Because the cryptocurrency business anticipates the subsequent halving, market analysts and buyers keenly observe the potential impacts on Bitcoin’s value.

The halving, a programmed discount within the rewards miners obtain, is anticipated to happen on April 20. It can reduce the reward from 6.25 BTC to three.125 BTC. Subsequently, this occasion will successfully lower Bitcoin’s inflation price from 1.7% to 0.85% yearly.

Bitcoin Stays Bullish Earlier than the Halving

Traditionally, Bitcoin halvings have been related to volatility within the quick time period however bullish developments in the long run. Vincent Maliepaard, Advertising Director at IntoTheBlock, informed BeInCrypto that the 2016 and 2020 halvings noticed Bitcoin rallying into the occasions, adopted by a drop shortly after, however ultimately breaking earlier all-time highs inside months.

This sample means that whereas merchants could attempt to front-run the halving, resulting in short-term fluctuations, the lowered provide positively impacts value motion over time.

One other notable pattern is the diminishing proportion enhance in value post-halving. For example, Bitcoin’s worth surged by 4,802% after the primary halving. Nonetheless, such a price of enhance has declined with subsequent halvings.

“Given Bitcoin’s considerably bigger market capitalization as we speak, attaining the identical proportion progress would require a considerably bigger funding, suggesting that future proportion will increase are more likely to proceed lowering,” Maliepaard stated.

Learn extra: Bitcoin Halving Countdown

The upcoming halving additionally differs from earlier ones. Certainly, Bitcoin has already surpassed its all-time excessive, possible as a result of substantial institutional funding following the approval of Bitcoin ETFs. This institutional influx, constant demand from ETFs, and a lowering provide may enhance Bitcoin’s worth.

Furthermore, crypto whales have entered an enhanced accumulation and strategic holding in anticipation of value rises. These actions reveal a mixture of short-term hypothesis and a longer-term strategic transfer to carry Bitcoin as a uncommon asset.

Total, these patterns exhibit a extra profound comprehension and adaptation to the impacts of the halving cycle on Bitcoin’s worth over time.

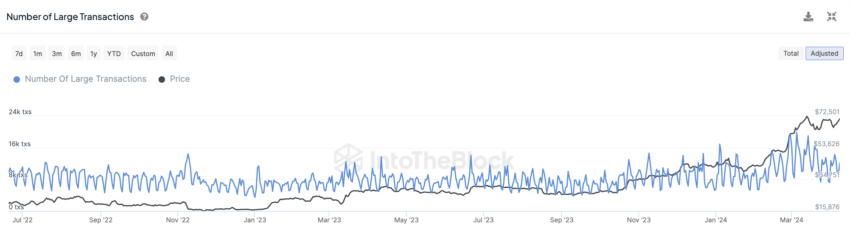

“There’s a clear upward pattern within the variety of giant transaction volumes, transactions bigger than $100.000, particularly for the reason that approval of Bitcoin ETFs. Concerning earlier halvings, this metric principally began going up in the direction of the top of the bull market,” Maliepaard informed BeInCrypto.

One other attention-grabbing remark by Maliepaard is the rise within the Miner Flows quantity share. Prior to now yr, the proportion quantity has climbed from round 4% to over 12%, representing a 200% enhance. This rise in Miner Flows quantity share is essential as a result of it signifies a significant change in miner habits, which may influence Bitcoin’s provide and liquidity dynamics.

Learn extra: Bitcoin Value Prediction 2024/2025/2030

Whereas the Bitcoin halving is anticipated to carry short-term volatility, the long-term outlook stays bullish, pushed by lowered provide and continued institutional curiosity.

“The deliberate lower in emissions is likely one of the key financial measures that distinguishes Bitcoin from fiat currencies. Within the months main as much as and following a Bitcoin halving, market sentiment sometimes shifts from anticipation to optimism as buyers speculate on the halving’s influence on Bitcoin’s shortage and value,” Maliepaard concluded.

Buyers ought to monitor key indicators, resembling buying and selling quantity and miner habits, to gauge the halving’s influence in the marketplace.

Disclaimer

Following the Belief Undertaking pointers, this function article presents opinions and views from business specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its workers. Readers ought to confirm info independently and seek the advice of with an expert earlier than making choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.