Pla2na/iStock by way of Getty Pictures

The VanEck Junior Gold Miners ETF (NYSEARCA:GDXJ) is more and more in danger from the continuing rise in actual bond yields, which have been notably unfavourable for gold miners in recent times. Even at present elevated gold costs, the underlying MVIS International Junior Gold Miners Index is experiencing unfavourable free money flows, creating potential for a spike in credit score threat. Whereas a flight to security bid in gold value amid rising recession fears can’t be dominated out, there isn’t any assure that even this could carry the GDXJ as rising default threat might outweigh any optimistic impression. Long run, actual yields ought to transfer considerably decrease, supporting gold costs, however the GDXJ is an costly and dangerous method to profit from such a transfer.

The GDXJ ETF

The GDXJ tracks the efficiency of the MVIS International Junior Gold Miners Index, a market-cap-weighted index of worldwide gold- and silver-mining corporations, with an 80% give attention to gold shares. The ETF has a weighted common market cap of $3.0bn, making it a mid-cap index. Pan American Silver Corp. (PAAS) is the biggest single inventory with a weighting of 6.8% and a market cap of $5.2bn.

Since my final article on the GDXJ in Could, the ETF has misplaced 15% at the same time as gold has fallen by simply 4%, and as I argued then this underperformance has been a long-term characteristic of the GDXJ with little motive to count on it to reverse.

The present dividend yield on the underlying MVIS International Junior Gold Miners Index stands at 1.3%, which is close to all-time highs, however with free money flows in unfavourable territory this can’t proceed. Over the subsequent few months, we may even see dividends observe free money flows decrease to the purpose the place the yield falls under the fund’s expense payment, driving the GDXJ’s dividend yield unfavourable.

Closely Uncovered To Tight Financial Coverage

Regardless of the appreciable underperformance of the GDXJ versus gold costs, the index nonetheless trades at a lofty 44% trailing earnings. In the meantime, free money flows really unfavourable, with capital expenditure exceeding working money flows for over a yr now.

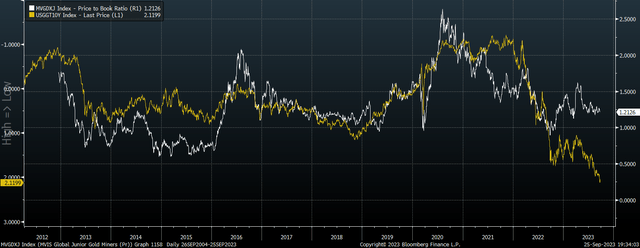

Gold mining bulls prefer to give attention to the comparatively low EV/EBITDA, value/gross sales and value/e book worth ratios on the GDXJ as proof that the market is affordable, implicitly assuming that profitability will recuperate. Nevertheless, even utilizing these metrics valuations are roughly according to the common seen over the previous 10 years, whereas surging actual bond yields counsel they need to be decrease.

GDXJ Value/E-book Vs 10-12 months US Actual Yields (Bloomberg)

Rising Default Danger Could Drive The Index Beneath E-book Worth

Some buyers have argued that gold is nicely positioned to profit as a protected haven asset as Fed tightening undermines shares, however this view is illogical. Whereas nothing could be dominated out, historical past means that gold ought to be the primary victims of continued tight coverage. Moreover, even when it’s the case that gold stays elevated, gold mining shares should undergo from rising default threat. This was the case through the Covid panic when the GDXJ misplaced nearly half its worth at the same time as gold remained fairly secure. An identical scenario occurred through the International Monetary Disaster, the place rising default issues noticed the underlying index lose 70% relative to gold costs.

It Would Take A Main Reversal In Actual Yields To Drive GDXJ Positive factors

In an effort to see a robust revival within the GDXJ we might seemingly have to see the Fed ease coverage with out there being a deflationary episode that drives up mining inventory threat premiums. Such a situation would help a rally in gold costs and permit miners to outperform as they’ve tended to do throughout gold value rallies. Nevertheless, as I argued final week on this article, the Fed is simply prone to reverse coverage after we see a crash in market confidence, which might seemingly trigger the GDXJ to fall additional. Long run, I totally imagine that the US’ dire fiscal place will necessitate a transfer again under zero in actual bond yields, which ought to be very optimistic for gold and the GDXJ. Nevertheless, the GDXJ is an costly and dangerous method to guess on such an end result.