MarsBars

It pays to have belongings that pay you again, particularly in the event that they function in industries with pure limitations to entry. As earnings traders know nicely, getting paid is among the pleasures of investing, as a result of as good as capital positive factors are, they don’t pay the payments like a gradual dividend examine does for the investor.

This brings me to International Companions (NYSE:GLP), which provides traders somewhat of all the pieces – dividends (referred to as distributions), dividend development, and capital positive factors. Perhaps I’m somewhat bit late to the celebration in overlaying this inventory, as GLP is up 18% over the previous 12 months, as proven beneath. On this article, I consider the inventory and talk about whether or not it’s a worthy purchase at current, so let’s get began!

GLP Inventory (Searching for Alpha)

(Observe: International Companions points a Schedule Ok-1)

Why GLP?

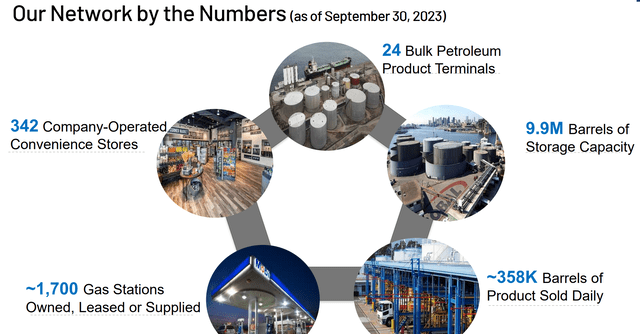

International Companions is a grasp restricted partnership that’s one of many “largest unbiased house owners, suppliers, and operators of gasoline stations and comfort shops” in Northeastern U.S. It additionally “owns, controls, or has entry to one of many largest terminal networks” within the area, distributing gasoline, distillates, and renewable fuels to wholesalers, retailers, and business prospects. This huge array of power belongings is maybe greatest exemplified by the next graphic.

Investor Presentation

Whereas some might view GLP as working in a no-growth trade, contemplating that the gasoline infrastructure is already constructed out, there’s something to be stated about trade consolidation, which GLP is nice at. Asset consolidation allows integration and scale and serves as an exterior driver of development. This contains 60 company-operated comfort shops that had been added final 12 months, bolstering product margins by 6.1% within the first quarter of this 12 months.

GLP’s development technique in recent times mixed with a wholesome and rising distribution has labored nicely for shareholders, producing a complete return of 194% over the previous 10 years, surpassing the 154% whole return of the S&P 500 (SPY). Only for kicks, I’ve additionally included the efficiency of built-in oil giants Exxon Mobil (XOM) and Chevron (CVX) over the identical timeframe, and GLP has outperformed each of them as nicely, as proven beneath.

GLP Complete Return (Searching for Alpha)

In the meantime, GLP’s current third quarter outcomes might look disappointing, as adjusted EBITDA declined to $77.7 million from $168.5 million within the prior 12 months interval, and adjusted DCF declined to $43.3 million from $128 million within the prior 12 months interval. Nonetheless, it’s value noting that final 12 months was a little bit of an anomaly, contemplating the reverberations from a excessive mismatch between demand and provide in 2022. As proven beneath, the value of oil per barrel has declined considerably from nicely over $100 per barrel to $77.58 at current.

YCharts

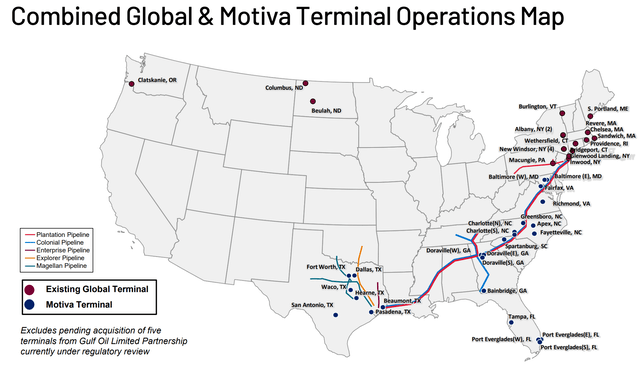

As such, I consider GLP’s most up-to-date quarterly outcomes are extra reflective of a real run-rate for the enterprise. Wanting forward, GLP continues to seek out alternatives to increase its footprint, as mirrored by its settlement to amass 25 refined product terminals from Motiva Enterprises for $306 million in money. This buy is supported by a 25-year take-or-pay throughput settlement and is anticipated to shut by year-end.

This buy advantages GLP in that it strengthens and diversifies its terminals whereas opening up GLP to new business and retail prospects in further markets. As proven beneath, Motiva’s terminals increase GLP’s presents into Texas and the Southeastern areas of the U.S. and sit alongside main pipelines owned and operated by Colonial, Enterprise Merchandise Companions (EPD), and Magellan Midstream, now part of ONEOK (OKE), amongst others.

Investor Presentation

Furthermore, GLP is additional increasing its direct to shopper footprint by just lately starting to function 64 comfort and fueling amenities in Better Houston market underneath a three way partnership with Exxon Mobil. Whereas transition to electrical automobiles poses as a danger, the current decline in fuel costs throws into query the excessive price of EVs for shoppers.

As such, the recent growth within the hybrid car market implies that the gasoline market could also be wanted for for much longer than what some trade observers might consider. Plus, in a nod to the EV market, GLP just lately activated its first company-owned EV charging station, and has 5 further EV websites underneath development.

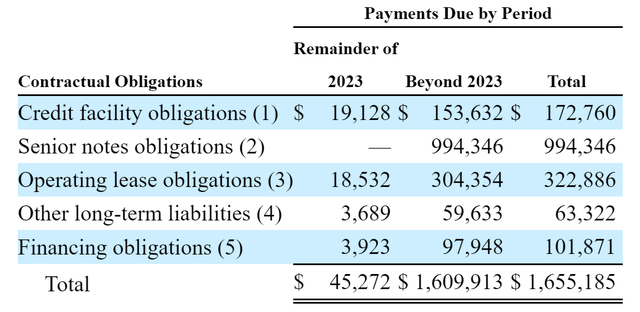

Dangers to GLP embody its low credit standing of B+ from S&P, which implies increased price of debt. Nonetheless, GLP is inside compliance of its debt covenants and has an inexpensive debt to TTM EBITDA of three.7x, though this ratio might development increased ought to the value of gasoline decline. As proven beneath, whereas GLP’s remaining debt maturities this 12 months aren’t too materials, it does have $1.6 billion value of debt maturities put up 2023 which will must be refinanced at increased charges.

GLP Debt Maturities (Q3’23 10-Q Submitting)

In the meantime, GLP at the moment yields 7.2%, and the DCF-to-distribution protection ratio together with the particular distribution is 1.4x. GLP has additionally demonstrated a propensity to development the distribution with a 5-year CAGR of seven.2%.

Lastly, GLP at the moment trades at $37.94 with a ahead PE of 12.5, sitting slightly below its regular PE of 12.7. As such, I consider a lot of the near-term worth across the inventory has already been realized particularly contemplating the potential affect from increased rates of interest.

Extra risk-averse earnings traders might need to think about the Most popular Sequence A inventory (NYSE:GLP.PR.A). This most popular inventory at the moment carries a ahead yield of 12%, however traders ought to needless to say this can be a floating distribution price now that it trades previous its name date of 8/15/2023. On the present worth of $25.82, GLP.PR.A trades at a 3.2% premium to its $25 par worth, signaling that the market doesn’t anticipate for this most popular problem to be referred to as anytime quickly. This most popular problem can be cumulative, which implies that any missed funds have to be made up until if GLP turns into bancrupt.

Investor Takeaway

Total, GLP provides traders publicity to a various, economically important asset base and a rising distribution, making it a lovely possibility for income-oriented traders. Whereas there are some dangers to think about, akin to its debt profile and the potential affect of upper rates of interest, GLP’s current asset acquisitions including to the underside line might offset a few of these headwinds. Contemplating all of the above, I view GLP and its Most popular Sequence A inventory as being a ‘Maintain’ at current, contemplating that the frequent shares commerce close to their regular valuation and the popular inventory trades at a premium to par worth. As such, traders might need to watch for a greater margin of security earlier than shopping for at current.