DINphotogallery

In early October, I shared an replace on World Ship Lease (NYSE:GSL), making a case for why promoting the corporate’s most well-liked inventory (GSL.PR.B) to purchase extra of the widespread can be a useful commerce. In this replace, I’m revisiting GSL to touch upon its Q3 outcomes and reiterate why it stays considered one of my high holdings.

Q3 Outcomes: One other Rock-Stable Buying and selling Interval

GSL’s Q3 results have been as soon as once more sturdy, a pattern we have turn into used to seeing through the previous a number of quarters. Its containerships preserve producing steady and extremely worthwhile money flows as they nonetheless profit from multi-year leases signed through the peak of the containership craze about two years in the past, within the midst of the pandemic.

Whereas liners have suffered throughout this time (simply have a look at ZIM Built-in Delivery Companies’ (ZIM) share value plunge), lessors akin to GSL and Danaos (DAC) proceed to put up a number of the greatest ends in their histories – funnily sufficient, at liners’ expense. A have a look at GSL’s current numbers displays this story.

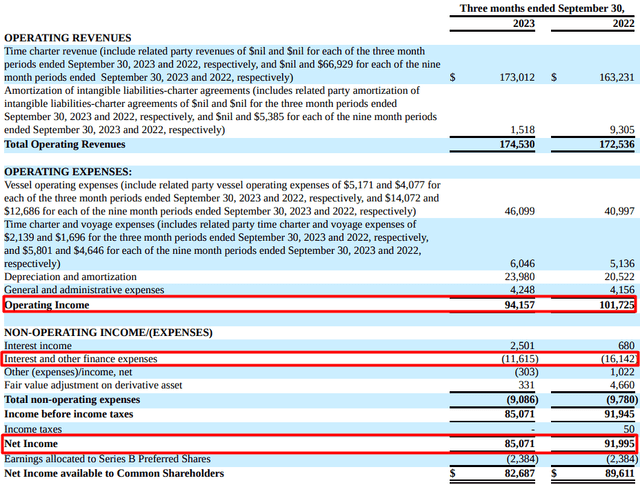

Revenues for the quarter have been $174.5 million, up 1.2% in comparison with final yr. Whereas the impact of straight-lining time constitution modifications had a adverse impression on the corporate’s high line, constitution renewals at larger charges on a number of the vessels and the acquisition of 4 vessels that have been delivered within the earlier quarter greater than offset it.

Working earnings additionally got here in sturdy. Whereas it considerably declined from final yr’s $101.7 million to $94.2 million on account of larger vessel working bills and administrative bills, working earnings nonetheless represented an amazing 54% of revenues.

World Ship Lease’s Q3 Revenue Assertion (6K)

One other merchandise I’ve highlighted in GSL’s Q3 earnings assertion above is the corporate’s curiosity bills, which fell from final yr’s $16.1 million to $11.5 million. We additionally noticed this after I analyzed Danaos’ earnings assertion in my most up-to-date article, as each corporations have adopted the technique of using their multi-year monster charters to pay down debt and enhance their stability sheets.

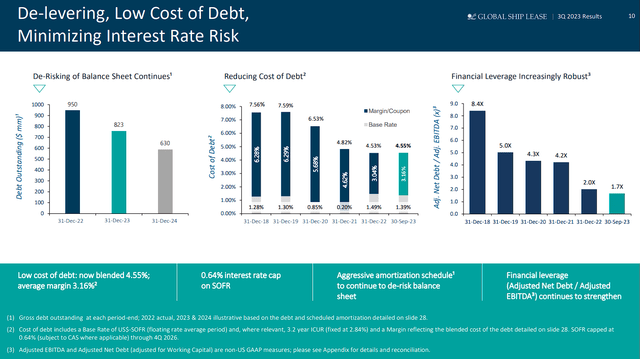

It is very refreshing to see a transport firm’s curiosity bills come this low relative to revenues/working earnings, displaying GSL’s deleveraging efforts over the previous few years. The slide beneath illustrates this, with GSL’s leverage presently sitting at a document low of simply 1.7X.

World Ship Lease Q3 Presentation (Q3 Presentation)

Regardless, the direct impact of decrease curiosity bills is properly proven in GSL’s internet earnings, partially offsetting the modest decline in working earnings. Actually, at $85.1 million, internet earnings represented 49% of revenues. It displays my earlier level relating to the advantages of GSL’s extremely worthwhile pandemic-powered leases being nonetheless in place.

Capital Allocation Excellence Instills Confidence

Whereas discussing Danaos lately, I emphasised the importance of the corporate’s money move assertion over the earnings assertion—a theme that additionally holds true for GSL. Each containership lessors have secured their future revenues by means of multi-year contracts, rendering their income streams, and thus earnings, extremely predictable. The pivotal issue shaping their funding instances lies in how they allocate these money flows.

Within the case of Danaos, I discussed how some traders have expressed skepticism lately (myself included), albeit the current uptick in capital returns has been well-received. Conversely, GSL has garnered constant reward from traders who applaud administration’s adept capital allocation selections.

This recognition stems from their stellar strategy, together with the discount of debt (as beforehand famous), strategic inventory repurchases, and paying a hefty dividend. Actually, I’d characterize GSL’s capital allocation as wonderful, with its most up-to-date Q3 outcomes reaffirming my view.

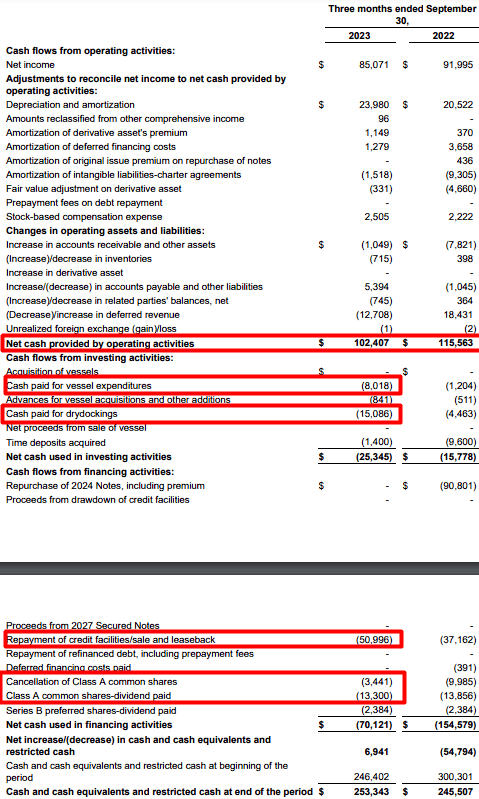

GSL’s money move assertion for the interval beneath, working money flows got here in at $102.4 million. From there, excluding about $23 million in CAPEX for vessel expenditures and dry dockings, we noticed a wholesome combine between deleveraging (about $51.0 million) and capital returns (about $17 million).

GSL’s Q3 Money Circulation Assertion (6K)

Whereas the $13.3 million paid in dividends does not appear to be a lot, and GSL might positively afford to pay notably extra, the inventory’s yield nonetheless stands at a passable 8.1%. Thus, it needs to be sufficient to please traders whereas permitting the corporate to retain sufficient money to maintain on paying down debt.

In distinction to Danaos, which recorded an LTM Web Debt to Adjusted EBITDA ratio of 0.16X in Q3, GSL’s corresponding metric stands at a extra substantial 1.7X, as talked about earlier. As a consequence of this variance, I anticipate GSL’s present capital allocation combine to stay unchanged, prioritizing enhancing the stability sheet over elevating capital returns.

Regardless, I discover no grounds for criticism in GSL’s strategy to capital allocation—no questionable investments or extravagant vessel acquisitions. As an alternative, the corporate demonstrates a dedication to prudent deleveraging and rewarding shareholders. They cannot actually go unsuitable with that.

Why GSL Stays One among My Prime Holdings

After two years of tightly holding GSL, the inventory stays a serious place in my portfolio. The underlying rationale for my preliminary funding hasn’t modified. In essence, GSL not solely presents a compelling upside but additionally boasts a large margin of security for my part.

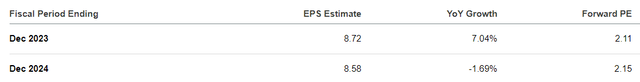

I imagine the corporate’s $1.8 billion contract backlog ensures that it’ll preserve posting super revenues/income over the short- to medium-term. Concurrently, as additional deleveraging goes on, curiosity bills will proceed to say no, permitting for an extra internet earnings margin growth. From there, you realize the recipe: Extra deleveraging, buybacks, paying the hefty dividend.

Throughout this unfolding situation, I discover myself positioned to learn from the beneficiant yield whereas leaving the potential for important upside open. This upside might manifest by means of both a broadening attraction of GSL’s earnings yield, drawing in additional traders, or the prospect of a buyout. Within the latter case, the likelihood arises if one other main transport participant or a non-public fairness agency expresses curiosity in taking GSL’s high-quality fleet non-public at an inexpensive P/E of simply over 2.0 and with the healthiest stability sheet in its historical past.

GSL’s Anticipated EPS (In search of Alpha)