Submitted by QTR’s Fringe Finance

Pal of Fringe Finance Lawrence Lepard launched his most up-to-date investor letter this week. He will get little protection within the mainstream media, which, in my view, makes him somebody price listening to twice as intently.

Larry was variety sufficient to permit me to share his ideas heading into This autumn 2023. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

That is the latest investor letter from my good buddy Lawrence Lepard, which accommodates an in depth writeup on the next and will probably be damaged up into two elements:

-

2023 Yr in Evaluate

-

The FED and Treasury Blink in This autumn

-

Inflation

-

Gold and Bitcoin Obtained the Memo

-

US Fiscal Place Not Enhancing

-

Catalysts for a Full Fed Pivot

-

When The Fed Pivots, We Get Paid

-

Gold’s Outlook Is Enhancing

Half 2 of this letter could be discovered here.

2023 YEAR IN REVIEW

Listed below are the foremost developments of 2023:

• No Recession – the speedy fee hikes of 2022 (principally from zero to 4.33% at year-end 2022) did not have the unfavourable influence that we anticipated on the economic system in 2023. “Fiscal Dominance” / “Bidenomics” (fiscal spending of $6.2 Trillion, not far off the COVID excessive of $7.2 Trillion) extra than offset the Fed’s hawkishness as GDP progress was stable (+2.8%) and unemployment remained low (3.7%). There was little or no spending restraint this yr with continued “can kicking” on price range selections ongoing till maybe after the election.

• Inventory Market Nears Report Excessive – this one actually stunned us. Regardless of the huge improve in rates of interest, the S&P 500 rallied +26 % ending simply shy of its January 3, 2022 all-time excessive. Our view is the US inventory market is pricey and prone to a serious decline. Discover within the chart under the present 19.5x PEx with 10 yr UST yields at 3.9%. This compares to the October 2007 (simply previous to 2008 crash) 15.1x PEx when treasury yields have been at 4.7%. Recall that following the 2000 bubble and the 2007 peak, the S& P500 declined 49% and 57%, respectively.

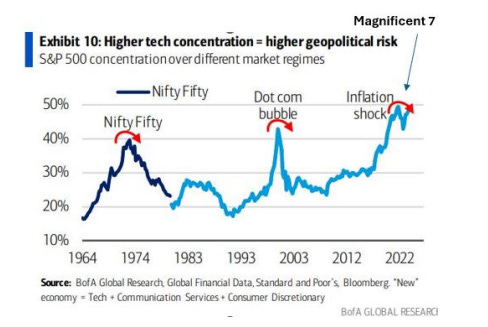

A lot of the S&P 500 features have been within the “Magnificent 7” giant tech shares, every of which was up between 48%-239%! It’s paying homage to the early Seventies and the focus of market capitalization in “The Nifty Fifty” shares again then. Because the chart under exhibits, the Nifty Fifty didn’t finish nicely, and we suspect the Magazine 7 can have the same destiny.

• Silicon Valley Financial institution – in March 2023, two of the most important financial institution failures in US historical past transpired. We coated this in our Q1 report. On the time, the US banking system was on the verge of a run as Treasury Secretary Yellen flip flopped a number of instances on the potential of guaranteeing the whole $17.6 Trillion US deposit base. As an alternative, the federal government violated the Dodd Frank regulation and created a brand new funding mechanism the BTFP1 which quickly grew to $80 Billion, and it continues to develop to at the present time — growing considerably prior to now a number of months to $140 Billion. It’s set to run out (require compensation) in March of 2024. We’ll imagine it after we see it.

This credit score occasion was very extreme and exhibits how shaky the system is and the way the Fed and Treasury will at all times present a monetary liquidity “put” (print cash) for monetary gamers and banks in instances of bother.

The BTFP was solely the small seen a part of the bail out. Pam Martens at “Wall Road on Parade” highlighted that the true bail out got here through the Federal House Mortgage Financial institution because it offered over $1 Trillion of liquidity to the banking system in March 2023, $100 billion greater than offered within the GFC of 2008.

• Geopolitics – usually the markets have ignored (maybe at their very own peril) varied geopolitical scorching buttons –the continuing Ukraine conflict, the rising unification of the BRICs bloc, the Israel Hamas conflict, and even the Crimson Sea happenings because the Houthis (doubtless backed by Iran/Russia) proceed to create havoc within the Freight markets. Some speculate that that is the work of others attempting to attract the US into the conflict in assist of Israel vs. Iran.

• US Politics – the polarization of politics continued, with extra “can-kicking” price range resolutions and the combat over the Speakership/elimination of Kevin McCarthy. So far as the upcoming 2024 election, maybe it’s apathy or simply how polarizing politics are, but it surely appears to us that only a few folks wish to talk about it. An important political takeaway for us is that whereas political information will definitely develop this spring and summer time, the end result is unlikely to have an effect on the fiscal spending trajectory, no matter which social gathering wins. Debt is debt, and math is math.

🔥 50% OFF ALL SUBSCRIPTIONS: Subscribe and get 50% off and no price hikes for as long as you wish to be a subscriber.

THE FED (AND TREASURY) BLINK

We begin the dialogue of present occasions by referring you to our Q3 report. In that report, we offered how the US Authorities Fiscal doom loop was getting worse and the way mathematically US Federal borrowings have been crowding out the debt markets – sending rates of interest greater.

The practically parabolic progress in US Federal curiosity prices is making the deficit worse and with out financial lodging, we recommended that the debt and fairness markets have been headed for actual bother. Lyn Alden’s chart (under) factors out that it is just a matter of time earlier than the Fed will probably be compelled to develop its stability sheet once more (print cash). In a closely indebted system, the availability of cash wants to repeatedly develop or the debt turns into unserviceable.

The Fed started to blink in This autumn. That is enormously vital and helps our thesis that the Fed and Treasury haven’t any selection however to loosen financial situations (additional debase the foreign money) in an effort to forestall market dysfunction. Let’s assessment what occurred.

The US 10 Yr Treasury Bond yield broke a technically vital degree (4.368%) on September 20, 2023 and rapidly rose to five.00%. This fee improve drove the S&P 500 down 7% in a matter of weeks, and down 11% from the latest peak. Each occasions set off alarm bells on the Fed and the Treasury.

The transfer within the US 10-year yield from September 1 to mid-October was dramatic, a 20% improve within the yield in roughly 6 weeks. We recall the vibe presently, and it reminded us of the UK Gilt Disaster within the Fall of 2022 as UK bond yields started to spike.

The Fed rapidly got here with the hearth vehicles. In speedy succession, we obtained the next “dovish” feedback out of at least 8 Federal Reserve Governors:

Fed’s Williams: central financial institution could also be performed with fee rises.

Fed’s Logan: greater yields might imply much less want to boost charges.

Fed’s Daly: rise in bond yields might substitute for a fee hike.

Federal Reserve Financial institution of Atlanta President Ralph Bostic reiterated that he doesn’t assume policymakers want to boost rates of interest any additional and that coverage is restrictive sufficient to convey inflation again to their 2% objective. “I believe that our coverage fee is at a sufficiently restrictive place to get inflation right down to 2%.” Bostic stated Tuesday throughout a dialog held on the annual conference for the American Bankers Affiliation. “I really don’t assume that we have to improve charges anymore”.

“We’re in a delicate interval of danger administration, the place we have now to stability the chance of not having tightened sufficient, in opposition to the chance of coverage being too restrictive” Fed Vice Chair Philip Jefferson stated, nodding to the rise in US Treasury yields and the necessity for the central financial institution to “proceed rigorously” with any additional will increase within the benchmark federal funds fee.

Minneapolis Fed President Neel Kashkari famous it’s “doable” that additional fee hikes will not be required.

U.S. Federal Reserve Governor Christopher Waller on Wednesday stated greater market rates of interest might assist the Fed sluggish inflation and let the central financial institution “watch and see” if its personal coverage fee must rise once more or not. Waller, who has been among the many most vocal advocates for greater rates of interest to combat inflation, stated worth knowledge appear to now be shifting again in direction of the Fed’s 2% goal, with monetary markets including additional credit score tightening on their very own.

Fed’s Harker says fee hikes doubtless over amid ongoing disinflation.

Fed’s Lorie Logan: Pump the brakes on quantitative tightening.

(h/t Luke Gromen, FFTT for summarizing these Fed feedback)

Primarily based upon the quantity and consistency of those feedback, we assume that it was a three-alarm hearth that the Fed had detected within the bond market, because the Bond Volatility Transfer Index ramped as much as ranges which point out extreme stress. A number of analysts have identified that bonds at the moment are extra risky than gold. This isn’t speculated to occur.

However wait, there’s extra: The Fed Governors jawboning charges decrease on the anticipation of no additional fee will increase, and doable fee cuts, was simply the primary act in a three-act play.

Act II opened up with US Treasury Secretary Janet Yellen upon the discharge of the Treasury Borrowing Advisory Committee (TBAC) report on November 1, 2023. This report feedback in the marketplace for US Treasury securities and estimates the quantity and nature of the debt gross sales that the US Federal Authorities will conduct in an effort to fund its debt and deficits.

The TBAC report is very technical with a number of inside macro baseball. However a number of issues on this most latest report stood out:

First, a a lot bigger share of the debt is now being purchased by US hedge funds and others who’re taking part within the “foundation commerce”.2

Second, the Treasury indicated that they intend to fund a a lot bigger proportion of the debt through quick time period payments and notes versus long term bonds. This means: (i) that the Treasury is having a tough time discovering demand for long term bonds (it’s, we are going to talk about a latest 30-year public sale under); and (ii), the market interprets the lean towards shorter time period notes to be a sign that the Treasury expects quick period yields to lower quickly. Markets seen this as an indication of extra financial lodging coming quickly.

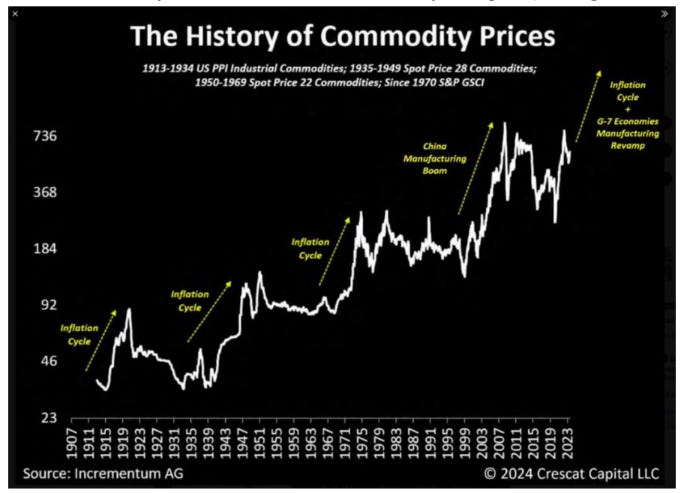

The Treasury has been anxious about some weak authorities bond auctions in This autumn when the Bid to Cowl was solely 2.24x, a lot lighter demand than regular. Given this anemic demand, main sellers (i.e., Wall Road banks) have been compelled to purchase 25% of the bonds auctioned (vs. in regular instances maybe they solely have to purchase 10-15%). Many have realized that bonds will not be an important funding in an inflationary world, the place the US cash provide has grown at 7% per yr during the last 50 years, on common. So, we will debate whether or not CPI is < 3% or not, however the actuality is – debasement is operating at 7% on common! Greater curiosity charges will probably be wanted to stimulate demand for US Treasuries. Look ahead to weak bond auctions as a serious danger issue to world markets over the subsequent few years.

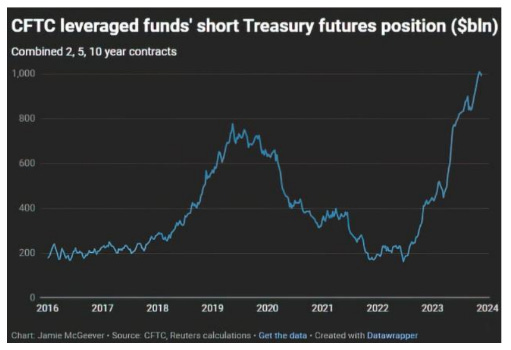

The idea commerce talked about above can be a danger that bears watching given it’s a small cadre of extremely levered hedge funds enjoying this arbitrage sport of shorting US Treasury Futures whereas shopping for US Treasury on-the-run bonds. Given the > 50x leverage employed, there’s actual danger if this foundation commerce went afoul. Recall, Lengthy Time period Capital Administration was a “can’t miss” again in 1998, till it wasn’t. However, we are coping with a lot bigger sums of capital than LTCM’s $1bn of fairness levered 100x. As you possibly can see within the following chart, there seems to be $1 Trillion of Levered Brief US Treasury Futures positions.

Observe within the above chart, as charges have been rising in 2019/2020, this identical levered foundation commerce was current and coincided with the September 2019 Repo fee blowout which led to the unique Powell pivot. Moreover, a number of hedge funds at the moment have been rumored to be bancrupt and obtained emergency Fed swap strains. It could not shock us to see this film come to a theater close to you once more quickly.

Act III started with the Federal Reserve assembly on December 13, 2023. As anticipated, they held the Fed Funds coverage fee fixed at 5.25%, however very importantly they adjusted the “dot plot” of anticipated future fee ranges to replicate {that a} majority of the Fed Governors now imagine the Fed will probably be slicing charges subsequent yr. Maybe much more importantly, the next alternate passed off within the Q&A session with Fed Chair Powell:

Jennifer Schonberger of Yahoo Finance: You stated again in July that you just wanted to start out slicing charges earlier than attending to 2% inflation. As you talked about PCE inflation is now operating at 3.5% on core. On a six-month annual foundation, core PCE is operating at 2.5%. Although once you have a look at supercore and shelter, they’re, in fact, stickier. So, when trying within the totally different elements of the information, how a lot nearer do you need to get to 2% % earlier than you take into account slicing charges?

Chair Powell: the explanation you wouldn’t wait to get to 2% to chop charges is that coverage could be too late… you’d wish to be lowering restriction on the economic system nicely earlier than (EMA emphasis added) 2%…..so that you don’t overshoot, if we consider restrictive coverage as weighing on financial exercise. It takes some time for coverage to get into the economic system, have an effect on financial exercise, and have an effect on inflation.

That, women and gents is the “Powell pivot” (notably the second, since he additionally pivoted in 2019). Chair Powell is trying much less like Paul Volcker and extra like Arthur Burns.

The Chair of the Federal Reserve simply instructed us that they won’t anticipate PCE to hit 2% earlier than starting to chop rates of interest and loosen financial coverage. As we predicted, the Fed has as soon as once more modified the narrative to go well with their goal. And let’s be clear, their goal is to maintain the bond and inventory markets functioning nicely. So, we will add “greater for longer” to the prior Fed mis-directions of:

-

Inflation is simply too low.

-

Inflation is transitory.

-

We’re not even enthusiastic about enthusiastic about elevating charges.

-

We’ll keep greater for longer to ensure inflation is beneath management.

As we have now stated earlier than, they’ve a tiger by the tail and are swerving between the 2 extremes of extreme inflation and extreme deflation. Given coverage lags, they’re making a large number of it.

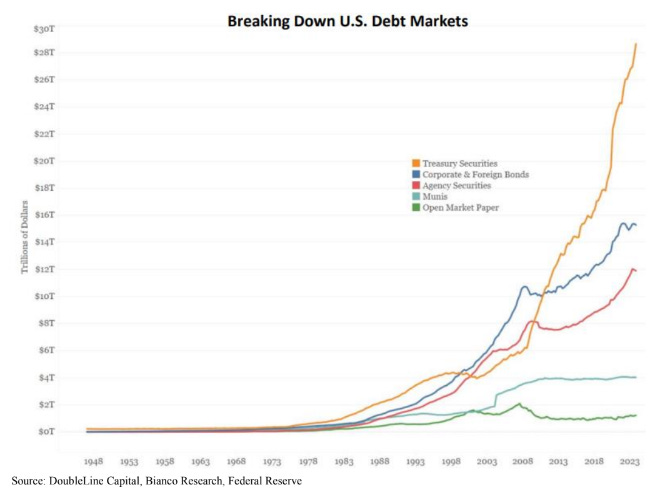

All we will say is nice luck, notably when trying on the subsequent chart under. Discover the parabolic improve in US Treasury issuance since 2009. In a single snapshot right here, we will see simply how a lot the authorities not solely has to finance its personal growing authorities expenditures, but in addition the again door help it has more and more wanted to offer over the previous 14 years to assist this levered system we have. That is solely going to compound much more quickly, and God assist us within the subsequent disaster. Once more, debt is debt and math is math.

INFLATION

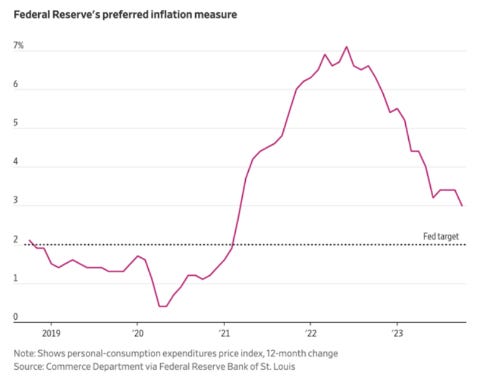

The extent of reported PCE inflation has come down considerably (see chart under). Don’t get us began on whether or not these numbers are correct or not, simply keep in mind that that is the gauge which the Fed makes use of.

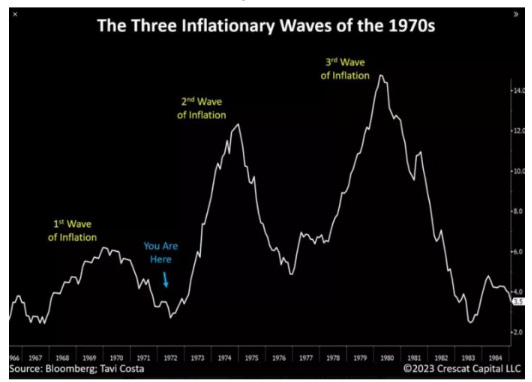

In essence, the Fed Chair is implying that inflation taming has been adequate for Authorities work. And maybe it’s. Some assume inflation will proceed to fall and will even perhaps go unfavourable – notably as proprietor’s equal hire is ~35% of CPI and its influence is lagged by practically a yr (OER is down over the previous yr). Something is feasible on this out-of-control system. Nevertheless, inflation solely goes unfavourable if we have now a system broad deflationary collapse which is able to absolutely result in report financial lodging. The extremely irresponsible 2002 “Helicopter Cash” speech by Bernanke on stopping deflation indicated the Fed won’t ever let deflation happen. The system would collapse. We’re not certain of the trail of the subsequent Fed printing, or timing, however we will clearly see the problem. The percentages are good that the subsequent wave of lodging results in a resurgence of inflation, just like the 1970’s.

Our view is that we have now left the deflationary years of 1980 to 2020 behind and that in March of 2020 with the US 10-Yr bond yielding solely 54 foundation factors, we achieved peak deflation. We now dwell in an inflationary world till these debt points are resolved. Or, stated one other manner the one manner we get deflation is that if the Fed and different financial authorities permit a deflationary collapse. (not inconceivable, however unlikely).

Half 2 of this letter could be discovered here.

QTR’s Disclaimer: I’m an fool and sometimes get issues mistaken and lose cash. I’ll personal or transact in any names talked about on this piece at any time with out warning. Contributor posts and aggregated posts haven’t been truth checked and are the opinions of their authors. They’re both submitted to QTR, reprinted beneath a Inventive Commons license or with the permission of the creator. This isn’t a advice to purchase or promote any shares or securities, simply my opinions. I typically lose cash on positions I commerce/spend money on. I’ll add any title talked about on this article and promote any title talked about on this piece at any time, with out additional warning. None of this can be a solicitation to purchase or promote securities. These positions can change instantly as quickly as I publish this, with or with out discover. You might be by yourself. Don’t make selections primarily based on my weblog. I exist on the perimeter. The writer doesn’t assure the accuracy or completeness of the data offered on this web page. These will not be the opinions of any of my employers, companions, or associates. I did my greatest to be sincere about my disclosures however can’t assure I’m proper; I write these posts after a pair beers typically. Additionally, I simply straight up get shit mistaken quite a bit. I point out it twice as a result of it’s that vital.

Larry’s Disclaimer: These presentation supplies shall not be construed as a suggestion to buy or promote, or the solicitation of a suggestion to buy or promote, any securities or providers. Any such providing might solely be made on the time a certified investor receives from EMA formal supplies describing an providing plus associated subscription documentation (“providing supplies”). Within the case of any inconsistency between the data on this presentation and any such providing supplies, together with an providing memorandum, the providing supplies shall management.

Securities shall not be supplied or bought in any jurisdiction through which such provide or sale could be illegal until the necessities of the relevant legal guidelines of such jurisdiction have been glad. Any choice to spend money on securities should be primarily based solely upon the data set forth within the relevant providing supplies, which must be learn rigorously by potential buyers previous to investing. An funding in EMA not appropriate or fascinating for all buyers; buyers might lose all or a portion of the capital invested. Buyers could also be required to bear the monetary dangers of an funding for an indefinite time period. Buyers and potential buyers are urged to seek the advice of with their very own authorized, monetary and tax advisors earlier than making any funding.

The statements contained on this presentation are made as of the date printed on the duvet, and entry to this presentation at any given time shall not give rise to any implication that there was no change within the info and circumstances set forth on this presentation since that date. These presentation supplies might include forward-looking statements throughout the which means of US securities legal guidelines. The forward-looking statements are primarily based on EMA’s beliefs, assumptions and expectations of its future efficiency, making an allowance for all info presently accessible to it, and might change on account of recognized (and unknown) dangers, uncertainties and different unpredictable components. No representations or warranties are made as to the accuracy of such forward-looking statements. EMA doesn’t undertake any obligation to replace any ahead

trying statements to replicate circumstances or occasions that happen after the date on which such statements have been made. Historic knowledge and different info contained herein, together with info obtained from third-party sources, are believed to be dependable however no illustration is made to its accuracy, completeness, or suitability for any particular goal.

No illustration is being made that any funding will or is prone to obtain earnings or losses just like these proven. Previous efficiency is not indicative of future outcomes. This report is ready for the unique use of EMA buyers and different individuals that EMA has decided ought to obtain these presentation supplies. This presentation will not be reproduced, distributed or disclosed with out the specific permission of EMA.

Loading…