- Bitcoin’s demand has dropped to its lowest ranges in latest weeks as costs consolidated.

- Nonetheless, the lowering Bitcoin provide on exchanges made the case in opposition to important worth drops.

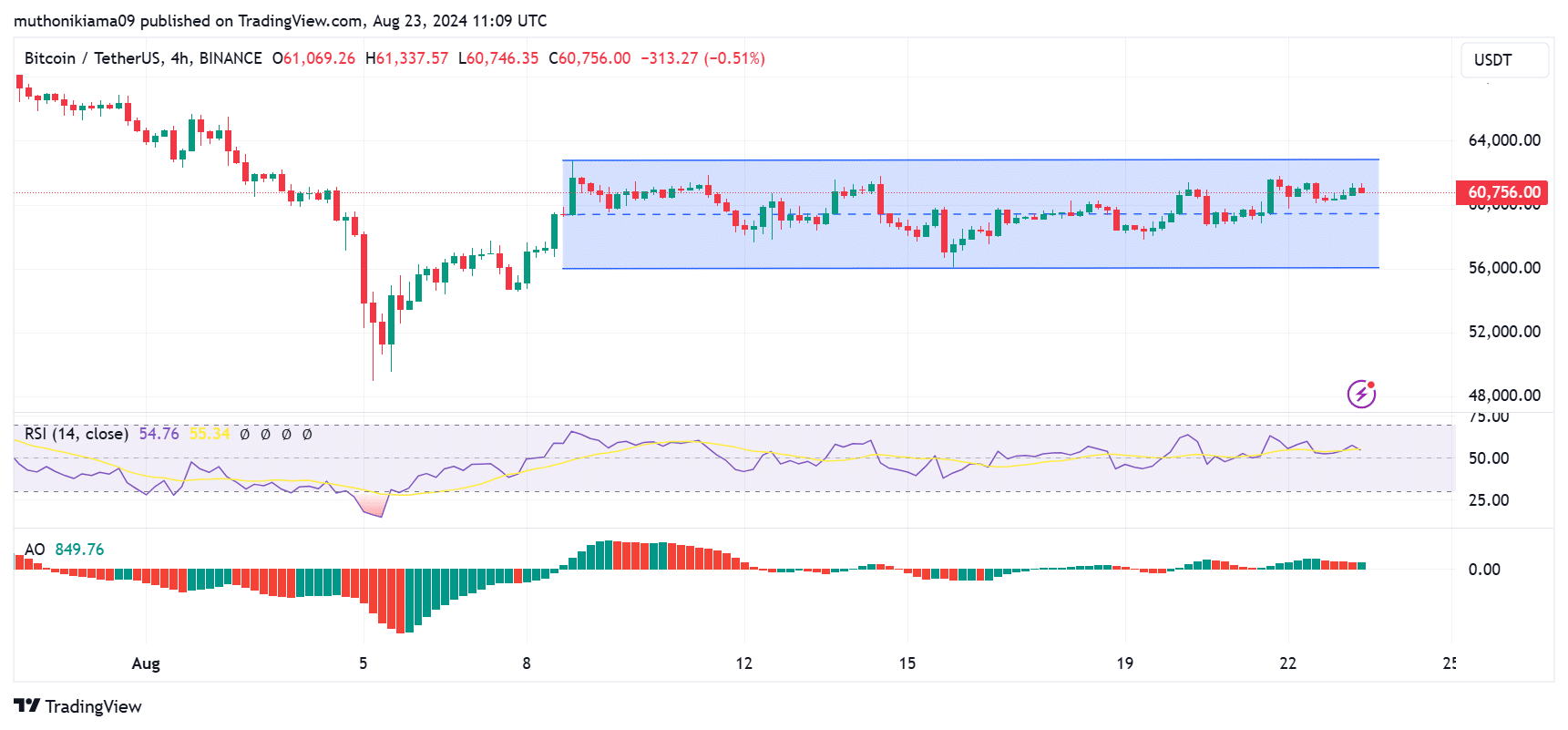

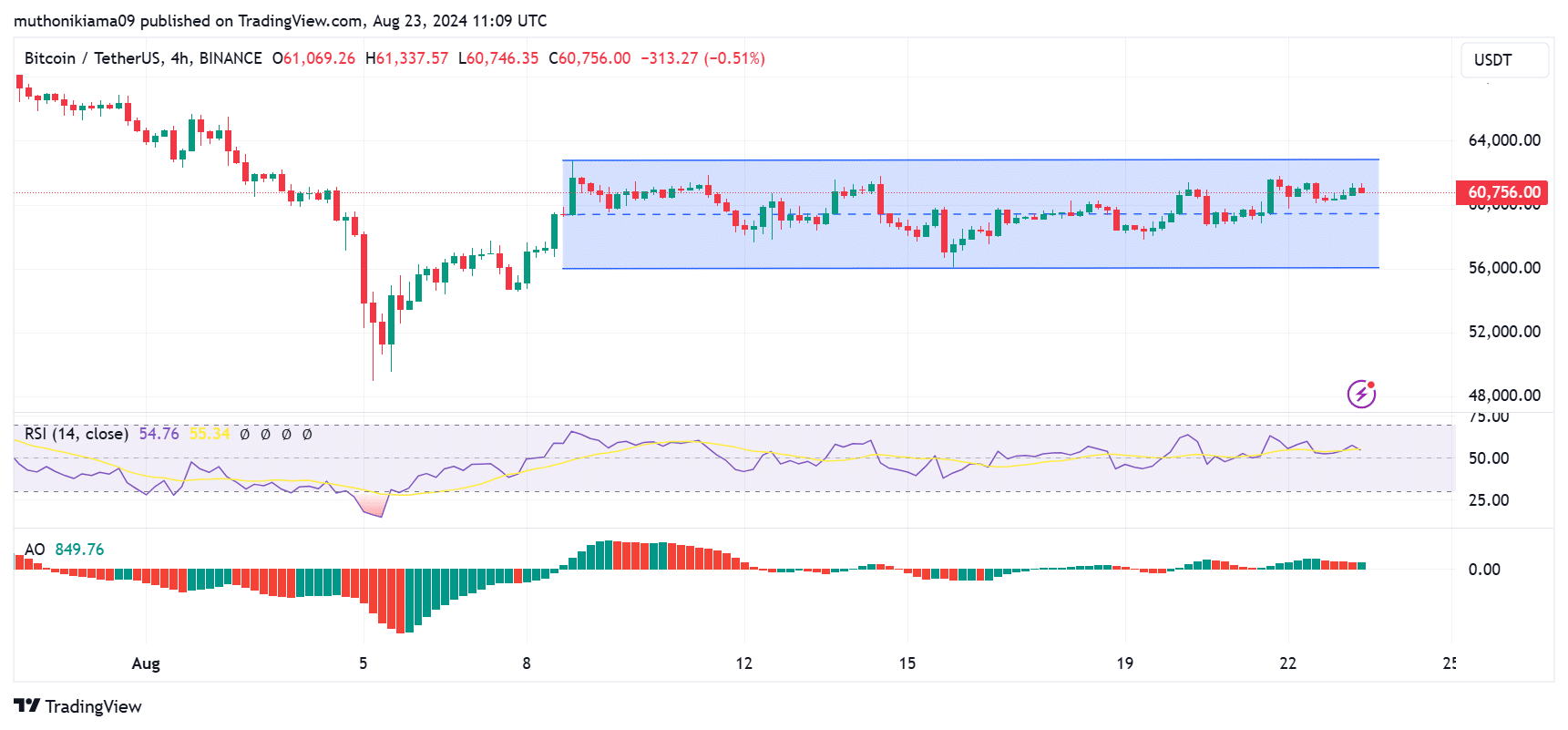

Since recovering from the drop on the fifth of August, Bitcoin [BTC] has traded rangebound between $56K-$62K.

The worth has not damaged under or above this vary for the reason that eighth of August, signaling doable consolidation or market uncertainty.

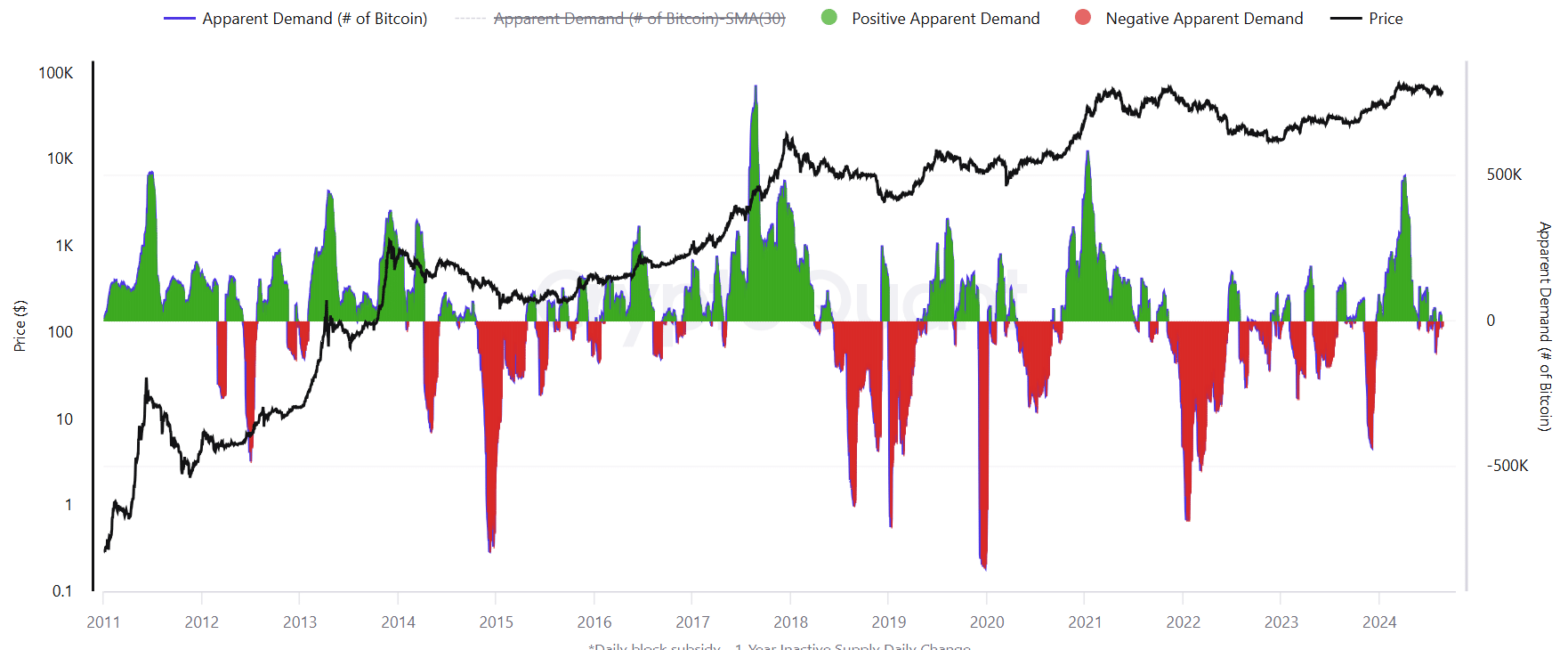

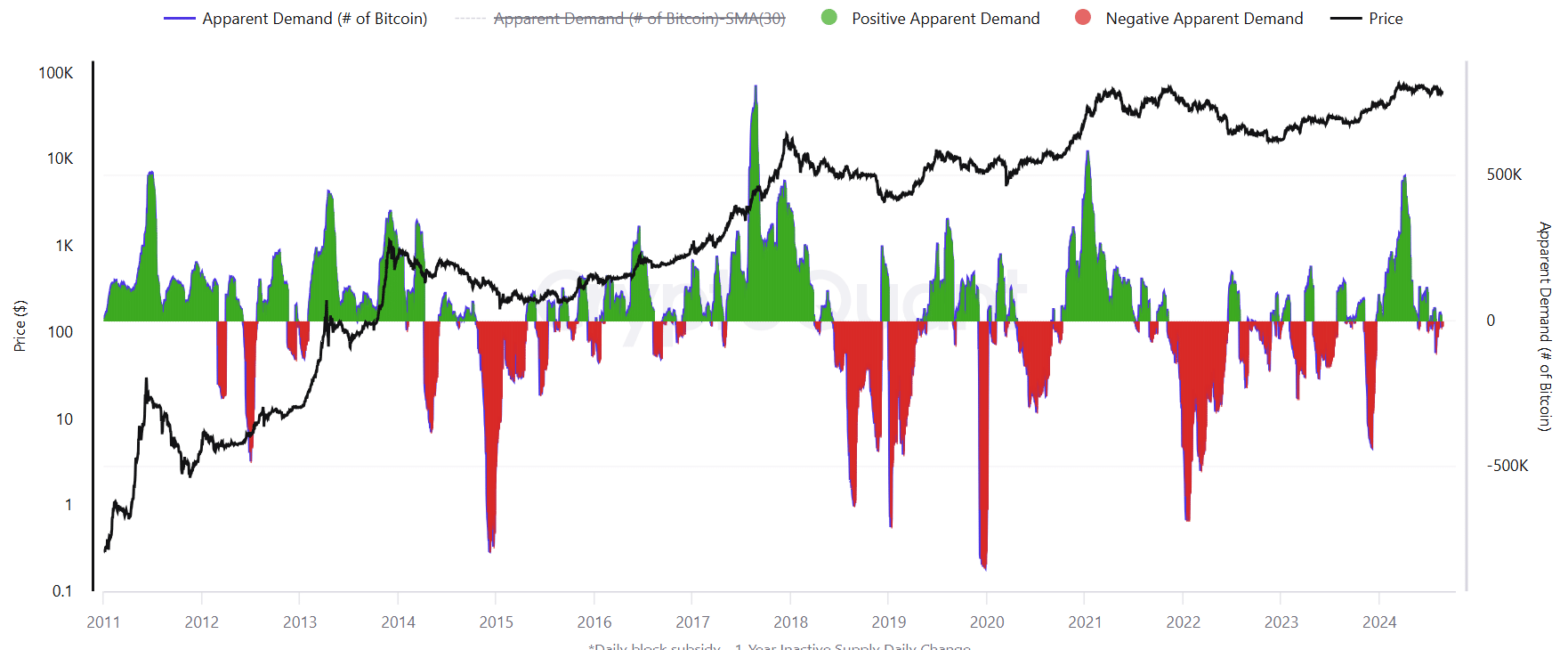

One of many elements stopping main breakouts above this zone is weak Bitcoin demand development, which remained at low ranges, per CryptoQuant. This even turned adverse in latest weeks.

Supply: CryptoQuant

Bitcoin’s demand hit a three-year peak in April 2024 coinciding with the Bitcoin halving occasion. Nonetheless, it has since dropped to the bottom degree this yr.

So why is Bitcoin’s demand falling?

Taking a look at ETF and whale exercise

The evaluation identified the drying inflows into spot Bitcoin ETFs. In March, as BTC surged to all-time highs, the typical each day purchases into Bitcoin ETFs stood at 12,500 BTC.

This dropped to 1,300 BTC final week.

Whole inflows into spot Bitcoin ETFs have remained under the $100M mark for the reason that ninth of August, as seen on SoSoValue. Whereas these merchandise maintain over $55 billion in internet belongings, shopping for exercise is required to spice up the general demand.

Whales additionally seem like lowering their Bitcoin stake. The 30-day common whale holdings have dropped from 6% in February to 1%. This marks the quickest drop since February 2021 per CryptoQuant.

Whales play a vital position in supporting Bitcoin worth development. Decreased whale holdings level to a common bearish sentiment throughout the market.

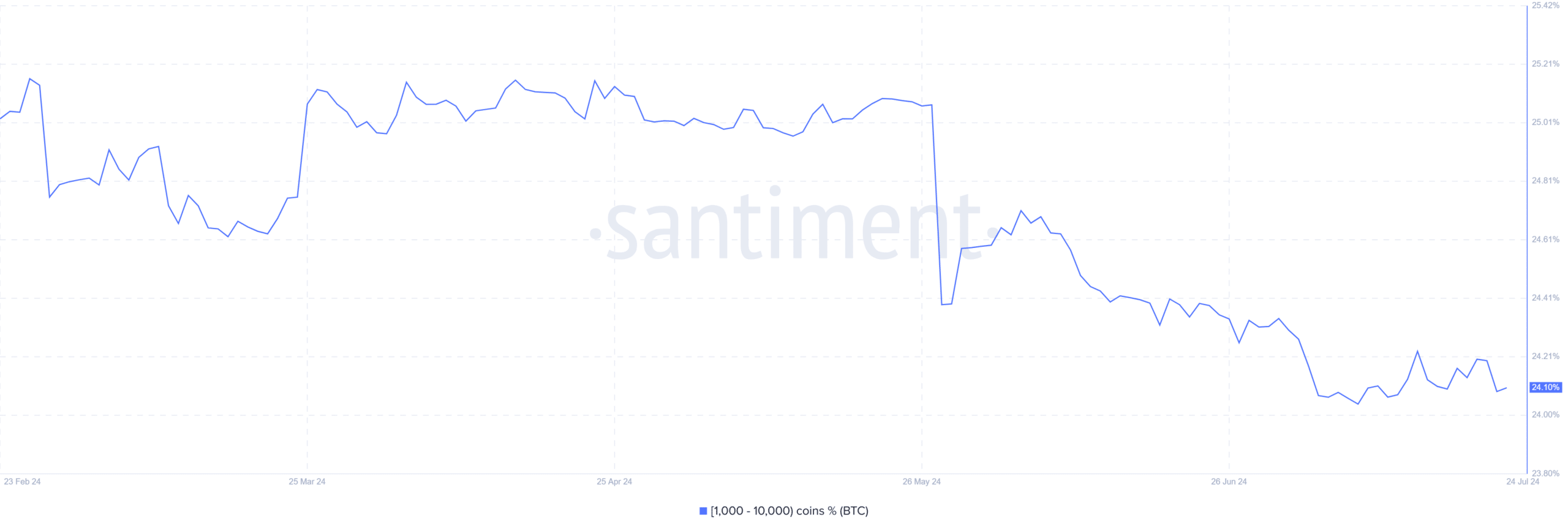

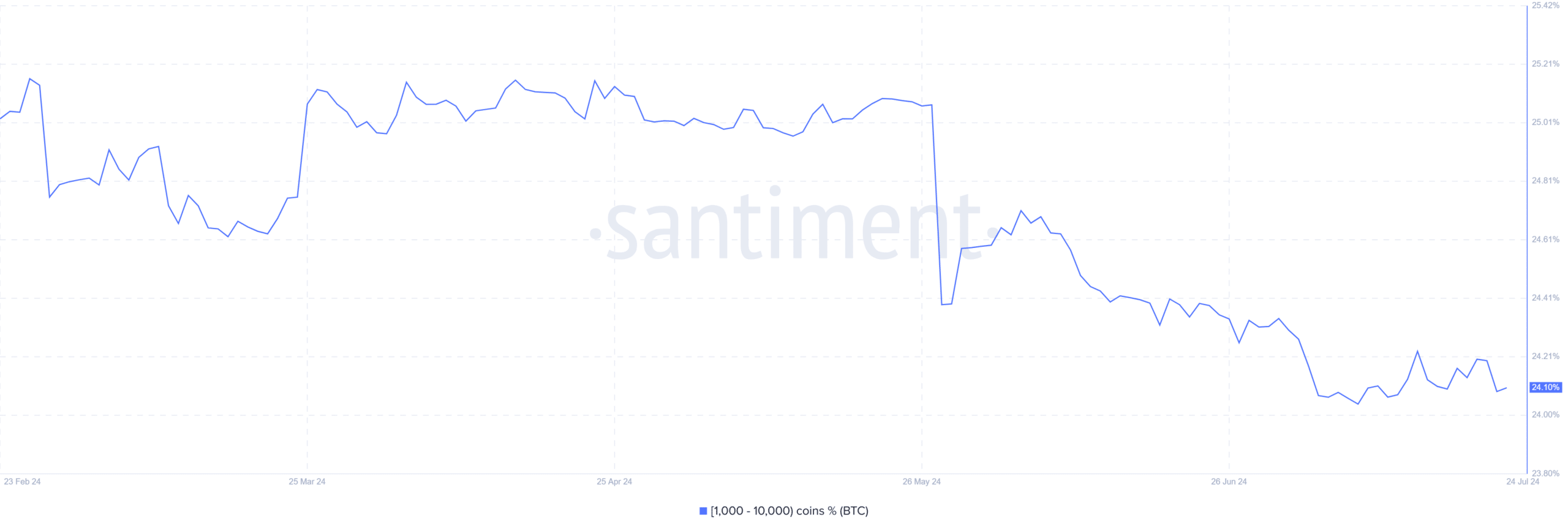

A decline in whale exercise was additional confirmed by knowledge from Santiment, which confirmed that Bitcoin addresses holding between 1,000 and 10,000 cash have dropped considerably since March.

Supply: Santiment

Regardless of slower whale exercise, long-term Bitcoin holders have elevated their positions. These holders have been growing their BTC holdings at a fee of round 391,000 BTC per 30 days.

Will Bitcoin breakout of its vary?

As demand for Bitcoin slows, it begs the query whether or not it can get away of the $56K-$62K vary. A deeper look into on-chain knowledge paints a grim image.

Based on IntoTheBlock, over 3 million addresses purchased Bitcoin at this worth vary. New traders who purchased at these costs haven’t made important earnings.

Due to this fact, breaking out previous $62K shall be met with promoting stress as they rush to take earnings.

Technical indicators additionally fail to make the case for a breakout. The Relative Power Index (RSI) has additionally remained rangebound with no important surges in shopping for momentum.

The Superior Oscillator, which was within the optimistic area, confirmed an uptrend. Nonetheless, the brief histogram bars pointed in the direction of a probably weakening uptrend.

Supply: TradingView

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nonetheless, the potential of a steep downtrend under the present vary is unlikely within the brief time period, because of the declining provide of Bitcoin on exchanges.

Per CryptoQuant, the Change Provide Ratio has been on a steep decline over the previous yr. Due to this fact, regardless of demand being considerably low, trade provide can be low, lowering the danger of steep corrections.