Ole_CNX

Funding Thesis

Earlier in November, I coated Google (NASDAQ:GOOG) the place I mentioned the corporate’s robust stability sheet and potential for prime shareholder returns. On this article, I’ll focus on the corporate’s current launch of its AI system, Gemini. This is a vital growth and exhibits vital strides Google has been making in AI. Gemini’s large-language mannequin in three variations presents a robust alternative for it to determine itself as an working system for foundational LLMs. Primarily based on benchmark scores, Google’s Gemini mannequin seems to be closing in on efficiency parity with GPT-4 and different Massive Language Fashions. This positions Google successfully to increase the usage of its Gemini fashions past its personal purposes, probably producing income by way of chatbots, copilots, and API utilization on the Google Cloud platform. I consider the introduction of Gemini might result in a progress increase of low to mid-single digits for its Cloud phase. Other than income from cloud utilization and copilot adoption, there’s additionally the potential for licensing charges if companies select to undertake Gemini as a typical. Therefore, I keep my purchase score on Google given its present valuation hole vs friends.

Gemini AI Paving the Approach for Multimodal Developments

Google’s new AI mannequin, Gemini, marks a major stride in bridging the know-how hole with main AI gamers like OpenAI’s GPT-4, Meta’s Llama, and Anthropic’s Claude. Developed by Google DeepMind, Gemini is designed to be a multimodal AI, able to understanding and working throughout several types of info, together with textual content, photographs, audio, video, and code. This makes it extremely versatile and complicated in its reasoning and coding capabilities.

The launch is poised to develop Google’s affect within the AI area, significantly by leveraging its widespread distribution channels akin to Google Search, YouTube, and the Android ecosystem. These platforms are anticipated to speed up the event and refinement of huge language fashions at a faster tempo in comparison with its opponents.

Gemini gives three distinct versions, every designed for particular functions: Extremely, Professional, and Nano. These variants are fine-tuned for various purposes, with Extremely serving as probably the most in depth and highly effective mannequin appropriate for intricate duties, Professional excelling in versatility throughout a broad spectrum of duties, and Nano being probably the most environment friendly selection for on-device operations. This adaptability permits Gemini to carry out successfully on numerous platforms, spanning from in depth knowledge facilities to cell units just like the Google Pixel 8 Professional.

By way of sensible purposes, Gemini’s capabilities are numerous. As an example, it may well generate code primarily based on numerous inputs, mix textual content and pictures, and carry out visible reasoning throughout languages. Its skill to know and course of several types of knowledge concurrently opens up new prospects for AI purposes in numerous fields.

Alphabet has the potential to generate extra income by way of its Gemini foundational Massive Language Mannequin, significantly within the domains of cloud coaching and inferencing resulting from its native multimodal capabilities. Whereas OpenAI GPT-4 can be multimodal, Google’s benchmarking data means that it has considerably closed the efficiency hole with its opponents, together with Anthropic’s Claude and Meta’s Llama.

In the meantime, Microsoft’s enhancements to Bing search and the introduction of copilots for GitHub and Workplace 365 are anticipated to spice up income amongst its enterprise consumer base. Nonetheless, Microsoft depends on OpenAI because the foundational LLM, whereas Google has the potential to include native LLM capabilities into its Android working system.

Forbes

Robust Benchmark Scores In comparison with GPT4

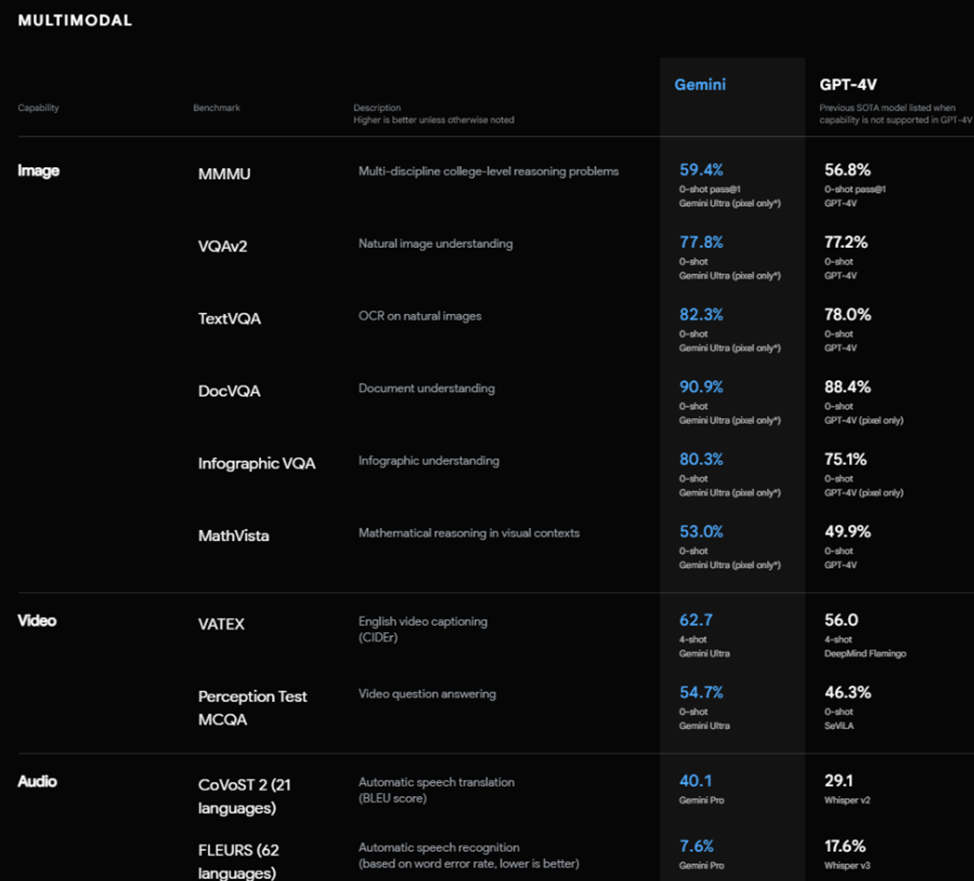

Gemini demonstrates spectacular efficiency throughout a spread of AI benchmarks. It achieves a outstanding rating of 90.0% on the Huge Multitask Language Understanding benchmark, surpassing human specialists. Moreover, Gemini outperforms present fashions on 30 out of 32 generally used benchmarks within the area of huge language fashions. For instance, within the realm of multimodal duties, Gemini Extremely stands out with a rating of 59.4% on the MMMU benchmark, which entails complicated duties that demand cautious reasoning.

The spectacular efficiency of Google’s Gemini fashions compared to different main AI fashions like GPT-4, Claude from Anthropic, and Meta’s Llama signifies that Google has successfully responded to the aggressive panorama in foundational massive language fashions. This means that Google is well-positioned for speedy developments and iterations sooner or later. Moreover, the multimodal performance of Gemini, an enhancement over its predecessor PaLM2, units a brand new normal within the AI area. This development could create a aggressive problem for specialised fashions which are centered solely on singular modalities like photographs or movies, underscoring the rising significance of versatile, multimodal AI capabilities.

I count on Google to introduce modifications to its consumer interface, together with options like summarized views and the potential to generate textual content and pictures, much like what Bing-ChatGPT gives. These modifications can be geared toward retaining consumer engagement on Google’s search web page and sustaining its edge in offering real-time search outcomes in comparison with ChatGPT, which makes use of a pre-trained generative mannequin.

Valuation

Alphabet has made progress in narrowing the valuation hole in comparison with its friends. The impression of Bing-ChatGPT on Google’s core search enterprise is diminishing, however Alphabet continues to face regulatory scrutiny within the US and Europe resulting from issues about its dominance within the search market. YouTube’s prospects have improved barely, because of the shift to linked TVs and a rebound in digital promoting spending. The profitability of Alphabet’s cloud enterprise has additionally improved, pushed by the demand for cloud infrastructure for AI workloads, and cloud income estimates have been positively revised with expectations of IT spending restoration in early 2024. The corporate has substantial annual free money movement, a major money reserve of over $100 billion, and a robust equity-to-debt ratio, supporting its wonderful monetary place. The rising significance of synthetic intelligence within the tech business is predicted to additional strengthen the basics of main tech firms, offering room for elevated funding and mergers and acquisitions.

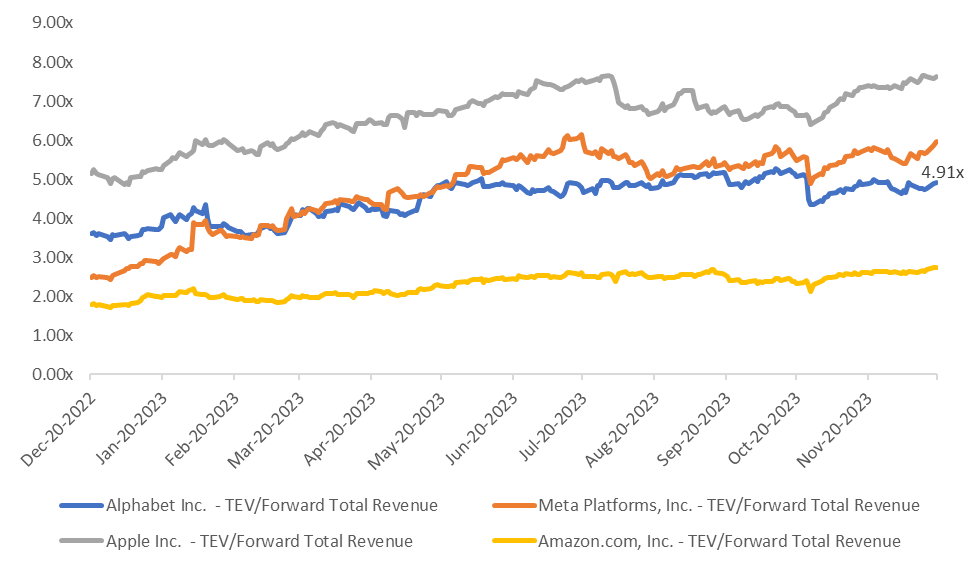

Alphabet’s ahead EV/income is roughly in-line with the FAANG group’s common. The inventory trades at a premium to Amazon however at a reduction to Apple, Meta Platforms, and Netflix. At present ranges, I keep my stance that Alphabet is undervalued and, subsequently, keep a purchase score for the inventory.

Capital IQ

Key Dangers

Aggressive habits stays a key situation amongst digital-ad suppliers. The Division of Justice’s antitrust lawsuits against Alphabet pose a threat to the corporate’s advert income. The potential fines on data-privacy guidelines and the unfold of misinformation on YouTube can have Alphabet’s revenues. Google at present has three main lawsuits concentrating on Google’s invaluable ad-tech chain of companies probably current probably the most critical antitrust risk for the tech large up to now. The fits are pending in three completely different districts and anticipated to be jury trials. This triples the chance to Google, which might have a troublesome time defending enterprise techniques that seem aggressive to a jury. One of many issues survived early dismissal efforts and we consider the others may, too.

Conclusion

Google’s launch of Gemini marks a major occasion within the firm’s progress on AI techniques. The excessive benchmarks positions the corporate to successfully use its fashions past its personal purposes, probably producing income by way of chatbots, copilots, and API utilization on the Google Cloud platform. My optimistic outlook on the corporate stays unchanged, and I keep my purchase score on the inventory.