Digital asset supervisor Grayscale has deposited billions of {dollars} price of Bitcoin to crypto alternate Coinbase because the approval of spot BTC exchange-traded funds (ETFs), on-chain information exhibits.

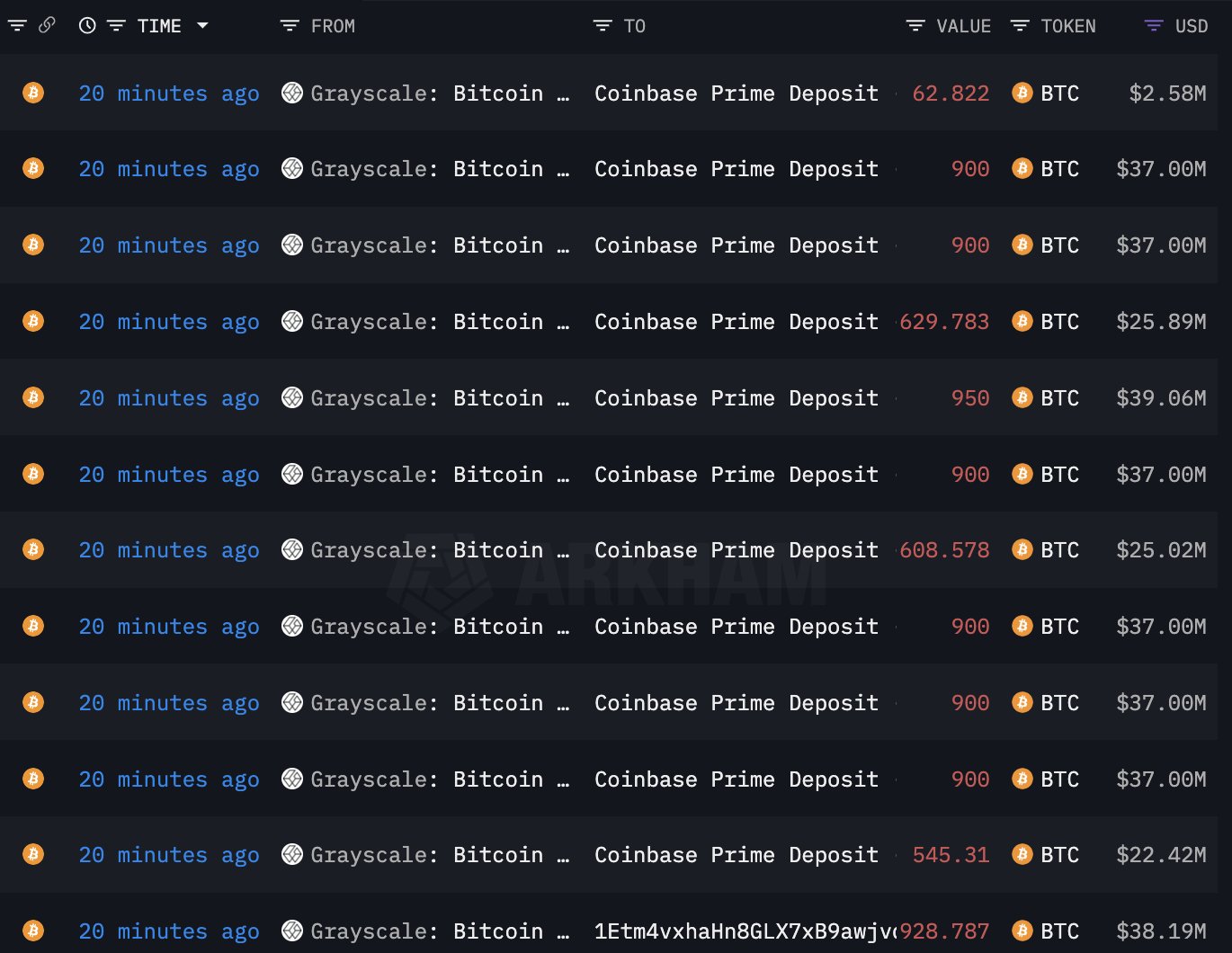

Blockchain monitoring agency Lookonchain says that on Friday, Grayscale deposited $410.9 million in BTC to Coinbase Prime, the crypto alternate’s platform that caters to institutional shoppers.

The deposit added to an already massive stream of BTC deposits from Grayscale, which in keeping with Lookonchain, now totals over $4.64 billion because the ETF approvals. Even after the large deposits, Grayscale stays the third-largest holder of Bitcoin to the tune of 502,043.26 BTC price $20.67 billion.

Whereas Grayscale’s Coinbase deposits are presumably placing promote stress on Bitcoin, information gathered by crypto analyst InvestAnswers suggests the launch of ETFs is general bullish for the crypto king.

Says InvestAnswers,

“THE GOOD NEWS:

1) Blackrock has practically $2 billion in belongings beneath administration and after [Friday] can have 50,000 BTC

2) Constancy rising quicker than Blackrock, Constancy clients love BTC extra

3) If you happen to take away Grayscale – on common, $550 million {dollars} per day are rolling into BTC ETFs

4) If you happen to take away Grayscale – these ETFs sucked in 140,000 BTC

5) The ETFs alone are sucking in 15.5x the every day Bitcoin provide created

6) Bitcoin bottomed earlier this week – now FOMO (worry of lacking out) instances.”

At time of writing, Bitcoin is buying and selling at $41,984.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Generated Picture: Midjourney