Serhii Shleihel/iStock by way of Getty Photographs

Pricey readers/followers,

I didn’t count on that I 2023 would be capable to “BUY” Hexagon (OTCPK:HXGBY) at an truly enticing share worth, and go lengthy in my portfolio. However that is precisely what has occurred. By a mix of attractively-priced Places and Calls, I’ve been capable of commerce each the draw back and the upside of this firm, however I just lately added a non-trivial place of the corporate tied to a lined name buy-write, which ensures a 16.5% annualized price of return till mid-next yr until the corporate falls under a not possible (primarily based on my estimates) degree.

I’ve additionally been including widespread shares to my company portfolio, now that the corporate has seen some decline that is truly made these costs enticing for the primary time in a really very long time.

Beforehand, Calling Hexagon a “BUY” has been doable provided that you assume vital EPS and continued margin enlargement, which can be doable, however maybe for my part underestimates a number of the extra structural challenges going through not solely Hexagon however your entire business.

Hexagon very not often exhibits dangerous or unfavorable developments of their earnings – nevertheless it does occur, and I additionally count on it to occur extra going ahead – however this does not imply that the corporate is not an attention-grabbing funding right here.

Let’s take a look at the upside now that we’re 6% decrease than my final article, which you could find right here.

Hexagon – One of many few corporations I “BUY” at a premium

2Q23 was the catalyst for the downturn that declined the corporate’s premium by a big quantity. Regardless of robust natural progress of 8%, 84% money conversion, 66% adjusted gross margins, and virtually 30% working margins, the corporate nonetheless fell – so I might say that the decline was overdone. It is also why I made a decision to go deeper with new possibility contracts and even added widespread shares when the corporate hit 98 SEK/share not way back.

Together with the final article, the corporate is now down greater than 15% – and this, being a price investor, is clearly one thing I welcome.

Why is the corporate down, as I see it?

The elevated price of debt and elevated manufacturing/wage/service/ transport/general inflation has been the “broad-stroke” cause for why corporations are dropping the premiums they’ve been holding for roughly your entire interval that we have had low rates of interest.

I might put relevance to the outcomes, to not the brief report by short-seller Viceroy, which I view as not related to the long-term thesis – or actually something related. Hexagon has already formally dismissed the short-seller allegation, and I’ve lined this intimately in my earlier articles on Hexagon.

The wanting it, almost about that report, is that I share the corporate’s view that they’ve gotten their details fully improper.

Whereas rates of interest and value of debt have the inevitable results of impacting an organization’s margins, until we’re speaking about an organization with zero debt (and even then, price will increase are very related), we already know that the markets have a powerful tendency in the direction of overreaction, each on the unfavorable and constructive facet of the spectrum.

The most recent set of quarterly outcomes on no account invalidates the longer-term constructive thesis for the corporate. Development each within the prime and backside line was present in GES, together with the enticing Geosystems and A&P areas. The headwind for the quarter, and for the corporate at the moment, was improvement within the Infrastructure, Positioning, and security section, which adopted the general macro improvement of the market and fell by almost double-digits.

With continued contract wins internationally although, I view such developments as restricted of their scope. Value mentioning on this context is a contract with a world chief (identify undisclosed) within the semiconductor business, with over 100,000 workers and 50,000 exterior contractors.

Clearly, Hexagon with its historical past additionally has plans for bettering present developments. We’re speaking a couple of new effectivity program that is set to save lots of over €150M, annualizing €160-€170M over the following few years, with a full run price from early 2025. Hexagon is within the technique of reducing places of work and services by 25% company-wide. As with most companies, automation is the secret, and the web beneficiaries of those developments will likely be firm shareholders – reminiscent of us.

Going ahead, there are some things to regulate even with Hexagon buying and selling at under 100 SEK/share. Given its publicity to Asia, the Chinese language actual property and infrastructure market has the potential to be a outcome drag for a very long time. Hexagon is clearly making an attempt to offset these unfavorable developments with sectors which might be booming – on this case reminiscent of mining and VR/AR – however everytime you’re shifting sectors, this can be a lengthy and considerably risky course of.

Blaming simply China would not actually work both. The European building market is not a lot better, neither is the US one. Center East and APAC-ex China is healthier right here.

My preliminary response going into 2Q23 and now that we’re deep in 3Q23 was to be thrilled on the downturn for the corporate. I stay on this place now, and I’ve additionally expanded my place in Hexagon. The corporate’s progress in key segments like GES is to me, proof that the corporate will proceed to develop in segments even whereas others are taking place.

Hexagon is down because of growing prices. That is it (as I see it). This makes it no totally different than some other firm that’s going through revaluation of its premium and upside because of growing prices of debt, manufacturing, providers, and inflation, which makes it a case about firm high quality and potential upside.

And fortunately, that potential upside is critical right here.

Let me present you what we will count on from Hexagon for the following 1-2 years primarily based on the present valuation.

Hexagon – The upside is now over 15% per yr.

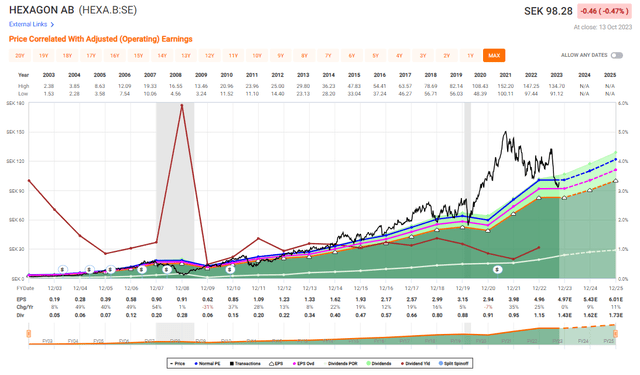

So, to start with, the premium. I take into account the premium legitimate for this firm given the completely strong earnings progress historical past, which you’ll see under.

F.A.S.T Graphs Hexagon upside (F.A.S.T graphs)

That is a mean EPS progress price of 16% per yr for the previous 20 years – and even with the present developments, anticipating no progress in 2023E, we’re nonetheless with an organization with a strong EPS progress development with no forecast misses on a 2-year ahead foundation, with beating these forecasts greater than 15% of the time.

That being stated, you’ll be able to see how premiumized the corporate has been for a few years right here. We have to low cost it considerably as a result of over 140 SEK for Hexagon is a ridiculous worth and never one I intend to pay.

In my final article, I gave the corporate a 103 SEK/share PT. This represents a ahead worth goal of not more than 17.5x P/E. And even to that valuation, now we have a big upside. Possible the premium I might take into account legitimate is a spread between 17-21x P/E, not the 26.2x P/E we have seen on a 5-year common. The upside to that 21x P/E is now simply round 15% annualized, which is why the corporate is such an amazing “BUY” right here.

Except you suppose the corporate is value solely 15x P/E or under any kind of premium, Hexagon turns into a purchase right here. Given its market-leading place, I can’t see myself giving the corporate any lower than a 17-20x P/E premium. The corporate is a low-yielder, which must be stored in consideration – however nonetheless provides an excellent mixture of wonderful potential capital appreciation and a few dividends.

S&P World analysts comply with Hexagon and provides the corporate a mean of 85 SEK to 140 SEK, with a imply goal of 110 SEK/share. I’m going barely under this goal. Most analysts do not but consider the “backside is in”. I can see this attitude as being no less than considerably legitimate, which is why my main entry into Hexagon remains to be an possibility, each on the lengthy and on the CSP facet if the corporate declines to low sufficient ranges. That is the benefit of choices – you are capable of dictate your costs, and going again to final fall in 2022 once I began incorporating choices into my technique, most of my “performs” (93.5%) have turned out as I anticipated, that means out of the cash – and over half of those who ended up going ITM are corporations that I’ve stored long-term.

Hexagon is an ideal candidate for this kind of play. That is why primarily, I might nonetheless take a look at going the CSP or the Coated-Name Purchase-write technique, aiming for that 15% annualized RoR on a 4-12 month foundation. It has been my expertise that it is simpler to get 15% on lined calls than on cash-secured places, however I all the time test each.

The widespread shares have some attraction – however I might nonetheless say that given the corporate’s potential to drop decrease within the brief time period, the choices play remains to be the stronger and safer solution to go right here.

Due to that, I give the corporate the next thesis right here as of October of 2023.

Thesis

- Hexagon is probably probably the most enticing positioning industrial/software program firm on this planet. on the proper worth, this firm turns into vital, and one you don’t look “again” on till it is excessively overvalued. This firm is extraordinarily well-capitalized, attractively managed, and has experience in future-proof world industries with a excessive upside.

- The developments in October of 2023 have now seen the corporate get well from what I view as overvaluation – and I’m sustaining my ranking of “BUY” for the corporate right here – although it comes with caveats, and I might watch out about investing the “improper method” right here, which is why I might go the choices method above the widespread share investments right here.

- My PT for the corporate is ideally double digits however at 103 SEK/share, I am shifting to “BUY” because of the causes talked about above

Keep in mind, I am all about

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly large – corporations at a reduction, permitting them to normalize over time and harvesting capital positive aspects and dividends within the meantime.

2. If the corporate goes properly past normalization and goes into overvaluation, I harvest positive aspects and rotate my place into different undervalued shares, repeating #1.

3. If the corporate would not go into overvaluation, however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

- This firm is general qualitative.

- This firm is basically secure/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is at the moment low-cost.

- This firm has a practical upside primarily based on earnings progress or a number of enlargement/reversion.

The corporate is now at a adequate place to supply a double-digit upside, which makes it a “BUY” in my e-book – although there are higher methods nonetheless of coming into this funding at an excellent worth.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.