murat4art

Airline consolidation isn’t solely comparatively frequent however obligatory for development and competitiveness, and the latest announcement of Alaska Airways’ deliberate acquisition of Hawaiian Airways is a main instance of this pattern.

The transfer, valued at $1.9 billion, signifies extra than simply a enterprise transaction. It represents a strategic positioning for future development in a extremely aggressive, extremely concentrated sector.

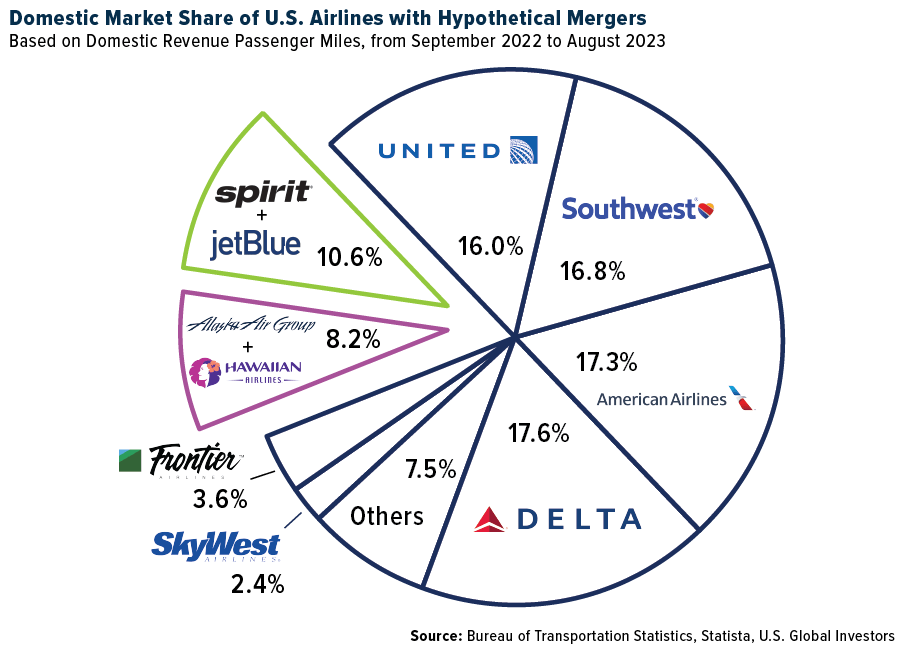

As soon as the deal is accomplished, Alaska and Hawaiian can have a mixed market share of roughly 8.2%, making it the fifth-largest U.S. airline-unless JetBlue Airways succeeds in getting regulatory approval to amass rival low-cost service Spirit Airways. Extra on that later.

U.S. International Buyers

Alaska’ supply to buy Hawaiian for $18 per share-today it is buying and selling round $13-includes taking over $900 million in debt, however the potential benefits are substantial. The Washington State-based service not solely good points a major foothold within the profitable, $18 billion Hawaii market but in addition achieves a number of strategic advantages:

- Capability Rationalization: The deal permits for higher competitors with Southwest Airways by rationalizing capability between the West Coast and Hawaii.

- Fleet Enlargement and Flexibility: Alaska will purchase widebody plane for long-haul flights and improve fleet flexibility for various route choices.

- Enhanced Community Utilization: The merger guarantees improved utilization of huge narrowbody plane throughout the mixed networks.

The announcement despatched Hawaiian’s mother or father firm shares hovering 193% final Monday, reflecting the market’s optimistic view of the deal. This constructive response underscores a broader pattern within the airline business, the place smaller gamers search mergers to remain aggressive towards bigger rivals.

JetBlue’s Case To Purchase Spirit

Parallel to the Alaska-Hawaiian deal, JetBlue formally wrapped its case in federal courtroom final week to amass Spirit for $3.8 billion. If permitted, the deal would reshape the U.S. airline business, probably difficult the dominance of the 4 main carriers and marking probably the most vital occasion of airline consolidation for the reason that American-US Airways merger in 2013.

In accordance with Evercore ISI’s Duane Pfennigwerth, who was current for closing arguments on Wednesday, the decide’s line of questioning “learn favorably for a settlement,” and JetBlue appeared to have “a extra cohesive argument [than the Justice Department], which required much less clarification by the decide.”

Among the many most compelling arguments made by JetBlue attorneys is that the New York-based service requires scale to develop and compete towards the Massive 4 airways. Smaller rivals are anticipated to fill the gaps created by an outgoing Spirit, which JetBlue insists cannot make it alone within the present market anyway.

The Justice Division isn’t so positive. The company claimed {that a} JetBlue-Spirit merger would wipe out half of all ultra-low-cost service (ULLC) capability within the U.S., relied on by many price-conscious Individuals. Additional, “Spirit anchors pricing in bigger markets and is an innovator, with self-service bag drops an instance of a latest innovation,” writes Pfennigwerth, summarizing the Justice Division’s line of reasoning.

A choice is anticipated as early as this week.

Again To The Lengthy-Time period Common

Home airline shares rallied final week on the constructive information, with the NYSE Arca Airways Index closing up practically 13% from the earlier Friday. This represents the most important weekly achieve for the group since November 2020.

Taking time from its courtroom case in Boston, JetBlue raised its monetary outlook for 2023, with anticipated annual revenue growth of 4% to 5%, up from earlier steering of three% to five%, and a smaller-than-anticipated adjusted loss. This uplift is buoyed by sturdy bookings and operational efficiency.

Delta Air Traces reported strong vacation journey demand and growing company bookings, projecting a shiny finish to 2023 and stable starting to 2024. Talking on the Morgan Stanley International Client & Retail Convention, Delta CEO Ed Bastian doubled down on the service’s constructive 2023 steering, citing file revenues for the Thanksgiving vacation. Christmas bookings look to be “very, very sturdy,” Bastian mentioned.

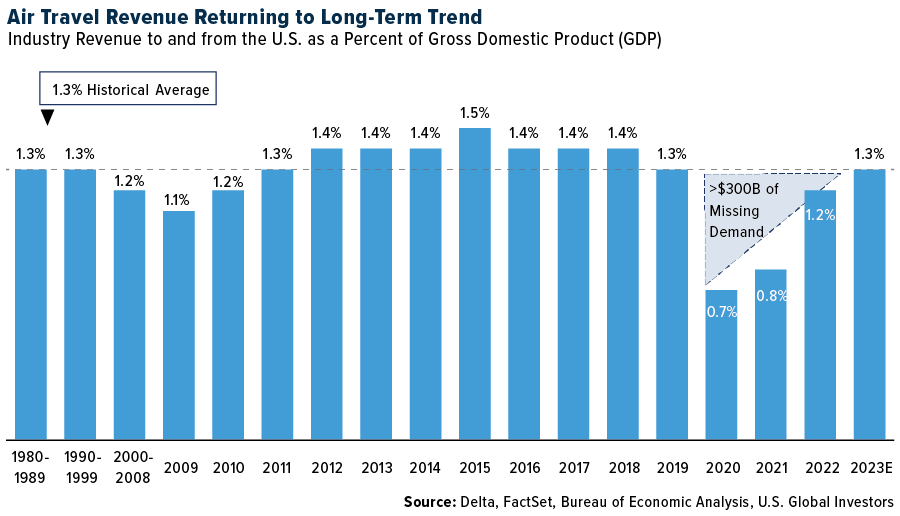

Throughout his presentation, Bastian shared an attention-grabbing chart that reveals that air journey as a p.c of gross home product has returned to the long-term common. Since 1980, quickly after deregulation, business air journey expenditure has traditionally averaged round 1.3% of the U.S. financial system, with notable deviations occurring because of 9/11 and the 2009 monetary disaster. Nevertheless, probably the most vital disruption was throughout the pandemic, leading to roughly $300 billion of misplaced demand from 2020 to 2022.

U.S. International Buyers

The latest journey growth, Bastian identified, is a response to pent-up demand, although it is solely introduced the business again to the 1.3% common with out addressing the lacking $300 billion hole. Bastian expects to recoup this quantity over the subsequent few years as demand stays close to or above current ranges.

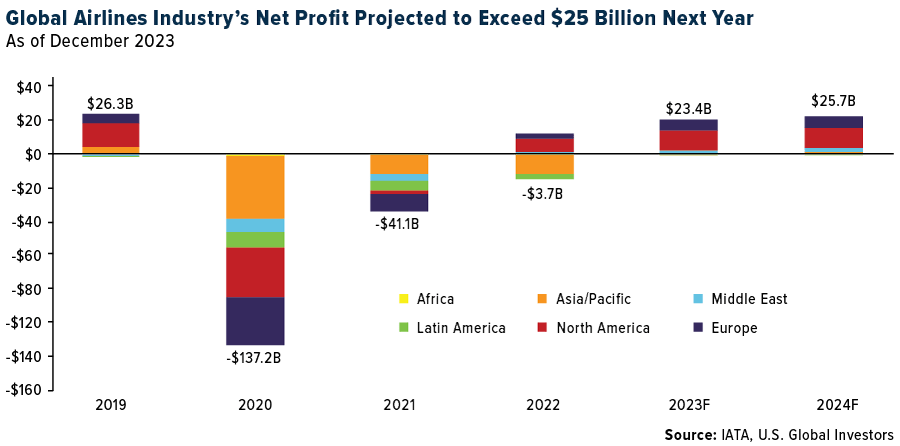

IATA Forecasts Report Working Income In 2024

On a remaining, encouraging observe, the Worldwide Air Transport Affiliation (IATA) forecasts internet earnings of $25.7 billion for the worldwide airline business in 2024, with working earnings reaching a record $49.3 billion. North American carriers, which have been first to return to profitability in 2022, are set to gather a mixed $14.4 billion in earnings, the IATA says.

This projection, coupled with an anticipated surge in passenger site visitors, paints an image of an business on the cusp of a historic rebound.

U.S. International Buyers

The airline business’s journey by way of the pandemic was fraught with challenges, however its fast return to profitability is a testomony to its resilience and adaptableness. Because the Alaska-Hawaiian and JetBlue-Spirit offers take form, it is clear that the business is not only recovering however is actively reshaping itself for a brand new period of development and competitors.