Mario Tama

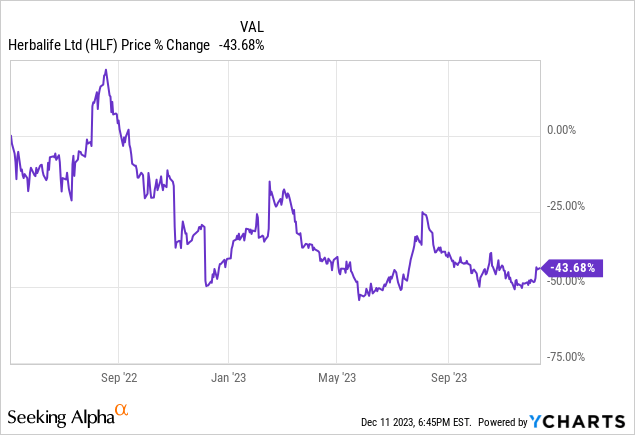

Herbalife Ltd. (NYSE:HLF) is an fascinating enterprise particularly between the accusations, the Ackman-iCahn rift, regulatory fines, administration modifications, and many others. For myself, my calls on Herbalife have been primarily based extra on the corporate’s underlying enterprise efficiency, merchandise, funding technique, and valuation. Between 2017 and 2018, I used to be bearish, with the firm’s enterprise worth trending between $6 billion to $9 billion. Then shifted impartial at a $6 billion valuation and turned bullish round $5 billion by early 2022. Traditionally, the enterprise has generated about $400+ million in free money movement and the enterprise was steadily rising gross sales throughout the COVID setting. Nonetheless, I shortly offered within the following weeks in Could 2022 after administration lower their gross sales and EPS steerage. Though I used to be dissatisfied in taking a fast 10% loss between April and Could 2022, abandoning my bullish place turned out to be the proper one, as shares subsequently plunged one other 44%.

Maybe probably the most fascinating occasion for Herbalife was hiring Michael Johnson for the CEO position to steer the corporate on Dec. 27, 2022. Mr. Johnson has been arguably an important driving pressure for the corporate, who “quadrupled gross sales and expanded its operations around the globe from 58 to 95 markets.“

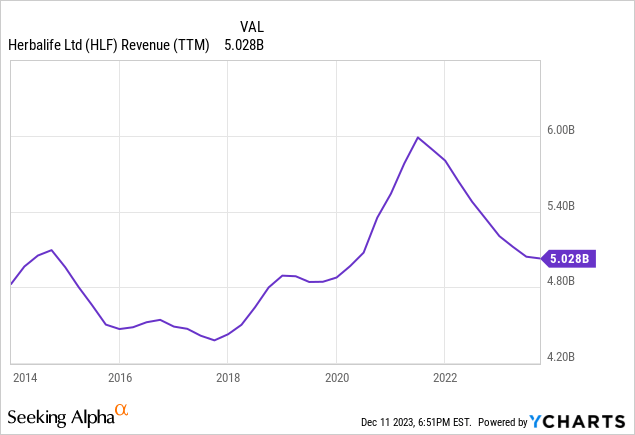

The query is whether or not he can transfer the corporate in the proper route once more, as gross sales have slumped from their excessive watermark of $6 billion all the way down to $5 billion right this moment. Gross sales are usually not horrible relative to historic ranges, thereabout pre-pandemic ranges, however the pattern signifies waning momentum.

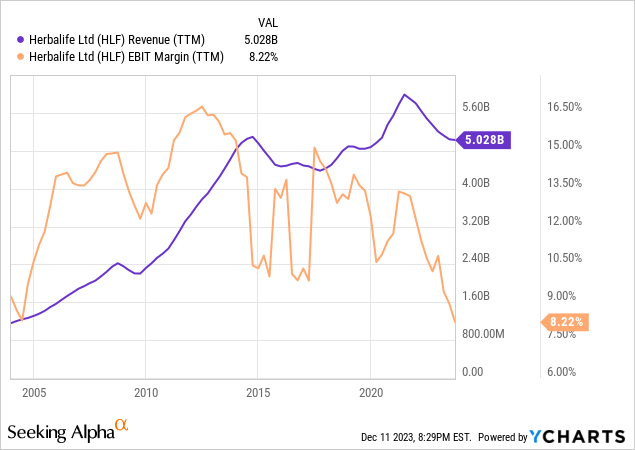

For the three months and 9 months ended September 30, 2023, quantity factors have been down 11% and 5.6% worldwide, respectively. General fairly anemic, albeit bettering on a quarter-over-quarter foundation. Primarily based on the Q3 2023 earnings presentation, reported gross sales solely declined by 1.1% due to a major combination value enhance of 6.3%. Nonetheless, Herbalife’s gross margin and working deleveraging (i.e. fastened prices as a share of the overall value construction) are critically pressuring margins. For instance, in prior downturns of 2008-2009 and 2015-2018, EBIT margins frequently vacillated within the double digits, however have simply fallen to eight.2% in 2023.

Administration outlined within the Q3 2023 earnings name that uncooked materials and manufacturing overhead prices have been the first points: “Adjusted EBITDA margin benefited by roughly 190 foundation factors from the pricing will increase we now have applied over the previous 12 months. Nonetheless, increased uncooked materials prices and manufacturing overhead prices proceed to influence our outcomes, which drove an approximate 290 foundation level margin headwind versus Q3 of ’22.“

Gross sales have achieved comparatively properly up till 2023, however now Herbalife is growing costs as volumes are falling, principally to offset inflationary value pressures. I feel for the dietary product house the place there’s tons of competitors and prospects are value delicate, ongoing value will increase into declining volumes is a dangerous technique. Nonetheless, administration additionally talked about that This fall will return to internet gross sales development, partially pushed by new product rollouts. This, mixed with stabilization of their lively gross sales leaders from 459K to 467K, has helped buoy gross sales volumes.

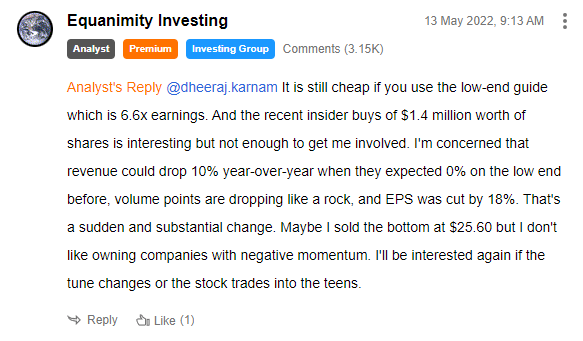

Turning to valuation. In my earlier article, I discussed I might solely have an interest within the inventory if “the tune modifications or the inventory trades into the kids.”

Herbalife Article Remark (Writer)

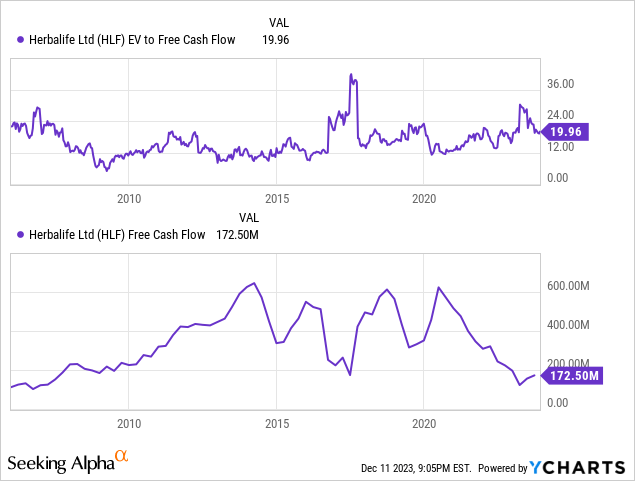

What’s fascinating is that Herbalife’s enterprise worth is now at its “most cost-effective” degree since 2010. Nonetheless, this time its working revenue has collapsed and the overall internet debt excellent is about $2 billion. So inherently, there’s extra danger throughout the capital construction, which I personally would require a wider low cost. Clearly on the present annualized FCF of $173 million, or an EV/FCF of 20x, the inventory will not be very compelling.

Both the celebrities must align so FCF can revert again to its historic $400 million degree, or the inventory wants to say no additional earlier than I would think about accumulating shares. We will argue that the enterprise has extra stability with Michael Johnson on the helm, but I do not like anchoring the validity of an funding thesis on one particular person. For these causes, I am not inquisitive about proudly owning shares of Herbalife right this moment. Thanks for studying and please remark under.