- Whereas Grayscale decreased its Bitcoin ETF holdings, BlackRock continued to build up.

- BTC’s value motion remained bullish, however the pattern would possibly change quickly.

Bitcoin [BTC] ETFs have as soon as once more come into the limelight as a number of high corporations decreased their holdings. Whereas that occurred, BTC’s value motion remained within the bulls’ favor.

Let’s check out whether or not this newest ETF improvement would have a damaging impression on BTC’s value.

Did Grayscale have an effect on Bitcoin ETF holdings?

As per a tweet by Lookonchain on the nineteenth of July, Grayscale, one of many largest BTC ETF holders, decreased its holdings by 845 BTC, value greater than $55.5 billion, holding 272,160 BTC at press time.

Apparently, whereas Grayscale bought BTC, BlackRock added 1,616 BTC, value greater than $106 million, and held 325,449 BTC at press time, value $21.4 billion.

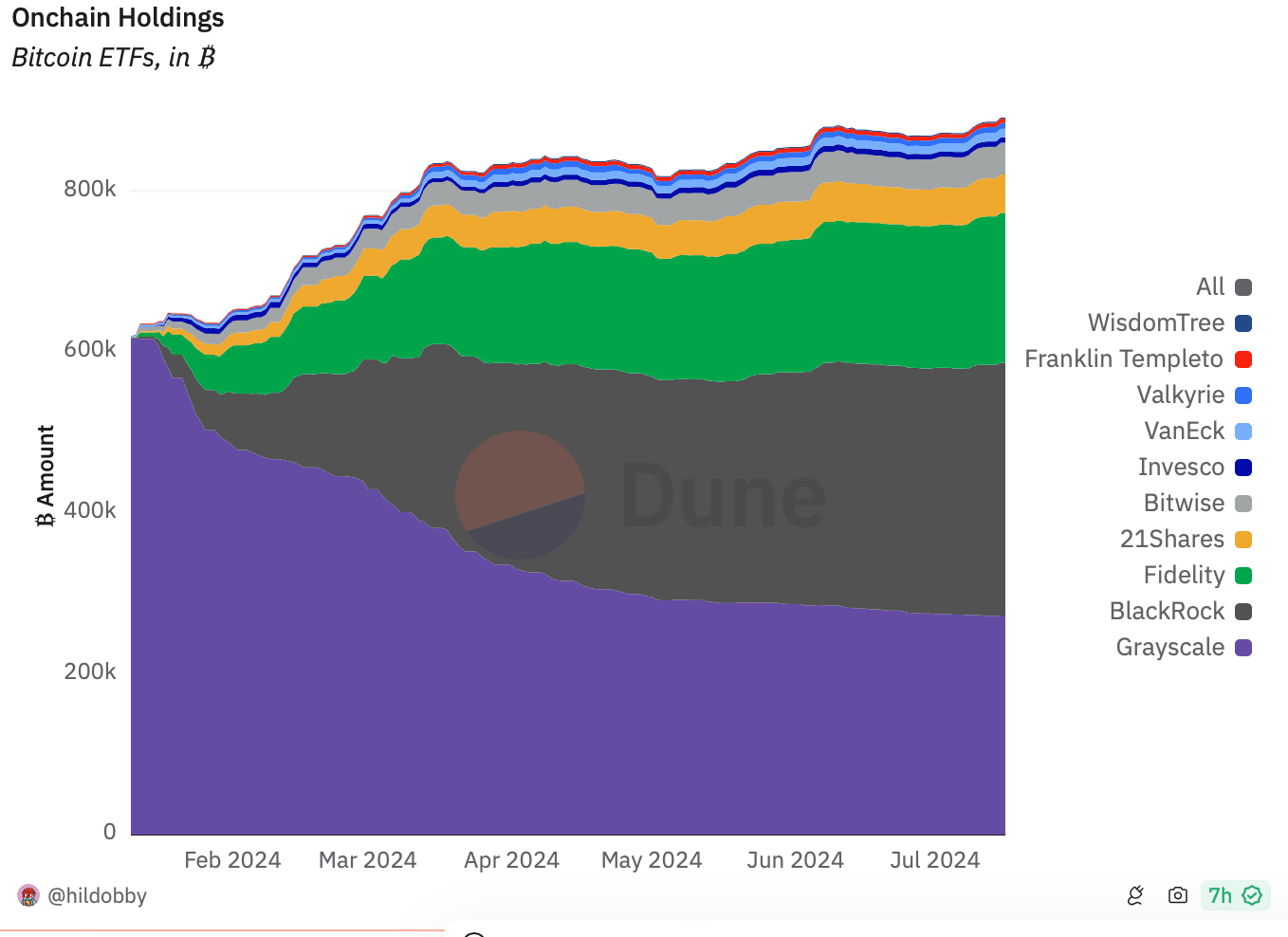

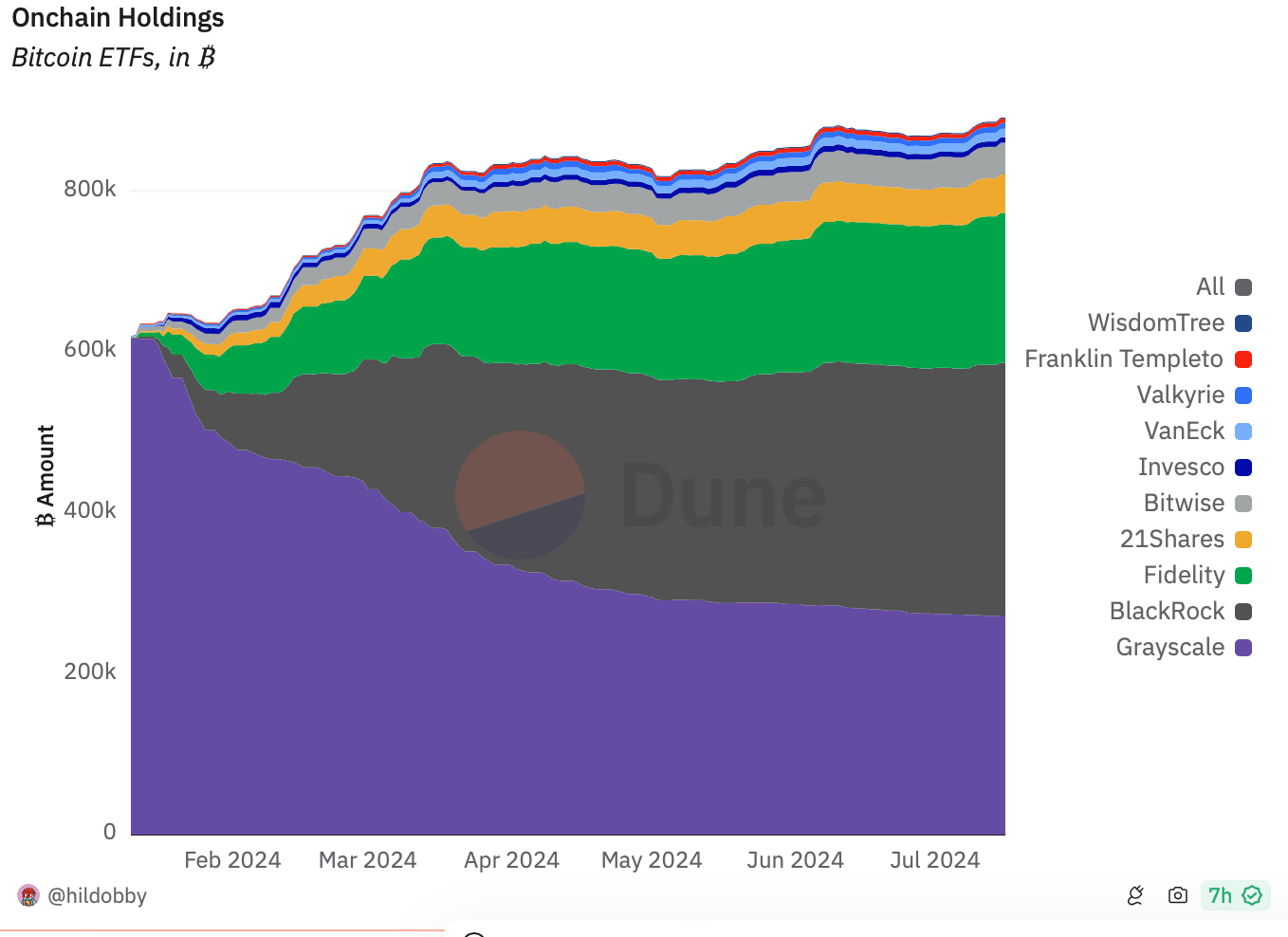

AMBCrypto then analyzed Dune Analytics’ data to higher perceive how Bitcoin ETFs have been doing. As per our evaluation, since its launch, over $16 billion value of BTCs have flown into ETFs.

Within the final seven days, the netflow remained optimistic as ETFs added one other $0.32 billion to BTC’s holdings. The full quantity of BTC that was held in ETFs accounted for 4.5% of Bitcoin’s whole provide.

Mentioning the highest ETFs, Grayscale stood out at first, adopted by BlackRock, Constancy, and 21Shares.

Supply: Dune Analytics

How did BTC react?

Whereas this occurred, bulls continued to dominate the market at press time. In line with CoinMarketCap, Bitcoin’s value elevated by greater than 7% previously week.

On the time of writing, BTC was buying and selling at $67,283.62 with a market capitalization of greater than $1.32 trillion. Due to the latest value improve, over 93% of BTC buyers have been in revenue, as per IntoTheBlock’s data.

AMBCrypto then deliberate to evaluate CryptoQuant’s data to search out out whether or not the developments within the Bitcoin ETF sector would have an effect on BTC’s value.

As per our evaluation, BTC’s internet deposit on exchanges was excessive in comparison with the final seven days’ common, which means that promoting stress was rising.

Its aSORP was additionally within the crimson, which prompt that extra buyers have been promoting at a revenue. In the course of a bull market, it could possibly point out a market high.

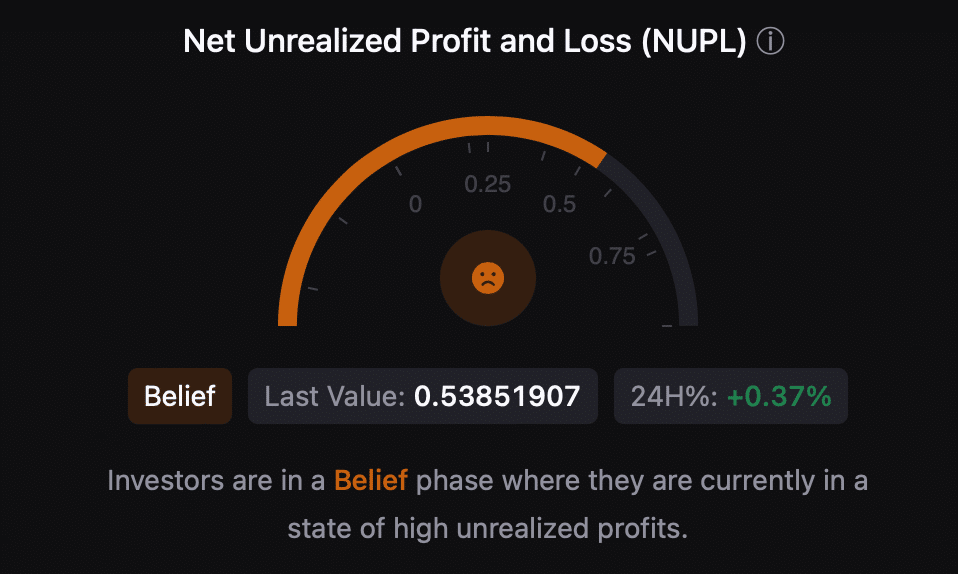

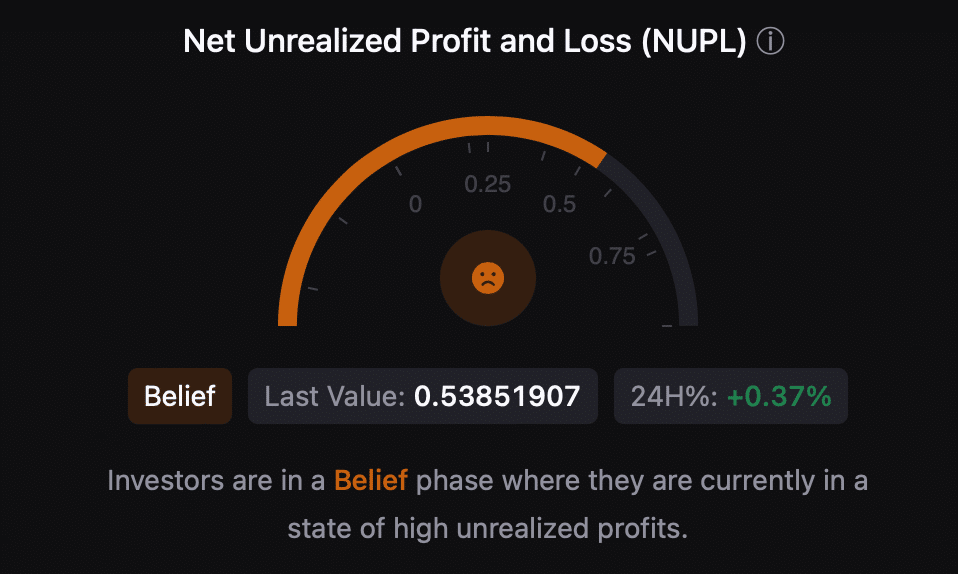

Moreover, its NULP revealed that buyers have been in a perception part the place they have been at the moment in a state of excessive unrealized earnings, which appeared bearish.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024-25

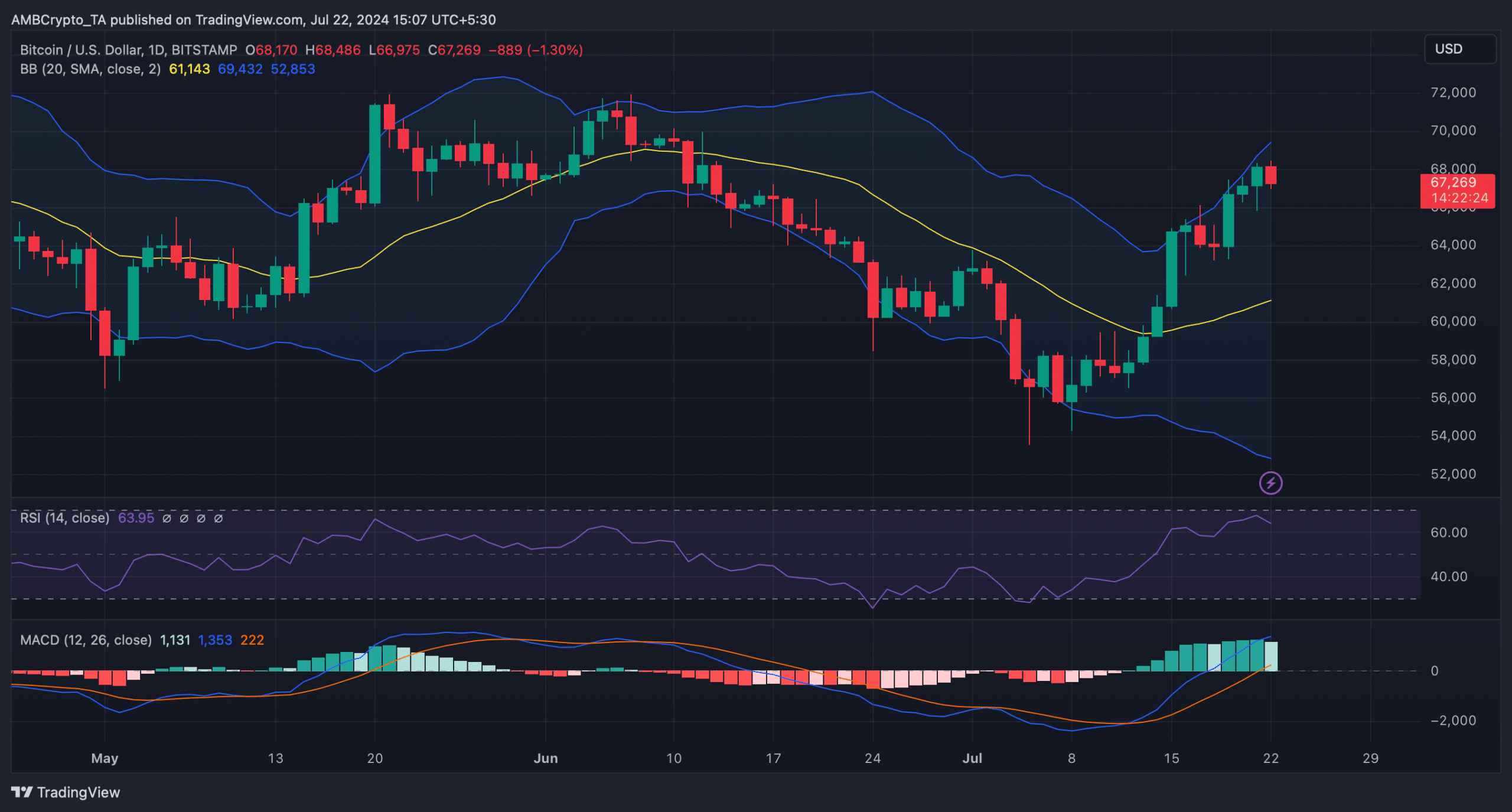

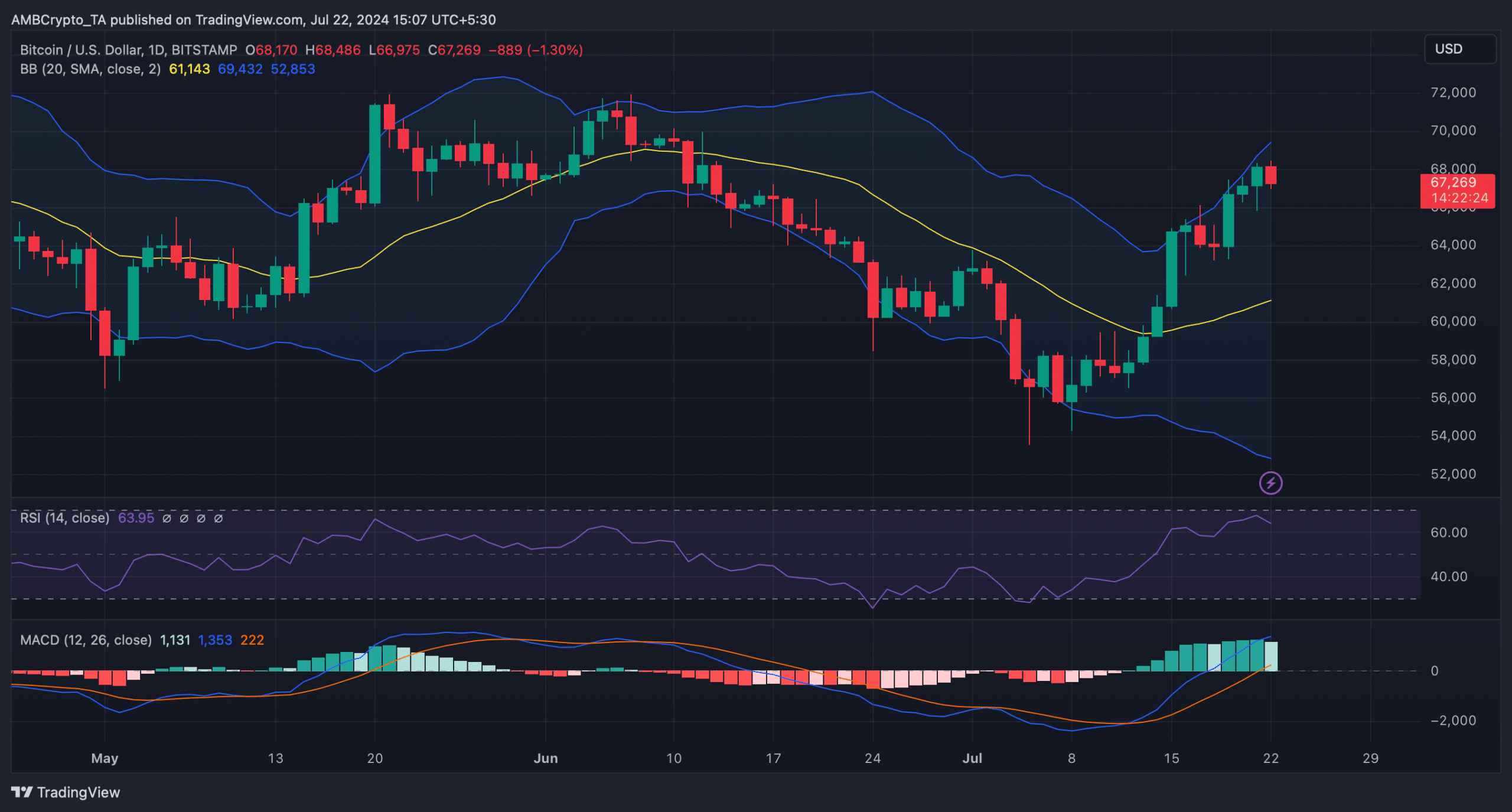

AMBCrypto then analyzed the king of crypto’s every day chart, discovering that the Relative Power Index (RSI) registered a slight downtick on the time of writing.

Furthermore, BTC’s value had touched the higher restrict of the Bollinger Bands, which regularly ends in value corrections. Nonetheless, the MACD displayed a bullish benefit available in the market.

Supply: TradingView