thitivong

Introduction

To start with, we wish to specific our condolences to all Israeli residents affected by the unprecedented act of terror dedicated by Hamas on October 7, which may have a long-term unfavourable influence on Israeli territory and your complete Center East area. We hope that eventually peace and prosperity will return to all civilians and their affected households within the Israeli territories.

On this article, we are going to analyze Direxion Each day S&P Oil & Fuel Exp. & Prod. Bull 2X Shares ETF (NYSEARCA:GUSH), has caught our consideration resulting from current developments within the crude oil market. Sadly, we’ve been confronted with information in world monetary media in regards to the closure of the Pink Sea passage for worldwide ships. It is a very severe occasion, which may add to inflationary pressures in developed international locations as delivery cargo charges will most seemingly expertise a big improve resulting from greater insurance coverage prices, longer freight mileage, and potential disruption all through your complete provide chain. When it comes all the way down to long-term investing, this occasion will almost certainly be negligible if we have a look over the subsequent 20 years or extra. Nonetheless, high-risk-taking traders may attempt to monetize utilizing every day leveraged ETFs like GUSH. Moreover, they might even construction some sort of lengthy name choice, or a straddle, and even purchase a put choice if they’re pessimistic in regards to the prospects of the crude oil market.

Pink Sea passage closure and influence on world crude markets

Closure of the Pink Sea passage resulting from repeated Houthi attacks will almost certainly result in volatility in world crude oil markets. Merchants are right here left with two extremely seemingly situations: 1) the crude oil provide may very well be disrupted by the longer delivery route by way of Cape of Good Hope which is roughly 40% longer in comparison with the generally used route via the Suez Canal thus resulting in greater crude oil costs, or 2) the demand for crude oil may very well be negatively impacted by a disruption in world commerce thus resulting in precise deflationary strain on the crude oil markets (f.i. one thing just like what we skilled initially of the COVID-19 lockdowns in March 2020). Each GUSH and its reverse counterpart Direxion Each day S&P Oil & Fuel Exp. & Prod. Bear 2X Shares (DRIP) may very well be utilized by day-traders to monetize on potential crude oil market volatility or its technical discrepancies over the subsequent couple of months. Our recommendation is to comply with carefully the entire world political and financial developments and attempt to decide the sense of what may very well be long-term drivers of both crude market provide shock or deflationary pressures of developed economies. Then accordingly merchants may both purchase the dip or enter the quick place on the prime of the development.

Our readers ought to remember that this ETF follows primarily Oil and Fuel producers, which aren’t instantly tied to short-term fluctuations within the crude oil market. As an illustration, a big oil producer like Shell (SHEL) has almost certainly signed long-term contracts with for example Chinese language prospects for a sure amount of crude oil at a predetermined worth. Subsequently, a short-duration Pink Sea passage closure will almost certainly not have a big influence on Shell’s profitability or manufacturing capability within the quick run.

“The disruption is unlikely to have massive results on crude oil and LNG costs as a result of vessel redirection alternatives suggest that manufacturing shouldn’t be instantly affected,” analysts on the funding financial institution mentioned in a report.

(Supply: CNBC)

That can be one thing that Goldman Sachs (GS) has highlighted within the quote above, as our readers ought to remember that solely roughly 5% of the worldwide oil provide commerce ( ≈4.8 million oil barrels per day) goes through the Pink Sea passage. Subsequently, short-term inventory worth fluctuations for giant oil and fuel producers must be much less unstable in comparison with the futures of Brent crude oil. Nonetheless, our readers ought to remember that any extended closure of the Pink Sea passage may fully disrupt current signed contracts. An attention-grabbing query may come up: Who will bear the upper value of delivery, the vendor or the client? This might set off monumental disruption all through the provision chain, as some events may begin to default on their pre-obliged contracts. Think about a state of affairs by which a tanker operated by a third-party firm that has to ship crude oil from the Center East to Europe can not bear the upper gasoline consumption and the entire value of transportation throughout the Cape of Good Hope. At that time, bigger multinational oil producers like Shell or Exxon Mobil (XOM) may begin to see operational or monetary points, resulting in decrease quarterly outcomes.

Finance Yahoo

Based on the determine above, we are able to discover within the prime 8 holdings a number of the largest crude oil and fuel producers within the US, together with Phillips 66 (PSX), Southwestern Vitality (SWN), and Pioneer Pure Sources (PXD). Sadly, This fall ’23 and annual 2023 outcomes might be launched initially of subsequent 12 months, the place firms can even present extra particulars on how the present disruption within the world provide chain in crude oil impacts their firms.

These are American firms, which almost certainly have a decrease share of delivery routes via the Suez Canal in comparison with Center Japanese producers who’ve the next publicity to supplying crude oil and fuel via that path to European and American prospects. Then again, our readers may possibly attempt to lookup American refineries which are extremely depending on imported crude oil from the Center East and possibly take into account short-term bearish positions if administration boards begin to announce unfavourable operational and monetary outcomes resulting from blocked Pink Sea passage. If the US Military decides to military intervene in Yemen, then Pink Sea passage may very well be blocked for a substantial time sooner or later. This might fulfill our beforehand talked about pessimistic situations.

Our recommendation is that merchants in DRIP or GUSH may use that basic discrepancy to their benefit. For instance, if there’s a short-term excessive rise within the crude oil worth, which additionally impacts beforehand talked about firms. As a result of American Oil and Fuel producers are largely concerned in numerous routes just like the East Coast to Europe or the West Coast to Asia, any sort of escalation within the Pink Sea mustn’t materially influence their enterprise efficiency. These merchants can possibly search for a possibility to enter DRIP contracts, in view of shorting the crude oil market, as issues deescalate within the Center East and world provide returns to regular. Then again, if traders anticipate an additional escalation between the U.S. Military and Yemeni Houthis, then they’ll rely on psychological components that the inventory costs of the most important American Oil and Fuel producers will go up resulting from bullish sentiment on crude oil markets primarily pushed by geopolitical points. Nevertheless, they need to have in mind these are nonetheless two separate markets – futures on Brent Crude and U.S. oil and fuel manufacturing, and shouldn’t be equated as one.

Market Value Efficiency of an ETF and its High Holdings

On this article, we are going to focus solely on market worth efficiency for as much as 12 months as it’s the most related for our underlying instrument GUSH.

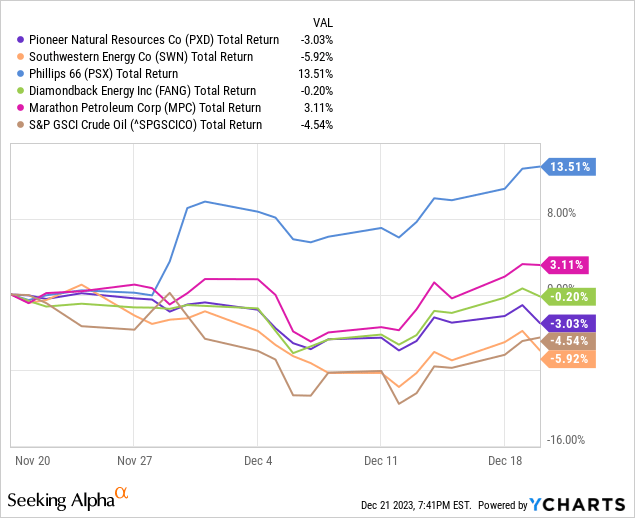

Based on the determine above, we are able to establish that bigger Oil and Fuel producers like PSX and Marathon Petroleum (MPC) are fully non-correlated to the efficiency of the S&P Crude Oil index during the last month, whereas smaller producers like DiamondBack Vitality (FANG) or PXD have generated the same unfavourable complete return to the actual oil index within the vary of -3% to -6%. This means our earlier ideas that the most important oil producers are much less prone to be considerably impacted by the closure of the Pink Sea passage within the quick run.

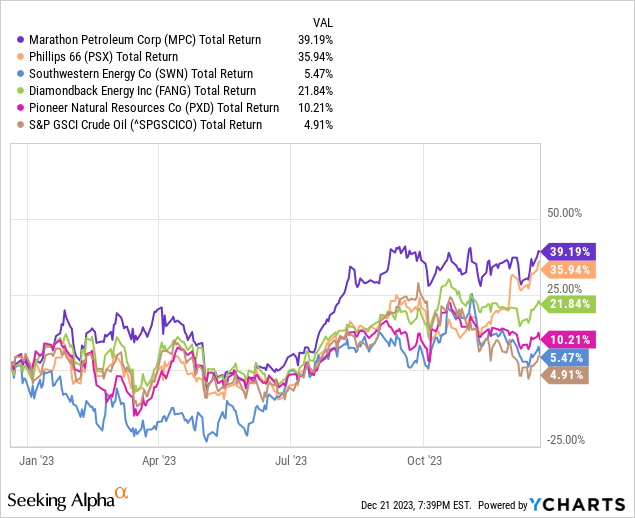

Nevertheless, if we have a look into the final 12-month efficiency, then we are able to simply see that main oil firms have outperformed the efficiency of the final crude oil market. This efficiency was primarily pushed by constructive enterprise sentiment on Wall Avenue and general constructive macroeconomic tendencies in developed international locations, thus lifting demand for crude oil all through 2023. As well as, oil firms have reported stable monetary and enterprise quarterly outcomes to date in 2023.

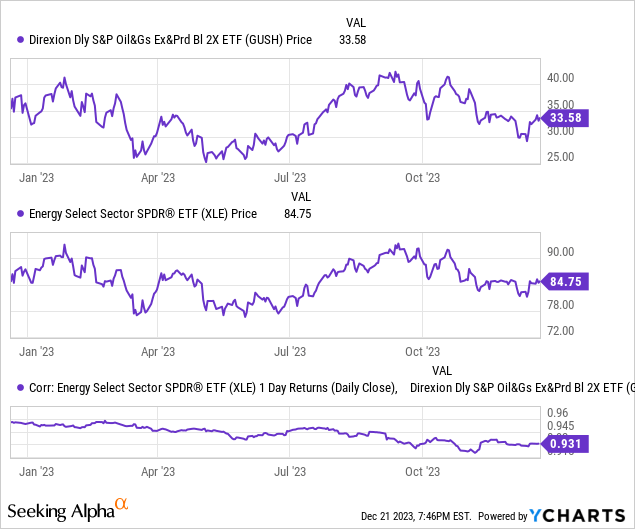

Based on the determine above, we’ve determined to try how GUSH levered ETF compares to the most important ETF investing within the oil trade Vitality Choose Sector SPDR Fund (XLE). Our correlation evaluation signifies there was a correlation between 90% and 96% which signifies that the efficiency of GUSH is extremely correlated to the general efficiency of the most important firms within the oil trade. As we’ve beforehand talked about, our readers mustn’t equate GUSH to the general efficiency of the final crude oil market. We all know that firms within the oil trade may very well be affected by different components, resembling the final financial surroundings, psychological traits on Wall Avenue (sturdy pessimism), or altering client preferences in the event that they resolve to go electrical and begin to boycott fossil gasoline merchandise resulting from their unfavourable influence on our surroundings.

Conclusion

In our view, disruption within the world delivery route via the Pink Sea ought to result in greater oil costs over the approaching months, thus resulting in a possibility for short-term merchants to monetize on it. Nevertheless, our readers ought to remember that utilizing every day leveraged ETFs is a really dangerous sort of funding, which additionally results in greater capital return taxes in comparison with holding an funding for a chronic interval (over 15 years). As well as, there may be nonetheless a danger that world demand might be negatively impacted by the worldwide provide crunch resulting from extended delivery routes, thus resulting in excessive losses of going in opposition to the downfall development within the crude oil costs with the GUSH instrument. If our readers are conscious of all of these dangers and nonetheless consider they’ll appropriately predict the worldwide oil market and GUSH’s relation to it, then they’ll attempt to monetize it. Simply remember that high-risk investing is known as so with a motive as it may result in vital losses in a short while.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.