200-week MA aligns with the decrease excessive resistance, presenting an important juncture for Bitcoin’s worth within the close to future. Regardless of his macro bullish stance on Bitcoin, Rekt Capital cautions that Bitcoin has but to beat the $28,000 decrease excessive resistance within the 1-week chart.

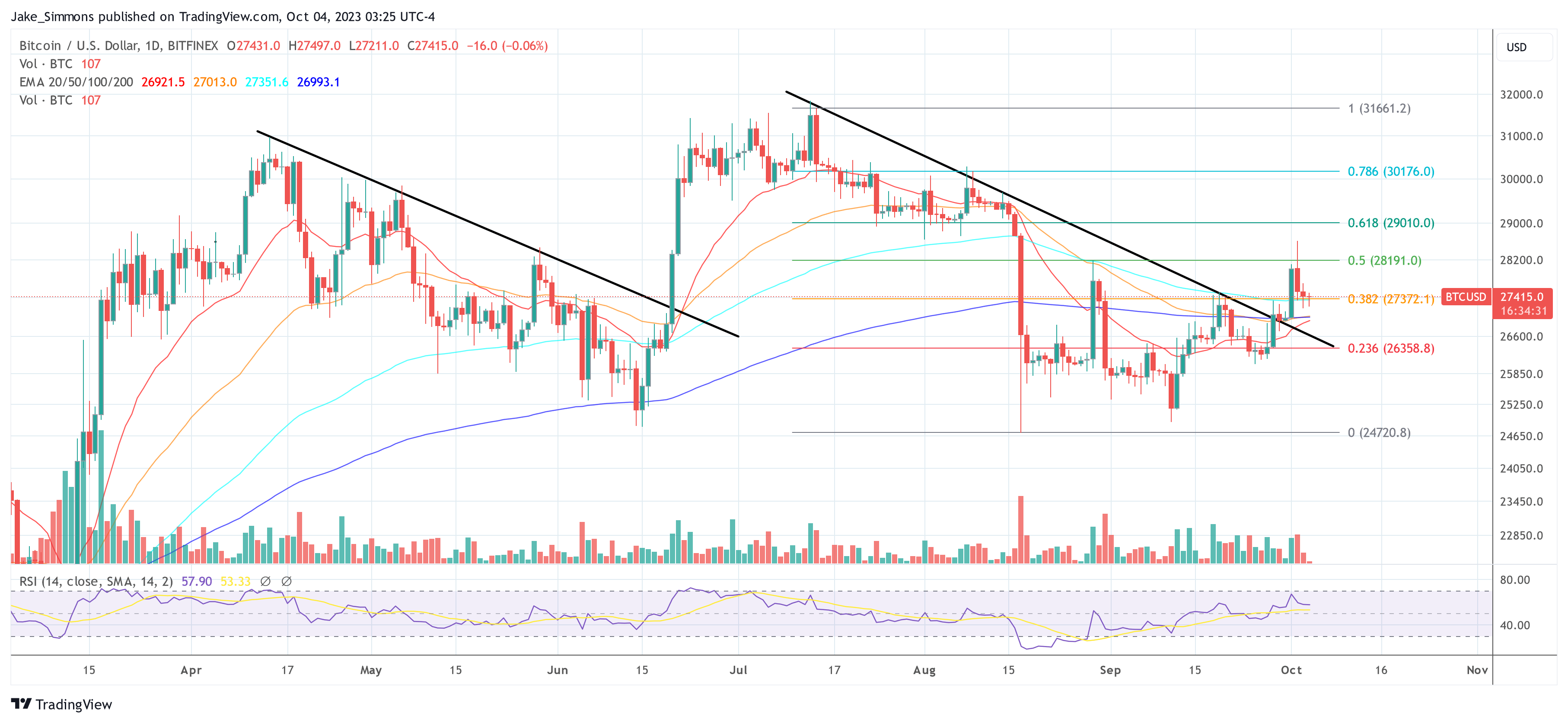

On the day by day chart, Bitcoin is hovering barely above the 38.2% Fibonacci retracement mark. For Bitcoin to keep away from a descent beneath the established development line (represented in black), it’s essential for it to keep up a place above $27,372.

Featured picture from Shutterstock, chart from TradingView.com