- Grayscale noticed optimistic BTC ETF inflows for the primary time in over 4 months.

- BTC was buying and selling above the $64,000.

Over the previous few weeks, the spot Bitcoin ETF skilled steady outflows, reaching a peak with the most important outflow quantity recorded on the first of Might.

Equally, Grayscale, presently holding the most important Asset Underneath Administration (AUM) and ETF market cap, additionally witnessed outflows till just lately. Might the reversal in ETF move affect the value development of BTC?

Bitcoin ETF sees the second day of influx

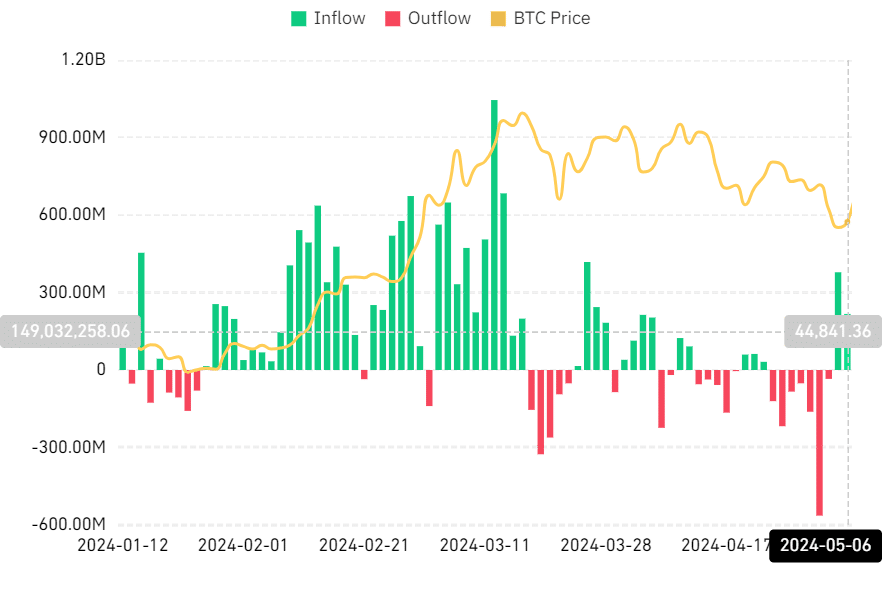

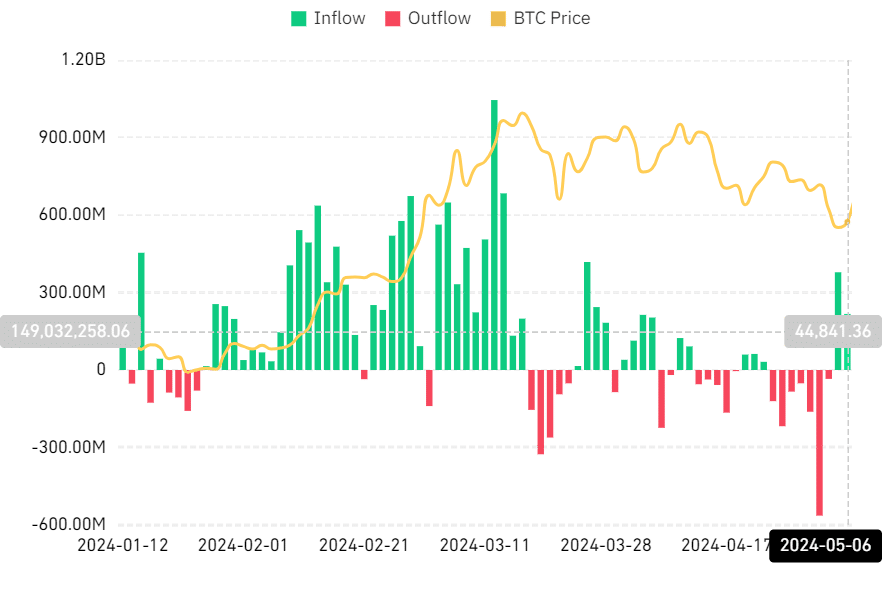

Evaluation of the Bitcoin ETF Web Influx revealed a notable shift because it returned to optimistic territory following a number of consecutive days of outflows.

AMBCrypto’s examination of the move chart indicated that the spot ETF skilled outflows from the twenty fourth of April to the 2nd of Might. It reached its peak outflow quantity on the first of Might, exceeding $563 million.

Supply: Coinglass

Nonetheless, on the fifth of Might, it marked a big turnaround with the primary influx in weeks, amounting to over $378 million.

This optimistic development continued on the sixth of Might, recording a consecutive influx of $217 million. After over 4 months, Grayscale noticed its first influx throughout this era.

Grayscale information its first Bitcoin ETF influx in months

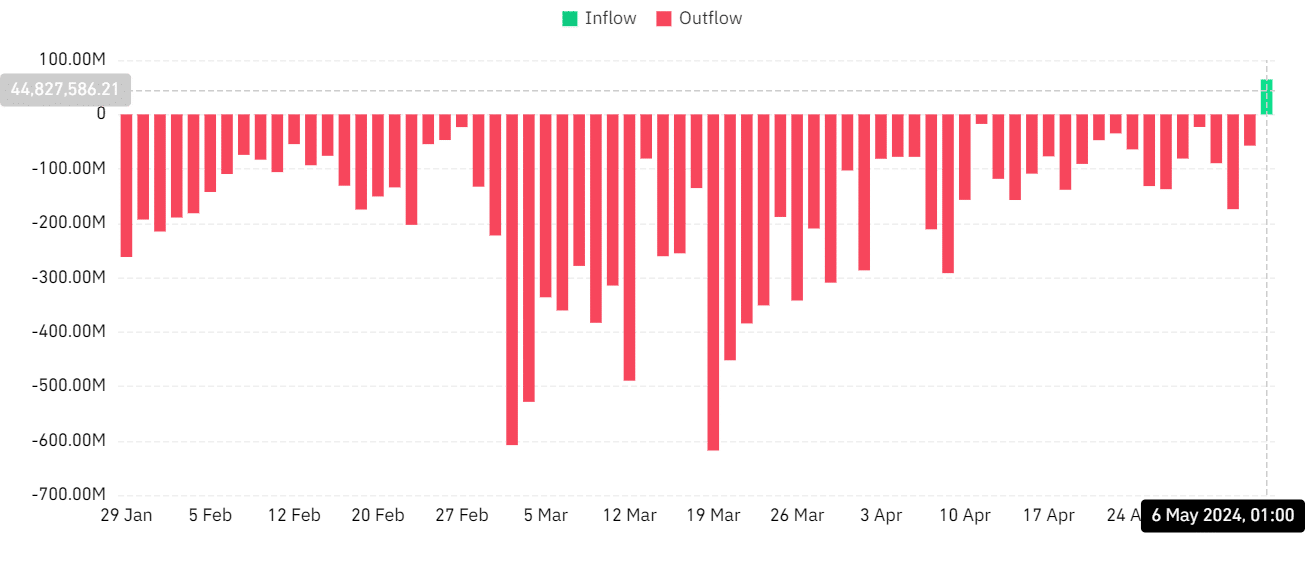

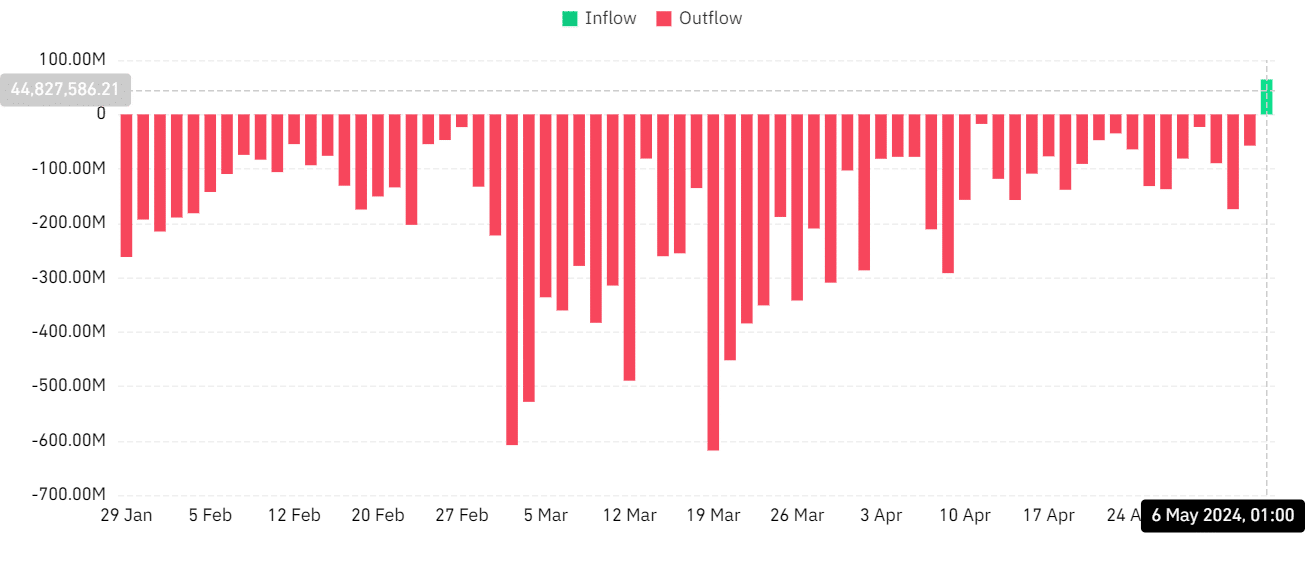

AMBCrypto’s evaluation of the Grayscale Bitcoin ETF Netflow metric on Coinglass indicated a constant development of outflows since January.

In response to information from Coinglass, Grayscale boasts the most important spot BTC ETF market cap, exceeding $18 billion on the time of this writing.

Moreover, it maintains the most important Asset Underneath Administration (AUM), surpassing $18 billion. Given the substantial measurement of its holdings, the continued outflows in latest months have prompted inquiries.

Supply: Coinglass

Nonetheless, on the sixth of Might, a big shift occurred as Grayscale skilled its first influx. The chart displayed a $64 million influx, marking the top of the outflow streak.

Since its transition from a belief to a readily tradable ETF, GBTC has witnessed withdrawals of about $17.46 billion.

A few of these outflows could also be attributed to repayments by crypto companies that confronted chapter in recent times.

What the ETF influx means

Inflows for a spot Bitcoin ETF signify the capital invested within the ETF by buyers. These inflows enhance the AUM of the ETF and might signify heightened investor urge for food for Bitcoin publicity.

Conversely, outflows denote the funds switch out of the spot Bitcoin ETF. This happens when buyers divest their shares within the ETF, resulting in a discount in its AUM.

Outflows could transpire because of numerous elements, together with buyers realizing income, adjusting their portfolio allocations, or reacting to shifts in market dynamics.

Affect of BTC’s worth?

The current uptick in ETF inflows could recommend a resurgence of investor curiosity following a part of revenue realization. This renewed engagement might bolster the value of BTC within the quick time period.

Nonetheless, whereas alterations in ETF flows would possibly affect short-term fluctuations in Bitcoin’s worth, they represent merely part of the bigger image.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Quite a few different variables exist that might exert affect on the overarching worth trajectory over the lengthy haul.

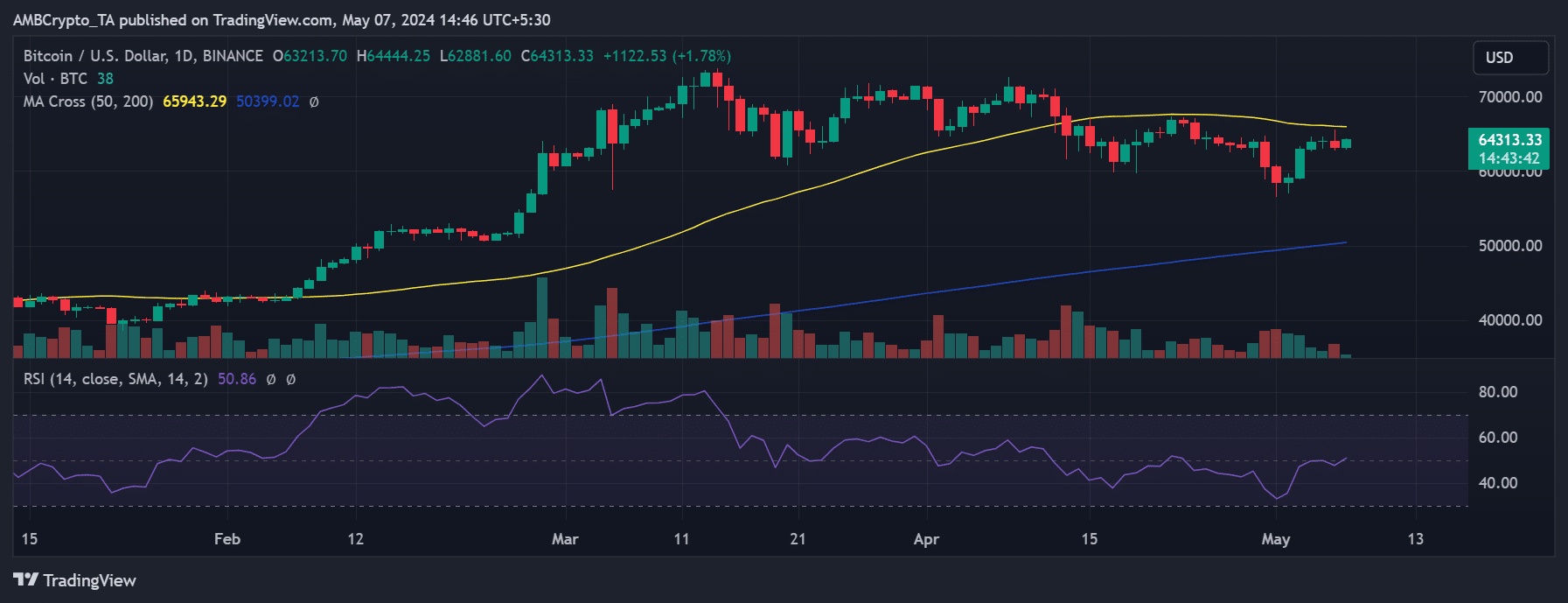

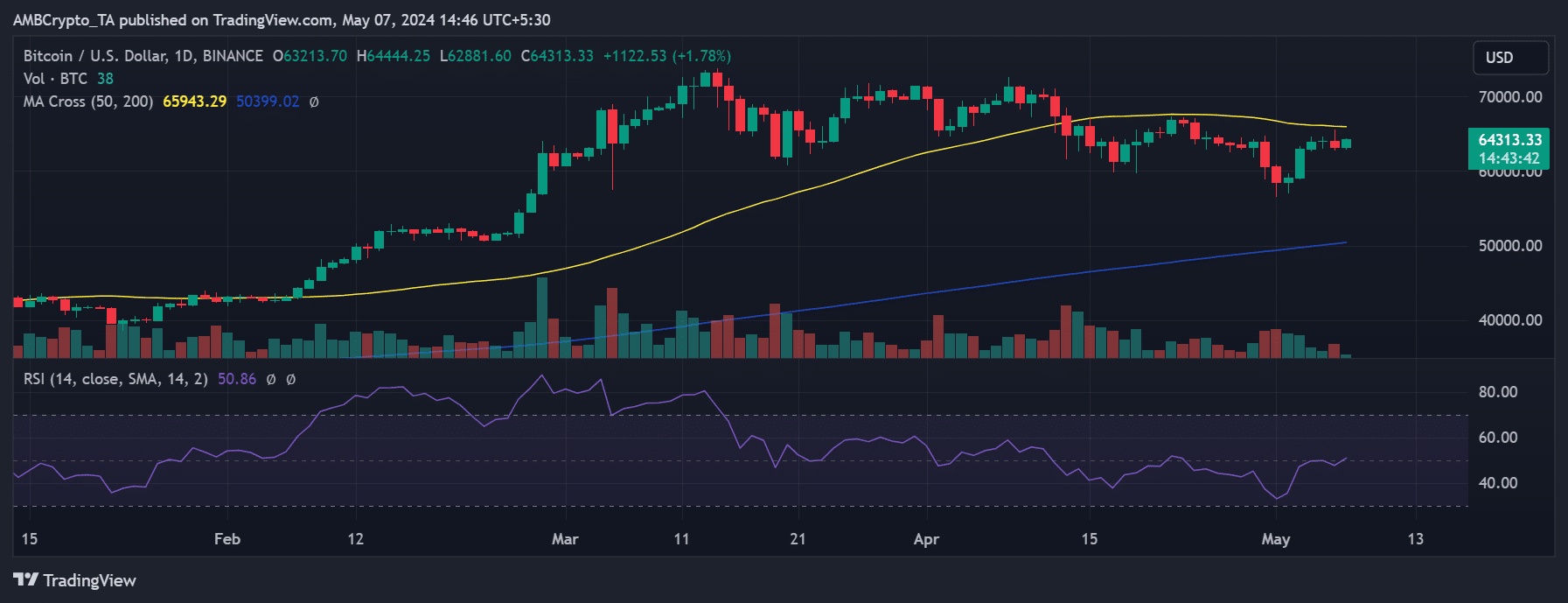

AMBCrypto’s have a look at Bitcoin’s worth development revealed a notable restoration from its earlier dip under the $60,000 mark. As of this writing, it was buying and selling at round $64,290, showcasing a rise of over 1.7%.

Supply: TradingView