Justin Sullivan

Gilead Sciences, Inc. (NASDAQ:GILD) is among the many largest pharmaceutical corporations on the earth, with a market capitalization slightly below $100 billion. The corporate’s anti-viral discoveries have gone by means of a number of phases, with enhancements in HIV, adopted by a treatment for HEP C, and extra COVID-19 medication.

As we’ll see all through this text, the corporate’s total portfolio, together with development in its most cancers enterprise, assist substantial long-term development regardless of a interval of wrestle.

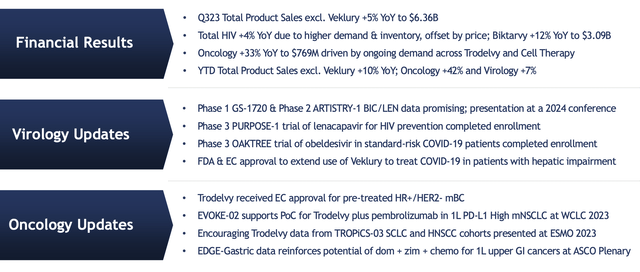

Gilead Sciences Quarterly Outcomes

The corporate had robust quarterly outcomes, indicating its continued concentrate on quarterly efficiency.

Gilead Sciences Investor Presentation

The corporate’s complete product gross sales, not counting Veklury, hit $6.3 billion, with HIV development of 4% and robust development in Biktarvy. HIV stays the core of the corporate’s portfolio, and it is good to see the corporate’s continued dominance there. The corporate’s innovation right here, with new medication like PrEP, assist to retain its market dominance.

The brilliant spot within the firm’s outcomes was robust Oncology outcomes, with a 33% YoY enhance supported by Trodelvy and Cell Remedy, with Trodelvy receiving new market approvals. The corporate has spent years attempting to construct a publish Hepatitis C portfolio, with a number of miss-steps, however we really feel it is lastly again on observe.

This was undoubtedly an thrilling quarter for the corporate’s long-term potential.

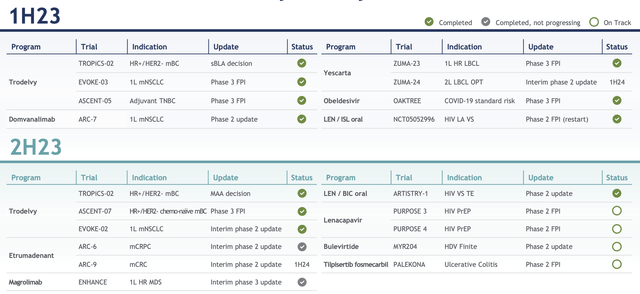

Gilead Sciences Milestones

The corporate has plenty of milestones it is engaged on that we really feel will broaden on its prior success.

Gilead Sciences Investor Presentation

The corporate’s most enjoyable milestones focus on Trodelvy, a drug that is crossed $1 billion in annualized gross sales and is anticipated to cross $4 billion in peak sales. The corporate has a handful of milestones earlier than the top of the 12 months, many in Part 2, nonetheless, it might assist set-up some thrilling Part 3 trials for the upcoming years.

These milestones will outline the continued development of the corporate’s portfolio.

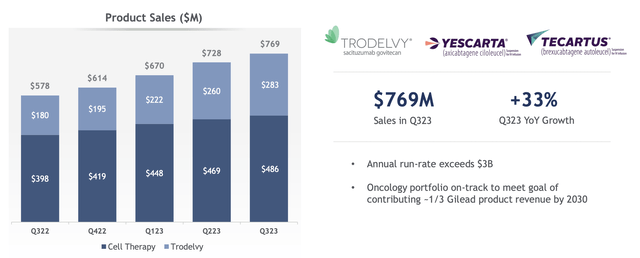

Gilead Sciences Accelerating Most cancers Enterprise

The beneath data offers a more in-depth view of the corporate’s rising most cancers enterprise.

Gilead Sciences Investor Presentation

Whereas the corporate spent many billions and nonetheless has a methods to go, it is doing properly for successfully an acquired enterprise. The outcomes above are the results of nearly $40 billion in acquisitions, lots of which have been written down. Nevertheless, for individuals who make investments now, you are already getting the advantage of these write-downs which the market has priced in.

The enterprise presently has greater than $3 billion in annualized gross sales. Mixed annual gross sales forecasts for the three merchandise above is greater than double that, with a run-rate extending into subsequent decade. The corporate’s steerage that the portfolio is on observe to satisfy the objective of contributing 1/3 of income by 2030 is extremely thrilling to see.

Nevertheless, in fact, we might prefer to see the corporate to proceed to spend money on and develop a pipeline right here in addition to solely what it is spent some huge cash to amass.

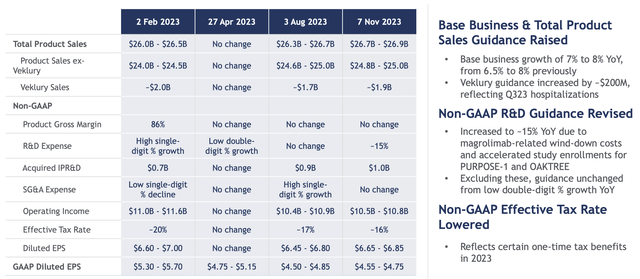

Gilead Sciences Shareholder Returns

Gilead Sciences has modified its steerage a number of occasions, and stays dedicated to shareholder returns.

Gilead Sciences Investor Presentation

The corporate’s narrowed present product sale steerage is $26.8 billion. Not counting Veklury (its COVID-19 drug), the corporate’s manufacturing steerage is $24.9 billion, a powerful steerage from the preliminary steerage regardless of continued Veklury weak spot. The corporate’s working earnings steerage is anticipated to be $10.6/7 billion, impacted by some larger R&D prices.

On the finish of the day, the corporate’s diluted EPS steerage is $6.75 / share, with GAAP diluted EPS at $4.65 / share. Versus the corporate’s share value, that is a non-GAAP P/E ratio of 12. The corporate is dedicated to sending a considerable % of its money to returns. The corporate’s ~$8 billion in annual earnings had $1.3 billion in quarterly money circulate.

The corporate has an nearly 4% dividend yield that it is continued with nearly $1 billion in quarterly dividends. The corporate additionally repurchased $300 million in shares. The corporate has managed to reduce its excellent shares persistently, and we might prefer to see that proceed.

Thesis Threat

The biggest threat to our thesis is the corporate’s capability to proceed rising the present belongings in its portfolio. Prescription drugs is an advanced and costly enterprise to be in, and the corporate’s write-downs and acquisition failures are a transparent instance of that. Whether or not the corporate can now succeed has luck concerned and stays to be seen.

Conclusion

Gilead Sciences might need lastly discovered the diversified portfolio that it is dreamed of. Veklury continues to generate robust gross sales, offering a pleasant cushion and a few additional money circulate. The corporate’s HIV enterprise continues to develop and stays dominant within the discipline due to its success with sufferers and continued innovation.

Now the corporate has two new companies. Its liver illness enterprise has a dying Hepatitis C enterprise that underpins revenues with rising Hepatitis B and D companies. We anticipate these to ultimately utterly change the Hepatitis C enterprise. Oncology is way more thrilling and stays on observe for 1/3 of 2030 income.

Gilead Sciences, Inc. continues to have robust constructive money circulate directed to dividends and buybacks, and total, is a priceless long-term funding.