LOUISE BEAUMONT

Abstract

I’m recommending a purchase score for Real Elements Firm (NYSE:GPC), as I consider the current lower in share worth is because of buyers being overconcerned by the 1% comparable gross sales progress within the US APG section. For my part, that weak efficiency is a blip, and I anticipate issues to get well. With the restoration within the US APG section and the continual energy seen within the IPG section, GPC ought to have the ability to proceed rising prefer it did traditionally (mid-single digits).

Enterprise

GPC Firm operates as a diversified distributor, catering to numerous sectors together with automotive alternative elements, industrial replacements, workplace provides, and electrical and digital supplies. Its main buyer base is located primarily in the US (contributing to 77% of gross sales), adopted by Europe (14% of gross sales), and Australasia (9% of gross sales). GPC contains two integral segments: the Automotive Elements Group (APG), liable for the distribution of automotive alternative elements, equipment, and repair objects, accounting for roughly 60% of EBIT; and the Industrial Elements Group (IPG), providing entry to an enormous stock of over 19 million industrial alternative elements and provides. IPG serves a various clientele of Upkeep, Restore, and Operations [MRO] and OEM prospects spanning varied industries. This section contributes to roughly 40% of EBIT.

Financials/Valuation

Primarily based on creator’s personal math

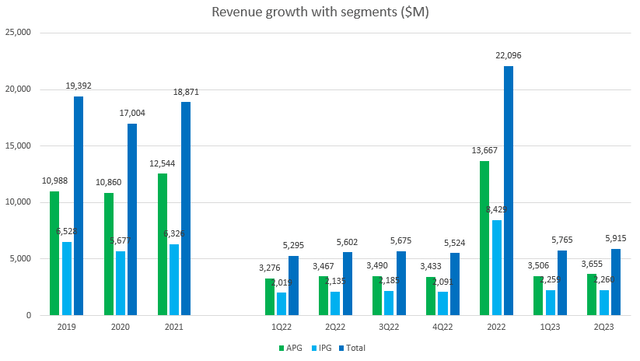

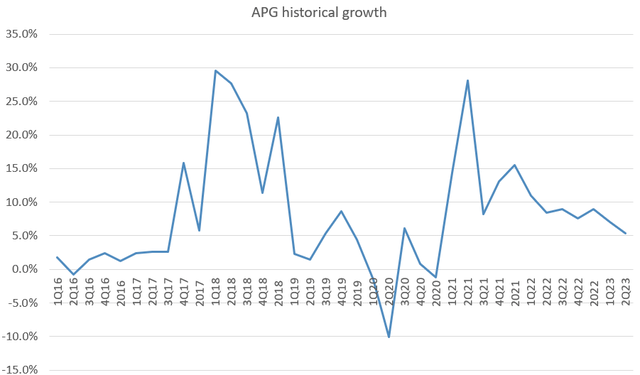

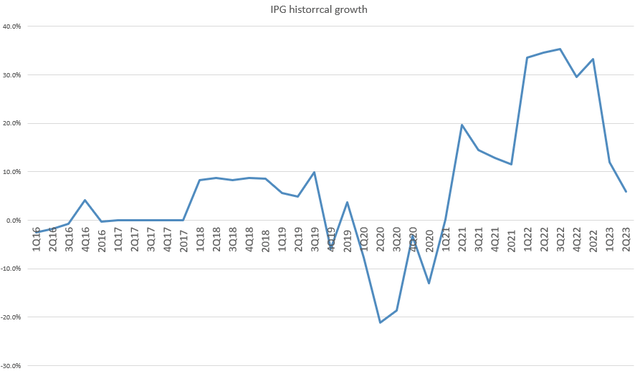

Complete revenues elevated by 5.6% from the earlier yr to $5.92 billion, which was simply shy of the $5.96 billion projection made by consensus. This progress was pushed by a rise in comparable gross sales of 4.9% and a progress in gross sales from acquisitions of 1.8%. Though APG’s gross sales elevated yr over yr by 5.4%, that is beneath the corporate’s long-term progress fee of round 10% (or a 9.5% CAGR from the primary quarter of 2016 to 2Q3). However, gross sales of IPG elevated by 5.9% in comparison with the earlier yr. Not like the APG sector, IPG is trending again towards its typical fee of progress. Gross sales to distinguished company accounts with established contracts exhibited robust efficiency, whereas progress was noticed in each product class and main industries catered to by the IPG section compared to the earlier yr.

Primarily based on creator’s personal math

Primarily based on creator’s personal math

Primarily based on creator’s personal math

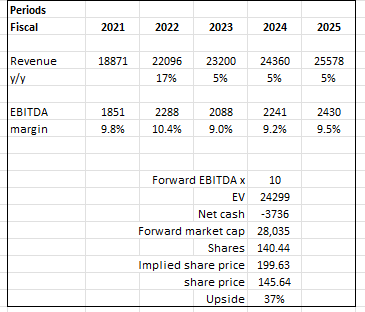

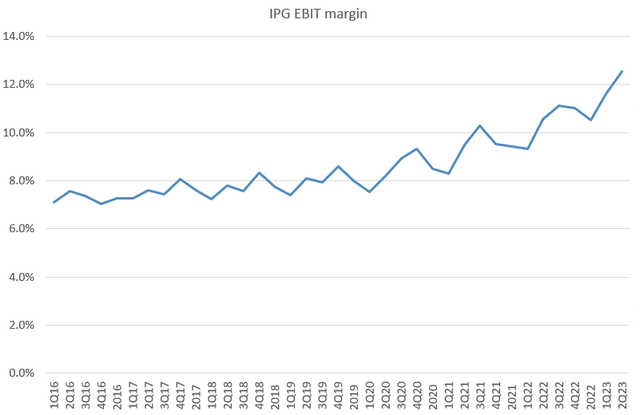

Primarily based on my view of the enterprise, GPC ought to have the ability to at the very least proceed rising at its present tempo of mid-single digits for the foreseeable future, supported by the restoration within the US APG section (mentioned beneath) and the continuing energy seen within the IPG section. I additionally anticipate the EBITDA margin to enhance modestly from right here, because the IPG section margin efficiency provides hope that long-term margins might additional exceed administration’s goal. On the present inventory worth, GPC is buying and selling consistent with friends median EBITDA multiples (O’Reilly Automotive, Autozone, and Advance Auto Half) at 10x ahead EBITDA. On condition that GPC has traditionally traded consistent with friends, I’m anticipating this to stay the identical, as I don’t see a particular catalyst that may drive any change.

Feedback

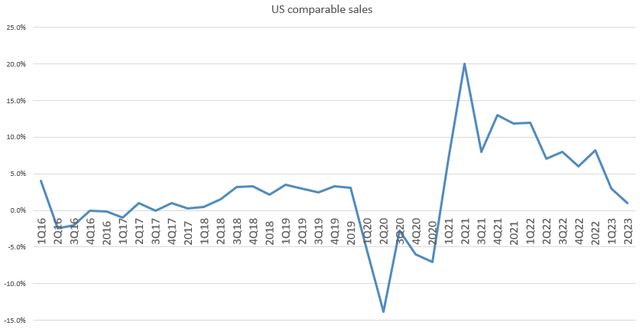

On condition that a big a part of GPC enterprise is within the US, I consider extra focus must be positioned right here. At first look, the newest quarter’s 1% year-over-year improve in comparable gross sales for GPC’s US APG enterprise appears dismal, as it’s beneath the corporate’s through-cycle common of three% progress. Administration’s efficiency commentary by means of 2Q23’s months was equally discouraging, with April and Could being the higher months and June developments softening, particularly within the second half of the month earlier than the July 4th vacation. This makes some buyers anxious concerning the efficiency into 3Q23, as administration made this touch upon July twentieth (nearly 1 full month into 3Q23). The bearish buyers will level to the trade’s efficiency (utilizing friends’ as a benchmark) to assist the case of a slowdown. As an illustration, AZO reported ~2% comparable gross sales, declining from the earlier quarter, and AAP reported flattish comparable gross sales, declining from the earlier quarter.

Primarily based on creator’s personal math

Nevertheless, I consider the pattern within the US APG enterprise stays optimistic. To start, the 1% decline in comparable gross sales will be defined partly by the truth that it adopted a yr of upper inflation-driven ticket progress. Adjusting for these counsel that progress might be nearer to historic ranges. Trying head, administration intends to drive progress by means of unit progress, a method which I believe is backed by robust trade fundamentals. As an illustration, the growing prevalence of previous automobiles in the US is driving up demand for aftermarket fixes. As well as, I anticipate that the affordability headwinds for brand new automobiles will persist within the close to time period because of the inflationary and charges atmosphere, which drives demand for used automobiles (thereby growing demand for elements) as an alternative. I believe GPC may even proceed to revenue from pricing, as the corporate’s administration is using AI and knowledge analytics to put costs extra advantageously in every particular person market. The APG as a complete ought to return to its through-cycle common of excessive single digits as soon as comparable gross sales within the US section enhance.

Primarily based on creator’s personal math

My standout spotlight of the quarter was the IPG section’s spectacular 12.5% working margin, marking a considerable 198bps enchancment from the earlier yr. It’s noteworthy that this efficiency is consistent with, and even surpassing, administration’s long-term objective of reaching an working margin exceeding 12% by FY25. This outstanding margin growth displays the effectiveness of the corporate’s management. To supply context, GPC achieved this by executing a sequence of strategic initiatives that enhanced each gross and working margins. These initiatives encompassed enhancements in pricing methods and sourcing practices. This accomplishment is especially notable as a result of it implies that the anticipated $50 million in synergies from the KDG acquisition might be absolutely realized by FY23, practically a yr forward of the preliminary timeline. Whereas administration cautioned that the second quarter’s 12.5% margin might not be indicative of your complete yr, I interpret it as a sturdy sign of the IPG section’s functionality to maintain long-term margin progress above 12%.

Threat & conclusion

As seen from the charts above, the intervals the place GPC confronted an enormous drop in gross sales have been throughout COVID. Any resurgence of comparable cases that will drive an exodus in automobile utilization might be deadly for the enterprise. To raised illustrate this, the share worth fell by 50% inside weeks. In conclusion, I like to recommend a purchase score for GPC. I consider it is a momentary setback, and GPC is poised for restoration. Trying forward, GPC’s mid-single-digit progress ought to proceed, pushed by the restoration within the US APG section and ongoing IPG energy. The inventory’s valuation is consistent with trade friends, and there are not any instant catalysts for a change.