Nudphon Phuengsuwan

By Vinay Thapar, CFA

Drugmakers don’t should dominate a healthcare portfolio. Fairness traders ought to forged a large web throughout the sector to seek out innovation and progress.

Pharmaceutical corporations typically seize the limelight within the healthcare sector. From COVID vaccines to Alzheimer’s therapies, groundbreaking pharma merchandise intention to remedy the afflictions of humanity and enhance high quality of life. Traders are sometimes enamored by the promise of a possible blockbuster drug to eradicate an intractable sickness—and ship a wholesome circulate of earnings.

Since huge pharma corporations rank among the many largest healthcare weights, they typically dominate sector positions in a world fairness portfolio or a stand-alone allocation. But, focusing an excessive amount of on prescription drugs may restrict a portfolio’s potential. Corporations that manufacture diagnostics, know-how and tools to deal with the world’s most urgent medical points have grow to be more and more vital for progress within the healthcare sector.

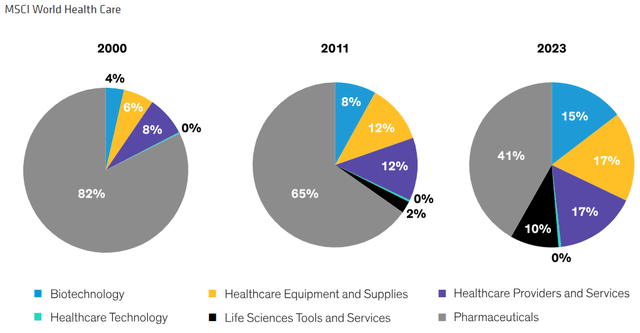

Adjustments to the healthcare benchmark over the past twenty years replicate this shift. The load of pharmaceutical corporations within the MSCI World Well being Care Index has fallen from 82% in 2000 to 41% in the present day (Show). Different industries have grow to be extra outstanding, providing fairness traders a broader array of alternatives in areas resembling life sciences instruments and providers, know-how and tools.

The Healthcare Sector Appears to be like Very Totally different At present

Diagnostics and Life Sciences Instruments and Providers—These areas are simply as vital for medical processes as remedy. Superior testing and imaging might help medical professionals detect illness at a lot earlier phases, bettering the efficacy of remedy and probabilities of restoration. And the ability of sequencing the human genome will unlock further potential new medicine and assist establish illness earlier.

When pharmaceutical corporations conduct exams on new medicine, they sometimes outsource scientific trials. Eurofins Scientific (OTCPK:ERFSF), based mostly in Luxembourg, is without doubt one of the largest diagnostic corporations exterior the US, providing an array of providers from scientific trials to environmental and meals testing. Synnex (SNX) of Japan sells diagnostic tools to research blood, from easy exams to establish a affected person’s blood kind to liquid biopsies for most cancers and detecting Alzheimer’s illness.

In biotech analysis and improvement, progressive drug-development processes in areas resembling gene remedy or the mRNA vaccine have traditionally been very capital intensive. Biotech corporations wanted many tanks for manufacturing biologic medicine in a number of areas. Sartorius Stedim Biotech (OTCPK:SDMHF) of Germany has developed a reusable system for the metal tanks utilized by biotech corporations that saves cash throughout the R&D course of and is extra environmentally pleasant, too.

Expertise and Synthetic lntelligence (AI) – In comparison with different sectors, healthcare has been a laggard in our high-tech society. However issues are altering. Corporations that may efficiently undertake new know-how might be able to dramatically change the way in which care is offered and delivered—and might be discovered in numerous components of the sector.

AI is being introduced in business instruments by corporations, together with Veeva Techniques (VEEV) of the US and Eire’s ICON (ICLR). As AI capabilities enhance and grow to be extra extensively used to diagnose illness, we consider corporations that supply software program as a service for healthcare will get pleasure from better demand. Veeva and M3 of Japan provide a variety of software program providers, from scientific trials to house well being monitoring to advertising and marketing software program for pharmaceutical gross sales.

Gear and Provides – From international drugmakers to your loved ones physician, the tools and instruments used to ship healthcare services and products are continuously altering. Modern tools utilized in lifesaving procedures can enhance outcomes for sufferers. Think about Edwards Lifesciences (EW), which manufactures a transcatheter aortic valve substitute (TAVR) that helps remedy a significant coronary heart ailment with a minimally invasive process. The worldwide marketplace for TAVR tools is poised to develop from $7 billion in 2024 to $10 billion in 2028, based on firm reviews.

For surgeons, a technological revolution is quickly unfolding. At present, an growing variety of procedures are utilizing robotic instruments that enable surgeons to entry hard-to-reach spots contained in the physique with high-precision, minimally invasive incisions, fewer problems and quicker restoration instances. Intuitive Surgical (ISRG) of the US manufactures a robotic surgical procedure system that’s in style in US working rooms and is gaining momentum exterior the US, with important progress alternative in Europe, Japan and China, in our view.

Three Attributes Outline Wholesome Progress

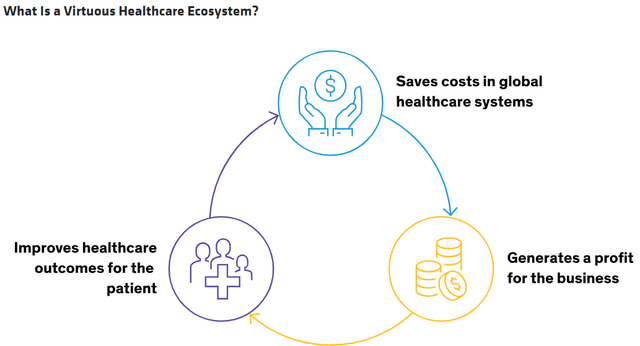

Whereas every trade has completely different dynamics, we consider traders ought to search for three attributes to establish engaging healthcare companies throughout the sector (Show).

First, search for services and products that enhance healthcare outcomes for sufferers. Second, corporations that may assist cash-strapped healthcare programs save prices are prone to profit from robust demand drivers. Third, merchandise that enhance outcomes and save prices should generate a revenue for the enterprise.

Supply: AB

In our view, corporations that possess these three attributes are working in a virtuous ecosystem. The dynamics of a wholesome ecosystem present a basis for corporations to profitably reinvest money flows, which helps assist constant earnings progress over time. We consider fairness traders ought to all the time keep centered on enterprise fundamentals when selecting healthcare shares, fairly than attempting to foretell scientific success, which is extraordinarily exhausting to do.

To make sure, pharmaceutical corporations that meet the factors of a wholesome ecosystem needs to be included in a diversified allocation of healthcare shares. However as an alternative of getting drugmakers anchor a healthcare portfolio, the start line needs to be to seek for high-quality enterprise fashions—wherever they could be discovered throughout the evolving spectrum of medical services and products.

The views expressed herein don’t represent analysis, funding recommendation or commerce suggestions and don’t essentially symbolize the views of all AB portfolio-management groups. Views are topic to vary over time.

References to particular securities mentioned are to not be thought-about suggestions by AllianceBernstein L.P.

Editor’s Word: The abstract bullets for this text have been chosen by In search of Alpha editors.