VioletaStoimenova

Goosehead Insurance coverage (NASDAQ:GSHD) offers private insurance coverage companies. The corporate has achieved a really excessive quantity of development by way of its franchising mannequin, capturing market share in a fragmented and large market. In 2023, Goosehead has achieved a superb profitability stage after various margins as the corporate scales. With present earnings, the corporate appears very costly, however as the corporate continues to develop, Goosehead’s story appears fairly intriguing for buyers.

The Firm & Inventory

Goosehead gives a singular answer within the private insurance coverage market. The corporate hires gross sales brokers for a number of insurance coverage carriers by way of the agent-operated franchises, serving to businesses in rising and optimizing their gross sales. At the moment, Goosehead has over 1400 operating franchises underneath the corporate. The corporate hires franchisees by way of gross sales school, offering the corporate with top-notch franchisees when it comes to gross sales expertise.

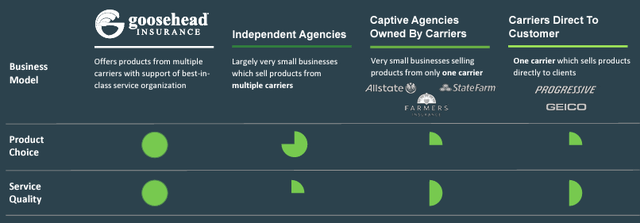

The corporate’s providing revolves round bringing a greater service for the client than different operators within the trade – the corporate has a variety of insurance coverage carriers in its portfolio that prospects could be chosen for, in comparison with single-carrier sellers’ restricted protection. As well as, Goosehead prides itself on a superb service high quality by way of skilled unbiased brokers:

Goosehead March Investor Presentation

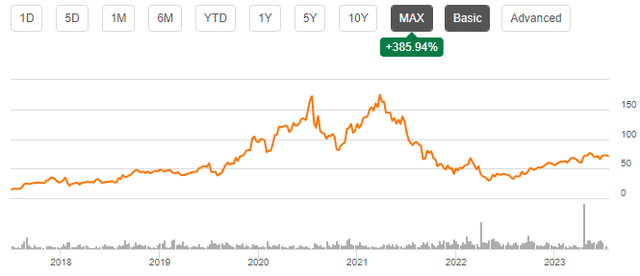

After Goosehead’s IPO in 2018, Goosehead’s inventory has carried out exceptionally nicely. Though the inventory is way from the excessive achieved in 2021, the inventory has regardless appreciated by 386% in its historical past:

Inventory Chart From IPO (In search of Alpha)

Financials

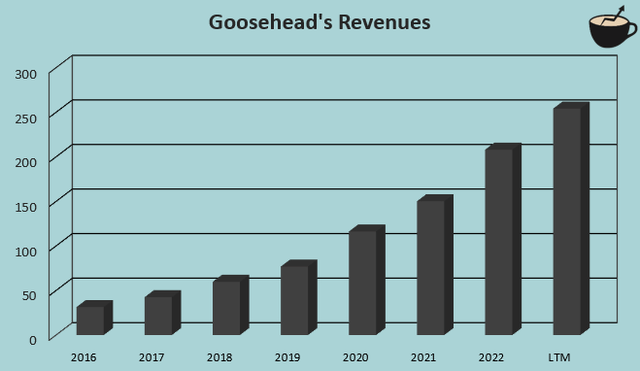

Goosehead has been in a position to develop its revenues persistently all through the corporate’s public monetary historical past. The corporate has achieved a compounded annual development charge of 36.3% from 2016 to trailing figures as of Q3/2023:

Writer’s Calculation Utilizing In search of Alpha Knowledge

The corporate needs to be positioned for important future development. In Goosehead’s Q3 earnings name, the corporate’s CEO Mark Jones communicated a purpose of a premium CAGR of over 30% by way of 2027. The corporate has made enhancements in productiveness and invested in know-how to assist the group in scaling. Goosehead is now specializing in headcount development to speed up the corporate’s topline; evidently Goosehead’s Q3 development of 23.3% is decrease than the corporate anticipates for the medium-term.

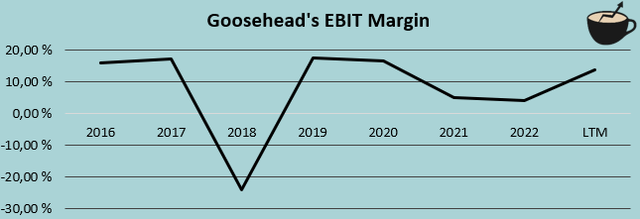

To this point, Goosehead’s profitability has assorted as the corporate has scaled its operations. From 2016 to trailing figures, the corporate’s common EBIT margin has been 8.3%:

Writer’s Calculation Utilizing In search of Alpha Knowledge

As Goosehead has had a concentrate on bettering agent productiveness, the corporate has achieved a superb margin stage in 2023 to this point with a trailing determine of 13.8%. The corporate is refocusing on rising headcount however continues to be concurrently concentrating on agent productiveness. The equation’s effectiveness is but to be seen, however I imagine that Goosehead’s technique ought to work fairly nicely. As well as, I imagine that the corporate’s wants for incremental SG&A is kind of low because the technological framework needs to be in place for a big scale – with development, Goosehead ought to have the ability to develop the margin considerably into a really excessive stage. Mark Jones communicated an adjusted EBITDA margin purpose of 40%, which I imagine ought to correspond to a GAAP EBIT margin within the mid-twenties.

Valuation

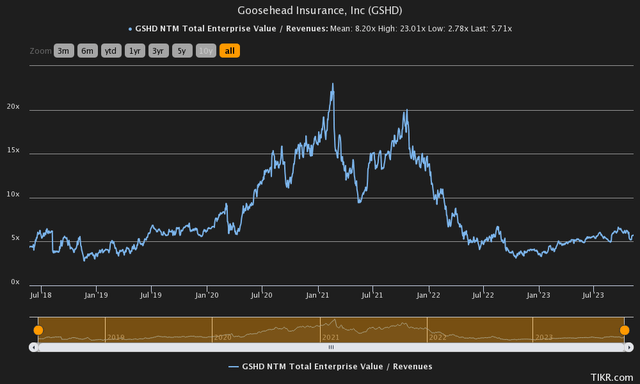

As Goosehead’s profitability has assorted massively to this point, I imagine that the inventory’s EV/S ratio finest describes Goosehead’s valuation when in comparison with its historic valuation. At the moment, the inventory trades at a ahead EV/S of 5.7, beneath the corporate’s common of 8.2 since its IPO and massively beneath the 2021 excessive of 23.0:

Historic EV/S (TIKR)

The EV/S ratio alone doesn’t contextualize the valuation nicely sufficient, although. To additional contextualize the valuation and to estimate a tough honest worth for the inventory, I constructed a reduced money circulation mannequin in my traditional method.

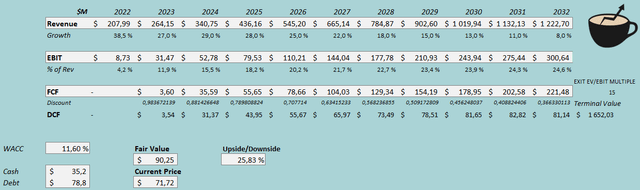

Within the mannequin, I estimate a excessive quantity of development for Goosehead going ahead, as the corporate has important elementary drivers fueling future development. I estimate a development of 27% for 2023, in step with Goosehead’s steerage. Past the 12 months, I estimate a development of 29% for 2024 and 28% for 2025, barely decrease than the administration’s premium development purpose of over 30%. After the years, I estimate the expansion to decelerate right into a determine of 8% in 2032. In whole, the talked about income estimates correspond to a CAGR of 19.4% from 2022 to 2032.

I imagine that Goosehead’s margins are fairly scalable. As talked about, the corporate’s know-how is generally in place, and the corporate can accumulate future revenues with a decrease share going into SG&A. The corporate additionally has a concentrate on bettering franchisee productiveness, driving greater margins for the corporate. I estimate the EBIT margin to scale into an finally achieved stage of 24.6%. I imagine that this estimate is kind of in step with the administration’s views of an adjusted EBITDA margin of forty p.c, which I see as achievable. In contrast to my traditional methodology of a perpetual money circulation development, I imagine an exit EV/EBIT a number of matches higher for a corporation with development when going into the terminal worth. In my view, an EV/EBIT exit a number of of 15 appears affordable.

Altogether, the talked about estimates together with a weighted common value of capital of 11.60% craft the next DCF mannequin with a good worth estimate of $90.25, round 26% above the worth on the time of writing:

DCF Mannequin (Writer’s Calculation)

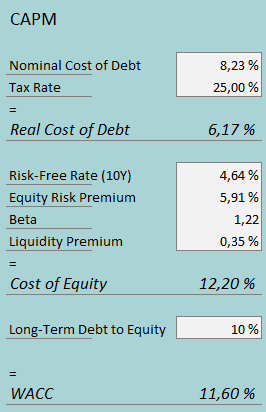

The used weighed common value of capital is derived from a capital asset pricing mannequin:

CAPM (Writer’s Calculation)

In Q3, Goosehead had $1.6 million in curiosity bills. With the corporate’s present quantity of interest-bearing debt, the corporate’s annualized rate of interest comes as much as a determine of 8.23%. Goosehead at present leverages debt very reasonably, however I imagine that as the corporate grows and its money flows enhance, Goosehead ought to have the ability to draw extra debt. I estimate a modest long-term debt-to-equity ratio of 10%. I imagine that the corporate’s rate of interest could possibly be decrease and its debt-to-equity ratio greater sooner or later than I estimate making the corporate’s financing cheaper, however in the interim, I see my estimates as affordable.

On the price of fairness facet, I exploit the US’ 10-year bond yield of 4.64% because the risk-free charge. The fairness threat premium of 5.91% is Professor Aswath Damodaran’s latest estimate for the US, made in July. Yahoo Finance estimates Goosehead’s beta at a figure of 1.22. Lastly, I add a small liquidity premium of 0.35% into the price of fairness, crafting the determine at 12.20% and the WACC at 11.60%.

Takeaway

Goosehead looks like a extremely intriguing decide. The corporate has been in a position to drive distinctive efficiency when it comes to development and operates in a large trade with virtually limitless market share to seize from this level. The corporate’s enterprise mannequin appears very aggressive because it combines a wide selection of carriers with a superb gross sales crew. The valuation does appear fairly steep with present earnings, however I imagine that the corporate can scale its earnings very nicely. My DCF mannequin estimates the inventory to be undervalued with estimates that I see as affordable, constituting a purchase score.