jetcityimage

Introduction

Basic Electrical (NYSE:GE) could also be probably the greatest examples of a profitable company comeback. I do not know if comparisons to the Patriots vs. Falcons Tremendous Bowl are applicable, but it surely certain feels a bit that method.

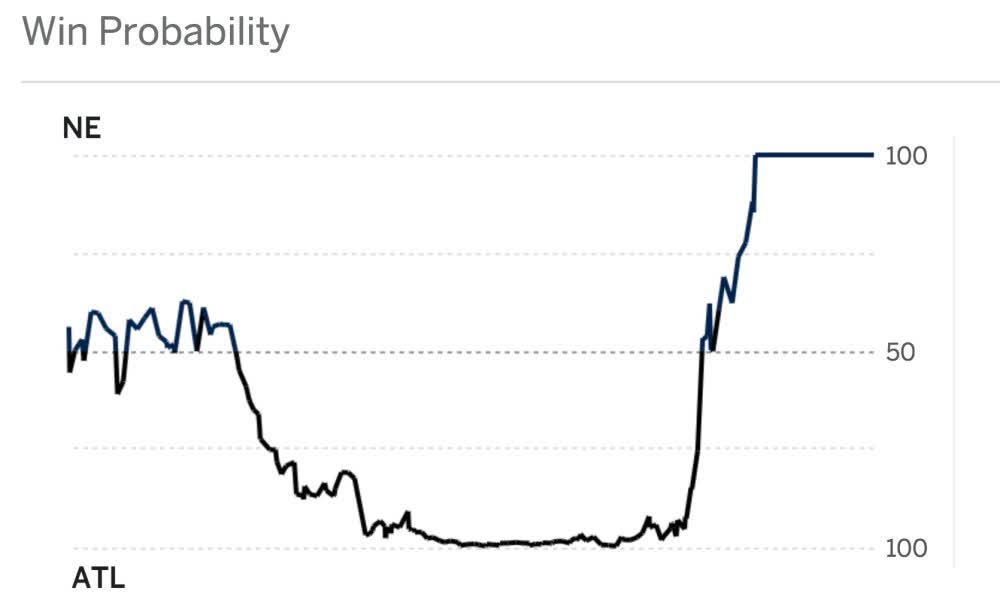

All through virtually the complete sport, folks thought the New England Patriots had been carried out, with an implied win probability under 1%.

ESPN (Through ForTheWin)

Then, they began one of many largest comebacks in sports activities historical past.

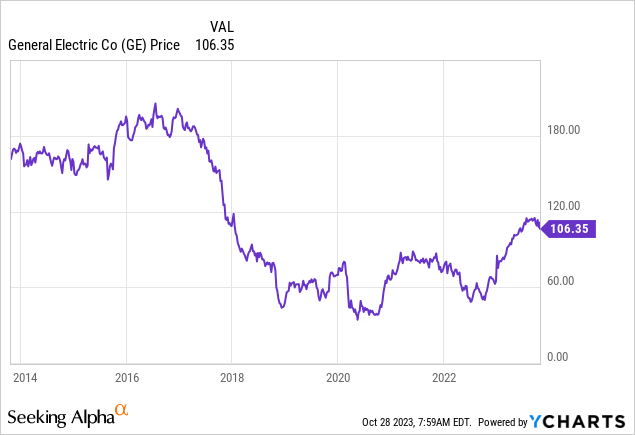

Basic Electrical is completely different but comparable. What was once one of the crucial profitable conglomerates in historical past became an environment friendly approach to shortly lose cash between 2017 and 2020.

Now, the corporate is again.

After spinning off its Healthcare phase, the corporate is now near changing into a pure-play aerospace firm, with full order books, profitable packages with a shiny future, and a wholesome steadiness sheet with room for aggressive shareholder distributions sooner or later.

Additionally, even after rising greater than 60% this yr, I imagine there’s extra room to run.

So, let’s get to it!

When Every thing Goes Proper

On August 27, I wrote an article titled Why Basic Electrical Is One Of The Greatest Aerospace Performs On The Market.

In a dynamic aerospace market, my choice leans in the direction of strong suppliers with pricing energy, like Basic Electrical, over plane producers.

With its strategic deal with superior engines, GE stands out as a dominant participant benefiting from accelerating aviation demand, which is emphasised at occasions just like the Paris Air Present.

The corporate’s industrial engine and repair income surged, and its protection sector orders greater than doubled.

[…] Backed by spectacular steering, GE has the potential for sustained double-digit EBITDA and free money stream progress, positioning it as an undervalued contender within the aerospace {industry}.

The excellent news is that each bullish factor I’ve talked about previously few quarters is popping into actuality – not as a result of I am so nice at predicting however as a result of Basic Electrical retains performing so properly.

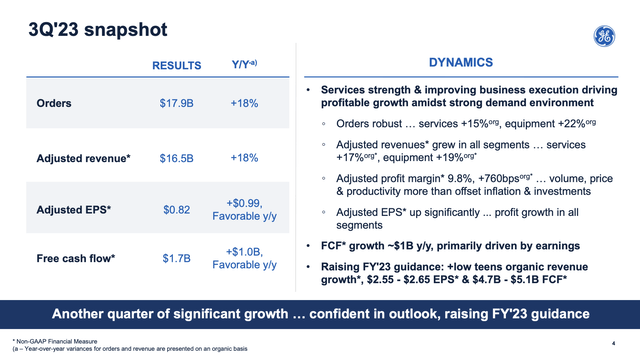

For instance, within the just-released third quarter, Basic Electrical delivered sturdy monetary outcomes.

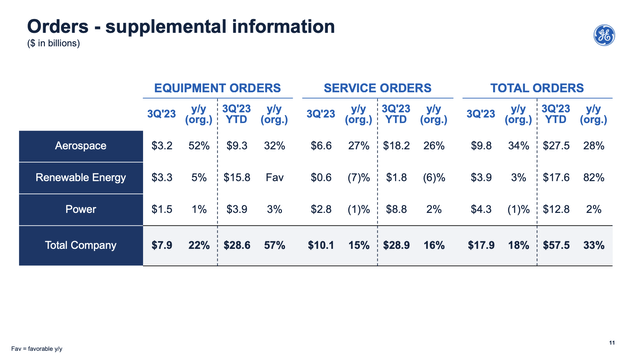

Orders elevated considerably, with service orders up 15% and gear orders up 22%.

Basic Electrical

The corporate noticed an 18% enhance in income, attributed to sturdy market demand, improved execution, and pricing.

Notably, all segments contributed to a exceptional adjusted margin growth of 760 foundation factors. Adjusted earnings per share reached $0.82, a year-over-year enhance of just about $1.00.

Excluding final yr’s wind-related expenses, adjusted margin nonetheless expanded by 400 foundation factors, and EPS elevated by $0.59, greater than tripling the earlier yr’s efficiency.

Aerospace

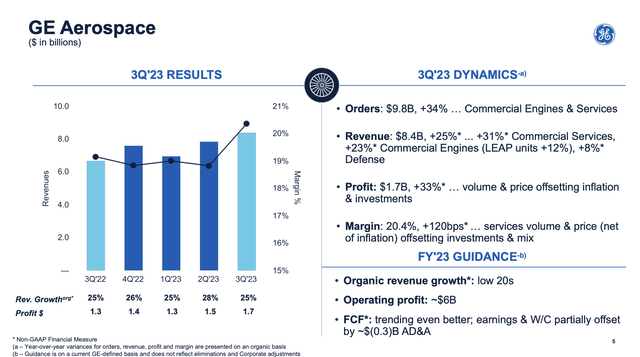

GE Aerospace, which can be a standalone firm subsequent yr, reported strong demand, with GE and CFM departures rising within the mid-teens year-over-year.

Orders had been up by 34%, pushed by sturdy progress in gear and companies.

Income elevated by 25%, led by industrial engines and companies. Revenue in GE Aerospace grew by over $400 million, with margins increasing to twenty.4%.

Industrial companies and exterior spare components had been important revenue drivers.

Basic Electrical

As an investor with greater than 25% aerospace publicity, I like to see how properly GE is doing. Order progress is nearly mind-blowing, because it now totally advantages from each the industrial rebound and protection power.

So as to add some shade, GE Aerospace is actively increasing its fleet of business engines, which at the moment consists of 41,000 industrial engines and 26,000 rotorcraft and fight engines.

This growth is a response to the rising demand and the corporate’s imaginative and prescient of defining the way forward for flight. Notably, industrial engine deliveries have seen a considerable 30% year-to-date enhance.

Basic Electrical

The advantages of this embrace important aftermarket gross sales progress for many years to come back, which is likely one of the advantages of investing in aerospace.

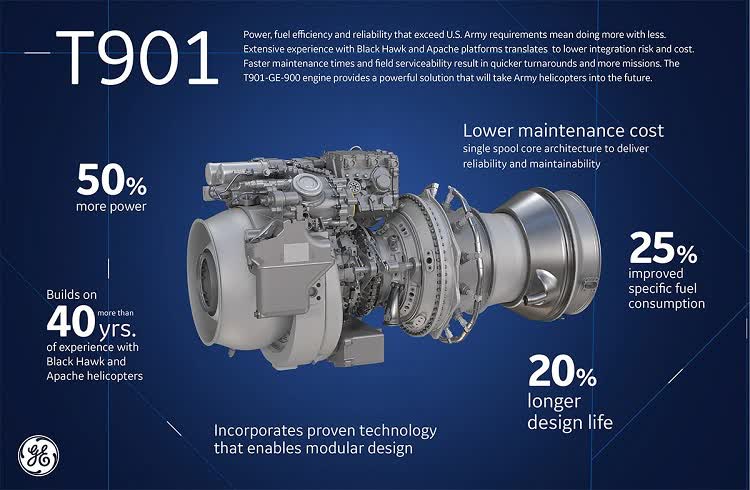

Moreover, throughout its earnings name, the corporate highlighted its contribution to the U.S. Military’s future assault reconnaissance plane prototypes by the supply of T901 flight check engines.

This program is predicted to boost army capabilities by offering elevated energy, decrease lifecycle prices, and decreased gasoline consumption.

The T901 engine was developed by GE, leveraging its intensive expertise in powering the Black Hawk and Apache helicopters with the T700 engine for over 4 a long time, a design that clocked up over 100 million flight hours. The brand new T901 engine builds on this success, offering a 50% enhance in energy and a discount in life cycle prices as a result of its simplified design and fewer components. As well as, the engine’s gasoline effectivity will enhance the enduring fleet’s vary, loiter time and gasoline consumption, all whereas decreasing upkeep and sustainment prices. – Metal AM

Basic Electrical

On prime of that, the corporate famous protection funding for its XA 100 program, which is a complicated protection engine that’s set to compete with the F-135 engine from Pratt & Whitney (owned by RTX (RTX)) for a spot within the mighty F-35 fighter.

Nonetheless, even with these sturdy outcomes, we’re removed from happy. Via our lean transformation, we’re making actual progress, bettering stream and eliminating waste. For instance, our staff in Pune, India has elevated output of LEAP excessive strain turbine manifolds by 3x. However we have to do extra, as do our suppliers, given the tempo of demand for each aftermarket companies and new engine deliveries. – GE 3Q23 Earnings Name

Vernova & A Pending Spin-Off

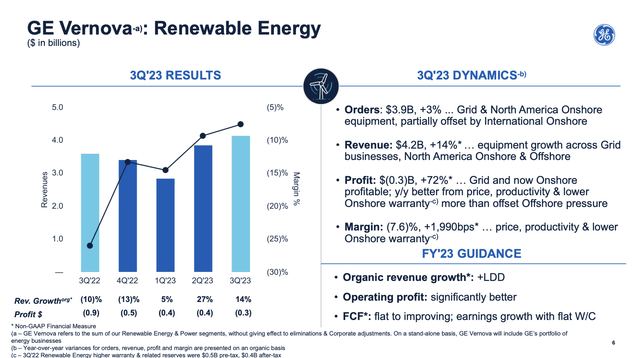

The renewable power phase’s efficiency wasn’t poor both.

GE Vernova’s outcomes improved as a result of lean practices, higher underwriting, selectivity, and productiveness, significantly within the grid and onshore segments.

- Orders in renewables grew by 3% within the quarter and over 80% year-to-date, reaching almost $18 billion.

- Grid orders elevated by over 50% within the quarter.

- Income within the onshore enterprise grew by 14%, and offshore income greater than tripled year-over-year.

Basic Electrical

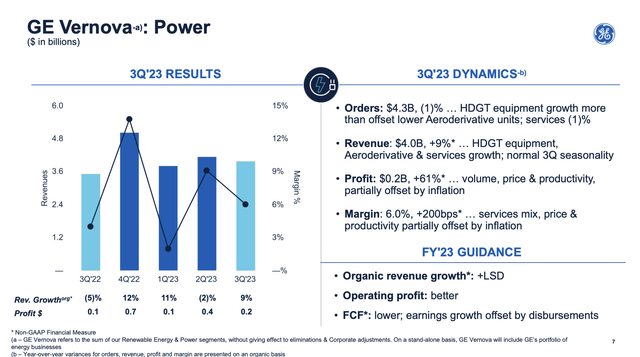

The facility phase confirmed stable year-over-year income progress and margin growth with seasonally decrease outages. Tools orders grew barely, whereas companies declined barely.

Income in energy grew by 9% as a result of pricing and better scope on heavy-duty fuel generators and aero-derivative gear.

Revenue elevated by roughly 60%, with 200 foundation factors of margin growth, pushed by larger quantity, pricing, and productiveness.

The Offshore Wind phase, nonetheless, has confronted challenges in 2023, reporting losses of roughly $1 billion. GE anticipates comparable losses within the following yr however expects substantial enhancements in money efficiency.

Basic Electrical

The facility phase continues to anticipate low single-digit income progress for the yr, with higher year-over-year revenue.

Including to that, as anticipated, GE has introduced extra particulars concerning its plans to spin off GE Vernova and launch GE Aerospace early within the second quarter of 2024.

These new entities can be listed on the New York Inventory Alternate. The corporate has made strategic hires and promotions to make sure sturdy management for these companies.

Basic Electrical

For instance, GE Vernova is on observe to file a confidential Type 10, with the preliminary public submitting anticipated within the first quarter.

Early in March, each GE Vernova and GE Aerospace plan to carry investor days to additional talk their methods and outlook.

Outlook & Valuation

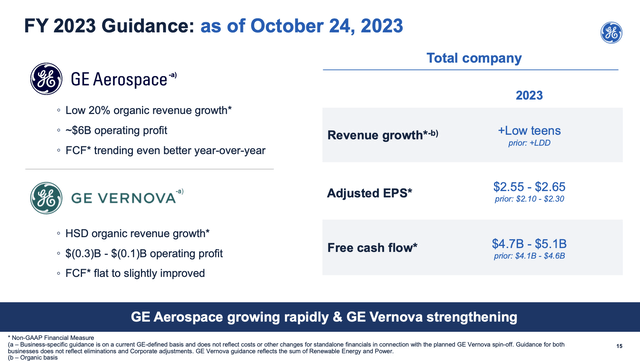

Primarily based on this context, the corporate raised its full-year steering because of the power of GE Aerospace and the advance in GE Vernova.

They now anticipate income progress within the low teenagers, up from low double digits, with adjusted EPS anticipated to be between $2.55 and $2.65, up $0.40 on the midpoint.

Basic Electrical

This enhance is essentially as a result of an enchancment in working revenue, which is predicted to be within the vary of $5.2 to $5.5 billion, and a rise in free money stream to $4.7 to $5.1 billion, up $550 million on the midpoint.

Thus far:

- The corporate is totally benefitting from each protection and industrial demand progress.

- Regardless of industry-wide strain on margins (most hike income steering however not revenue steering), the corporate has raised steering throughout the board.

- Even its non-aerospace segments are sturdy, despite the fact that offshore is weak, which I anticipate to proceed.

- The corporate is gaining momentum in sure protection segments and will take away orders from RTX in sure segments, though I anticipate the affect on RTX to be restricted.

- The valuation is engaging.

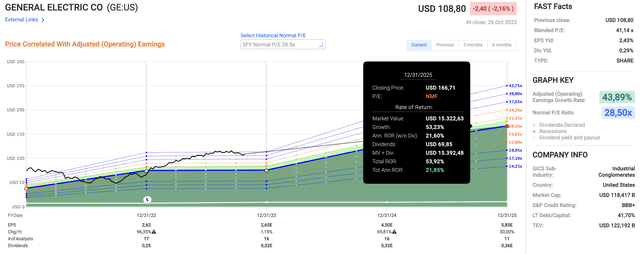

Regardless of a 60% rally year-to-date, the inventory is engaging. GE is buying and selling at 41x earnings. Whereas that will sound like a lofty valuation, the corporate is predicted to develop earnings by 70% subsequent yr, adopted by a 30% surge in 2025.

These numbers are seen within the overview under.

Even when the corporate returns to its 28.5x 5-year normalized earnings a number of, it may return 21% per yr by 2025. That is how highly effective this firm is – theoretically talking.

FAST Graphs

The present consensus worth goal is $131, which is 24% above the present worth.

Final month, Deutsche Financial institution (DB) gave the inventory a $141 goal, which I imagine is honest.

I even assume GE can rise as excessive as $150 with out being overvalued.

I’ve to say that I like GE a lot that I am contemplating shopping for it regardless of having greater than 25% aerospace publicity.

So, for sure, whereas the market may see short-term pullbacks as a result of financial headwinds, I anticipate this firm to have a really shiny future.

The corporate can be anticipated to generate near $8 billion in 2025E free money stream, which interprets to a 6.6% free money stream yield.

As the corporate has a internet leverage ratio of roughly 1x EBITDA and a BBB+ credit standing, we’re doubtless a wave of buybacks within the subsequent few years, boosting EPS for a few years to come back.

Real looking dangers are primarily potential cyclical headwinds, ongoing provide chain points within the {industry} hurting margins, and elevated charges hurting financing of huge initiatives within the aerospace {industry}. I imagine that every one dangers are subdued for GE.

Takeaway

Basic Electrical’s spectacular monetary outcomes, hovering order progress, and strategic strikes, together with the pending spin-off of GE Vernova, show its resilience and potential.

GE’s improved steering, sturdy efficiency throughout segments, and engaging valuation make it an attractive funding alternative.

Regardless of a 60% rally year-to-date, the inventory stays interesting, with potential for important progress within the coming years.

With a internet leverage ratio of roughly 1x EBITDA and a stable credit standing, GE’s future is promising, marked by buyback potential and sustained EPS progress.

As an investor, I am strongly contemplating including GE to my portfolio, assured in its shiny future and strong free money stream prospects.