Andriy Bocko/iStock by way of Getty Photographs

Introduction

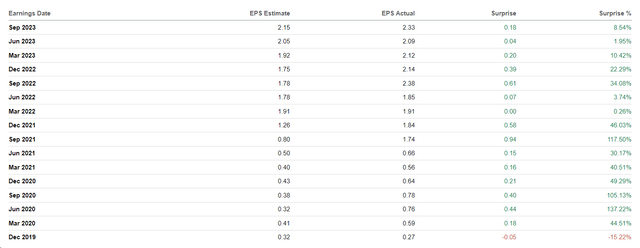

I first wrote an article about World Ship Lease (NYSE:GSL) in August 2021, earlier than the Q2 2021 report. Again then, it was a strategic bullish name, as I known as to purchase the corporate’s shares earlier than the report launch based mostly on the underestimated EPS consensus estimates. On the time, my prediction got here true: GSL beat EPS and income estimates by 30.17% and 4.76%, respectively, and, by the best way, has by no means had a unfavorable earnings shock since, regardless of the dire situations within the trade.

In search of Alpha, GSL’s Earnings Surprises

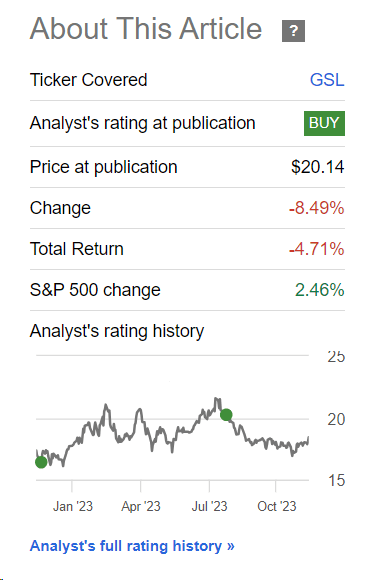

I then talked about GSL compared to Danaos (DAC) in December 2022 and final up to date my bullish thesis in August 2023. For the reason that final replace, the inventory has had a unfavorable complete return and underperformed the broad market:

In search of Alpha, Oakoff’s newest article on GSL

On account of this latest underperformance and the truth that GSL has already revealed figures for Q3 2023, I’ve determined at this time to replace my protection and assessment the energy of my earlier ‘Purchase’ score.

Latest Developments

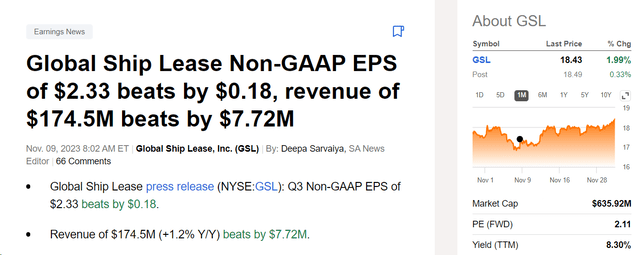

In Q3 FY2023 reported on November ninth, World Ship Lease had $174.5 million in working revenues, reflecting a YoY 1.2% improve. Yr-to-date working income reached $495.9 million, marking a 3.2% development over the identical interval within the earlier 12 months. GSL generated $121.9 million of Adjusted EBITDA for Q3 2023, representing a 9.4% improve from Q3 FY2022. EPS for Q3 2023 was $2.33, down 4.1%, with normalized earnings per share at $2.33, down 2.1%. Each high and backside strains surpassed the consensus estimates for the quarter:

In search of Alpha Information

The corporate added $224.7 million of contracted revenues to ahead constitution cowl between January 1, 2023, and September 30, 2023. With 82% of 2024 ship days already contracted, the present 12 months was successfully totally lined, the administration group commented through the earnings name.

The corporate expanded its relationship with Ascenz Marorka to implement Sensible Transport options throughout its containership fleet, aiming for real-time knowledge and AI-supported stay efficiency administration capabilities.

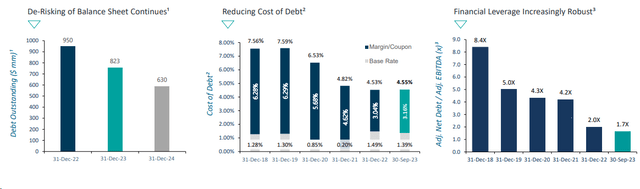

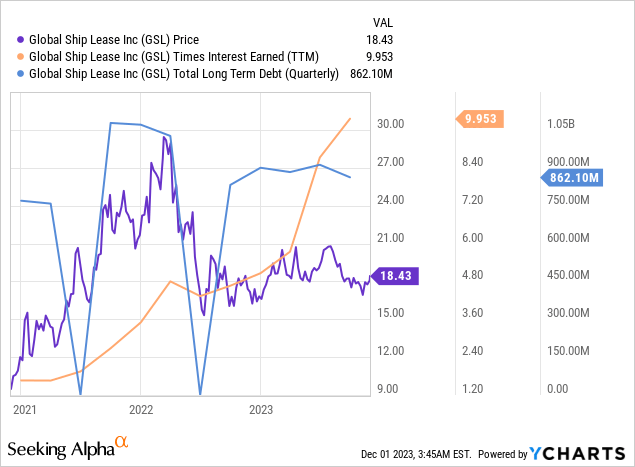

Ian Webber, Chief Government Officer, highlighted GSL’s technique of de-levering and de-risking, sustaining a aggressive value of debt, and making value-enhancing investments to make sure long-term success. And the corporate’s precise outcomes are certainly in keeping with what the CEO says: GSL’s debt profile is getting higher and higher each quarter:

GSL’s IR supplies

The corporate demonstrated a sturdy stability sheet by decreasing gross debt to $874.3 million from $999.5 million in Q3 FY2022, regardless of including $76 million in new debt for not too long ago acquired vessels. GSL closed the quarter with $267.3 million in money, together with $155.3 million in restricted money (complete liquidity stage is at ~42% of market cap, which is lots).

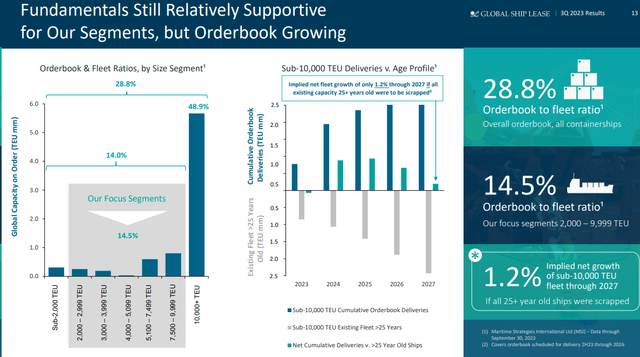

Regardless of macro headwinds and geopolitical uncertainty within the trade, GSL’s fleet of mid-sized and smaller containerships, supported by fixed-rate time charters, positions the corporate nicely for future alternatives and shareholder worth creation. I significantly like the truth that the corporate is specializing in the vessels phase the place the bottom future provide is predicted (comparatively low order e-book): This means probably extra steady freight charges sooner or later and consequently extra steady contract revenues in comparison with different corporations with bigger vessels.

GSL’s IR supplies

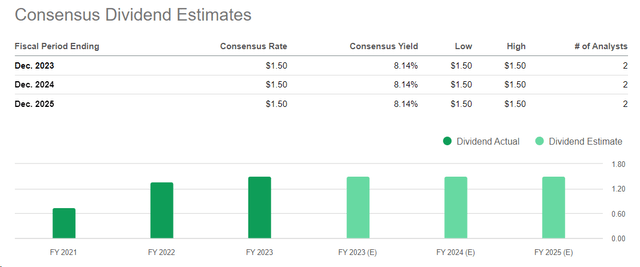

On the similar time, the corporate doesn’t overlook to reward its shareholders. GSL continued its share repurchase program, shopping for again an mixture of 187,479 Class A typical shares throughout Q3 2023. Additionally, GSL maintained a sustainable quarterly dividend, totaling $1.50 per share on an annualized foundation. Analysts count on these dividend funds to stay unchanged over the subsequent 2 years, giving traders a dividend yield of 8.14% on high of the buybacks – the overall shareholder return that GSL intends to realize seems enormous.

In search of Alpha, GSL’s Dividend Estimates

General, I like the basic profile of the corporate, which I consider is operationally much less dangerous than a lot of its friends because of its sturdy stability sheet and the character of its fleet of vessels. GSL’s affordable shareholder coverage ought to, in idea, additionally present some form of safety.

World Ship Lease’s Valuation

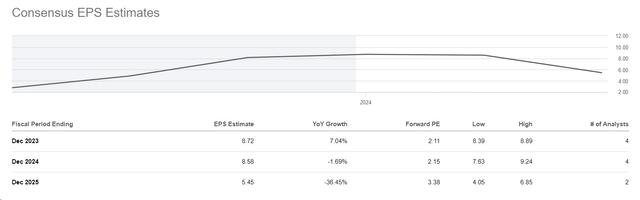

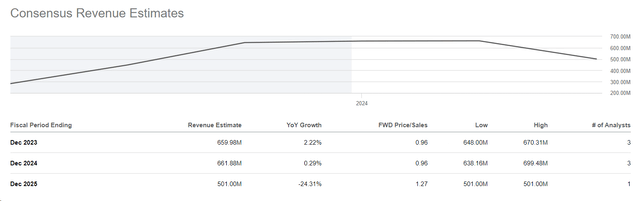

In my view, the dividend yield of over 8% itself is a sign of undervaluation, particularly if we assume that this yield is sustainable. For the time being, the consensus is unanimous on simply that, however by way of EPS, analysts have a very reverse opinion:

In search of Alpha, GSL

As contracts expire and roll, analysts see charges considerably decrease than earlier ones (which is logical) – therefore the sharp fall in EPS in FY2025. Nonetheless, as we’ve already seen earlier than, analysts have been unsuitable with their forecasts in latest quarters, regardless of the obvious ease of predicting contract income.

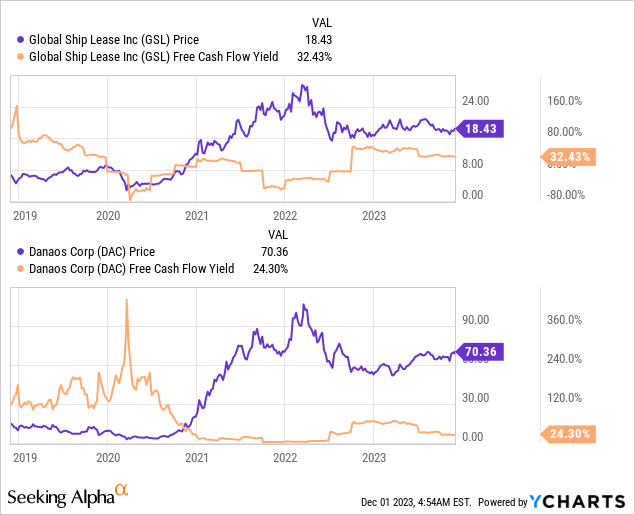

However even when they’re right with the EPS for FY2025, GSL’s implied P/E ratio will nonetheless be beneath 3.5x amid such a pessimistic decline forecast. I already wrote in my latest article on Danaos, the place we see the same image, that that is little or no even for a cyclical firm like GSL.

By the top of FY2025, the corporate’s debt will seemingly lower even additional (because of wealthy FCF era), which ought to have a optimistic influence on the underside line. Due to this fact, the corporate’s revenue margins needs to be comparatively steady. They are going to almost certainly be decrease than at this time, however I do not suppose the extent of the decline can clarify the discrepancy between the decline in estimated EPS and revenues.

In search of Alpha, GSL

Talking of FCF: The big 32.43% at GSL is even greater than what we noticed in DAC’s case (24.3%):

Following the identical logic as for the valuation of Danaos, I feel it is honest to imagine an EPS shock of 5% for FY2024 and an exit P/E of 3x. Then we get a good worth of $27.03, which is 46.6% above at this time’s worth.

Danger Components

GSL’s monetary efficiency is delicate to world financial situations and fluctuations in constitution charges, making it vulnerable to market volatility. Moreover, the corporate’s use of leverage for vessel acquisitions poses monetary dangers, particularly throughout financial downturns or difficult market situations. Counterparty threat, tied to GSL’s reliance on constitution agreements with liner operators, and operational dangers similar to geopolitical tensions additional contribute to the funding panorama.

In cyclical industries, every part appears low cost when corporations are approaching their operational peak – maybe I’m unsuitable to say that GSL is undervalued. The corporate’s EPS and income estimates for the subsequent few years may really be nicely beneath present inventory market estimates.

So traders needs to be conscious of those elements and conduct thorough due diligence earlier than contemplating GSL as an funding.

Your Takeaway

Regardless of the prevailing dangers, I like World Ship Lease at $18-19 per share, which for my part is simply too little with an FCF yield of >34% and a dividend yield of >8%. I reiterate my Purchase score and advocate income-oriented traders to think about shopping for this inventory.