- Bitcoin may create a brand new all-time excessive in This autumn with a rally pushed by a number of catalysts.

- Nonetheless, profit-taking actions would possibly proceed to stifle the short-term rally.

Bitcoin [BTC] traded at $63,663 at press time after an 8% acquire previously seven days. Because the final quarter of the yr attracts close to, hypothesis is rife that the most important crypto could possibly be on target to create a brand new all-time excessive.

In its weekly report, 10x Research outlined three key elements that would see Bitcoin surpass $73,000 within the coming months.

The primary is the US presidential elections set for the fifth of November. This political occasion may spur optimistic momentum available in the market. The report additionally mentions the distributions to FTX collectors as one other attainable catalyst to Bitcoin’s rally as the method will coincide with a bull market. The report said,

“FTX collectors are anticipated to distribute $16 billion to clients between December 2024 and March 2025, with the market doubtless front-running this expectation. We anticipate $5-8 billion to movement again into the crypto house,”

Thirdly, MicroStrategy has raised extra funds to fund its Bitcoin purchases. This elevate may set off a surge in demand for Bitcoin.

Nonetheless, amid these speculations, are different macro elements and on-chain knowledge aligning to help a bull run?

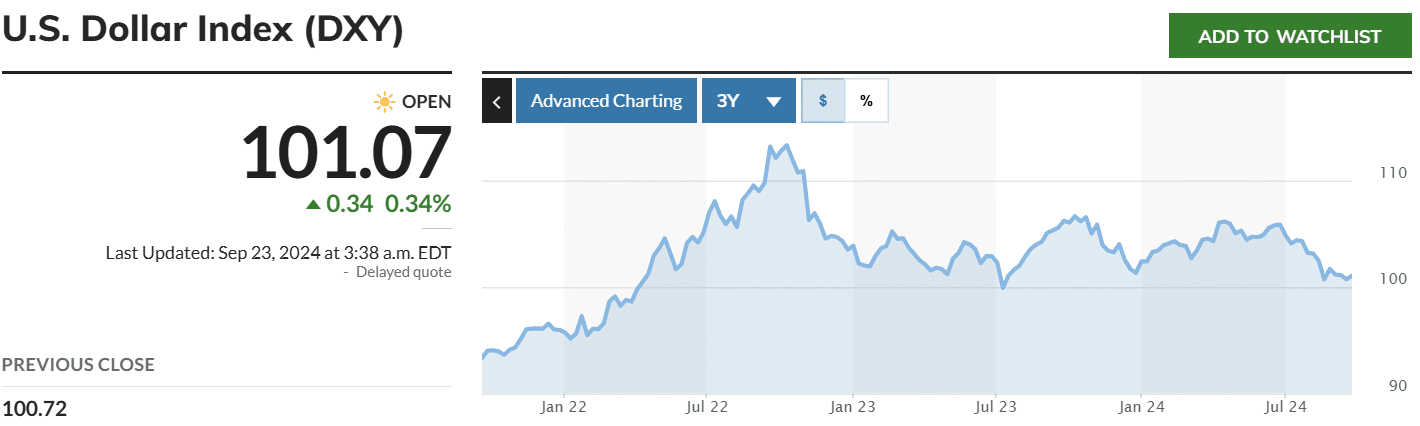

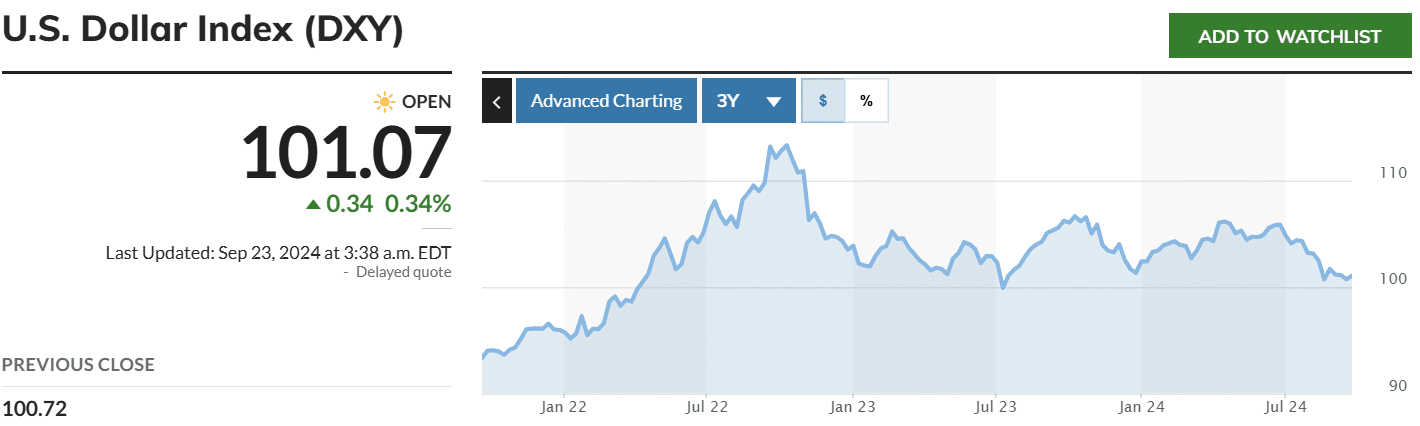

The greenback index is at vary lows

The US greenback index (DXY) has been trending downwards. At press time, this index stood at 101 and has been shifting at vary lows of $100-$101 since August.

(Supply: MarketWatch)

The DXY measures the energy of the US greenback towards different high world currencies. A decline on this index alerts a weakening greenback, which in flip stirs optimistic sentiment round Bitcoin.

Traditionally, at any time when the DXY weakens, Bitcoin usually data features. As such, if the DXY falls underneath 100, Bitcoin may turn into enticing as an inflation hedge.

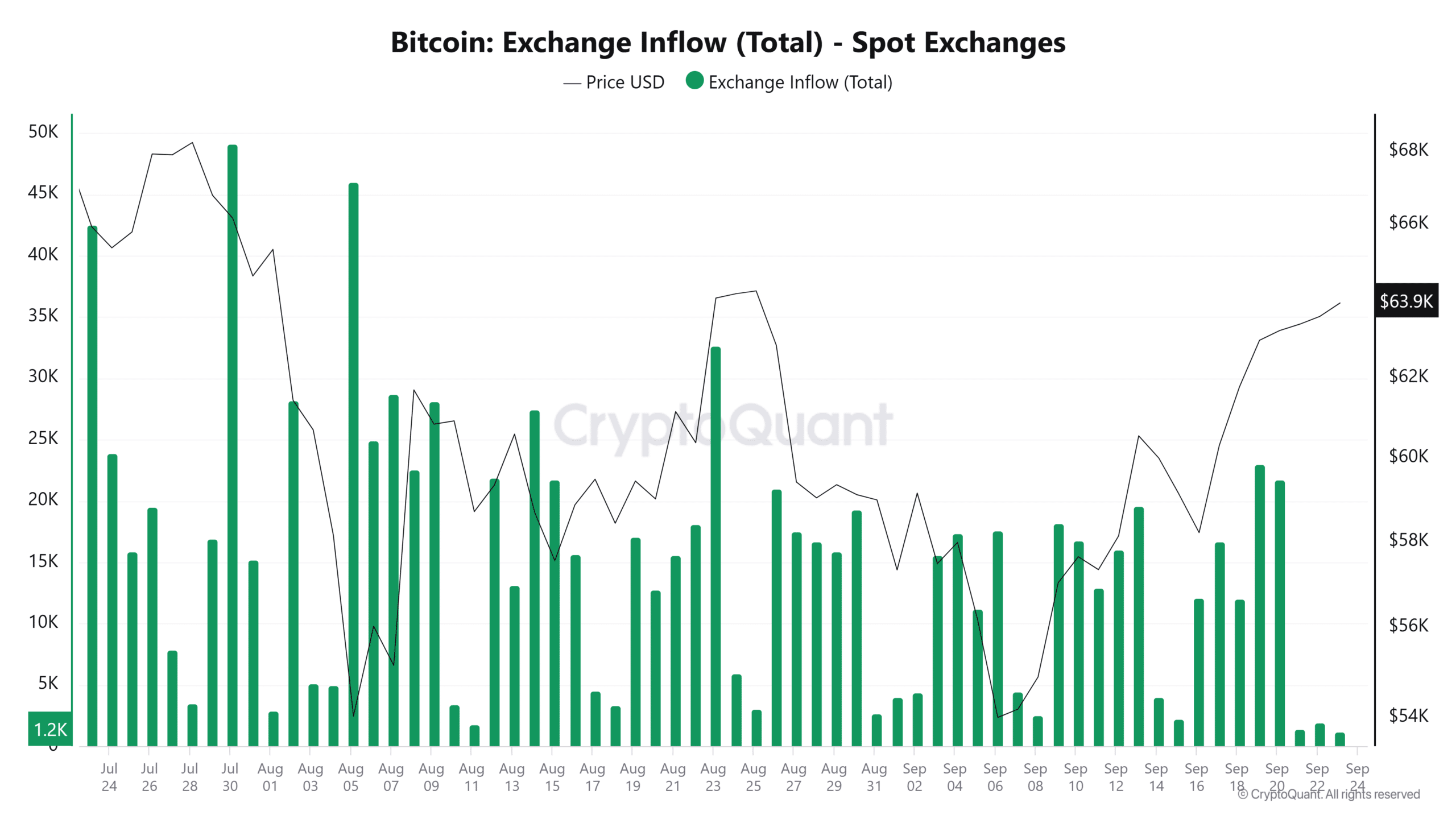

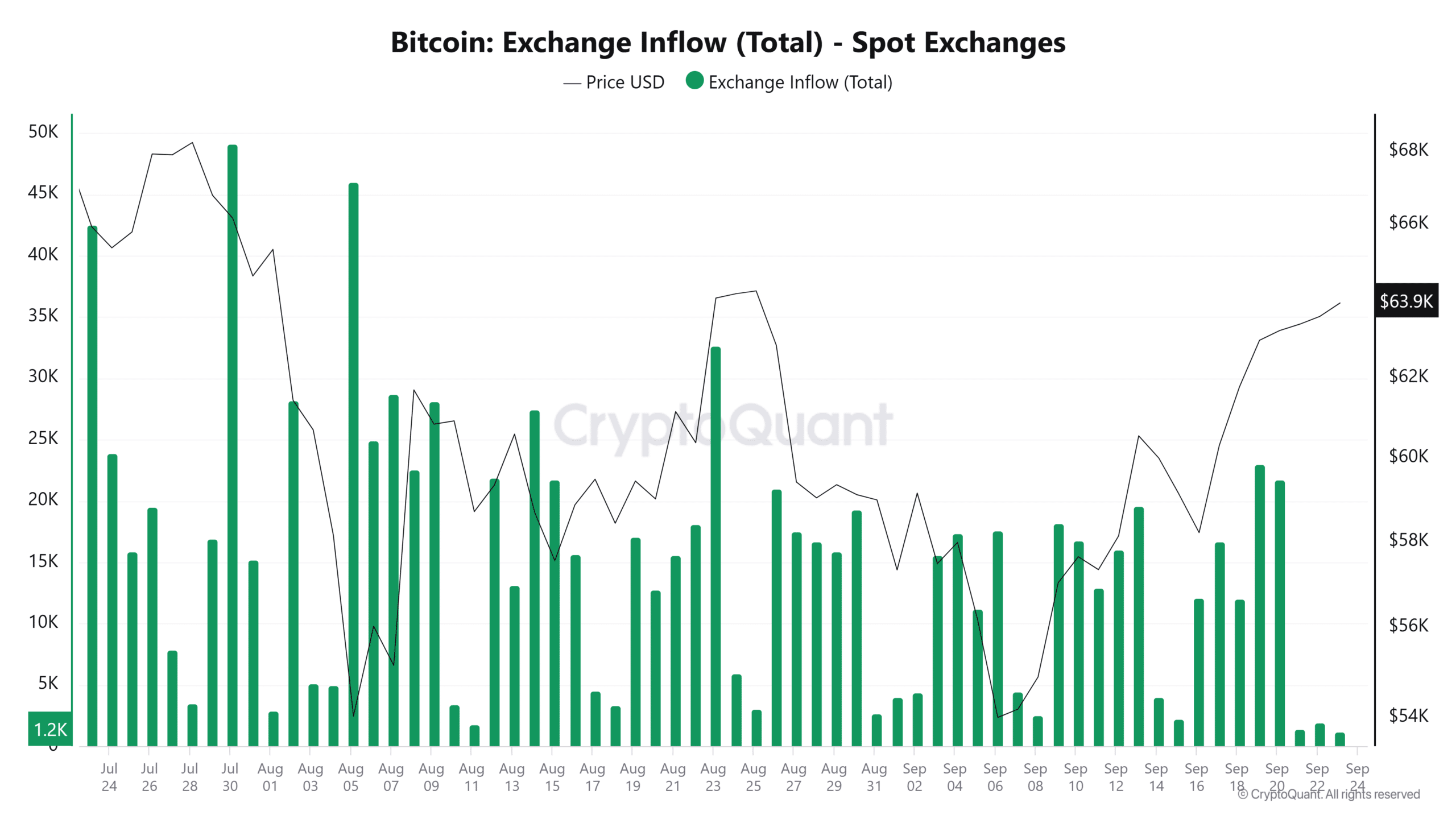

Bitcoin trade inflows

Information from CryptoQuant exhibits that Bitcoin trade inflows remained subdued over the weekend after a interval of intense profit-taking.

Supply: CryptoQuant

This decline means that merchants could possibly be gaining confidence in Bitcoin’s rally and its potential to maintain costs above $60,000.

Nonetheless, it is very important word that weekends are sometimes related to low buying and selling volumes. To verify that profit-taking actions have slowed down, merchants ought to be careful for the shift in movement knowledge through the week.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

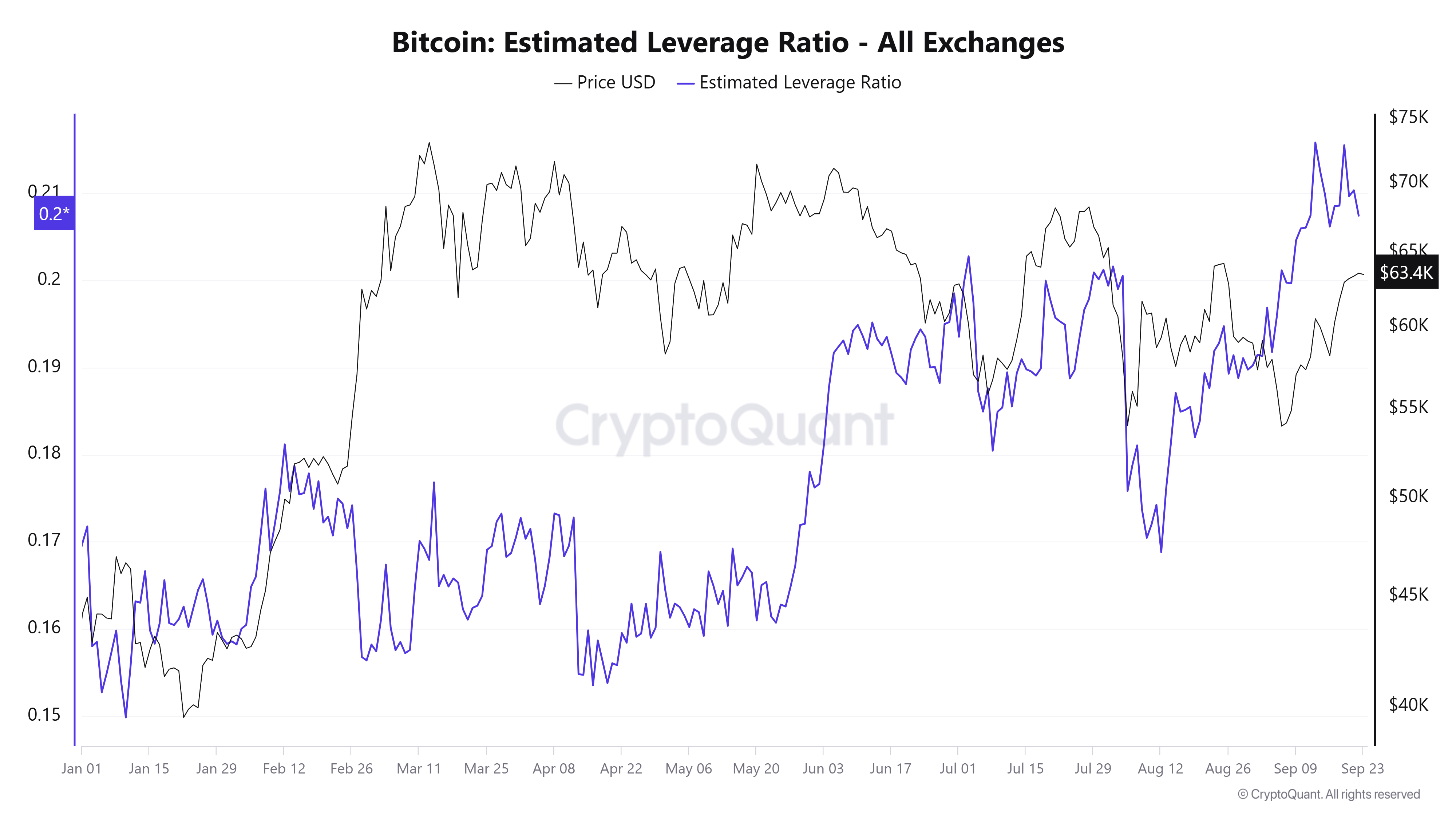

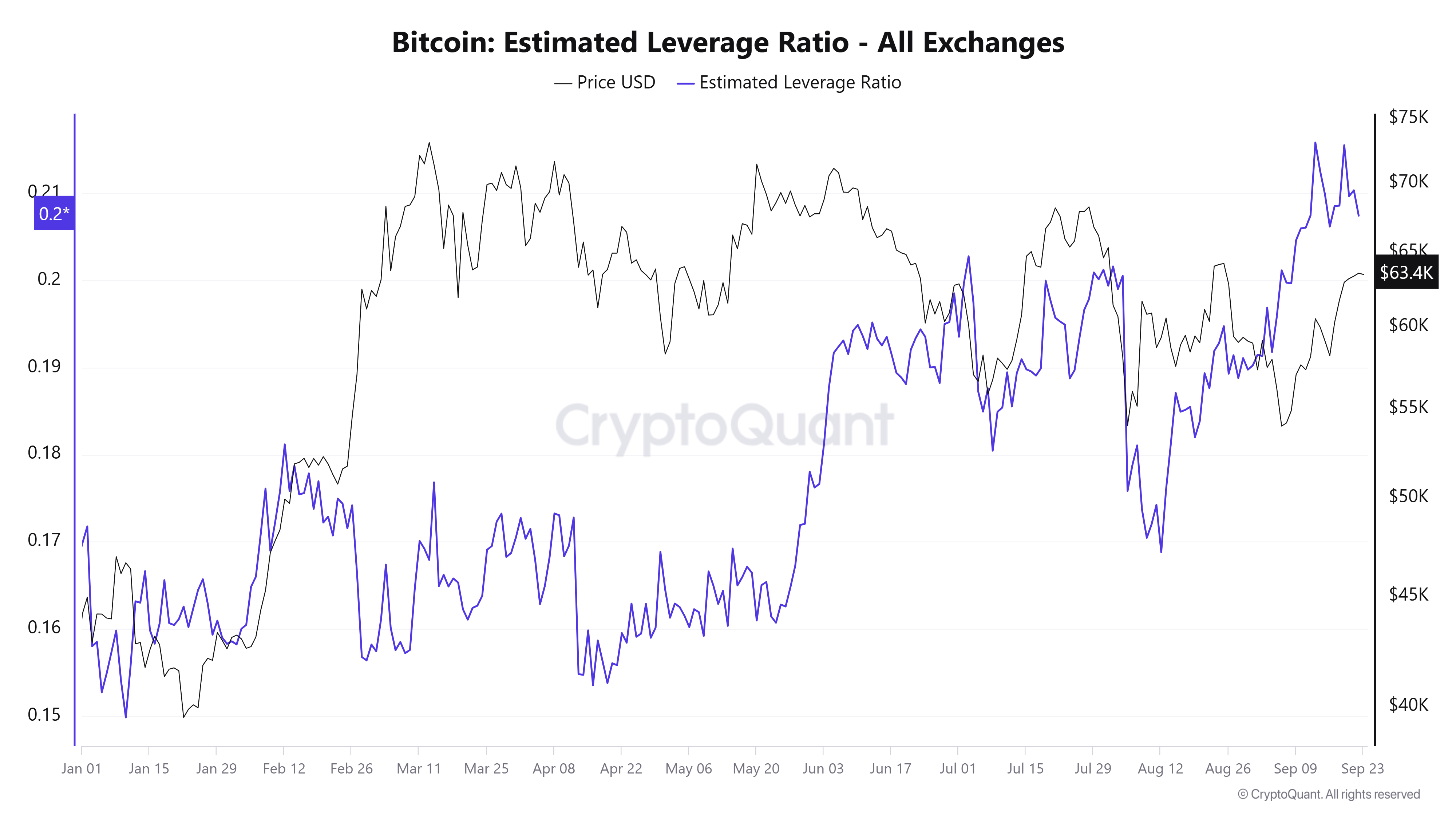

Moreover, the estimated Bitcoin leverage ratio has been rising, and it at present sits on the highest degree year-to-date.

A excessive leverage ratio often displays rising bullish sentiment as merchants enhance their margin positions on BTC. Nonetheless, an increase on this metric may additionally level in the direction of incoming volatility.

Supply: CryptoQuant