Crypto markets have been rattled by days of Bitcoin offloading by the business’s largest digital asset supervisor, Grayscale. Bitcoin continues to fall beneath $40,000, however a lot of the Grayscale outflow has been scooped up by different fund managers, so why are merchants promoting their cash?

Grayscale has been promoting Bitcoin since US regulators permitted spot BTC exchange-traded funds on January 11.

Grayscale Bitcoin ETF Share Promoting Continues

Because it was permitted to transform its GBTC fund right into a spot Bitcoin ETF on January 11, the agency has seen greater than $3.3 billion in outflows. Moreover, it has been depositing giant quantities of Bitcoin into Coinbase in preparation for additional gross sales.

The rationale for the Grayscale exodus is basically as a consequence of traders rebalancing their portfolios and coming into funds with decrease charges for higher returns.

On January 24, CC15Capital, which has been posting updates on Bitcoin ETF holdings, stated:

“Cease panic-selling your Bitcoin simply since you see panic-inducing tweets about GBTC cash being despatched to Coinbase each morning.”

It added that each one Bitcoin offered by Grayscale to this point has been scooped up by the opposite (lower-fee) ETFs.

BlackRock and Constancy have been the largest patrons of Bitcoin, with 39,925 and 34,127 BTC held, respectively, as of January 22. Nevertheless, Grayscale has offloaded 82,525 BTC in the identical interval.

Learn extra: What Is a Bitcoin ETF?

However, the overall mixture quantity of BTC purchased by the newly launched spot ETFs, not together with Grayscale, stays a constructive determine at 25,938 cash, in response to CC15Capital.

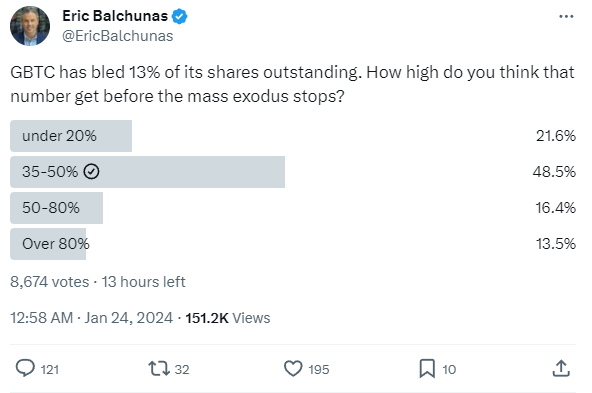

On January 24, ETF analyst Eric Balchunas held a ballot to gauge when individuals assume Grayscale will cease promoting:

“GBTC has bled 13% of its shares excellent. How excessive do you assume that quantity will get earlier than the mass exodus stops?”

Almost half of the respondents voted for the 35%-50% choice, suggesting that sentiment stays bearish.

He added that each himself and fellow analyst James Seyffart assume it is going to be round 25%,

“However this isn’t one thing I’d be[t] a sushi lunch over, too many unknowns.”

In keeping with its web site, the Grayscale Bitcoin Trust holds 536,694 BTC value an estimated $21.3 billion. So, it’s unlikely that the promoting is over but.

However, a decrease BTC worth can be excellent news for the opposite ETF issuers and traders ready to purchase the dip.

Acquisition Potential

ETF Retailer president Nate Geraci commented:

“A strategic acquisition of a agency equivalent to Grayscale makes a ton of sense for the fitting conventional ETF issuer assuming the value is palatable.”

Seyffart backed the notion {that a} bigger participant might purchase the crypto asset supervisor:

“Somebody buying Grayscale is theoretically attainable, probably even doubtless over an extended sufficient timeframe, significantly with the present points surrounding their father or mother firm.”

In the meantime, Bitcoin costs had misplaced $40,000 once more. They have been down 0.8% on the day at $39,710 on the time of writing.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.