Gold costs have been on a tear, with bullion prices ripping upward since the outbreak of war in the Middle East late final 12 months. Whereas mining shares have gone up as properly, bodily gold has been leaving them within the mud:

Gold inventory efficiency is clearly tied to rather more than simply the bullion worth. For one, shareholder worth can all the time be diluted while you’re holding shares, whatever the business. Gold mining corporations even have overhead for exploration, extraction, processing, and storage. There are additionally worth fluctuations in oil, supplies, and labor that gold miners need to take care of. Bodily gold additionally comes with some overhead — primarily with regard to storage, transportation, and safety — however the prices are decrease compared.

Nonetheless, gold mining shares have the additional advantage of paying dividends. They only include the necessity to contemplate an extended checklist of variables like government administration, the price of exploration, and growing older tools that might require restore or alternative. When the broader economy isn’t doing great and overhead costs are lower, winning gold miners can fare extremely well.

Actually, successful gold miners could be very worthwhile and at occasions can outperform bullion, particularly within the shorter and medium-term. That’s why Peter Schiff nonetheless recommends allocating capital to gold miners as a part of a diversified valuable metals portfolio. Nevertheless, to guard your wealth in the long term despite macroeconomic traits, you also needs to all the time maintain the metallic itself. No matter which gold mining shares you select, nothing beats bodily bullion as a secure haven in an inflationary surroundings the place central financial institution cash printing is operating amok.

That’s very true throughout occasions like these, when the Fed is predicted to begin reducing rates of interest and printing cash to finance meddling in a rapidly-expanding Center East battle. If inflation rockets again up, it permits gold miners to set larger costs for his or her bullion, however will increase their overhead resulting from having to cowl their prices in a devalued foreign money. This doesn’t negate the knowledge of holding the proper mining shares, however reinforces that gold bullion stays the highest safe haven asset when it comes to easy money policies and the chaos of warfare.

Peter Schiff commented on the Commodity Culture podcast:

“To the extent that the Fed simply tolerates larger inflation and continues to ease within the face of it, that’s going to destroy the greenback, after which gold’s simply going to undergo the roof.”

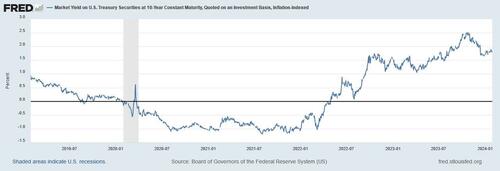

Talking of inflation, a divergence within the gold with the value of Treasury Inflation-Protected Securities may point out that the market is much from assured that the Fed actually has inflation beneath management. The 2 break up in 2022, with a niche that’s threatening to widen much more within the coming months if the gold worth accelerates upward.

Proudly owning inventory in the proper mining corporations is crucial for any well-rounded gold investor. The correct picks can yield larger returns than bodily gold, given sure circumstances. However change is one in every of life’s few ensures, and with Keynesians nonetheless firmly in cost, so is cash printing. Bodily gold stays the king of secure long-term safety towards central financial institution financial tinkering and common international chaos.

Loading…