- Galaxy Digital purchases $23.4 million price of BTC.

- Institutional funding sees Bitwise broaden to European market.

All year long, company Bitcoin [BTC] holders have been on a shopping for spree. Because the launch of BTC spot ETFs and a worth spike to a report excessive, corporations have tried to build up the king coin additional.

In current developments, Galaxy Digital has bought 400 BTC.

Galaxy Digital purchases $23.4M price of BTC

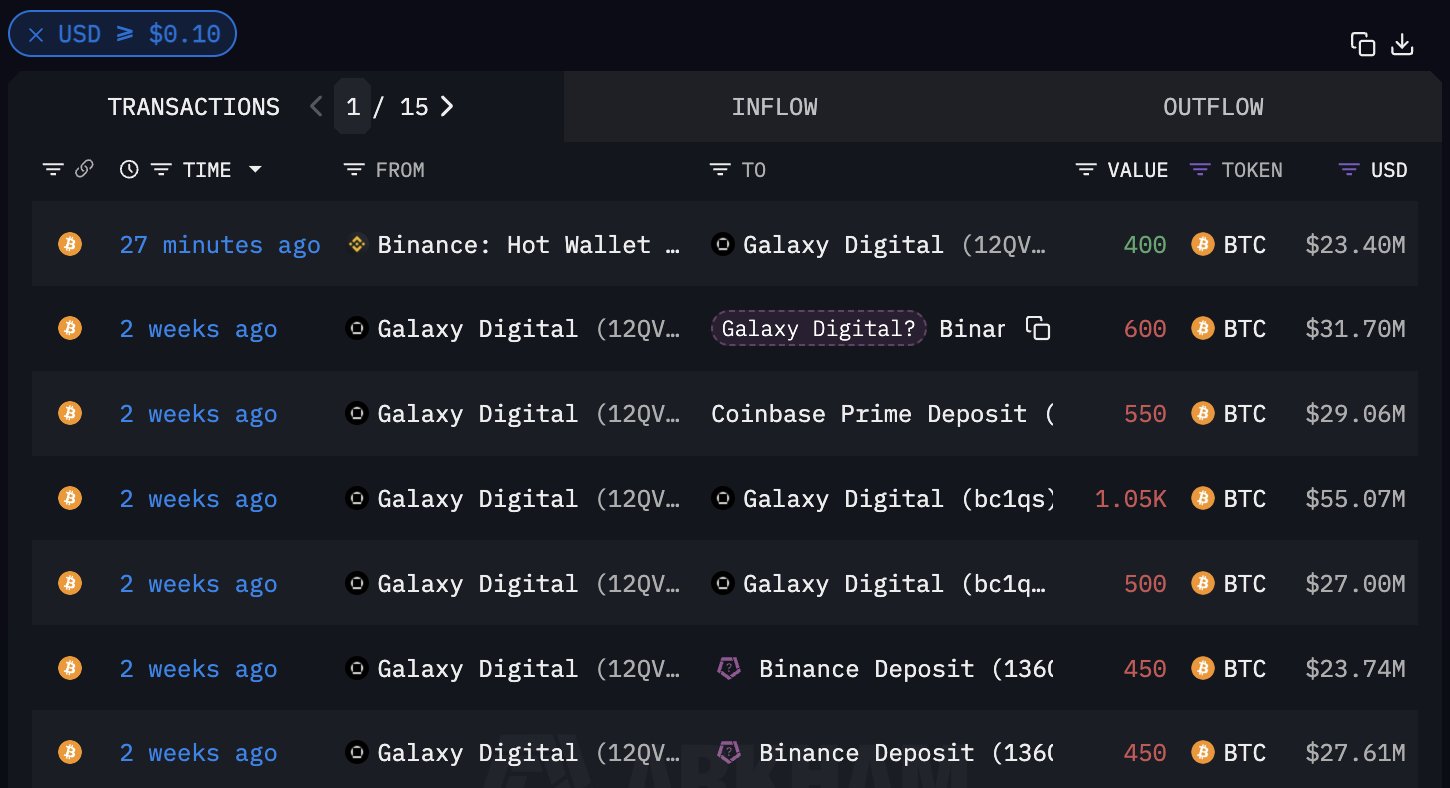

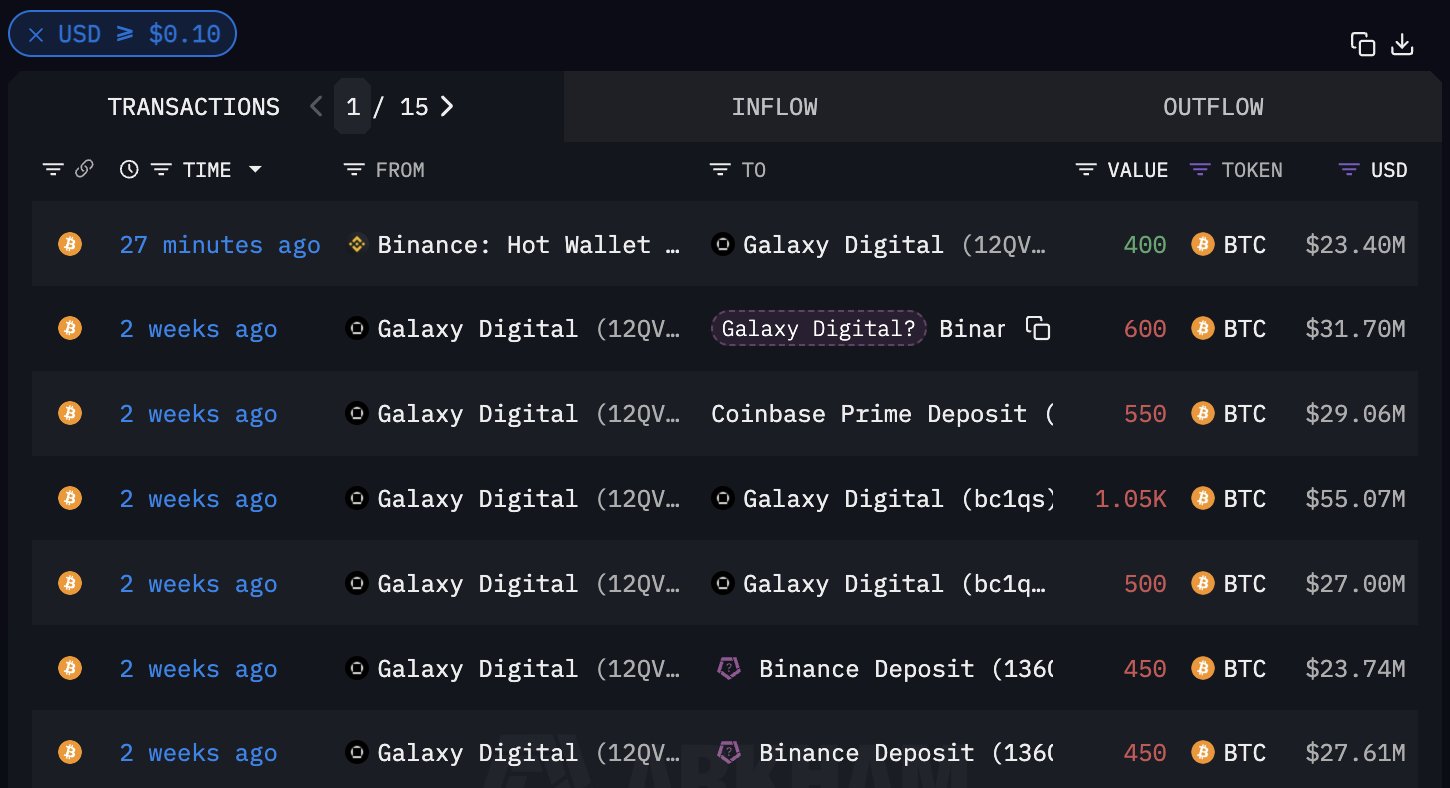

In response to a report from Arkham Intelligence, the asset supervisor’s pockets 12QVsf acquired 400 BTC from Binance.

Based mostly on market charges, the acquisition was price $23.4 million. The transaction was reported by On-chain analyst ai_9684xtpa by way of the X web page, noting that,

“Galaxy Digital ( @galaxyhq) is suspected to have elevated its holdings by 400 BTC half an hour in the past, price 23.4 million US {dollars}.”

Supply: X

The current buy suggests the corporate’s shift in its funding technique, particularly when the crypto market is experiencing excessive volatility.

Galaxy Digital’s BTC Technique

Galaxy Digital’s transfer to bolster its holdings arises when it has been on a promoting spree. In response to the On-chain analyst report, the agency has just lately made main gross sales. By X, ai_9684xtpa reported that,

“The company has withdrawn a complete of 6,950 BTC from #Binance between 07.27 and 08.02, with a worth of as much as 464 million US {dollars} and a mean worth of $66,776.Then, within the week from 08.03 to 08.06, one other 2050 cash (about 112 million US {dollars}) had been recharged to the trade. In the event that they had been bought, they’d lose 24.78 million US {dollars}.”

Galaxy Digital has a singular method to Bitcoin because it makes gross sales with out capitalizing on favorable market circumstances. The corporate’s method to BTC is broadly dynamic because it sells after which purchases.

The corporate employs an acquisition and redistribution technique for its Bitcoin holding. Subsequently, the current acquisition reveals the agency’s confidence within the long-term worth of the crypto.

What it Means for BTC?

The most recent transfer by Galaxy Digital displays the broader market sentiment of establishments. Institutional buyers have elevated their funding in Bitcoin.

As reported earlier by AMBCrypto, BTC company holders equivalent to Marathon, Microstrategy and Metaplanet have all shifted to accumulation. Subsequently, establishments are staking on BTC future worth with elevated shopping for actions, additional driving BTC costs up.

Bitwise expands in Europe with ETC Group

Galaxy Digital’s current buy follows the general market curiosity on the crypto market amongst main corporations. As an example, Bitwise has made an enormous transfer by increasing its operations throughout the European market.

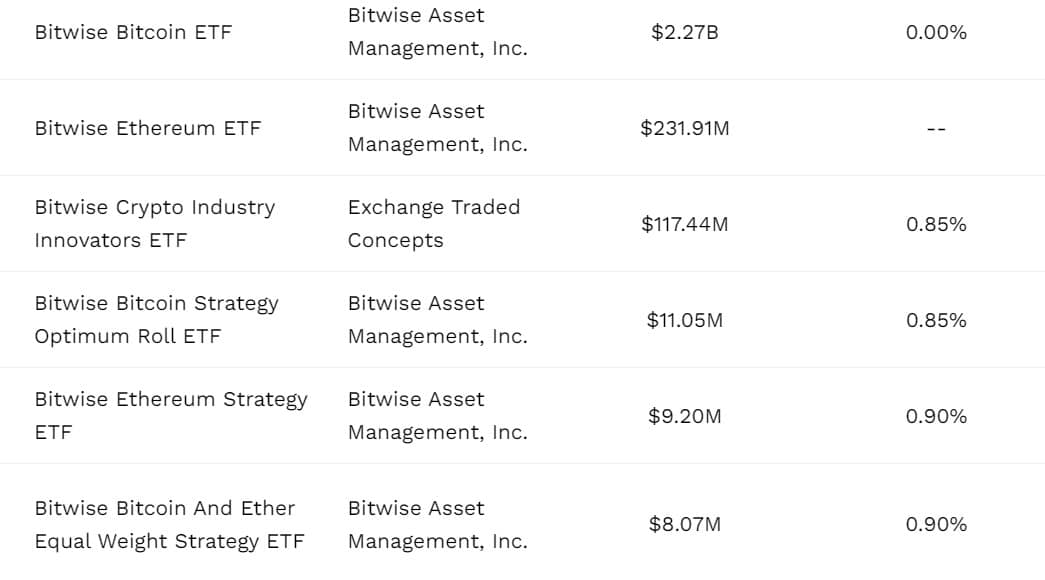

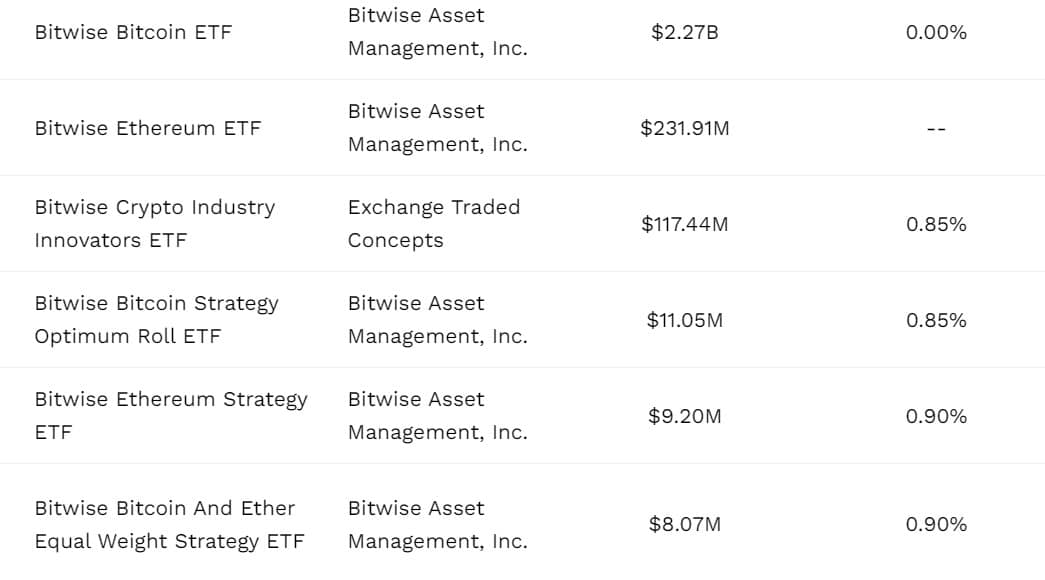

The San Francisco-based asset supervisor Bitwise has introduced the acquisition of ETC Group, a London-based crypto ETP issuer. ETC Group is a significant crypto asset supervisor with greater than $1 billion in belongings beneath administration.

Subsequently, the acquisition marks Bitwise’s growth into Europe, including 9 European-listed Crypto ETPs to its suite of ETPs.

Supply: ETFs.com