Golden_Brown/iStock by way of Getty Photos

Main Mexican financial institution Grupo Financiero Banorte, S.A.B. de C.V. (OTCQX:GBOOY) (OTCQX:GBOOF) has made constructive strides through the years in diversifying its platform past banking, with fee-generating companies like asset administration, brokerage, and insurance coverage now contributing >20% of the general backside line. However the key supply of upside right here stays the financial institution’s leverage to an more and more compelling nearshoring-driven progress story in Mexico. Alongside the nation’s low credit score penetration, mortgage progress seems poised to run effectively above different LatAm banks for the years to come back. Additionally boosting Banorte’s prospects is its steady share gains on the expense of CitiBanamex (now set to be spun out of Citi (C) after sale talks broke down earlier this yr), notably within the mortgage section.

Whereas sustained mortgage progress via the cycles is nearly a given, the catch right here is that Mexico is now headed for decrease charges (albeit at a delayed pace than lots of its Latin American friends). Thus, considerations concerning the financial institution’s web curiosity margin (NIM) path are warranted, with its latest downward NIM revision (by ~25bps to six.6% in Q2) being a working example. That mentioned, Banorte’s progress momentum units it other than different LatAm banks and, assuming no unexpected regulatory headwinds, ought to make sure the financial institution sustains returns effectively above its value of capital even via a financial pivot.

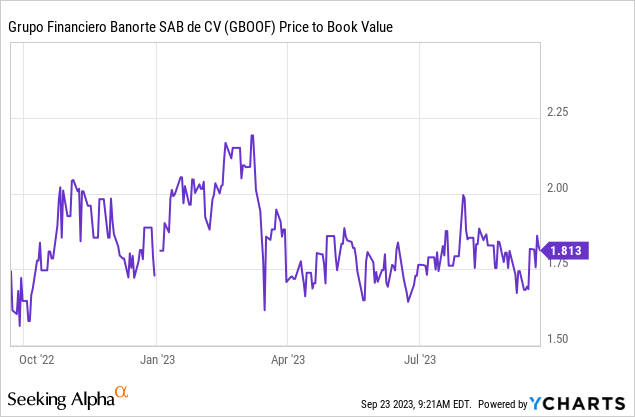

So even with valuations at present at a relative premium at 1.8x e-book (albeit consistent with historic averages), Banorte’s favorable working backdrop (nation dynamics and {industry} tailwinds) justifies it, for my part. Within the meantime, there’s a lot right here for revenue buyers, as the present yield might nonetheless see some upside as administration frees up capital over time. An upcoming particular dividend later this yr provides a possible upside catalyst to the near-term story.

Decrease NIMs however Total Earnings Steerage Nonetheless Strikes Larger

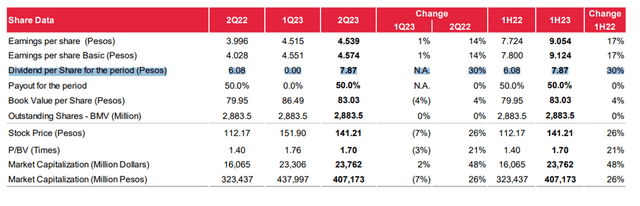

Banorte has been a key beneficiary of upper rates of interest to date, as its sticky low-cost deposit base has allowed for wider NIM growth than friends. This charge tailwind is reversing, nevertheless, and in tandem, the financial institution has been actively lowering its P&L sensitivity (right down to MXN865m per 100bps charge change vs MXN1.1bn in Q1) via hedges, in addition to an expanded floating charge combine. This hasn’t come at an excessive amount of value to the highest line, which nonetheless seems nice at +24% YoY web curiosity revenue progress in H1 – consistent with the ~20% YoY tempo at key friends Santander Mexico (BSMX) and BBVA Mexico.

Administration additional hiked steering numbers throughout the board as effectively, most notably mortgage progress (as much as 10-12% from 6-8% beforehand) on the again of broader financial tailwinds. So even with charges poised to fall over the following yr, Banorte’s financial institution ROEs are on observe to remain effectively above 20% (20.5-21.5% steering on a consolidated foundation).

Banorte

The catch is that NIM steering revisions are already on a downward path – the Q2 steering replace calls for six.2% – 6.4% NIMs for the total yr (vs 6.5% – 6.8% prior), with financial institution NIMs at 6.5% – 6.7% (vs 6.7% – 7.0% prior). A part of the NIM headwind might be mitigated, although, and whereas I might count on a narrower unfold in 2024/2025 as effectively, the extent of the compression might shock consensus on the upside (i.e., ‘greater for longer’ margins). Plus, Banorte’s observe document of industry-leading financial institution ROEs at >20% means it may well nonetheless lengthen its long-term earnings runway via reinvestments, notably with the broader financial system additionally gaining momentum.

Leaning on Ancillary Earnings Streams as Price Headwinds Loom

With Banorte’s banking margins set to come back below some stress, count on administration to push for extra payment revenue on the non-bank facet. For context, the financial institution has diversified its non-banking income base extensively over the previous few years (primarily via acquisitions) and now has a presence in brokerage, insurance coverage, pensions, and annuities. Exterior of insurance coverage (56% ROE in H1 2023), most of those newer income contributors aren’t but accretive, although all have gained significance, driving a >20% non-bank earnings base.

Banorte

Additionally attention-grabbing are Banorte’s ventures into digital banking (‘a digital financial institution with branches’), probably a long-term progress driver of its general deposit base. The digital monetary providers platform Rappi has been a vibrant spot, persevering with to realize income momentum, and is now on observe to achieve P&L breakeven within the coming quarters. In the meantime, Banorte’s headway into digital banking by way of Bineo is pacing effectively for a Q1 2024 launch, presenting upside to future expense steering (be aware Bineo will probably be a two share level drag on bills this yr). Administration hasn’t offered a breakeven timeline for Bineo (or any quantitative steering, for that matter), so any incremental deposits or effectivity positive factors are seemingly not but within the value.

Strong Capital Place Underpins Extra Dividends Forward

Backed by a well-capitalized financial institution stability sheet (CET1 at 15.4%), Banorte’s ongoing dividend payout is greater than sufficiently coated. This does not but account for its non-bank subsidiaries, which provide a further capital base to faucet into. Given administration has pegged its CET1 ratio goal at 14% by year-end, this leaves ample room to take care of or enhance the present 50% payout via the cycles. Whereas there isn’t particular steering on payout ranges for the mid to long-term, Banorte ought to fairly simply handle a 60% payout from right here.

Banorte

Alternatively, administration might additionally go for periodic particular dividend payouts. Following the common dividend payout in H1 (50% of 2022 earnings), for example, the financial institution will probably be following up with a unprecedented dividend of MXN15bn later this yr. This takes the whole dividend yield to a really engaging ~9% (>80% payout of 2022 earnings), which can please the income-focused investor base.

Price Cuts Loom, however There’s Nonetheless Trigger for Optimism

Proudly owning banks right into a charge lower cycle may not appear to be the most effective concept. On the one hand, NIM compression is inevitable, as highlighted by Banorte’s newest 25bp steering lower for 2023 (now 6.6% on the midpoint). However the tempo of Mexican mortgage progress (at present pegged at 10-12%) can be vital, helped by the nation’s favorable positioning in a multipolar world, in addition to its low base of credit score penetration.

So even with rate of interest cuts looming, there’s sufficient progress momentum right here (on the banking and non-banking sides) for Banorte to maintain returns effectively above its value of capital. Therefore, I really feel fairly snug underwriting a sustained >20% ROE for the group. Relative to the financial institution’s return profile and earnings progress trajectory, the present ~1.8x P/B valuation isn’t all that steep both. Affected person, long-term-oriented buyers get a high-single-digit % recurring dividend to attend, together with the occasional particular payout.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.