Maxiphoto/E+ through Getty Photos

Greif, Integrated (NYSE:GEF) produces industrial packaging and is predicated in Ohio. The corporate operates in three reportable enterprise segments: International Industrial Packaging, Paper Packaging and Companies, and Land Administration. Its merchandise embrace metal and fiber drums, bundle lids, packing containers and tubes and cores. Greif operates in 37 nations to achieve native markets and has factories in 22 of these, together with the US (31), China (8), Russia (9), Brazil (8). Its main prospects are chemical corporations, paint producers, meals and beverage producers, and prescription drugs companies. It is a mid-cap firm with a capitalization of $3.1 billion that has been in existence since 1926. It has a Beta of 1.01, so Greif’s shares typically transfer with the market over the long run. Nevertheless, the inventory has lots of short-term volatility in its efficiency, as the corporate is typically delicate to recession and adjustments in rates of interest.

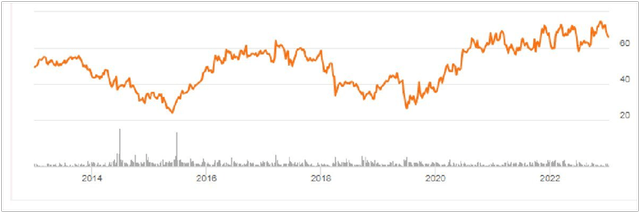

GEF Worth Historical past (Searching for Alpha charting)

Greif shares reached an all-time excessive of $74.90 in July 2023. They’re presently down 11.3% to $66.47. Nevertheless in March of this 12 months, they have been as little as $58.00. As mentioned within the 2022 Annual Report, the corporate has two lessons of widespread inventory, the acquainted Class A shares (GEF) and the much less traded Class B shares (NYSE:GEF.B), each listed on the NYSE. Greif’s fiscal 12 months ends on October 31.

2022 Was One other Sturdy 12 months

Greif generated report gross sales of $6.35 billion in 2022, up 14.4% from $5.55 billion in 2021 and up 40.8% from $4.51 billion in 2020. The rise in 2022 was primarily as a result of increased volumes and better sale costs throughout the reportable segments. There was report shopper demand in 2021 and 2022, as a result of stimulus funds, and inflation-boosted promoting costs. At the moment about 60.0% of the corporate’s income comes from the International Industrial Packaging division (GIP), one other 39.0% from Paper Packaging and Companies (PPS) and 1.0% or much less from Land Administration. Land Administration has about 244,000 acres of timberland within the southeastern US that it manages and sometimes harvests. Regardless of the robust earnings in 2022, International Industrial Packaging skilled slowing demand towards the tip of the 12 months, principally from headwinds within the economies of Europe, the Center East and Africa. Paper Packaging and Companies had favorable worth will increase for the entire 12 months, which offset inflation in its supplies prices.

The Class A earnings per share have been $6.36 in 2022, $6.57 in 2021 and $1.83 in 2020. In line with its annual report, the Firm applies the ”two-class methodology” of computing earnings per share, so earnings are allotted in the identical vogue as dividends can be distributed. Underneath the Firm’s certificates of incorporation, this ends in a 40% to 60% break up to Class A and B shareholders, respectively. Earnings per share for the Class B have been $9.53 in 2022, $9.84 in 2021, and $2.74 in 2020. Regardless of two years of robust outcomes, Greif is in an trade that’s extremely depending on the efficiency of the economies the place it’s situated, so earnings are risky, various from 12 months to 12 months, as you may be beneath:

Variation in Earnings Per Shares (Creator sourced)

2023 Will Be Slower, Steering Lowered

In line with the Q3 2023 Earnings Transcript, per Larry Hilsheimer, Chief Monetary Officer “…whereas we will not be in a broad financial recession, world manufacturing PMIs remained beneath 50 for the eleventh month in a row, and year-to-date volumes throughout International Industrial Packaging and Paper Packaging and Companies are each monitoring down mid to excessive teenagers year-to-date…If that is not indicative of an industrial recession, then I am unsure what’s… volumes (typically) have been roughly 15% decrease…Our prospects are telling us that it isn’t getting worse, however they’re additionally telling us that they do not count on any enhancements over the following two quarters.”

Due to the slowing economies in Greif’s main markets, 2023 earnings have been revised beneath these of 2022. For the fiscal 12 months ending Oct 2023, the Consensus EPS is $5.90 per A Share, with a spread of $5.81 to $6.05. For B Shares, this might equal a spread of $8.72 to $9.08.

Within the third quarter 2023, throughout the corporate, gross sales have been down 17.9% from $1.62 billion in 2022 to $1.33 billion in 2023. Gross revenue was down 11.5% from $346.9 million in Q3 2022 to $307.0 million in Q3 2023. Earnings per share for the third quarter dropped from $2.35 in 2022 to $1.75 in 2023. The slowdown was felt throughout each segments.

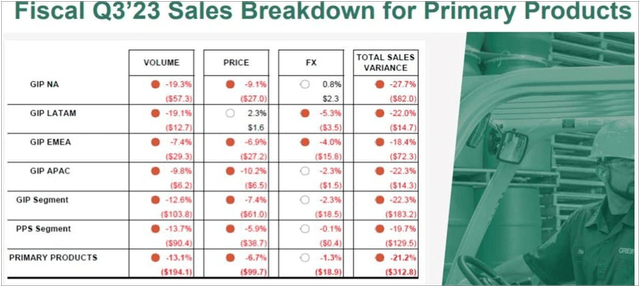

In International Industrial Packaging, volumes remained at a low degree all through the quarter, trending barely down from the second quarter. The Asia Pacific markets didn’t see any enchancment from authorities stimulus actions there, and Latin America and North America had weak demand. There have been some margin enhancements in Q3, the results of constant value administration. In Paper Packaging & Companies gross revenue declined 23.1% as reported within the Q3 2023 Presentation. Demand remained delicate throughout most essential paper finish markets however was partially offset by a rise in development markets. An evaluation of third quarter outcomes by division and area is offered beneath:

Third Quarter Efficiency by Section (Q3 2023 Investor Presentation)

Inflation and Provide Points

The pandemic had various impacts on the corporate, together with volatility in demand for its merchandise, adjustments to enterprise operations, and disruptions to prospects. The Russian invasion of Ukraine was additionally an issue. Greif continues to function 9 amenities in Russia, however these vegetation serve locals, making up solely 3% of working revenue. In late 2022, North American demand started to sluggish. Provide chain disruptions and inflation have been a problem all through 2021 and 2022 as uncooked supplies Greif makes use of elevated in worth. Thus far the corporate has been in a position to move on rising prices to its prospects, and 2021 and 2022 have been two of its finest years regardless of the headwinds.

Metal, resin and containerboard, in addition to used industrial packaging, are the principal uncooked supplies for the International Industrial phase. Pulpwood, previous corrugated containers, and recycled coated and uncoated paperboard are the principal uncooked supplies for the Paper Packaging & Companies phase. Greif satisfies the necessity for these supplies by means of purchases on the open market or long-term provide agreements. The corporate expects costs for metal to say no barely subsequent 12 months, and costs for resin and previous corrugated containers to stay steady. Nevertheless, the prices of labor and, particularly, power are anticipated to extend as oil costs have risen considerably since July.

Lengthy-Time period Debt

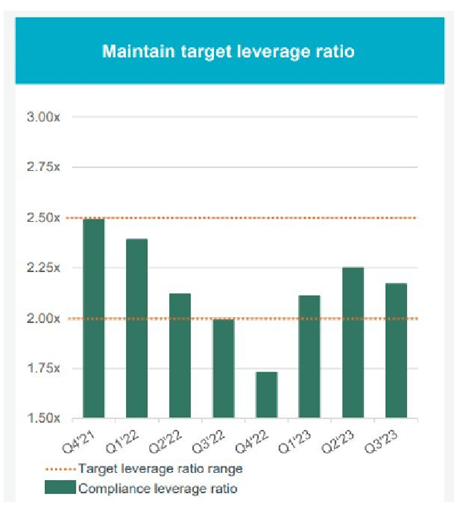

This trade is capital intensive, however Greif is making an attempt to cut back its debt. It is a clever transfer in a rising rate of interest surroundings. Long run debt was equal to 33.5% of whole belongings in 2022, down from 35.0% of whole belongings in 2021, and 42.0% in 2020. Debt could make the earnings per share differ significantly and curiosity prices – about one-third of web revenue in a few years – dropped to $61.2 million in 2022 (15.5% of web revenue), down from $92.7 million in 2021 (22.4.0% of web revenue), from $115.8 million in 2019 (93.2%). The corporate is making an attempt to considerably de-lever its stability sheet and achieved a decrease leverage ratio (outlined right here as web debt/EBITDA) final 12 months of 1.60x on the finish of 2022, down from 2.49x in 2021, in comparison with 3.66x in 2020. It’s presently 2.17x. Greif’s focused leverage vary is 2.0x – 2.5x. It paid off $189.4 million in long-term debt in 2022, utilizing proceeds from the sale of its Versatile Merchandise division. The corporate additionally undertook general value chopping measures, which led to 5 plant closings, and a complete of 177 worker severances with lowered pension liabilities.

GEF Present leverage Ratio (Q3 2023 Investor Presentation)

Progress by means of Acquisitions

Packaging is a aggressive trade and Greif ceaselessly grows by means of focused acquisitions. In early 2019, Greif acquired Caraustar Industries from non-public fairness agency HIG Capital for $1.8 billion. Caraustar is a frontrunner in manufacturing high-quality paper merchandise that embrace tubes and cores, situated in Austell, Georgia. In 2020, Greif’s web gross sales elevated $136.9 million, primarily as a result of a full 12 months contribution from Caraustar.

In late 2022, Greif acquired Lee Container for $300 million. Lee is, as described within the Fourth Quarter 2022 Investor Presentation, is a producer of high-performance molded containers, principally serving prospects in agriculture, specialty chemical compounds (the place it’s the North American chief), and pet care. Lee offered Greif with the rapid manufacturing of small plastic bottles. That is anticipated to extend Greif’s gross sales greenback for greenback by $162 million in 2023.

Within the latest Q3 2023 Investor Presentation the corporate introduced a brand new joint-venture taking 51% possession in ColePak Inc., a frontrunner within the area of interest North American partitions market (cardboard that separates gadgets in packing containers). ColePak produces specialty partitions for the meals and beverage industries. This may usher in one other $20 million per 12 months.

On April 1 of 2022, Greif offered its 50% curiosity in its Versatile Merchandise & Companies to Gulf Refined Packaging, of Vernon, California. The corporate held this stake for 11 years and the division made baggage and versatile packaging. The sale netted the Greif roughly $123 million in proceeds, which it used to pay down debt.

Packaging is a Aggressive, Cyclical Business

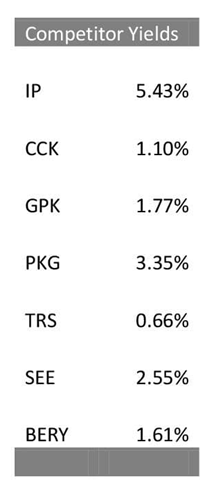

The markets by which Greif sells its merchandise are aggressive and there are various producers. No single firm dominates the worldwide industrial packaging enterprise, and Greif competes with corporations akin to Worldwide Paper (IP), Crown Holdings (CCK), Graphic Packaging (GPK), Packaging Company of America (PKG), TriMas Company (TRS), Sealed Air (SEE), in addition to Berry International (BERY), Nefab Group and Schutz. Per Greif’s administration they “are significantly delicate to cost fluctuations brought on by shifts in trade capability and different cyclical trade circumstances…and uncooked supplies are bought in extremely aggressive, price-sensitive markets, which have traditionally exhibited worth, demand and provide cyclicality.” Thus you will have the big variety in earnings per share of $2.89 in 2019, $1.83 in 2020, and $6.57 in 2021 and $6.36 in 2022 for the Class A shares.

The Dividend

The Firm has two lessons of widespread inventory, Class A (GEF) and Class B (GEF.B). Each are listed on the NYSE. Underneath the Firm’s articles of incorporation, a distribution of dividends have to be within the ratio of $0.01 a share for Class A Widespread Inventory to $0.015 cents a share for Class B Widespread Inventory. Many B shares are owned by descendants of the founding households, and these are the one voting shares, successfully controlling the agency. The common quantity of A shares traded per day is 124,000; B shares common quantity is about 16,000, so lower than 13.0% of the A quantity. The shareholder rights are barely completely different. Within the occasion of dissolution: dividends can be paid equally to each holders, however A Class dividends have to be paid first. Thereafter proceeds of a sale are divided equally amongst all of the holders.

Greif just lately introduced a 4.0% improve within the quarterly dividend, now at $0.52 (up from $0.50) and $0.78 (up from $0.75) for Class A and B shares, respectively. The present yield on Class A shares is 3.13% with a worth of $66.38 (the 52 week excessive was $72.00). Present yield on Class B is 4.64%, with a share worth of $66.96. The corporate has paid quarterly dividends on the A Shares since 1996 they usually have elevated from $0.04 to $0.52, an annual compound progress fee of 10.0%. Nevertheless, the corporate doesn’t increase its dividend yearly, and it was caught at $0.44 per quarter from 2018 to the primary a part of 2021, when it was raised to $0.46. The B Shares have been listed in the marketplace since 2003 and started with a dividend of $0.10 per quarter. The dividend is now $0.78, for a compound annual progress fee of 10.8%. Right here, additionally, will increase haven’t been constant by 12 months.

In 2022, whole dividends paid to stockholders and non-controlling pursuits of Greif, Inc. have been within the quantity of $128.5 million (a 32.6% payout ratio), $113.6 million in 2021 (a 27.5% payout ratio) and $117.7 million in 2020 (a 95.7% payout ratio). Under are the dividend yields of a few of Greif’s rivals.

Competitor Dividend Yields (Creator generated)

Share Worth Supported by Buybacks

In June 2022, the Board of Administrators approved the repurchase as much as $150.0 million shares of Class A or Class B Widespread Inventory or any mixture thereof. In June 23, 2022, Greif entered right into a $75.0 million accelerated share repurchase settlement with Financial institution of America, N.A. for the repurchase of Class A or Class B Widespread Inventory, in open market purchases. About 80% of the anticipated repurchases have already occurred as 1,021,451 shares of Class A Widespread Inventory, with the remainder to be delivered in later in 2023.

Share Valuation

I estimate the present worth of GEF Class A shares to be $60.92, so these shares are about 9.0% overvalued at the moment versus the present worth of $66.38. I used a reduced money movement money to worth the corporate’s A shares, which concerned taking the estimated EPS, starting in 2023, then projecting ahead. I used a five-year time interval then capitalized the final 12 months right into a perpetuity. For the low cost fee, I regarded to the typical annual return of the S&P 500. The long-term common is about 9.25% whereas during the last 10 years it has been 10.4%. In valuing this firm, I feel I might take a extra conservative method, particularly given the cyclical nature of the inventory and anticipated upcoming fee hikes from the Fed. I’ve elected to make use of a reduction fee of 11.0%, discounting starting within the second 12 months. Greif’s earnings per share differ significantly from 12 months to 12 months, however the general long-term trajectory is up. Due to this fact I’ve used a really conservative progress fee of 1.0% per 12 months.

I used a beginning EPS for 2023 as $5.85, just under the typical analyst consensus however throughout the predicted vary. For calculating the reversion, I’ve used a fee of 10.0%. The outcomes are offered beneath:

GEF Discounted Money Circulation (Creator calculated)

The present PE Ratio for the A Shares is 9.98. For the B Shares it’s 6.73, considerably decrease, so the market is perceiving increased danger with these shares. From the 2022 annual report: “Class A Widespread Inventory is entitled to cumulative dividends…after which Class B Widespread Inventory is entitled to non-cumulative dividends… distribution in any 12 months have to be made in proportion of 1 cent a share for Class A Widespread Inventory to at least one and a half cents a share for Class B Widespread Inventory.” Noncumulative doesn’t entitle buyers to receives a commission any missed dividends, so in idea there’s a component of danger, though the B Shares get dividends which might be 50.0% increased. To worth the B Shares I used an EPS of $8.75 for 2023, with 1.0% annual progress, a 12.0% low cost fee and a 12.0% reversion fee. The outcomes are offered beneath:

GEF.B Discounted Money Circulation (Creator calculated)

Even with very conservative assumptions, the B Shares worth at $79.45, considerably increased than the present worth of $66.96. So I estimate that B Shares are about 15.0% undervalued.

Dangers to Outlook

The first dangers to share valuations for Greif are additional will increase in rates of interest by the Federal Reserve and the potential for a real industrial recession in any of the worldwide markets by which it operates. In actual fact, latest articles state that demand for cardboard packing containers is declining rapidly, an industrial slowdown indicator. Demand is slowing in China particularly in addition to in Asia Pacific nations. Nevertheless Greif is diversified geographically and throughout packaging varieties.

Conclusion

At the moment the A Shares of Greif are about 9.0% overvalued whereas the B Shares are 15.0% undervalued. The B Shares are clearly the higher purchase with a dividend of 4.61% versus 3.14% for the A Shares. And the B Shares dividend will all the time be 50% increased than the A, as mandated by the corporate group filings. As a packaging enterprise Greif is topic to cyclical demand and is rate of interest delicate, however for a long run investor, the B Shares signify a powerful purchase choice, particularly if now we have any additional downturns within the broader market. I imagine buyers can get a wholesome yield and share worth appreciation from these. I’ve personally owned the A Shares for a few years, however I feel the Class B are a greater funding.