Urupong

The large information this week—although broadly anticipated—was the 4.9% annualized progress of the economic system within the third quarter. Analysts nonetheless contaminated by Phillips Curve considering anxious {that a} robust economic system would encourage the Fed to maintain charges “greater for longer,” thus posing the danger of a recession subsequent yr. (Be aware: financial progress doesn’t trigger inflation. In truth, over the previous yr the economic system has frequently beat progress expectations, all of the whereas inflation has been declining relatively considerably.) By week’s finish, worries about Center East tensions trumped progress fears, and inflation knowledge confirmed that disinflation, not inflation, stays the order of the day. Rates of interest backed off their highs, and equities traded decrease. Count on Phillips Curve nightmares to proceed to hang-out the market this coming week. As for Center East tensions, effectively, that deserves concern however I do not know of any apparent answer to that.

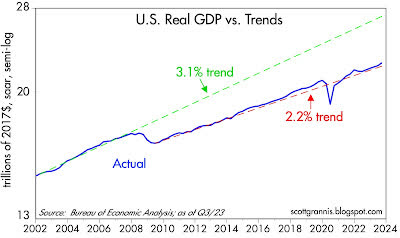

Chart #1

Whereas 4.9% progress in a single quarter actually stands out as an enormous quantity, it is value noting that it is an annualized quantity. In truth, the economic system reportedly grew just one.2% within the third quarter. And as Chart #1 reveals, the trail of actual GDP (blue line) skilled solely a small wiggle to the upside with this newest quantity. The large story with GDP is that the economic system has been rising by roughly 2.2% since mid-2009. That is rather a lot slower than the three.1% development which prevailed from 1965 via 2007. In the present day, the U.S. economic system is sadly not in peril of rising too quick. It’s simply muddling alongside, preventing the headwinds of very excessive tax and regulatory burdens aggravated by extreme authorities spending on switch funds and “inexperienced” power boondoggles (inexperienced power wants subsidies to compete because it’s woefully inefficient).

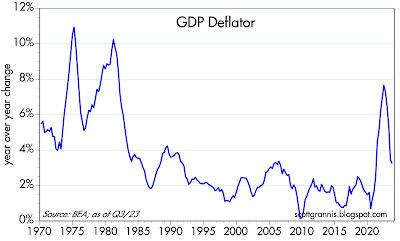

Chart #2

Chart #2 reveals the year-over-year change within the GDP deflator, which is the broadest measure of inflation we’ve got. By this measure, inflation has fallen from a excessive of seven.7% to now 3.2%.

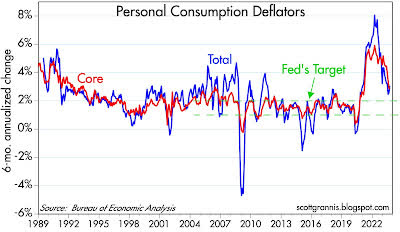

Chart #3

Chart #3 reveals the 6-mo. annualized price of change of the Private Expenditures Consumption Deflator and its core (ex-food and power) model (word: the PCE deflator is a greater measure of inflation than the CPI as a result of the weights of its elements change dynamically as client habits change). Over the previous six months, each of those measures present inflation rising at a 2.8 – 3.2% annual price, solely about 1 proportion level sooner than the higher finish of Fed’s goal.

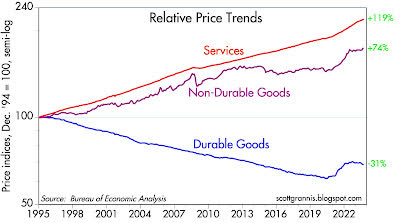

Chart #4

Chart #4 breaks down the Private Consumption Deflator into its 3 foremost classes. Be aware the spectacular decline in sturdy items costs which started in 1995, the yr China first opened its economic system to world commerce. A lot of the improve in inflation in latest many years comes from the service sector, which in flip displays principally wages. The large improve in wages alongside a big decline in sturdy items costs signifies that an hour’s value of labor right now buys greater than 3 instances as a lot in the best way of sturdy items because it did in 1995. We have by no means earlier than seen such a rise in buying energy; previous to 1995, sturdy items costs by no means declined on a multi-year foundation.

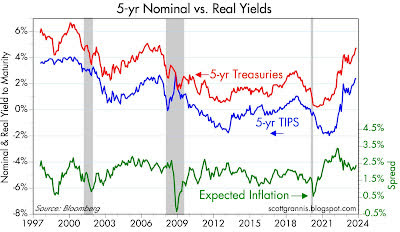

Chart #5

Chart #5 reveals actual and nominal yields on 5-yr Treasuries and the distinction between the 2 (inexperienced line), which is the market’s expectation for what CPI inflation will common over the following 5 years. The rise in yields over the previous 18 months has been pushed virtually solely by the rise in actual rates of interest. Actual charges, in flip, are the most effective measure of how tight financial coverage is. Thus, tight cash (as measured by a 340 bps rise in actual yields) has introduced inflation expectations all the way down to about 2.3%, which is nearly precisely the higher sure of the Fed’s goal for PCE inflation (2%), as a result of the CPI tends to exceed the PCE deflator by about 30-40 bps per yr.

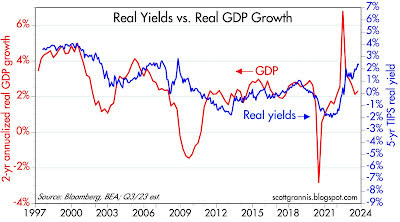

Chart #6

Chart # 6 compares the extent of actual yields on 5-yr TIPS to the 2-yr annualized progress of GDP (which I exploit as a result of it smooths out the random quarterly variations in precise GDP progress, and it doubtless mimics the general public’s notion of what present GDP progress is). Actual yields have a tendency to trace the power or weak point of the economic system; excessive actual yields prevailed within the late Nineteen Nineties when the economic system was exceptionally robust (progress charges of 4-5%), and actual yields have been low throughout many of the previous decade because the economic system has averaged 2% annual progress. Excluding the previous 18 months, in fact, when actual yields have surged. If the economic system stays on a 2.2% progress path, it would not be unreasonable to count on that actual yields will decline considerably from right now’s 2.4% ranges. That will doubtless coincide with a rest of the Fed’s financial stance, and that, in flip, would offer welcome reduction to the market.

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.