Because the final FOMC assertion on Could 1st, bonds, shares, and gold have rallied strongly whereas crude costs have declined with a small drop within the greenback…

Supply: Bloomberg

Fee-cut expectations have dovishly elevated (however are nicely off the post-CPI spike highs)..

Supply: Bloomberg

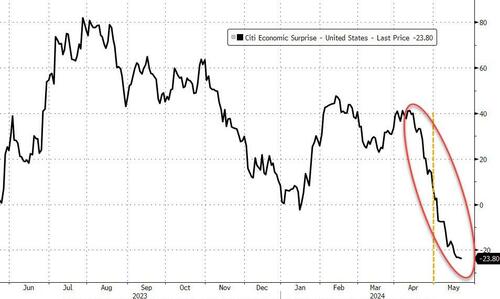

With US Macro knowledge serially shocking to the draw back (with each ‘laborious’ and ‘delicate’ knowledge deteriorating quickly with CPI and Retail Gross sales printing after the final assembly)…

Supply: Bloomberg

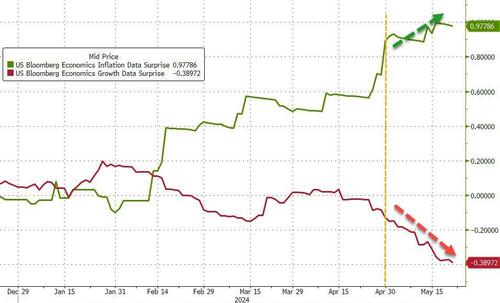

Development-based macro components have weakened significantly because the final FOMC assembly whereas inflation-related components have elevated.

Supply: Bloomberg

So, with stagflationary alerts abounding, what’s going to The Fed need us to learn into the Minutes at the moment…

Expectations had been for affirmation that rate-hikes are off the desk… The Fed nonetheless expects progress with out inflation… the Fed stays centered on shelter inflation…

Headlines from the Minutes embrace:

On Fee-Hikes:

Varied contributors talked about a willingness to tighten coverage additional ought to dangers to inflation materialize in a means that such an motion grew to become applicable.

On Monetary Circumstances:

Quite a lot of contributors famous uncertainty relating to the diploma of restrictiveness of present monetary circumstances and the related threat that such circumstances had been insufficiently restrictive on combination demand and inflation. Though financial coverage was seen as restrictive, many contributors commented on their uncertainty concerning the diploma of restrictiveness.

On Development upside and draw back:

A number of contributors commented that elevated efficiencies and technological improvements may elevate productiveness progress on a sustained foundation, which may enable the economic system to develop quicker with out elevating inflation.

Members additionally famous draw back dangers to financial exercise, together with slowing financial progress in China, a deterioration in circumstances in home CRE markets, or a pointy tightening in monetary circumstances

On disinflation:

Members advised that the disinflation course of would possible take longer than beforehand thought.

On tapering QT:

Nearly all contributors supported choice to start to sluggish tempo of decline of central financial institution’s securities holdings; just a few may have supported continuation of present tempo.

On monetary stability:

Members who commented famous vulnerabilities to the monetary system that they assessed warranted monitoring.

Learn the total Minutes beneath:

Loading…