- FTX has introduced a plan to repay collectors as much as $16.3 billion

- Analysts consider repayments might stability market dynamics, resulting in a bullish 2nd half in 2024

FTX, the crypto-exchange that filed for chapter final 12 months, has announced a major plan to repay its collectors, doubtlessly injecting new momentum into the crypto-market. On 8 Might, it was disclosed that the change might repay roughly 98% of its collectors, which might quantity to as a lot as $16.3 billion.

These holding declare quantities beneath $50,000 are eligible for as much as 118% restoration, based mostly on November 2022’s cryptocurrency costs. This transfer has been welcomed by the market, with CEO Ray noting,

“We’re happy to be ready to suggest a Chapter 11 plan that contemplates the return of 100% of chapter declare quantities plus curiosity for non-governmental collectors.”

The reimbursement plan by FTX is anticipated to have important ripple results throughout the crypto-market. This was the topic of K33 Analysis’s newest report, authored by analysts Vetle Lunde and Anders Hesleth.

In accordance with the identical, the money payouts from FTX are more likely to create a “bullish overhang” for the market, doubtlessly resulting in elevated shopping for strain.

Analysts weigh In: FTX repayments vs. market dynamics

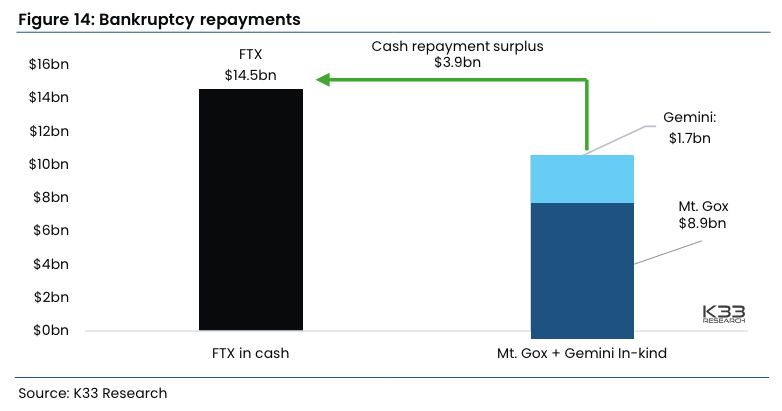

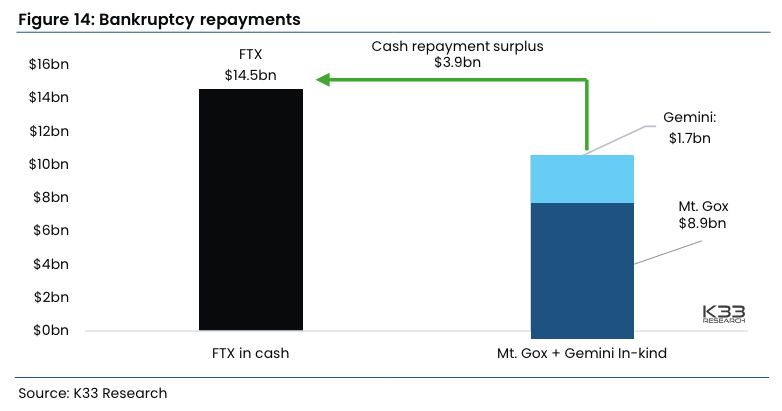

K33 Analysis’s analysts consider that not all creditor repayments have a bearish influence. Of their view, cash-based repayments by FTX will probably be opposite to the crypto-based repayments deliberate by different entities like Mt. Gox and Gemini, that are valued at a mixed $10.6 billion.

They argue that the shopping for strain from money recipients of FTX might neutralize the promoting strain from these receiving crypto payouts. “Not all creditor repayments are bearish,” they emphasised, suggesting that the general impact may very well be extra balanced than initially anticipated.

Nevertheless, the precise affect of those repayments in the marketplace is difficult to foretell upfront. Ergo, the timing of those funds will probably be essential in assessing their full influence.

Whereas Gemini’s $1.7 billion reimbursement is anticipated in early June and Mt. Gox’s $8.9 billion by October 2024, the FTX reimbursement schedule remains to be underneath courtroom overview, with most collectors anticipating disbursements later this 12 months.

“The completely different timing of those repayments represents one more indication of a gradual summer time out there and a strong finish to the 12 months.”

Market traits and future outlook

In the meantime, the worldwide crypto-market has proven robust bullish indicators not too long ago, with Bitcoin and Ethereum breaking main resistance ranges. Over the past 24 hours alone, the market has surged by 5.8%, including over $100 billion to the worldwide crypto-market cap.

This uptick has led to important quick dealer liquidations. Within the aforementioned interval, 58,875 merchants had been liquidated, totaling $159.13 million in liquidations. This wave of liquidations follows a current development the place ETH and PEPE contributed to $50 million briefly dealer losses.

Supply: Coinglass

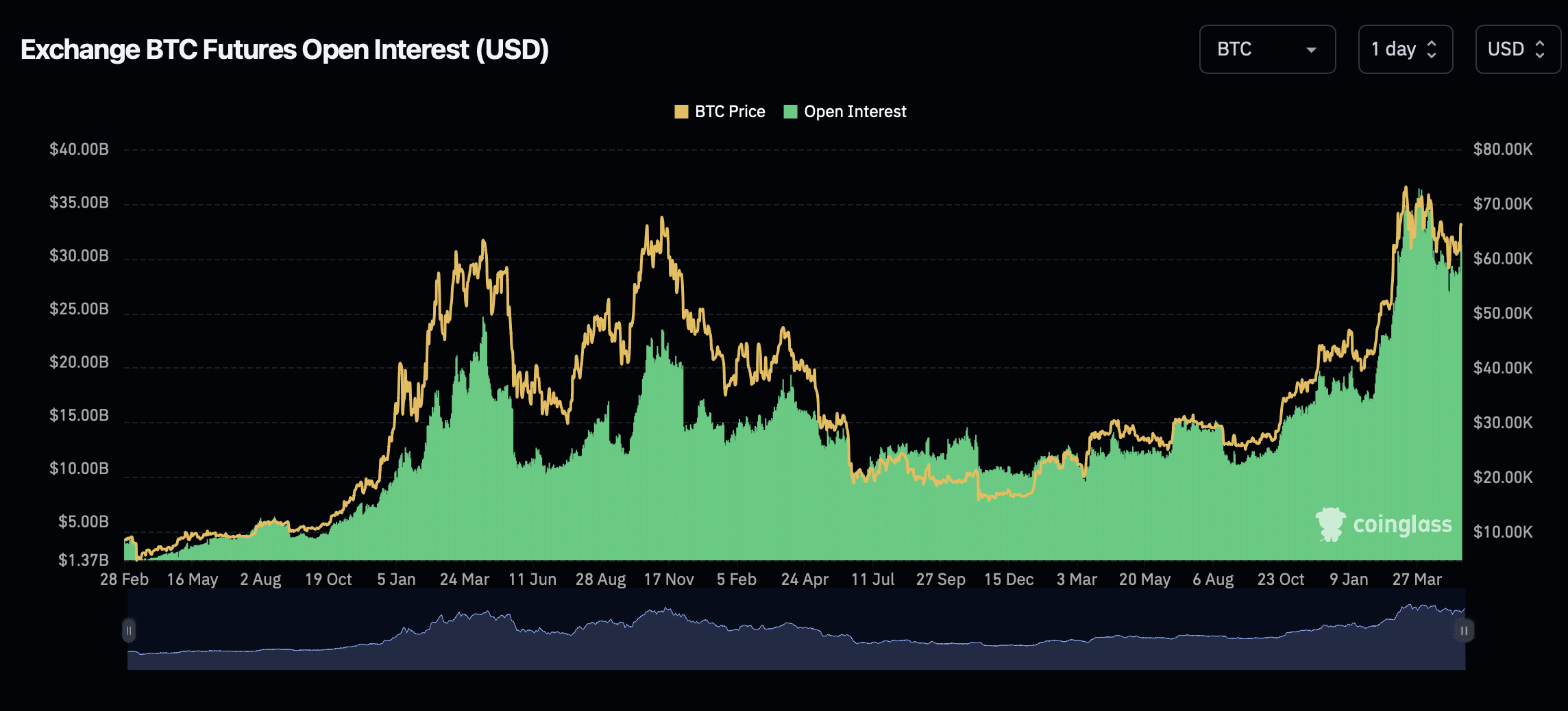

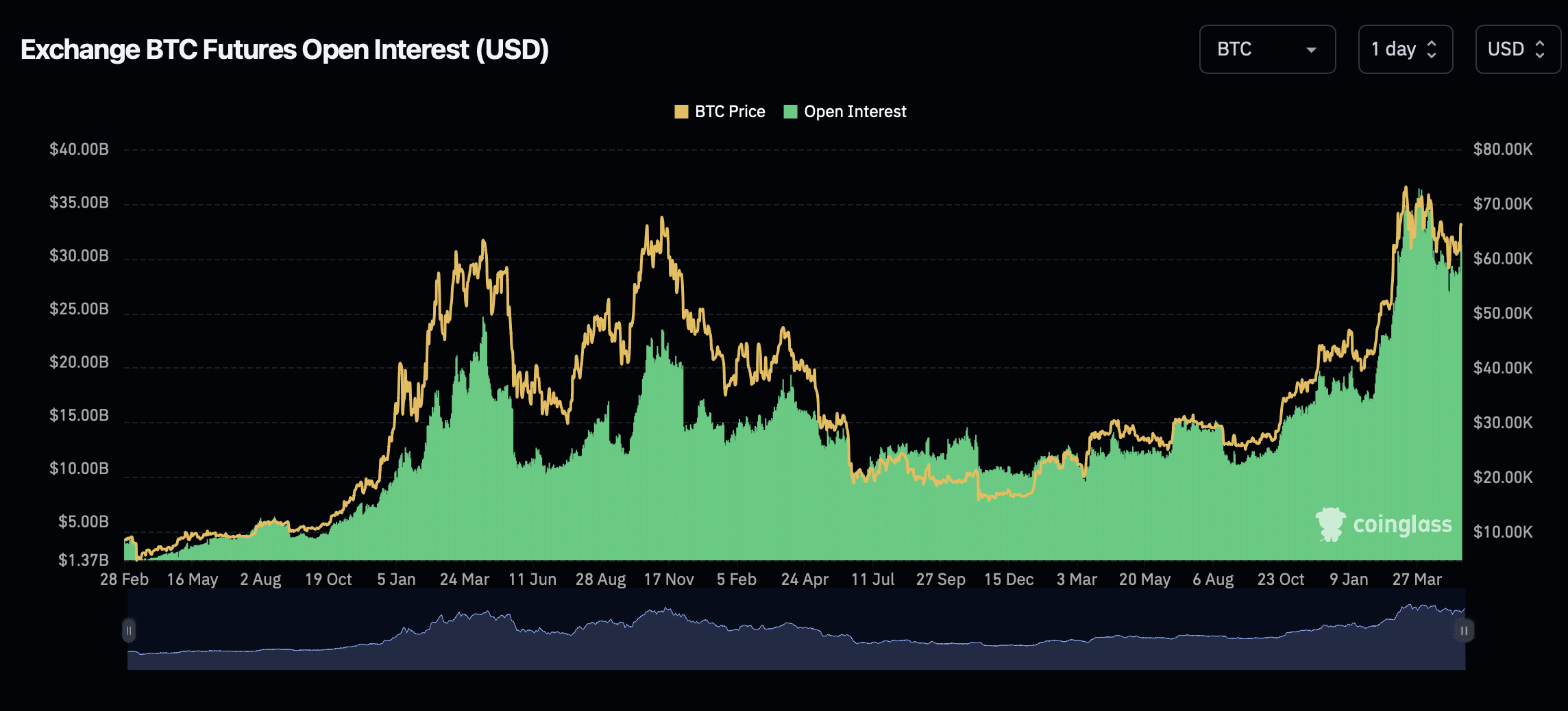

Furthermore, the hike in Bitcoin’s open curiosity, up almost 10% within the final 24 hours, signifies rising capital influx into the market. That is additionally an indication of traders being more and more assured concerning the market’s path.

Supply: Coinglass