Overview

As Western Australia continues to face a looming energy supply-demand deficit inside the subsequent decade, important investments in energy era for the area are imminent and Frontier Vitality (ASX:FHE, OTCQB:FRHYF) is completely positioned to doubtlessly grow to be not solely a key a part of the State’s vitality answer within the instant future, but in addition profit from what’s forecasted to be record-high vitality costs.

The South West Interconnected System (SWIS), the primary electrical energy grid for Western Australia’s southwest area, is in instant want of appreciable funding in electrical energy era for the area, with the Australian Vitality Market Operator projecting a rise in vitality demand of between 78 and 220 p.c.

The challenges this forecast represents are solely additional exacerbated by the Federal Authorities’s plans round renewable vitality. By 2030, Australia goals for 82 p.c renewable energy era. This consists of the deliberate closure of all coal-fired energy capability by the identical 12 months, which represents roughly 30 p.c of provide.

Solely 35 p.c of the SWIS is at the moment generated by renewable vitality.

While the State is planning a serious enlargement of the grid, this may take time and appreciable value. Following this enlargement, further funding and additional time for approvals are required to develop new vitality to hook up with the grid.

WA’s points are not at all an remoted occasion on a world scale, with grid constraints constantly recognized as the main roadblock to attaining its renewable vitality targets, all whereas additionally making certain vitality safety and secure provide.

Frontier Vitality, a near-term, absolutely built-in renewable vitality and hydrogen developer, will be capable of meet the market’s pressing requirement for vitality with the event of their Stage One (120MW) photo voltaic undertaking to start development in 2024.

This, nonetheless, is admittedly solely the beginning for Frontier, as they’ve outlined a three-pronged technique that goals to not solely meet these pressing vitality necessities and better costs, but in addition place the corporate for future development industries, corresponding to hydrogen. This technique will see the corporate develop three essential areas of the enterprise: photo voltaic, hydrogen and a twin fueled hydrogen (pure fuel) peaking plant.

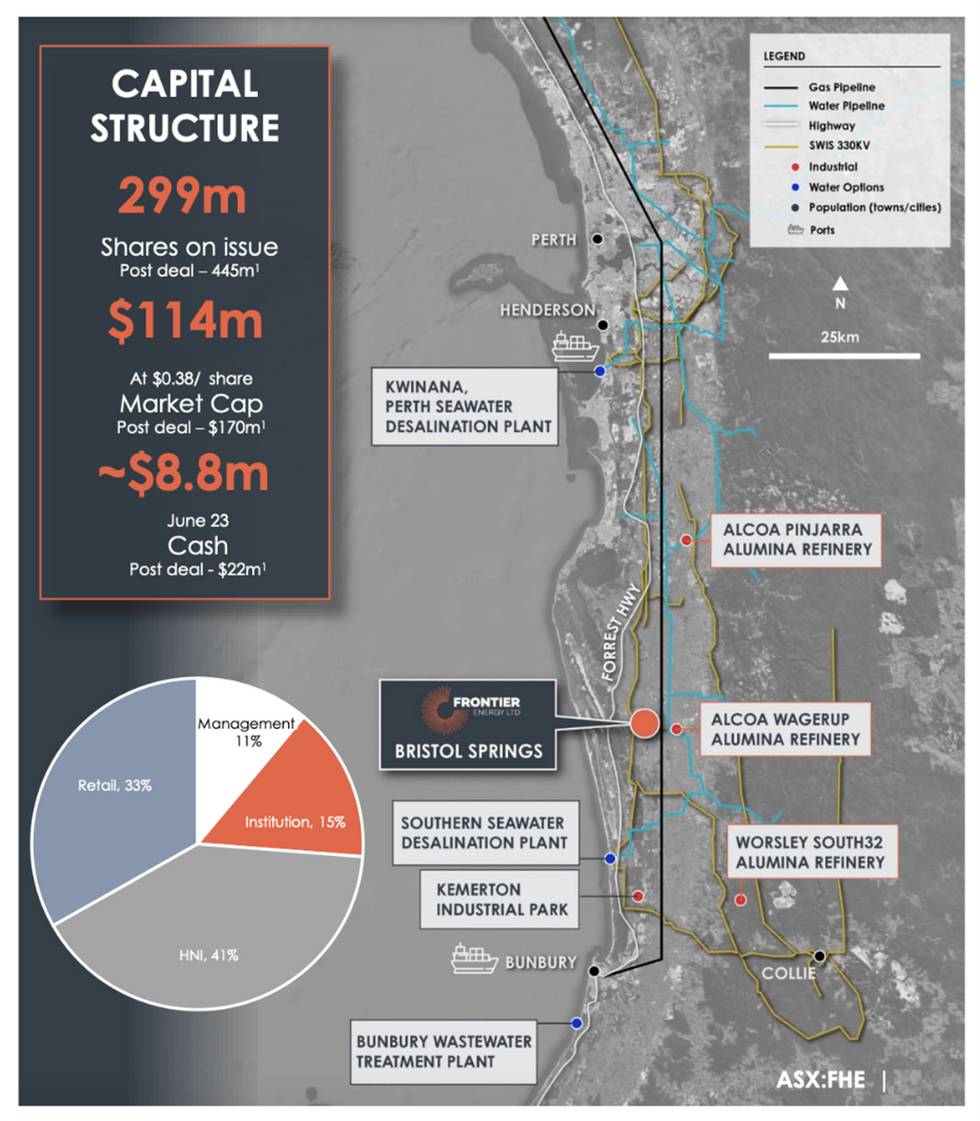

The explanation Frontier is able to transfer ahead so shortly is that the flagship undertaking the place all the pieces is going down, Bristol Springs, advantages from world-class infrastructure and strategic partnerships, which embody an settlement with Western Australia’s Water Company, entry to the Dampier Bunbury Pipeline, pre-approved energy connections, and 868 hectares of freehold land with no native title. With out these property and partnerships, the undertaking’s capex would have elevated by over $1 billion and its manufacturing timeline would lengthen to greater than 5 years. As well as, all permits and approvals for the undertaking have already been secured.

Maybe essentially the most essential facet, nonetheless, is that the connection to the WA electrical energy community is already in place. These connections are extraordinarily troublesome to entry and take years to determine.

Frontier is wanting far past its Stage One growth as the corporate not too long ago introduced the deliberate acquisition of Waroona Vitality (TSXV: WHE) that will probably be accomplished in December 2023. This transaction will give Frontier entry to 355 MW of shovel-ready photo voltaic era, with potential to increase to over 1 GW, which might doubtlessly play an necessary function within the State’s vitality necessities.

Renewable Vitality answer within the coronary heart of commercial WA

Firm Highlights

- Frontier’s flagship undertaking, Bristol Springs, has entry to world-class infrastructure which significantly reduces each upfront capex and its total growth timeline.

- The acquisition of Waroona Vitality will function a capstone on Frontier’s growth technique, including 355 MW of solar energy era with the capability to increase as much as 1 GW.

- The corporate is anticipated to generate main information movement because it strikes in the direction of FID on a number of growth alternatives in 2024.

- These are the strongest ever market circumstances for each renewable vitality and hydrogen deployment. A near-term, absolutely built-in renewable vitality and hydrogen producer, Frontier Vitality is ideally positioned to learn from these circumstances.

- The South West Interconnected System, Western Australia’s main energy grid and vitality market, is in dire want of funding in new electrical energy era.

- The present demand forecast over the following decade ranges from 78 p.c to 220 p.c. Assembly this demand will probably be much more difficult on condition that the State intends to shut all coal-fired energy capability, which at the moment accounts for roughly 30 p.c of energy era, by 2030.

- SWIS at the moment generates solely 35 p.c of its energy by means of renewables, far beneath the Australian authorities’s goal of 82 p.c.

- The corporate has a three-pronged growth technique, starting with the institution of photo voltaic infrastructure as a basis adopted by the deliberate development of a dual-fuel hydrogen peaking plant and entry into the inexperienced hydrogen market.

- Frontier’s finish objective is to develop a scalable renewable vitality hub which can create long-term sustainable worth and supply a major contribution to each the State and Federal decarbonisation technique.

Key Venture

Bristol Springs

Located 120 kilometres from Perth, Frontier’s Bristol Springs Renewable Vitality and Inexperienced Hydrogen undertaking is on monitor to start development of Stage One photo voltaic growth in 2024. The 868-hectare undertaking is situated on flat, predominantly cleared freehold land which is simply 3.5 kilometres from the Landwehr Energy Terminal, lower than 3 kilometres from the Stirling Trunk Foremost Water Pipeline and three kilometres from a fuel branching level related to the Dampier-Bunbury Pipeline. Its proximity to this infrastructure reduces the undertaking’s upfront capex and considerably accelerates its growth timeline.

Frontier is at the moment engaged on a proposed acquisition of Waroona Energy for which it has already signed a Letter of Intent. This transaction, as soon as accomplished, will rework Frontier right into a large-scale renewable vitality firm with shovel-ready photo voltaic era of 355 MW and the potential for enlargement to over 1 GW. This acquisition additionally offers Frontier with a singular, accelerated turnkey answer for the event and consumption of inexperienced hydrogen courtesy of Waroona’s proposed 120 MW twin gasoline peaking plant, doubtlessly positioning Frontier because the main developer of inexperienced hydrogen within the nation.

All growth on Bristol Springs will probably be carried out with a concentrate on sustainability, as detailed in Frontier’s Q2 2023 inaugural Sustainability Report.

Venture Highlights:

- Betting on Photo voltaic: Photo voltaic vitality is likely one of the most superior and most dependable renewable vitality options, significantly in Australia, which has a number of the greatest circumstances for producing solar energy. Capital prices for photo voltaic have additionally fallen considerably over the previous decade, while innovation upside is arguably close to its peak.

- Assembly a Market Want: Frontier’s multi-pronged technique is geared toward assembly the wants of the electrical energy market while concurrently maximising its profitability:

- Photo voltaic vitality will energy the corporate’s hydrogen technique throughout low-price/shoulder intervals.

- Inexperienced hydrogen manufacturing will happen throughout noon.

- A peaking plant will function within the early night and early morning, throughout instances of peak vitality consumption.

- Accelerated Improvement: Bristol Springs advantages from the next agreements, insurance policies and infrastructure:

- The Landwehr Terminal will present the undertaking’s accomplished grid with as much as 1.1 GW of electrical energy export capability by means of two connections.

- An settlement with the Water Company provides the undertaking entry to 1,250 kl of unpolluted, contemporary water per day and eliminates the price of establishing a desalination facility (water is an important factor to create inexperienced hydrogen – the opposite being renewable vitality).

- Frontier intends to leverage the Australian Authorities’s Hydrogen Headstart program for additional growth. It at the moment meets all standards for consideration.

- A possible connection level to the DBNGP, Australia’s largest pure fuel pipeline, is situated simply 0.3 kilometres from the positioning of the undertaking’s proposed hydrogen plant. Federal and State governments have already begun the method of amending pure fuel legal guidelines and rules to introduce hydrogen and related gasses.

- Present Progress: Stage one growth of the undertaking is nearing its last funding determination (FID). Frontier/Waroona commenced a DFS for a 120-MWdc photo voltaic facility, which can ship a hard and fast value estimate and finalise the design, measurement and expertise choice.

- A Pathway for Inexperienced Hydrogen Consumption: Waroona Vitality has commenced a research to evaluate the event of a inexperienced hydrogen twin gasoline peaking plant which is anticipated to be accomplished in This autumn 2023. The 120-MW peaking plant, which will be fuelled by each inexperienced hydrogen and pure fuel, would generate a minimal of ~AU$27million each year in income.

Administration Workforce

Samuel Lee Mohan — Managing Director

Samuel Lee Mohan is an completed vitality government with over 20 years of expertise within the vitality and utilities business. His expertise spans many aspects of the business, from design and development by means of to strategic asset administration, regulation, coverage, industrial and innovation.

His earlier senior administration positions embody International Head of Hydrogen of Xodus Group, a subsidiary of Subsea 7, the place he developed and led the corporate’s total hydrogen technique. On this function, he additionally conceptualised the corporate’s largest hydrogen undertaking, Venture MercurHy. Previous to Xodus Group, Lee Mohan spent six years at ATCO, the place he was instrumental in growing the corporate’s hydrogen technique together with the conceptualisation, design and development of Australia’s first inexperienced hydrogen Microgrid, the Clear Vitality Innovation Hub.

Lee Mohan earned his MSc in mechanical engineering from the College of Portsmouth and an MBA from the Australian Institute of Enterprise.

Grant Davey — Govt Chair

Grant Davey is an entrepreneur with 30 years of senior administration and operational expertise within the growth, development and operation of worldwide mining and vitality tasks.

He’s the chairman of Frontier Vitality (ASX:FHE), director of Lotus Assets (ASX:LOT) and Cradle Assets (ASX:CXX), and is a member of the Australian Institute of Firm Administrators.

Chris Tub — Govt Director

Chris Tub is a chartered accountant and member of the Australian Institute of Firm Administrators with over 20 years of senior administration expertise within the vitality and assets sector, each in Australia and Southeast Asia. Tub has broad expertise together with monetary reporting, industrial administration, undertaking acquisition, ASX compliance and governance. He’s a non-executive director of Cradle Assets and firm secretary of Copper Strike.

Dixie Marshall — Non-executive Director

Dixie Marshall has 40 years’ expertise in strategic communications together with disaster communications, editorial media, promoting, advertising and marketing and authorities communications.

At present the chief development officer of Marketforce, WA’s oldest promoting company, Marshall beforehand labored because the Western Australian Authorities’s director of strategic communications in addition to for the 9 Community as a senior information anchor. At present, she serves because the deputy chair of the WA Soccer Fee and a commissioner of The Australian Sports activities Fee and can be a director of ASX-listed Lotus Assets.

Amanda Reid — Non-executive Director

Amanda Reid has a major background in authorities relations, offering recommendation to a large cross part of firms and organisations for greater than 15 years for 2 nationwide authorities relations and company communications companies. This included 5 years as Accomplice at GRA Companions. She was additionally a senior adviser in earlier WA state governments with accountability for managing a strategic communications unit.

She has held non-executive board positions throughout each non-public firms and not-for-profit organisations and is a member of the Australian Institute of Firm Administrators.

Catherine Anderson — Firm Secretary

Catherine Anderson (B Juris (Hons), LLB (UWA)) is a authorized practitioner admitted in Western Australia and Victoria with over 30 years’ expertise in each high-level non-public follow and in-house roles, significantly within the space of capital raisings, company acquisitions, structuring and regulatory compliance. She has suggested on all points of company and industrial legislation and brings intensive expertise over a variety of industries, specifically the mining and IT/cyber safety sectors.

Anderson is an skilled firm secretary for each listed and unlisted public firms, and has served as a director of an ASX listed junior explorer. She has supplied consultancy providers to entities wishing to proceed to IPO and ASX itemizing and has twice been nominated for the Telstra Enterprise Girl of the 12 months Award.

Warren King — Technical Director (Vitality)

Warren King is an engineer with 25 years of expertise, specialising within the client-side undertaking administration of the engineering, design, procurement and development of mineral processing crops and mine infrastructure (together with varied fuel energy options and photo voltaic). He has labored in Africa, Indonesia and Australia and holds each a Bachelor of Engineering (mechanical) and a Bachelor of Legal guidelines diploma.

King has carried out and managed varied undertaking execution fashions (corresponding to EPC, EPCM, and EP with proprietor managed development).

Amy Sullivan — ESG Supervisor

Amy Sullivan has nearly 20 years’ expertise within the mining business throughout Australia, holding government roles in approvals, atmosphere, neighborhood and authorities relations. While working with VHM Restricted, she led the approvals and development group for the Goschen Uncommon Earths and Mineral Sands Venture and performed a key function in establishing relationships with authorities, native councils and the neighborhood in addition to managing the State and Commonwealth approvals technique, together with acquiring main undertaking standing.

Extra not too long ago, Sullivan practised as a sustainability and ESG marketing consultant working with firms to implement ESG and sustainability methods. She holds a Bachelor of Environmental Administration with Honours from the College of Notre Dame.

Martin Stulpner — Company Improvement Supervisor

Martin Stulpner has over 20 years’ expertise within the mining and monetary providers industries, together with in company growth, M&A, strategic planning and fairness analysis (promote facet).

Stuplner’s earlier senior management positions embody GM at Aquila Assets, the place he was accountable for Aquila’s stake within the West Pilbara Iron Ore Venture (now below development because the $3-billion Onslow Iron Venture) and for Aquila’s South African enterprise. As director at Macquarie, he supplied fairness analysis of Western Australian metals and mining firms to institutional buyers in Australia and globally.

Lastly, as VP of technique at Anglo American Ferrous Metals (FTSE 100), Stulpner developed and led a world strategic planning group to facilitate knowledgeable strategic determination making by the chief.