KamiPhotos/iStock through Getty Pictures

Sprott Focus Belief Inc. (NASDAQ:FUND) invests in shares with a fundamentals-based method by way of a closed-end fund (CEF) construction. The attraction right here is the actively managed technique from a acknowledged establishment. Earnings traders can also discover attraction within the 7% yield by way of a managed distribution.

That being stated, we’re highlighting an ongoing selloff and lagging returns extra this yr. The fund’s concentrated portfolio with a heavy tilt in the direction of cyclical sectors together with fundamental supplies and power sectors has underperformed in 2023 and faces distinctive dangers within the present market surroundings.

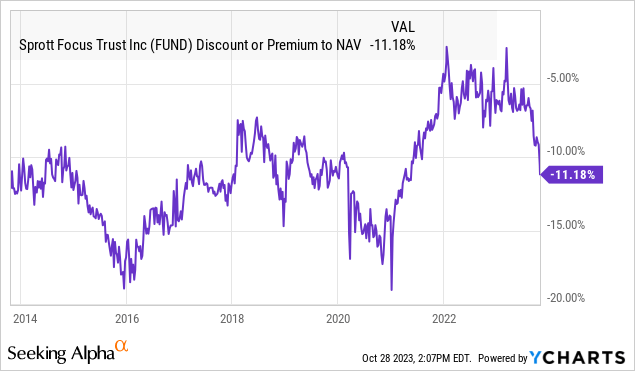

The sign we’re watching is a widening low cost to NAV which doubtless displays investor danger aversion towards this particular method. We count on the volatility to proceed and recommend avoiding FUND on the present degree.

What’s the FUND CEF?

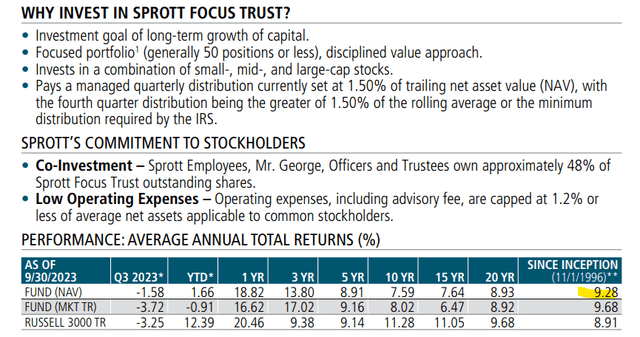

FUND has a major funding goal of long-term capital growth. In response to Sprott, the funding administration workforce focuses on “high-quality companies with sturdy steadiness sheets which are buying and selling at enticing valuations”.

Technically, the distribution coverage is to pay out 1.5% of the trailing web asset worth, the precise yield achieved by shareholders displays the altering share value. The quarterly dividend is variable when it comes to the per-share quantity. A portion of this quantity has been categorized as a return of capital.

Traditionally, the observe file right here is stable with information suggesting the fund has outperformed the Russell 3000 Index benchmark since its inception again in 1996. On the similar time, the efficiency has been combined over completely different time frames over the previous 20 years.

supply: Sprott

FUND Portfolio

At the same time as FUND does not have a serious investing constraint or particular mandated publicity, we discover the present portfolio displays a specific market philosophy per the fund sponsor Sprott Inc. (SII). The group is acknowledged for its treasured metals funding automobiles as a pioneer within the section because the Eighties.

Within the newest managers’ commentary from the tip of July, the FUND portfolio supervisor pointed to an outlook for structurally excessive inflation and rising rates of interest as a tailwind for “laborious asset investments”. On this case, past a choose variety of small positions in gold mining shares, broader fundamental supplies and power sectors collectively symbolize 53% of the portfolio.

We discover a “targeted” portfolio of 34 shares with Westlake Company (WLK), a chemical compounds producer, adopted by Pason Programs Inc. (OTCPK:PSYTF) within the oil companies trade, and Reliance Metal & Aluminum Co. (RS) as the most important holdings.

Down the portfolio, it is truthful to say that FUND likes metal shares with Nucor Holdings (NU) and Metal Dynamics (STLD) among the many high 10 investments. At the same time as there are positions in some mega-cap “blue-chips” like Exxon Mobil Corp. (XOM) and Berkshire Hathaway Inc (BRK.A), all the portfolio is primarily in mid-cap and small-cap shares.

supply: Sprott

FUND Efficiency

Whereas the FUND funding workforce has been largely proper on its name for larger rates of interest and cussed inflation, that backdrop simply hasn’t translated with a very good market efficiency this yr.

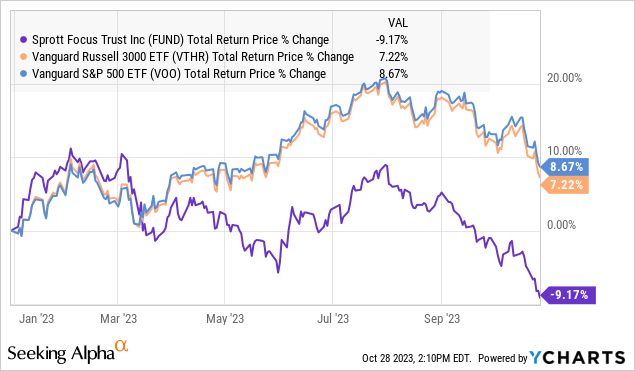

FUND is down by -4.3% on a complete return foundation at its NAV yr thus far, which is a big unfold in comparison with the 7% constructive return for its Vanguard Russell 3000 ETF (VTHR) benchmark.

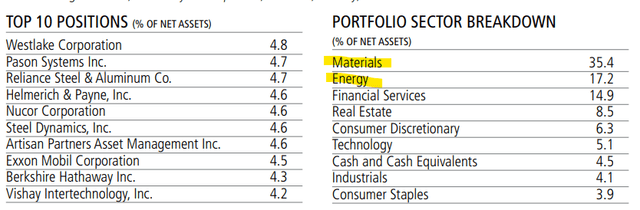

Our rationalization for the lagging returns is predicated on a number of elements. The primary level goes again to FUND’s sector publicity with supplies, financials, and actual property among the many worst-performing teams this yr. The sense is that these names have bought off extra primarily based on fears of a worldwide financial slowdown whereas inflationary pressures have turn into much less of a priority in comparison with 2022.

Individually, FUND is considerably underweight in know-how sector shares in comparison with its benchmark. This selection has been a detractor to the efficiency contemplating tech included among the market’s largest winners in 2023. By that very same measure, the fund’s weighting towards small caps as a market section has additionally underperformed, which has been one other headwind.

We consider this present portfolio positioning is contributing to FUND’s widening low cost to NAV which has compounded the losses for shareholders. In comparison with the -4.3% YTD decline on the web asset worth, FUND can be down -9% on a complete return foundation on the share value.

The present 11% low cost to NAV is down from a low of three% earlier this yr. Our interpretation right here is that the market is not too enthusiastic in regards to the near-term outlook for this portfolio. Needless to say FUND has traded with a reduction past 15% a number of instances over the previous decade which implies there could also be room for the fund to fall even additional.

What’s Subsequent For FUND?

In our view, the FUND technique, together with its current efficiency and prospects leaves so much to be desired. We’re not satisfied {that a} portfolio constructed round fundamental supplies will carry out nicely over the close to time period and into 2024.

Whereas the theme of inflationary beneficiaries stood out between 2021 and 2022 throughout a interval of worldwide provide chain shortages and momentum in commodities, the setup now could be a more difficult macro backdrop. The continuing power of the U.S. Greenback and indications for weaker financial circumstances going ahead have pressured many of those cyclical names.

In some ways, FUND in the present day seems extra like a contrarian play betting that inflation will re-accelerate or that the worldwide financial system will expertise some kind of progress renaissance.

In fact, we may very well be flawed, and it is truthful for anybody to have a bullish view of metals and even oil. Our response to that may be to say that there are doubtless extra focused or sector-specific funds which may be higher at expressing that market outlook. General, FUND makes an attempt to be a number of issues without delay whereas failing to have one sturdy promoting level.

Last Ideas

Sprott Focus Belief is a novel fairness CEF that merely seems to be on the flawed aspect of present market tendencies. Whereas its technique has labored over varied timeframes, we merely cannot suggest FUND as a core holding for many traders primarily based on what we view as underlying weaknesses to its method that carry an excessive amount of danger.

Our base case right here is for the fund to underperform its benchmark and the broader market on a complete return foundation with the expectation that the sectors the fund is underweight will find yourself outperforming going ahead.