georgeclerk

Heritage Nola Bancorp (OTCPK:HRGG) is a small Louisiana financial institution getting taken over by an area competitor. The financial institution was a mutual conversion, which is at all times an attention-grabbing place to search for bargains since usually talking the money from promoting the shares to the general public finally ends up on the steadiness sheet of the financial institution (and thus owned by the individuals who purchased these shares). Since Heritage Nola is sort of small, they do not actually have the size to be a standalone operation, however their couple of branches and mortgage/deposit e book in all fairness enticing to different native gamers seeking to develop.

I had written them up as a protracted on the Microcap Overview nearly precisely 6 years in the past after they traded at $11.80, once I had this to say:

...suggests banks in that profitability band have offered for a median of 133% of e book worth, which suggests a long run worth goal of $20 per share.

They’ve lately announced they’re promoting for a $6.5 MM premium (~31%) to e book worth at shut, with an estimated vary of $19.50- $20.50. So my long run sale estimate was fairly shut. Anyway, the historical past is considerably attention-grabbing however not too crucial, and at this level I am shopping for/holding this as a merger arbitrage place.

The massive cause the backstory is necessary right here is that I believe the draw back is comparatively restricted on the present share worth of $18.25. There would nearly actually be different bidders at a worth not that totally different to the present buy worth, and administration has now indicated a willingness to promote the agency. That is an enormous potential threat with undervalued small banks – that administration can simply run them for salaries for years. Since they’ve determined to promote, that eliminates a major threat.

E book worth at their last report was $20.7 MM, after which we get to $27.2 MM with the $6.5 MM premium. There are additionally 145k in-the-money choices that may presumably be exercised earlier than shut, which might get e book worth as much as $29.0 MM. With 1.384 MM shares excellent (together with the choices) that means current e book worth is $20.95.

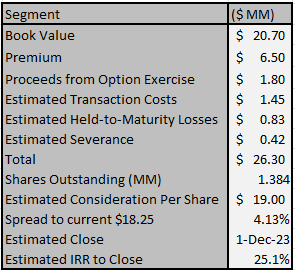

The discharge notes that HRGG’s transaction prices, losses on securities, and termination funds will all be deducted from the e book worth, which is how they bought to their $19.50-$20.50 vary. I will make my very own estimate.

Figuring 5% for transaction prices is $1.45 MM, and based mostly on previous expertise I believe that is cheap. The very fact the goal is paying their very own transaction prices in all probability makes administration extra prone to attempt to maintain them reigned in (incentives matter!).

Subsequent, of their most up-to-date financials (linked above) that they had $8.358 MM of held-to-maturity securities, I will assume a ten% loss on these which is one other $0.83 MM. Lastly, on their final proxy previous to going darkish, the CEO/CFO had a mixed base wage of $283k. I will assume they maintain everybody else and spend 1.5X that determine on severance, COBRA, and many others., which pulls off one other $0.42 MM. That will get me to an estimated worth of $19.00 per share, in comparison with a present share worth of $18.25, which is a 4.1% unfold.

I did write this up as an arbitrage for my Investing Group subscribers in August at $17.83, and at the moment I estimated an in depth of December 1, 2023. The press release for the deal indicated a This autumn shut, so I believe that the time limit remains to be cheap as an estimate. The fast shut makes fairly an enormous distinction to the anticipated IRR, which pushes a 4% unfold to a 20%+ IRR, though clearly just for just a few months. See the desk beneath for the worked-through calculations.

HRGG Consideration (Creator)

Dangers

After all, usually talking, each kind of funding comes with some sort of threat. And it is a merger arbitrage funding in a microcap financial institution deal, so there are a variety of various dangers.

On the regulatory aspect, there may very well be some form of hiccup. The mixed enterprise will not have any antitrust considerations, and I believe the FDIC is extra prone to approve mergers rapidly after the occasions in banking earlier this yr. Nonetheless, financial institution offers might be delayed for regulatory causes, which would cut back the IRR.

The opposite huge threat right here is that the consideration is not mounted, however is quite based mostly on the e book worth at shut and a specified set of changes. That makes it more durable to calculate and in addition topic to potential reductions for unforeseeable causes. Particularly, the losses on their securities’ portfolio usually are not straightforward to foretell and may very well be bigger than what I’ve estimated right here, particularly as long run rates of interest have continued to extend. That lowers the current worth of mortgage backed securities, rising the potential for losses on their portfolio. As an offset, they’ll get credit score for any enhance in e book worth from their earnings through the time it takes the deal to shut. I believe the chance of bills/offsets coming in greater than anticipated might be the largest threat right here. It is also seemingly the explanation for a larger-than-normal unfold – as a result of the precise consideration is tough to calculate, arbitrage traders are seemingly demanding a larger-than-normal margin of security. Many financial institution arbitrage offers commerce at a lot decrease estimated IRRs than what I’ve estimated right here, so in my view, the additional threat of the unsure consideration is compensated by the additional return.

Lastly, it is cheap to say that this trades OTC and does not file with the SEC. They do have publicly obtainable Name Experiences and file abstract financials with the OTC markets each quarter, so they are not darkish, however shares may be tough for some to purchase.

Conclusion

Heritage Nola is a sleepy little financial institution within the New Orleans space. It has transformed from a mutual establishment and is now getting offered as a part of ongoing consolidation within the sector. The precise consideration is considerably onerous to calculate, and I imagine that (together with it usually being an under-the-radar identify) has prompted a higher-than-normal merger arbitrage unfold.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.