Brett_Hondow/iStock Editorial by way of Getty Pictures

Notice: All quantities mentioned are in CAD. All costs mentioned choose to shares traded on the TSX in CAD.

On our final protection of Fortis Inc. (NYSE:FTS, TSX:FTS:CA), we made the case that the frequent shares had been possible to offer you comparatively poor general returns, pushed by valuation compression. We additional opined that the preferreds had been the place the cool children ought to hang around and indulge in increased yields and higher appreciation potential.

Whereas the frequent shares have develop into barely extra enticing as we roll in 2024 estimates alongside a lower cost level, the popular shares for Fortis are extremely good offers as we speak.

We now have had 4 and half months extra of information on the corporate and the macro setting since then. We have a look at how our urged concepts labored out and the place there may be worth as we speak.

Q3 2023

Fortis did a heavy beat of the consensus estimates in Q3, with EPS coming in at a stellar 84 cents versus expectations of 77 cents. The important thing drivers had been the BCUC approval of retroactive utility of capital parameters and an alternate price which went of their favor. The quarter additionally noticed many regulator selections being put into the rear view mirror. TEP permitted the 9.55% return on fairness allowance. BCUC allowed 9.65% which was retroactive from January 1, 2023 (that’s what allowed the large beat versus estimates). Alberta Utilities Fee additionally permitted recoveries in step with expectations.

Q3 2023 outcomes and convention name had been across the time when rates of interest had been going vertical, and it was no shock that that was the first focus of the convention name (emphasis added).

As regards to upcoming maturities, we at present have about $1.7 billion due via the top of 2021, together with virtually USD 200 million in nonregulated debt at Fortis Inc.

Our major publicity to elevated rates of interest pertains to holding firm debt as our regulated utilities in the end recuperate modifications in rates of interest via regulatory mechanisms and the periodic rebasing of buyer charges. We’ll proceed to watch the debt capital markets and contemplate rate of interest hedges or prefunding alternatives. With proceeds from our debt issuances and the anticipated sale of Aitken Creek, in addition to over $4 billion accessible on our credit score amenities, we stay in a powerful liquidity place and are comfortably positioned inside our investment-grade credit score rankings as we execute our $25 billion capital plan.

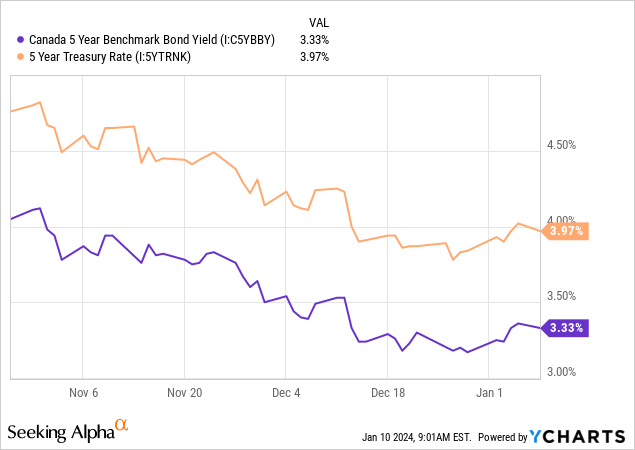

There was some additional quantification on the convention name, and FTS didn’t anticipate these charges to have a big hit to earnings. After all, since then, charges have gone in the wrong way.

Our outlook there may be that it is a pause within the development of upper long-term charges. Whether or not or not the Fed cuts, the yield curve ought to normalize sooner or later, and that can more than likely lead to at the least increased charges than what we see as we speak. However within the interim, the credit score markets have reopened with a bang, and FTS is little question getting the maturities addressed as we write this.

Valuation

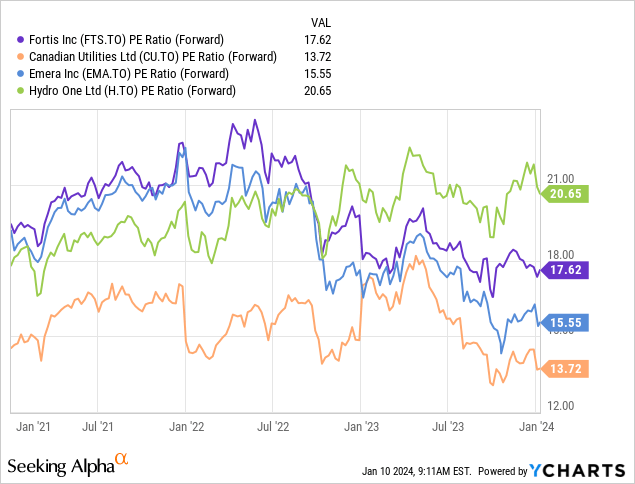

As a extremely regulated utility that has proven great price self-discipline and close to excellent execution, FTS tends to hold a premium valuation. On a straight P/E ratio, FTS rings in dearer than Canadian Utilities (CU:CA), and Emera Inc. (EMA:CA). Hydro One (H:CA) is insanely costly relative to the whole lot else due to its Ontario Authorities backing.

In the event you settle for that a number of and assume that’s stays the identical, it’s simple to get behind FTS. You’re very prone to see 5% earnings progress for the subsequent 5 years, simply based mostly on capital invested. You slap the 4% dividend on high of it after which you might be left questioning why would anybody select a 5 or 10 yr bond when you’ll be able to have utilities like these. Legitimate query. Right here is our legitimate response with a Canadian Utilities 10 yr chart.

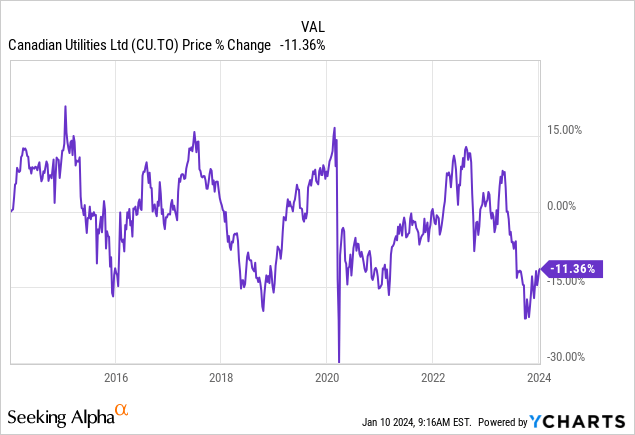

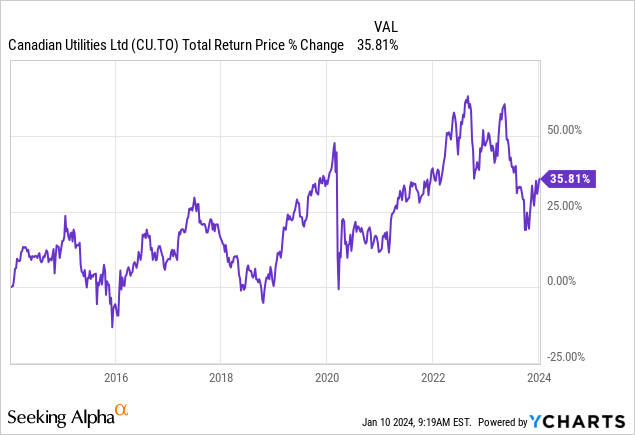

CU began the timeline with a close to 19X P/E, and now the ahead P/E has compressed to 13.72X. Earnings progress was a bit slower than anticipated and valuation compression gave you destructive worth returns. Do not get us mistaken. Whole return was a nonetheless optimistic 35.81% and did truly beat the overall return of a ten 12 months Authorities of Canada bond bought on the time (28% complete roughly).

However you all the time must watch out when shopping for at a premium valuation. Our take is that increased long-term yields will drive some compression right here for FTS and complete returns are prone to be poor. As there are not any actual crimson flags right here, we’re reluctant to go to a promote and proceed to price this as a maintain.

Most popular Shares

Final time round, we vouched for Fortis Inc. CUM RD 5Y SR G (FTS.PR.G:CA) and Fortis Inc. CUM RD 5Y SR Ok (FTS.PR.Ok:CA). Each have accomplished higher than FTS over the previous few months together with a much more beneficiant yield.

CIBC

Our opinion right here is that FTS.PR.G remains to be mildly undervalued regardless of the rally. Providing a 7.39% yield right here for a top quality utility remains to be an excellent deal. We’re eradicating our purchase ranking on this, although, and we do not personal the shares any extra.

FTS.PR.Ok is fascinating for those who share our outlook of rising charges into the subsequent two months. At the moment FTS.PR.Ok would reset to a yield of roughly 5.40% on par (It’s a GOC-5 plus 2.05%). That will make it yield about 7.5% for the subsequent 5 years. If charges rise as we anticipate, this could seize an superior reset. We’re tentatively sustaining this at a Purchase. We at present personal solely Fortis Inc. 1ST PREF SER M (FTS.PR.M:CA). That one is because of reset on December 1, 2024 at GOC-5 plus 2.48%. If the reset occurred as we speak, it could yield about 8.2% on the present $17.86 worth. We’re holding that and can possible promote over $19.00.

Please observe that this isn’t monetary recommendation. It might seem to be it, sound prefer it, however surprisingly, it isn’t. Buyers are anticipated to do their very own due diligence and seek the advice of with an expert who is aware of their goals and constraints.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.